Commercial property valuation software

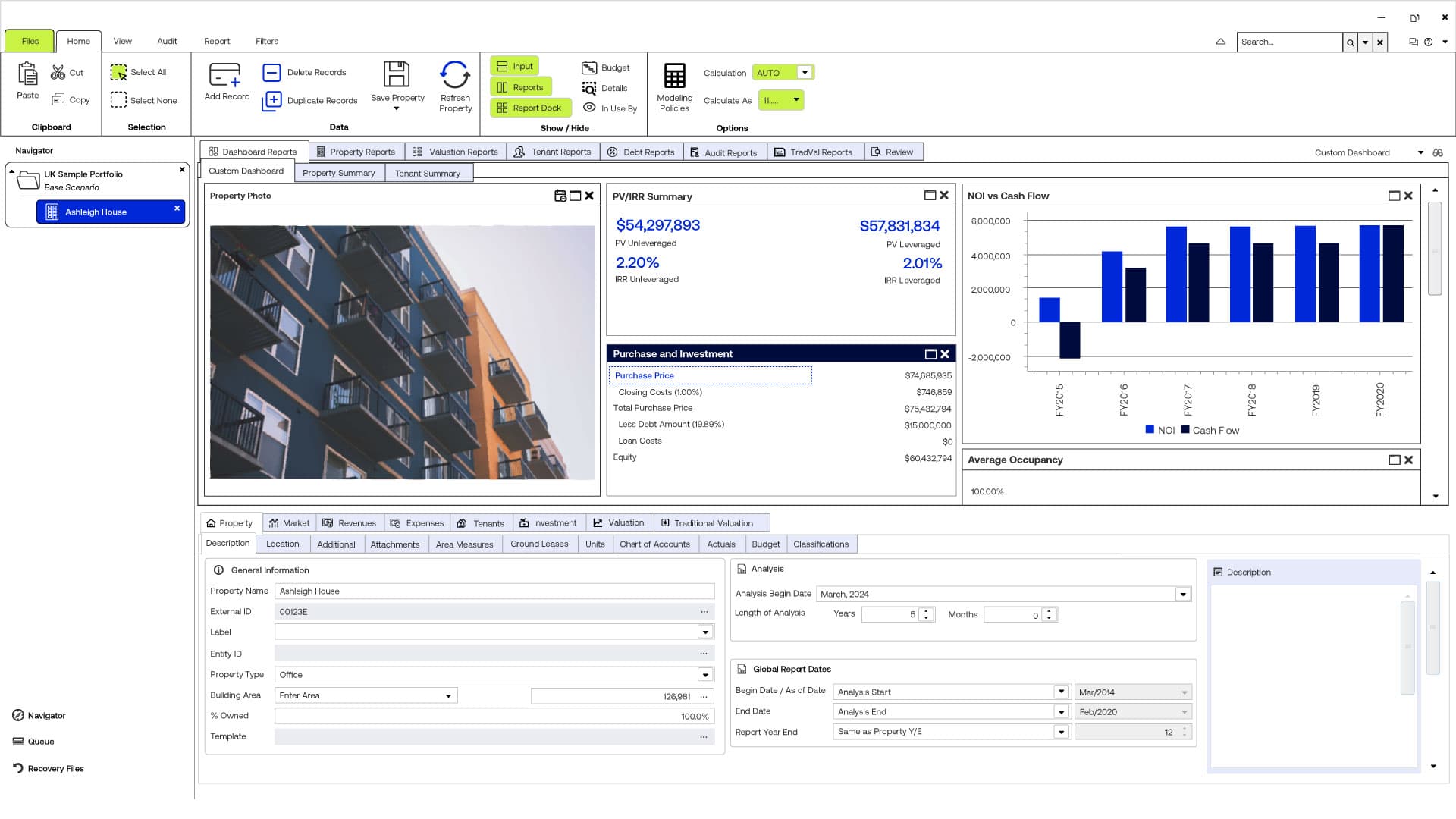

ARGUS Enterprise

Commercial property valuation and cash flow forecasting software now available as part of ARGUS Intelligence.

Discover ARGUS Enterprise

ARGUS Enterprise, now part of ARGUS Intelligence

Transforms how you model, monitor, and manage your commercial real estate (CRE) assets, portfolios, and funds by streamlining property valuations, cash flow forecasting, and asset management to enable informed decisions.

Don't miss out on all of ARGUS cash flow engine's features

Valuations

Model accurate and transparent commercial property valuations.

Cashflow forecasting

Track inflows and outflows for comprehensive visibility into performance and forecasts.

Budgeting

Integrate with property management solutions for efficient budgeting and reforecasting.

Scenario testing

Assess true impact of property and portfolio-level changes with detailed what-if analyses.

Reporting

Access over 40+ standard, configurable and exportable reports.

Collaboration

Share models and performance dashboards for better planning and collaboration.

How ARGUS Enterprise works

Value and manage your CRE portfolio

1. Model your cashflows

Rely on the leading commercial property valuation and cashflow forecasting solution to structure your valuations, budgets and forecasts.

2. Organize your models

Centralize and store your rich ARGUS models on ARGUS Intelligence, a flexible data platform that allows you to interact with external financial model data.

3. Explore your data

Better understand the performance of your investments and how various scenarios will impact outcomes with sleek, interactive dashboards.

Testimonials

Hear what our customers saying

FAQ

Get answers to commonly asked questions about ARGUS Enterprise

What is ARGUS Enterprise?

How much does ARGUS Enterprise cost?

What valuation methods does ARGUS Enterprise support?

Who can benefit from using ARGUS Enterprise?

How does ARGUS Enterprise integrate with other systems?

30+

years developing our ARGUS software

100+

countries across the globe using ARGUS

200+

universities and colleges teaching ARGUS

Industry-leading capabilities delivered through ARGUS Intelligence

ARGUS Intelligence

Portfolio Manager

Integrates ARGUS Enterprise valuations with scenario-based portfolio visualizations