Australian construction price outlook – Q3 2025

Our Q3 analysis reveals how higher energy costs shaped Australia’s construction pricing, with clear signals on material movements and cost pressures.

Key highlights:

Energy costs take centre stage - Electricity prices jumped 9% this quarter and 23.6% over the year, pushing inflation above target and feeding directly into material and manufacturing costs

Material escalation remains uneven - Energy-intensive products such as copper, cement and aluminium are emerging as the next cost flashpoints, while steel and diesel remain subdued

Regional divergence deepens - Brisbane leads national escalation heading into the Olympic cycle, as Sydney, Melbourne and Perth stabilise

Relief is unlikely before 2028 amid entrenched energy, labour and regulatory pressures

Overview

Australia has bent the emissions curve, but not yet the energy cost curve. Energy is now the linchpin between inflation, materials pricing and construction activity.

The Reserve Bank’s decision to hold the cash rate steady at 3.60% in November signalled caution. Inflation remains stubbornly above the 2-3% target band, in part due to electricity costs.

When electricity prices rise, they don’t just hit household bills. They lift the embedded cost of construction materials.

Electricity prices rose 9% this quarter and 23.6% over the past year, according to the Australian Bureau of Statistics, as state government rebates and short-term support programs expired.

Behind those headline statistics is a complex picture. Consumer electricity bills have increased, but wholesale electricity prices across the National Electricity Market (NEM) have stabilised, and in some regions, they have fallen. The Australian Energy Market Operator (AEMO) shows NEM spot prices were down 27% year-on-year and 38% since Q2.

Renewables now supply a record 42.7% of NEM generation, cutting emissions to its lowest point on record. While cleaner power is flowing through the grid, the pressure has shifted from generation to transmission – the network and regulatory charges that connect renewable energy to end users.

Costs are being passed through to manufacturers of energy-intensive materials such as bricks, cement, aluminium, copper and plasterboard. For example, Tomago Aluminium, Australia’s largest electricity user, now spends 40% of its operating budget on power and has warned of viability risks.

The challenge will intensify as the construction pipeline pivots from roads and rail to energy infrastructure, utilities and data centres – all of which draw enormous loads. AEMO forecasts electricity demand from data centres to rise 25% annually over the next decade, tripling national demand growth. OpenAI, the company behind ChatGPT, has warned that “electrons are the new oil” and estimated America alone will need to invest in 100 gigawatts of new energy capacity each year to keep up with demand. AI projects will need 20% of America’s skilled tradespeople over the next five years, OpenAI suggests.

In parallel, electrification of transport and buildings means more competition for materials with high energy content, from copper cabling and conduits to switchgear and transformers, not to mention more competition for those same skilled tradespeople.

While modular and offsite construction may relieve some cost pressure, the savings don’t come from energy. The advantage lies in repetition – faster delivery, less waste, fewer errors – not cheaper materials. Whether concrete is poured onsite or cast in a factory, it carries the same embodied energy.

Builders and developers face a convergence of pressures: rising network costs, surging demand from energy-intensive sectors, and growing competition for low-carbon materials. Energy has shifted from a background variable to a central constraint shaping project economics, resilience and returns.

Outlook on construction cost escalation

| Figure 1 - Altus Group’s outlook on construction cost escalation

Sydney | Brisbane | Melbourne | Perth | |

|---|---|---|---|---|

2019 | 4.0% | 3.0% | 3.5% | 2.5% |

2020 | 3.5% | 2.5% | 3.75% | 3.75% |

2021 | 4.5% | 3.25% | 4.0% | 7.25% |

2022 | 7.5% | 8.5% | 7.5% | 7.5% |

2023 | 5.9% | 9.25% | 6.25% | 6.75% |

2024 | 5.50% | 7.50% | 4.75% | 5.50% |

2025 | 4.50% | 7.00% | 4.50% | 5.75% |

2026 (previous forecast) | 4.50% (4.50%) | 7.00% (7.00%) | 4.25% (4.25%) | 5.25% (5.25%) |

2027 (previous forecast) | 4.50% (4.50%) | 6.50% (6.50%) | 4.00% (4.00%) | 4.75% (4.75%) |

Note: These figures are general, and individual projects and asset classes may have dramatically different spreads of costs. Previous forecasts were made in Sept 2025.

Source: Altus Group

Brisbane is expected to remain the nation’s escalation hotspot through to 2027, fuelled by Olympic-related works, persistent labour shortages, and supply chain pressures. Sydney and Melbourne show a slower trajectory due to weaker construction pipelines and fewer major project starts. Perth is also easing after its recent resource-driven spikes.

Although the pace of cost escalation increase is slowing in most cities, escalation rates remain well above pre-2021 levels. Meaningful relief is unlikely before 2028 given entrenched material, labour and regulatory cost pressures.

Escalation rates are highly variable, depending on project type, size, location and materials. Given these complexities, it is essential to consult professional quantity surveyors to evaluate project-specific costs and escalation factors. Tailored assessments ensure accurate forecasting and risk management.

Material price snapshot

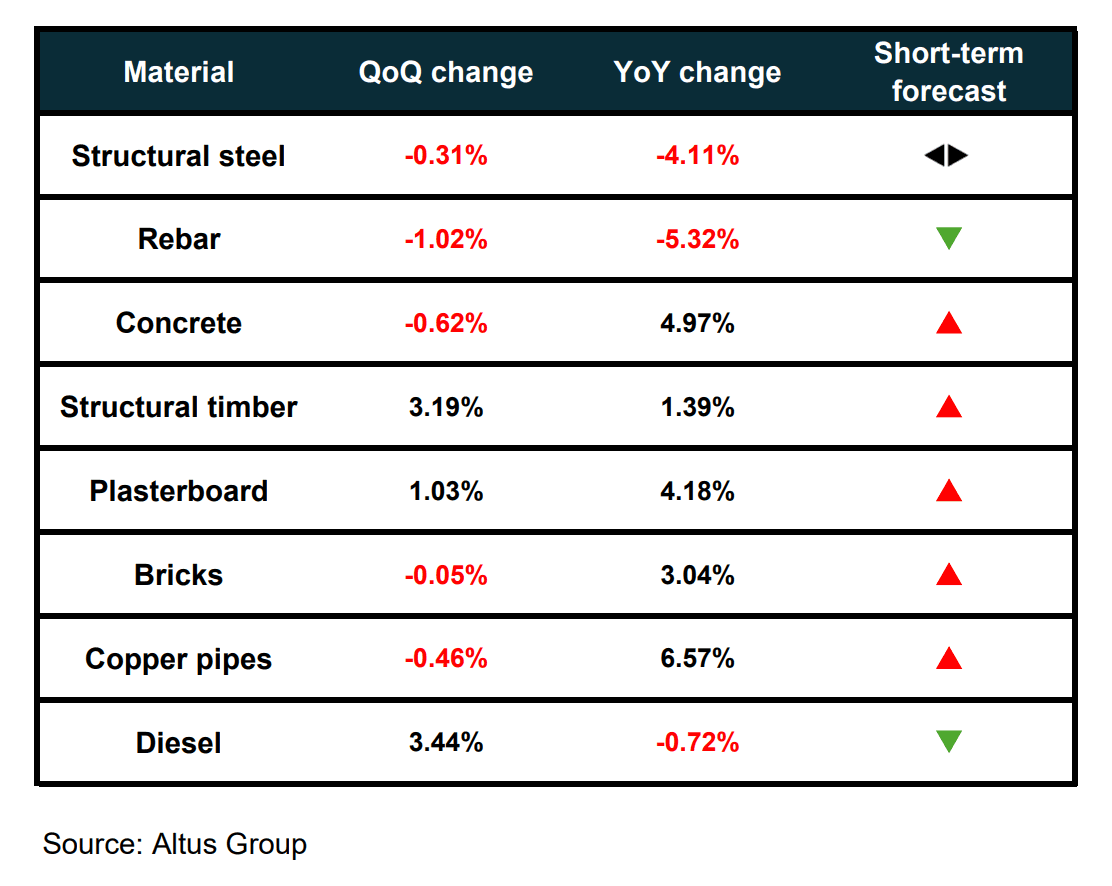

Figure 2 - A snapshot of Australian construction material price trends - Q3 2025

| Figure 3 - Altus Materials Escalation Index (Australia)

Altus Materials Escalation Index (Australia)

Download

Source: Altus Group

Structural steel and rebar: Asian steel prices remain soft, reflecting weak Chinese construction demand and ample supply, which has fed into downside pressure on Australian import offers. In September, China’s state-owned buyer CMRG reportedly instructed steel mills and traders to pause purchases of iron-ore cargoes from BHP during annual pricing talks in a move seen as Beijing flexing its pricing power.

Concrete: Concrete prices continue to climb, fuelled by energy costs and ongoing infrastructure projects, despite low levels of housing activity. Demand for this energy-intensive material remains strong.

Structural timber: Prices have edged higher for the first time in a year in a modest but notable shift. The uptick appears driven by both demand and supply constraints. Production volumes have tightened with recent mill closures and higher energy and labour costs flowing through the supply chain, while approvals for new dwellings add pressure to domestic capacity. Timber warrants closer attention in coming quarters, as most CLT manufacturing is based in Europe and North America, with Europe accounting for roughly half of global production capacity.

Plasterboard: Prices have trended higher this quarter. As a later-stage construction material, this may indicate a healthy pipeline of projects nearing completion. However, in July The Australian noted that “the highly concentrated building products sector provides some insight into why prices are still increasing”.

Bricks: Prices have softened slightly this quarter but remain elevated. Rising manufacturing costs – driven by surging energy prices, as brick kilns rely heavily on natural gas, and higher transport expenses – are keeping prices high. A new $81.4 million bio-energy facility was approved in July 2025 for a major brick-making site in New South Wales, reflecting the transition from fossil fuels to renewable biogas.

Copper: Prices have risen again this quarter. Goldman Sachs revised its average price forecast for the second half of 2025 by 8.2%, citing reduced inventory and economic activity in major copper-consuming nations. Demand in Australia remains strong, particularly from electrical trades.

Diesel: Diesel prices have fallen to pre-pandemic levels due to lower global demand and increased production. This reduction provides some transportation and logistics cost relief. The recent decline in diesel prices is partly due to a drop in global crude oil prices, which have reached a four-year low following increased production by major oil producers.

Macro-economic review

Consumer Price Index

| Figure 4 – All groups CPI, Australia, quarterly and annual movement (%)

All Groups CPI Australia

Quarterly and annual movement (%)

Download

Source: Australian Bureau of Statistics | Altus Group

Australia’s latest annual inflation rate of 3.2% moves it slightly above the upper end of the Reserve Bank of Australia’s target band of 2%-3%. This is also well above the benchmark inflation target of 2% adopted by many leading central banks in advanced economies, such as the European Central Bank, which explicitly aims for inflation “below, but close to, 2% over the medium term”.

Australia’s above-trend inflation matters because it increases the risk of tighter monetary policy and slower real growth. The RBA’s decision to hold rates steady in November 2025 reflects that concern.

Producer Price Indices - Input

| Figure 5 – Producer Price Indices (PPI) – Input, Australia

Producer Prices Indexes (PPI) - Input, Australia

Download

Source: Australian Bureau of Statistics | Altus Group

Australia’s construction sector remains broadly stable, though a slight uptrend warrants monitoring as the growing pipeline of housing projects could add pressure to costs. Input prices for house construction rose this quarter, driven by higher raw material costs and annual supplier price reviews. Timber and other metal products (notably aluminium and copper) were called out as contributors.

Over the year, input prices to house construction increased 2.1%, led by timber and joinery (+1.8%), metal products (+0.6%), and plaster materials (+0.5%). Although the sector appears to be stabilising, rising input costs and upcoming housing construction activity could push prices higher in coming quarters.

Producer Price Indices – Output

| Figure 6 – Producer Price Indices (PPI) - Output, Australia

Producer Prices Indexes (PPI) - Output, Australia

Download

Source: Australian Bureau of Statistics | Altus Group

House construction prices rose by 1.2% this quarter, marking the first annual growth increase since the June quarter 2024. New South Wales, Victoria, and Queensland made notable contributions, as stronger demand enabled builders to reduce incentives and pass through higher input costs, particularly for labour. House construction prices have risen by 0.5% over the year.

Growth in other residential building construction prices was also led by the three most populous states, driven by ongoing skilled and unskilled labour shortages and compounded by scheduled enterprise agreement wage rises in Queensland. Rising fixed and time-related project management costs, along with elevated insolvency rates and extended completion times, have heightened industry uncertainty, prompting builders to factor in higher risk margins when tendering.

Wage Price Index

| Figure 7 – Wage Price Index (WPI), Australia

Wage Price Index (WPI), Australia

Download

Source: Australian Bureau of Statistics | Altus Group

House and electricity prices continue to climb, with wage growth a central driver of inflation and monetary policy decisions. The seasonally adjusted Wage Price Index (WPI) rose 0.8% in the June 2025 quarter and 3.4% over the year, led by gains of 0.8% in the private sector and 1.0% in the public sector.

While WPI growth appears to be flattening, future trends will depend on policy shifts. Higher wages add inflationary pressure by raising costs for goods, services and housing. This dynamic can prompt central banks to lift cash rates to contain inflation.

Building approvals

| Figure 8 – Building approvals, Australia

Building Approvals

Source: Australian Bureau of Statistics | Altus Group

In September 2025, total dwelling approvals in Australia rose sharply by 12.0% to 17,019, marking a strong rebound in building activity. Approvals for private sector houses increased by 4.0% to 9,547, while approvals for private sector dwellings excluding houses surged 26.0% to 7,219. These figures underscore a renewed upswing in higher-density development as affordability and supply pressures continue to shape the housing market.

From 1 October 2025, the Home Guarantee Scheme (formerly the First Home Buyer scheme) will remove the cap on the number of places and lift the property-price limits. For example, in New South Wales the cap moves from $900,000 to $1,500,000 for capital cities and regional centres. While this may help buyers in the short term by expanding eligibility, it also risks driving demand even higher in markets where supply is already falling short. With the federal government effectively becoming a more active participant in the buyer pool, pressure on prices could intensify, and construction costs - which are already elevated due to supply constraints - are likely to rise further, potentially worsening affordability over time.

Summary

For now, stability in the rulebook offers some relief.

Building ministers have paused new residential changes to the National Construction Code until 2029, giving project proponents a clearer runway for compliance and pricing. Non-residential updates will proceed in 2026, with reforms around solar, fire safety and condensation expected to shape tender assumptions.

But delivery risk remains elevated. Construction continues to lead all industries for insolvencies, with 1,153 companies entering external administration between 1 July and 26 October 2025, according to ASIC. The next closest sector, accommodation and food services, recorded 736 insolvencies over the same period. Persistent cash-flow and margin pressures, along with high input costs, delayed payments and tight credit conditions, continue to strain builders and subcontractors.

Resilience now depends on more than cost control. It means anticipating energy exposure, material volatility and delivery risk together. Leaders who plan for energy resilience, invest in smarter delivery models and strengthen partnerships across their supply chain will be best placed to build confidently through the next cycle.

Methodology

Market research into the supply cost of core materials is conducted on a quarterly basis with manufacturers and suppliers. Our market assessment also involves a thorough analysis of secondary sources of market data on materials and labour prices.

These sources include the Australian Bureau of Statistics (ABS), the Australian Institute of Quantity Surveyors (AIQS), Fuel Price Index, Metal and Raw Material Price, and proprietary cost data from Altus Group.

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Lily Hoang

Analyst

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Lily Hoang

Analyst

Resources

Latest insights