CRE This Week: What's impacting the Canadian market

February 18, 2026 - Canada commercial real estate market insights, indicators, and notable transactions

February 18, 2026

Welcome to the latest edition of CRE This Week, curated by Altus Group’s Canada research team.

Our team has handpicked new and noteworthy market indicators, articles, and significant industry transactions that are impacting Canada's commercial real estate sector. We understand that your time is valuable, so we're excited to deliver research that helps you stay informed and saves you some time each Wednesday morning.

FEATURED TrANSACTIONS

Canada property transactions

Greater Toronto Area: Industrial

520 Abilene Drive, Mississauga

$28,500,000

$281 per sq. ft

Brokers: Tom Clancy, Nick Neila, Tessa Compagno (Avison Young) & Jeff Hord, Kyle Hanna (CBRE)

Greater Vancouver Area: Retail

9686 137th Street, #201, Surrey

$5,620,072

$1,188 per sq. ft

Broker: David Knight (Sitings Realty)

Greater Ottawa Area: Apartment

189 Gladstone Avenue, Ottawa

$1,335,000

$267,000 per unit

Greater Edmonton Area: Industrial

3623 78 Avenue NW, Edmonton

$7,975,000

$192 per sq. ft

Greater Toronto Area

Sector | Brokers | Municipality | Address | Price | Unit Price | Parameters |

|---|---|---|---|---|---|---|

Industrial | Tom Clancy, Nick Neila, Tessa Compagno (Avison Young) & Jeff Hord, Kyle Hanna (CBRE) | Mississauga | 520 Abilene Drive | $28,500,000 | $281 | per sq. ft. |

Apartment |

| North York | 15 & 25 Canyon Avenue | $87,842,500 | $375,395 | per unit |

Apartment | Jonathan Hittner, Neil Musselwhite, David Lieberman, Eamonn McConnell, Jonny Shaw (Avison Young) | Mississauga | 12 Park Street East | $21,835,000 | $363,917 | per unit |

Industrial |

| Burlington | 5330 South Service Road | $12,100,000 | $262 | per sq. ft. |

Greater Vancouver Area

Sector | Brokers | Municipality | Address | Price | Unit Price | Parameters |

|---|---|---|---|---|---|---|

Retail | David Knight (Sitings Realty) | Surrey | 9686 137th Street, #201 | $5,720,074 | $1,188 | per sq. ft. |

Apartment |

| Vancouver | 2280 McGill Street | $5,600,000 | $280,000 | per unit |

Industrial | Ross Forman & Jeffrey Pilkington (Babych Group Realty Vancouver) | North Vancouver | 375 Lynn Avenue, #104 & #106 | $4,300,000 | $618 | per sq. ft. |

Office | Brandon Buziol (Cushman & Wakefield) | West Vancouver | 2419 Bellevue, #112 & #113 | $1,625,000 | $1,029 | per sq. ft. |

Greater Ottawa Area

Sector | Brokers | Municipality | Address | Price | Unit Price | Parameters |

|---|---|---|---|---|---|---|

Apartment |

| Ottawa | 180 Gladstone Avenue | $1,335,000 | $267,000 | per unit |

Office |

| Ottawa | Albion Executive Tower | $30,000,000 | $220 | per sq. ft. |

Retail |

| Gloucester | 1880 Innes Road | $20,200,000 | $170 | per sq. ft. |

Retail | Jamie Boyce & Tim Eberts (CBRE), Jean Levac (DLRE Ltd.) | Ottawa | 2179 Elmira Drive | $12,500,000 | $144 | per sq. ft. |

Greater Edmonton Area

Sector | Municipality | Address | Price | Unit Price | Parameters |

|---|---|---|---|---|---|

Industrial | Edmonton | 3623 78 Avenue NW | $7,975,000 | $192 | per sq. ft. |

Apartment | Edmonton | 12040 82 Avenue NW | $2,088,000 | $116,000 | per unit |

Apartment | Edmonton | 11348 97 Avenue NW | $1,270,000 | $115,455 | per unit |

Industrial | Edmonton | 10351 61 Avenue NW | $1,010,000 | $184 | per sq. ft. |

ECONOMIC PRINT

Canada commercial real estate market indicators

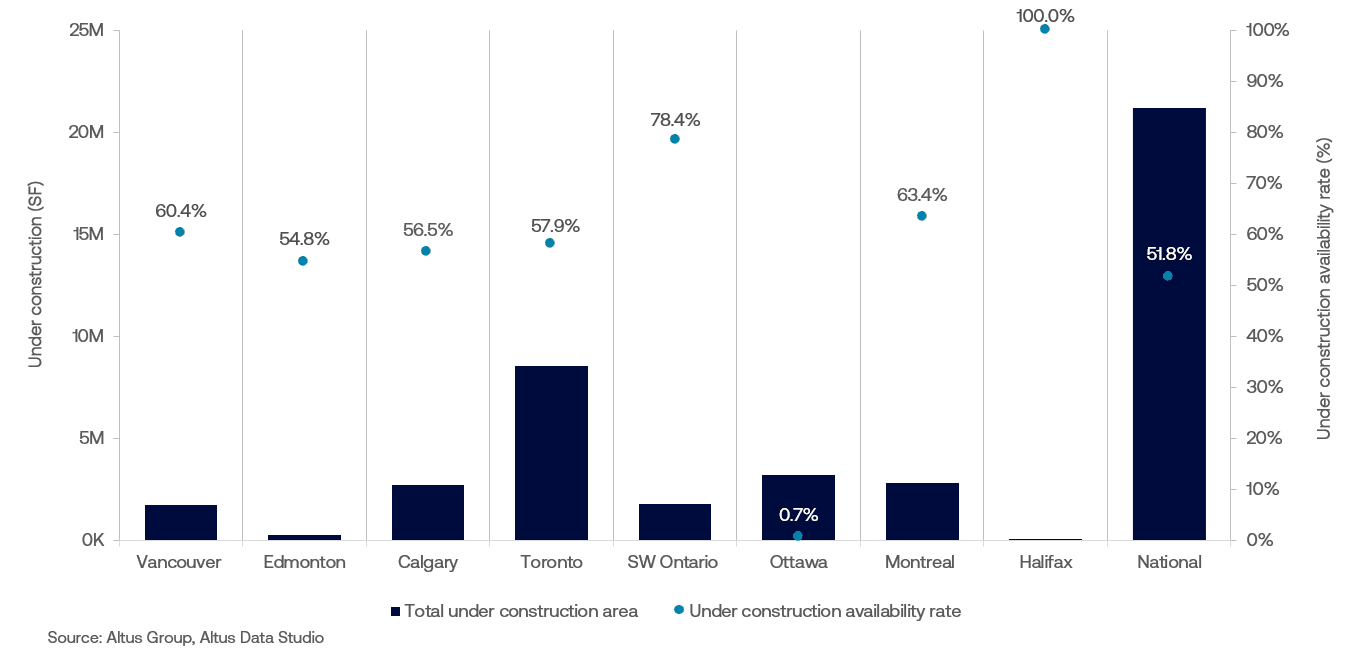

Industrial construction is still slowing down

Industrial construction activity continues to slow as pre-construction leasing is impacted with continued uncertainty. This is a stark contrast to a few years ago, whereby most of the space was leased before completion.

Figure 1: Industrial under construction & availability (Q4 2025)

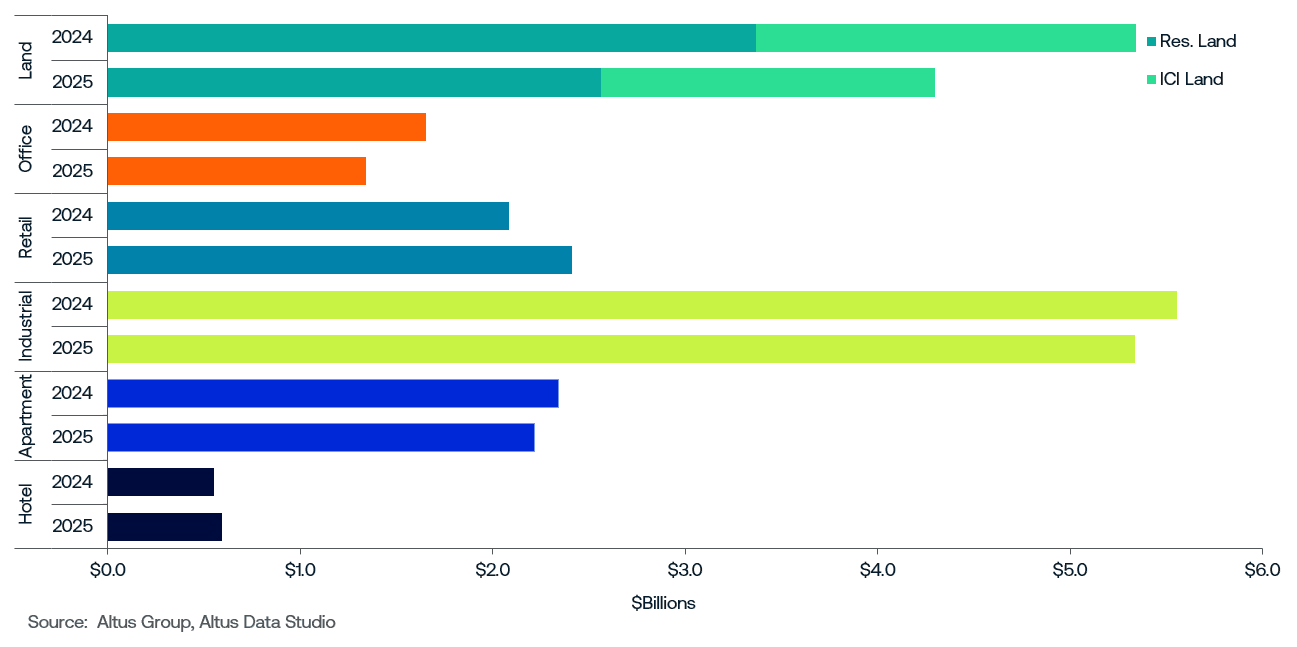

Toronto’s retail sector up 16% year-over-year as of Q4 2025

Retail was the GTA's bright spot in 2025, up 16% to $2.4 billion on strong demand for food-anchored assets. On the land side, activity contracted sharply — residential land declined 24% and ICI land fell 12%. Elevated borrowing costs and a complex regulatory environment kept developers in wait-and-see mode. Click here to get the full sector breakdown.

Figure 2: Greater Toronto Area property transactions by asset class (2024 vs. 2025)

INSIGHTS Spotlight

Catch the latest research and insights from Altus

Solving friction across CRE valuation teams with data and technology

Siloed valuation workflows slow down investment decisions. This article shows how unifying data across asset managers, appraisers, and portfolio managers turns friction into a competitive edge.

Toronto commercial market update – Q4 2025

GTA CRE investment totalled $16.2 billion in 2025, down 8% year-over-year. Retail led all asset classes, up 16% to $2.4 billion, driven by demand for food-anchored properties.

IMPORTANT DATES

Hear from our experts

Raymond Wong

Vice President, Data Solutions, Altus Group

Session:

Overview of office, retail, industrial and multi-unit residential markets

REALCAPITAL Conference, Metro Toronto Convention Centre

February 24, 2026

2:05-2:45 pm

About our research team

Ray Wong

Vice President, Data Solutions

Altus Group

Ray is the Vice President, Data Solutions, Client Delivery team with the Altus Group and has over 30 years of market research experience. He works closely with both internal and external clients to provide timely information and industry insights about the Canadian market and at a global scale. Ray is regularly asked to speak at various industry events and answer media outlet requests.

Edward Jegg

Research Manager

Altus Group

Edward Jegg serves as a Research Manager on the Data Solutions team at Altus Group, leveraging over 35 years of extensive experience in the commercial real estate sector to deliver market intelligence to the industry. Jegg plays a key role in creating and disseminating detailed market reports across Canada, providing stakeholders with timely insights for investment decision-making. Jegg is a recognized expert, frequently offering media commentary on real estate trends and recently receiving the prestigious Chair's Award of Merit from BILD for his outstanding contribution to the field.

Jennifer Nhieu

Senior Research Analyst, Data Solutions

Altus Group

Jennifer Nhieu is a Senior Research Analyst, Data Solutions with Altus Group, where she specializes in providing timely, data-driven insights into the Canadian market. Leveraging her background in commercial real estate and geographic information science, Jennifer is a key contributor to Altus Group’s quarterly research insights. She transforms complex data sets into clear, actionable intelligence, helping stakeholders make informed decisions.

About the Data Solutions team

Behind every update in our newsletter is the work of our Data Solutions team, a group dedicated to keeping you informed on commercial real estate activity across Canada. From Vancouver to Toronto (and everywhere in between), they track transactions, visit properties, and add the local context that numbers alone can’t capture. Their work goes beyond deals, by providing insights into new home developments and sales trends, as well as detailed office and industrial inventory data across key markets, from Montreal and Calgary to Winnipeg, Quebec City, and Atlantic Canada.

Disclaimer: The opinions expressed in this newsletter are solely those of the authors and are not endorsed by Altus Group Limited, its affiliates and its related entities (collectively “Altus Group”). This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Resources

Latest insights