Australian construction material price outlook - Q2 2023

Altus Group combines our market intelligence with a range of reliable and robust data sources to provide quarterly Australian construction material price indicators for the construction sector.

Key highlights

As the Australian construction sector enters a period of stabilisation, materials and commodities prices in some categories have fallen or flatlined

While new dwelling prices escalated, the rate of growth slowed as interest rates climbed, demand fell, and material costs eased

Building construction costs also increased due to labour shortages, while automotive fuel prices saw a slight decline

A downward trend in building permits indicates a potential slowdown in the housing construction sector ahead

Some demand pressures have eased as government stimulus packages and some large infrastructure projects wind up, but signs of nervousness within the construction sector are emerging

Read the latest update of the Australian construction price outlook.

Introduction

After several years of volatility, Australia’s construction sector is entering a period of stabilisation. Materials and commodities prices in some categories have fallen or flatlined, although some of these gains have been eroded by increasing labour costs. With governments reprioritising their infrastructure programs and pipeline visibility fading, market stability could give way to uncertainty for the remainder of 2023, although leading indicators suggest a strong bounce back in 2024.

Inflationary pressure eased over the quarter ending June 2023, following the fastest interest rate raising cycle in a generation. Australia's Consumer Price Index rose by 0.8%, driven by hikes to rents, growth in international travel and new dwelling purchases. Building construction costs also increased due to labour shortages. While new dwelling prices escalated, the rate of growth slowed as interest rates climbed, demand fell, and material costs eased. Automotive fuel prices saw a slight decline, with a notable drop in diesel prices. However, a downward trend in building permits indicates a potential slowdown in the housing construction sector ahead.

Some demand pressures have eased as government stimulus packages and some large infrastructure projects wind up. But there are signs of nervousness within the construction sector as governments pause or cancel large infrastructure projects, as insolvencies continue to cause headaches and as the forward workbook looks unclear beyond the next six months.

Material price snapshot

Altus Group combines our market intelligence with a range of reliable and robust data sources, including those from the Australian Bureau of Statistics and the Australian Institute of Quantity Surveyors, to provide national price indicators. These prices are subject to market movements.

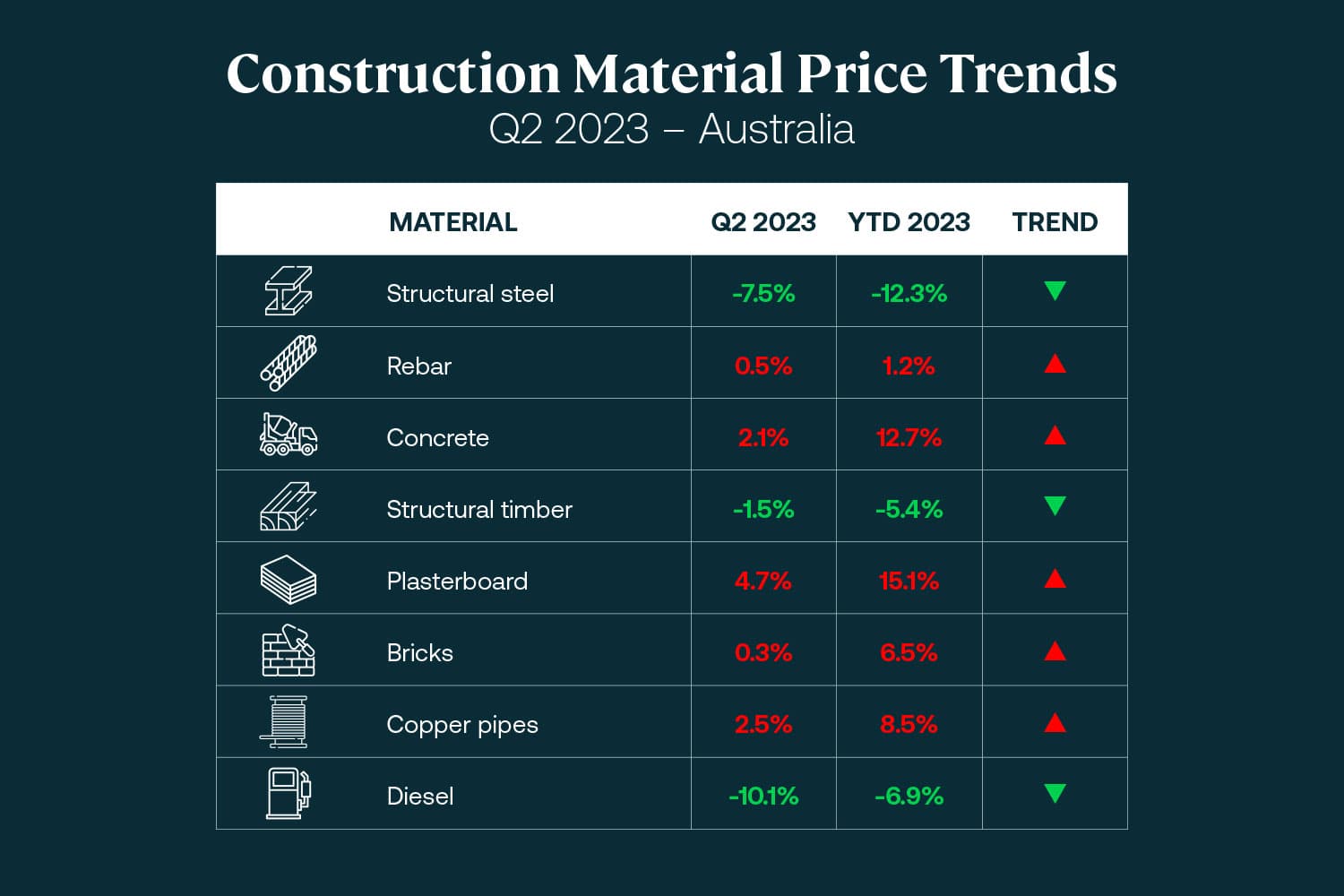

Figure 1 - A snapshot of Australian construction material price trends – Q2 2023

Material price movements

Altus Group provides insight into the materials and commodities that are common across most projects and sectors, and that therefore have the greatest influence on costs. These include:

Structural steel and rebar

Prices have stabilised, driven by a decline in global construction activity. Mills in China, which account for more than half of global steel production, have struggled as the nation’s property downturn continues. This has led to an oversupply of low-grade steel in Australia.

Concrete

Notoriously volatile due to its dependence on energy/transport costs and raw material supply chains, the price of concrete has continued to rise. While the cost of aggregate materials, such as sand and gravel, has eased off, the quest for low-carbon products, combined with the high cost of fuel in transportation, has driven price hikes.

Structural timber

Bushfires, the war in Ukraine, shipping costs and other Covid-related supply chain challenges drove severe shortages and several years of skyrocketing prices. Supply has since rebounded and a slight decrease over the quarter follows a modest increase over the year.

Plasterboard

This material remains one to watch, following strong growth over the quarter and the year. Covid-induced supply constraints have been resolved, and high demand has eased as housing stimulus projects conclude. Nevertheless, projects with substantial plasterboard may consider upward budget adjustments.

Bricks

Robust price increases over both the quarter and the year reflect the small pool of suppliers in Australia and the trend back to bricks as a solution to a range of quality and technical challenges. A larger issue of labour is emerging, which will also place pressure on budgets.

Copper

With steady price increases over both the quarter and the year, projects with significant copper components in electrical and plumbing works – notably large rail projects – can expect budget implications.

Diesel

Fuel prices remain elevated and well above that in the Covid era. However, the declining price of diesel is alleviating pricing pressures on other materials that rely on fuel for production and delivery, particularly civil projects involving heavy machinery.

In a constantly changing market, one factor is consistent: the need for accurate and independent cost advice.

Macro economic review - Q2 June 2023

Consumer price index

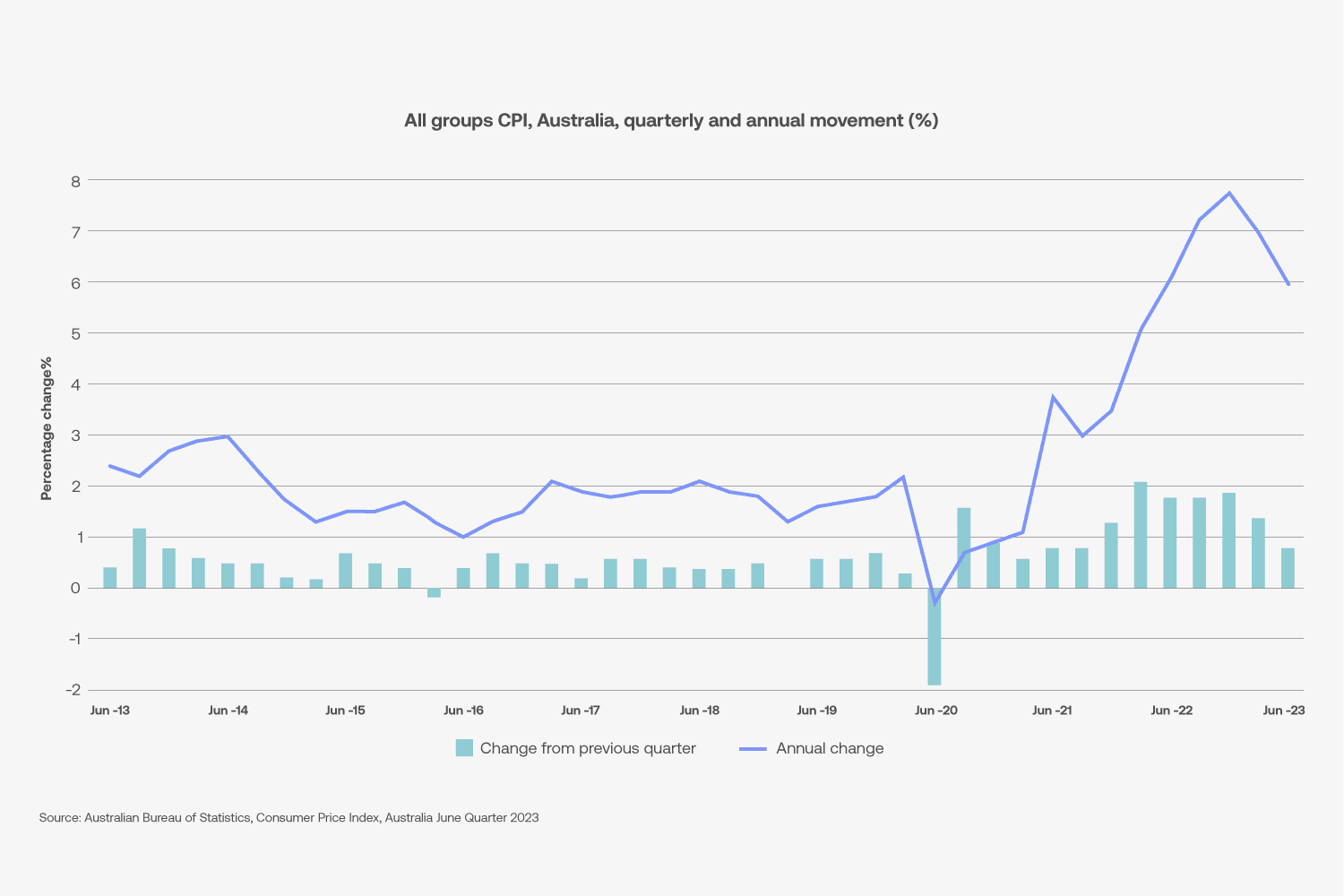

Figure 2- All groups CPI, Australia, quarterly and annual movement (%)

The Consumer Price Index (CPI) rose 0.8% this quarter. Over the 12 months to June 2023, the CPI rose 6.0%.

The most significant price rises were rents (+2.5%), international holiday travel and accommodation (+6.2%), other financial services (+2.5%), and new dwelling purchase by owner-occupiers (+1.0%).

Construction producer price indices

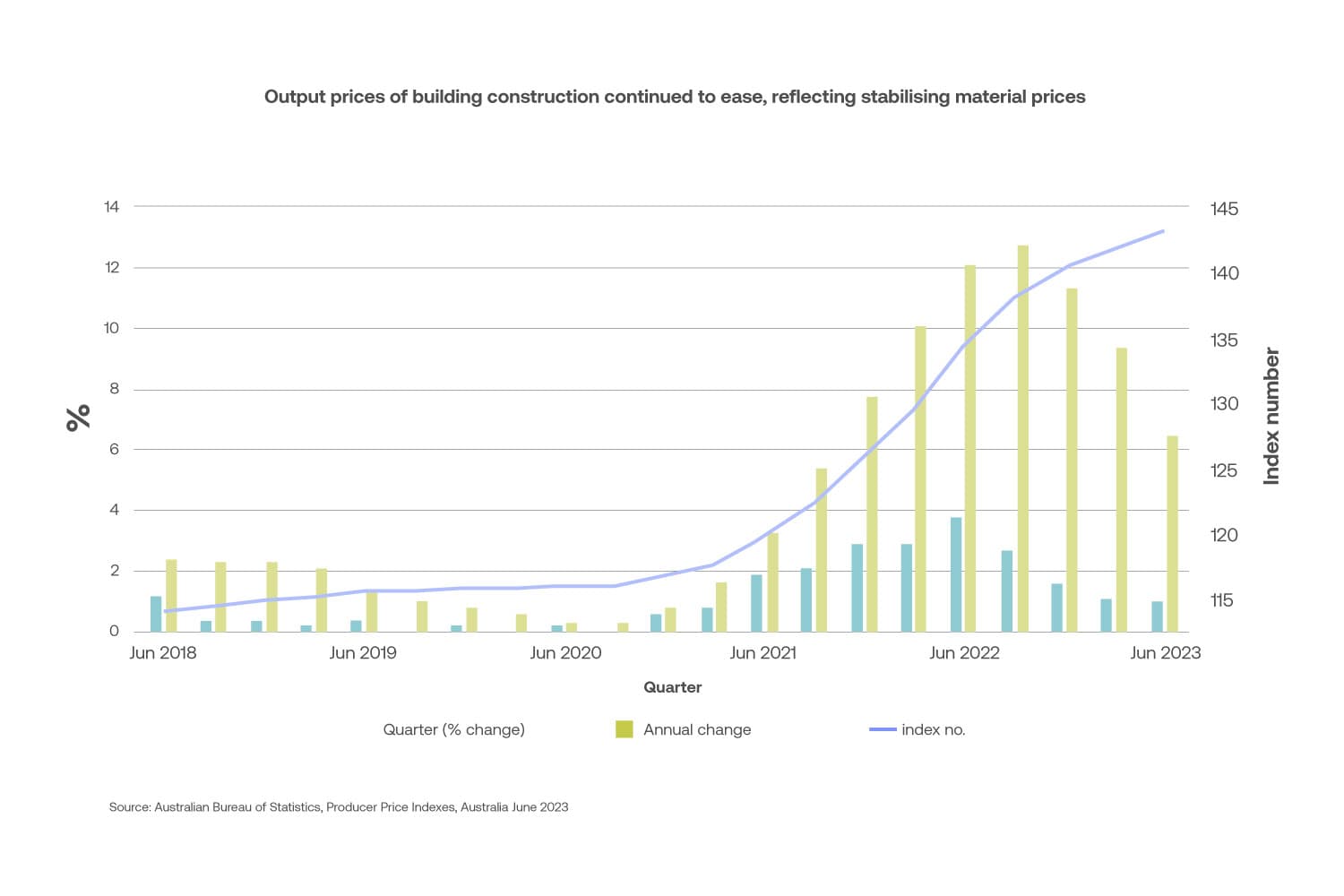

Figure 3 - Output prices of building construction. Source: ABS

Building construction prices rose 1.0% this quarter and 6.5% over the past 12 months.

Growth in the output of the construction industries continued to be driven by labour shortages, with demand for tradespeople placing upward pressure on output costs. While material prices have stabilised, increased prices for concrete-based structural components and internal fittings continued to rise. Demand for materials and labour remained high due to the ongoing activity in the non-residential market, as well as the residential and infrastructure sectors.

The contributors to the quarterly price movements were:

House construction (+1.0%)

Other residential building construction (+0.9%)

Non-residential construction (+0.9%).

New dwellings

The rate of growth in new dwelling prices continued to slow. Having peaked in the September 2022 quarter at 20.7%, annual inflation has fallen for the past three quarters to 7.8% in the June 2023 quarter. The recent moderation in price growth reflects lower new demand, improvements in the supply of materials and material costs easing.

Automotive fuel price

Automotive fuel prices fell 0.7% for the quarter. The main contributor was the fall in diesel prices of 6.5%, while prices for unleaded petrol rose slightly by 0.3%. Compared to the June 2022 quarter, unleaded petrol prices are 3.2% lower and diesel prices are 10.1% lower. The gap between unleaded petrol prices and diesel prices is the smallest since March 2022 quarter.

Labour costs

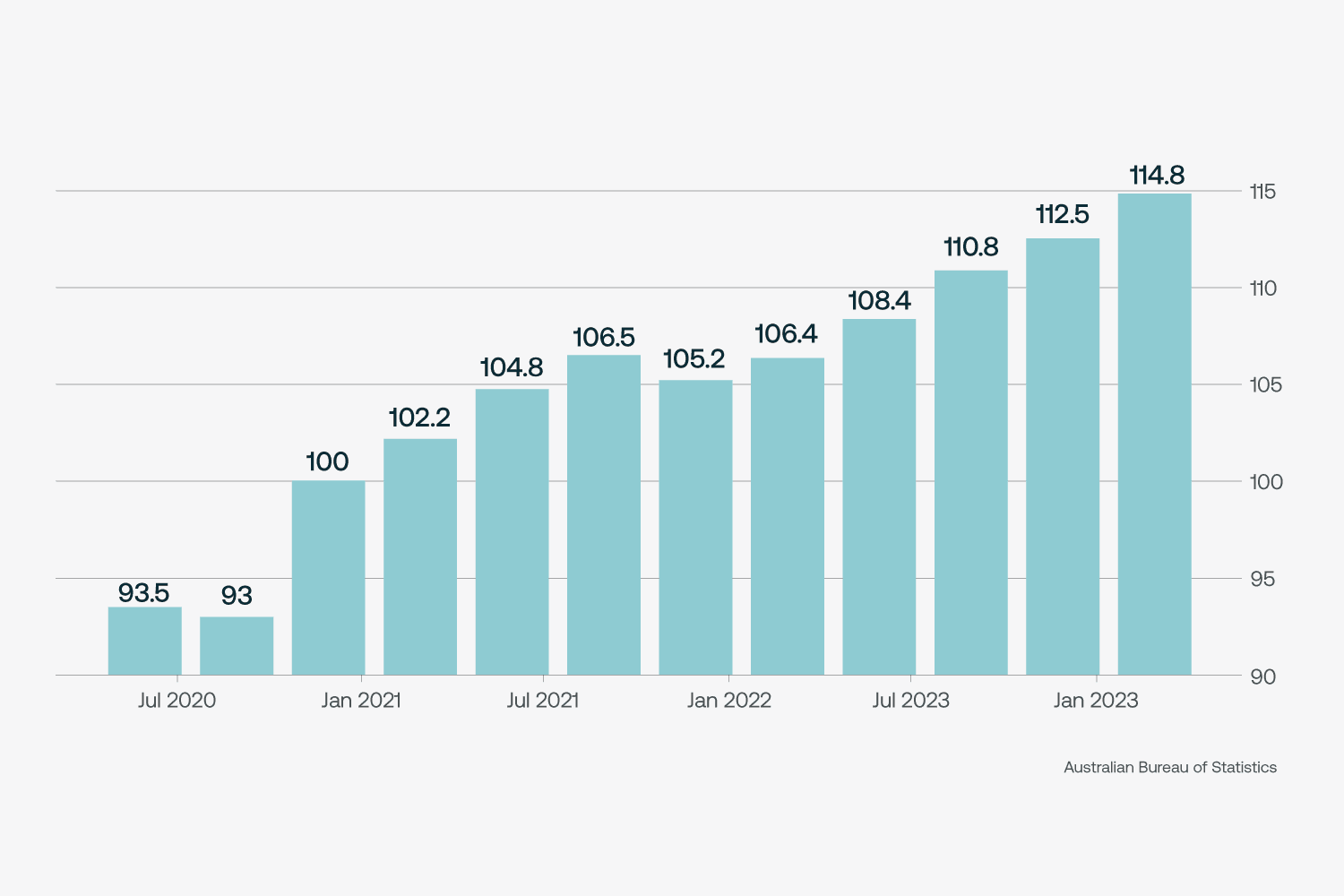

Figure 4 - Australia labour costs July 2020 – January 2023. Source ABS

Australia’s national unemployment rate remained at 3.5% in June and the employment-to-population ratio remains at a record high of 64.5%. To this effect, there are more than a million additional employed people than there were before the pandemic. Australia’s tight labour market, in which employment has recently increased in line with population growth, is placing pressure on all markets. In construction, this is translating into significant cost escalation.

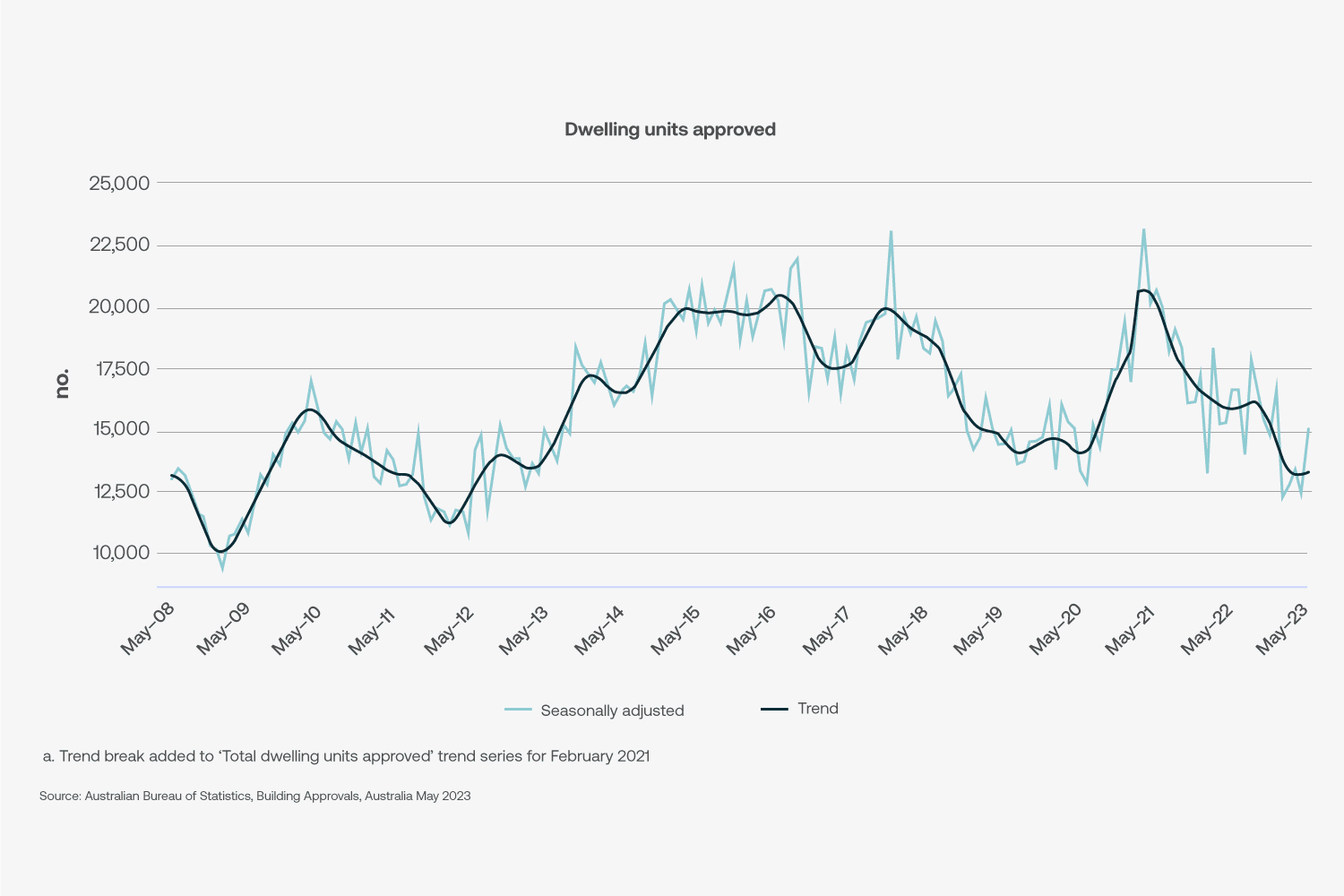

Building permits

Figure 5 - Nombre total d'unités d'habitation approuvées. SourceABS

Dwelling approvals are a leading indicator, which can help us predict or forecast future economic trends. The most recent data from the Australian Bureau of Statistics suggests a downward trend in the number of dwellings approved in recent months, both when compared to the previous quarter and the same period in the previous year. This could indicate a slowdown in the housing construction sector lies ahead.

However, the pattern of growth following the Global Financial Crisis is instructive; government stimulus delivered an immediate spike in approvals, followed by an easing in activity and then a quick recovery and period of steady and consistent growth. This trend suggests significant activity could be ahead from 2024 onwards.

Summary

Costs have stabilised for many key commodities and materials in the construction industry, but rapidly rising labour expenses are counterbalancing any savings. Furthermore, general market uncertainty has moved from prices to future projects.

We expect a rocky ride for the remainder of 2023 before Australia’s construction sector recovers in 2024. This recovery, however, is dependent on governments guaranteeing their project pipelines and prioritising planning reforms. With interest rates at a decade high, time is now a significant cost centre for any developer. Fast-tracked approvals are likely to stimulate the market and deliver housing needed to support a growing economy and drive down rents.

Methodology

Market research into the supply cost of core materials is conducted on a quarterly basis with manufacturers and suppliers. Our market assessment also involves a thorough analysis of secondary sources of market data on materials and labour prices.

These sources include the Australian Bureau of Statistics (ABS), the Australian Institute of Quantity Surveyors (AIQS), Fuel Price Index, Metal and Raw Material Price, and proprietary cost data from Altus Group.

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Disclaimer

This article is being provided for informational purposes only. No information included in this article constitutes, nor can it be relied upon as, legal, tax, investment, or other advice. Recipients should consult their independent advisors. The views and opinions expressed in this article are those of the authors themselves and do not necessarily reflect the views or positions of Altus Group Limited or its subsidiaries or affiliates (collectively, “Altus Group”). The article, the information contained therein, and any links to other sites are provided “as is” without any representations, warranties, or conditions of any kind, express or implied, including, without limitation, implied warranties, or conditions of fitness for a particular purpose or use, non-infringement or that any information is accurate, current, or complete. Altus Group has not independently verified any third-party information and makes no representation as to the accuracy or completeness of any such information. Altus Group and its advisors, directors, officers, and employees (collectively, its “Representatives”) are not liable or responsible to any person for any injury, loss, or damage of any nature whatsoever arising from or incurred by the use of, reliance on or interpretation of the information contained in the article or sites that are linked in the article. The foregoing limitation shall apply even if Altus Group or its Representatives have been advised or should have known of the possibility of such injury, loss, or damage. Any unauthorized use of the information is strictly prohibited. A user is not authorized to copy, circulate, disclose, disseminate, or distribute the information, either whole, or in part, to any third party unless first explicitly agreed by Altus Group.

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Alvin Yap Abidin

Quantity Surveyor

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Alvin Yap Abidin

Quantity Surveyor

Resources

Latest insights