Key highlights

Both investors and auditors expect real estate investment funds to ensure robust processes that produce transparent, timely, reliable valuations reflecting current circumstances

There are three areas where closed-end funds commonly experience challenges related to investment valuation processes: internal workflows, reporting and forecasting with economic headwinds predicted to continue for the foreseeable future, close-end funds must consider the strengths and weaknesses of existing valuation policies and processes

Those funds that don’t reinforce their valuation processes could face the prospect of losing credibility with current and potential investors, and ultimately, the competitiveness of their offerings

General consensus is that the US Federal Reserve will begin to decrease interest rates in either 2024 or 2025; having a consistent approach to incorporate these changes or lack of changes within the valuation process is paramount to investor credibility

There has also been a structural realignment for asset classes – both positively and negatively towards certain sectors and markets, which means differentiating by asset is more critical than eve

Complexity, uncertainty. These are the characteristics that define today’s global environment – and they are significantly impacting the confidence and expectations of commercial real estate investors – including those invested in closed-end funds.

According to the EY Global Wealth Management Research Report, recent market volatility hasn’t had a significant impact on levels of investor satisfaction with traditional asset classes, but it has had a negative impact on satisfaction levels with investments such as private equity real estate.

Now, more than ever, constrained access to capital, higher interest rates, low transaction volumes and depressed asset values are driving demand for more scrutiny and risk management. Understandably, investors want a clear sightline on performance and to understand the impact of volatility on their assets.

Acutely aware that illiquid assets are now riskier (with redemption queues in certain markets calling for limits and restrictions), both investors and auditors expect real estate investment funds to implement robust processes that produce transparent, timely, reliable valuations reflecting current circumstances. While closed-end funds may not be subject to the same terms as a public prospectus or have the same rigor around their valuation processes as do open-end funds or non-traded REITs, these expectations are driving demand for more exacting valuation processes to deliver greater transparency and insights.

With headwinds present in raising capital and increasing speculation surrounding the performance of funds on the point of exit, it’s critical for closed-end funds to review and fortify their valuation processes to inform decisions regarding how to navigate today’s challenges.

Following are suggestions for a transparent approach that will provide reassurance to investors, auditors, lenders and other fund stakeholders.

"With less price discovery right now, the importance of transparency and liquidity has grown. There's a need for values that you can trust and understand."

Common challenges in three key areas

There are three areas where closed-end funds commonly experience challenges related to investment valuation processes: internal workflows, reporting and forecasting.

1. Internal workflows

For closed-end funds, accurate and timely valuations are essential to making informed investment and risk management decisions. They enable fund managers to stay ahead of potential market volatility and focus on maximizing returns to investors. For investors, these valuations are crucial for assessing the performance of their investment.

Some funds prepare valuations internally to maintain the lowest possible cost structure, but this is becoming increasingly onerous for the following reasons.

Resourcing

Valuations that are performed in-house are often led by asset managers. In some cases, there may not be a dedicated valuation team, and portfolio managers and asset managers co-ordinate through periodic valuation cycles with minimal oversight or support.

Funds must allocate scarce resources and time to manage the process, produce valuation updates, source market data, as well as RFP, review (and sometimes challenge) external appraisers, and track valuation and model changes over time.

An asset manager’s most important role lies in maximizing the value of investments. However, many are spending too much time preparing and coordinating valuations that have become more complex.

"Due to current market conditions, the role of the asset manager is key – returns depend, not simply on appreciation, but on driving efficiencies and creating revenue streams. Adding time-consuming responsibilities for valuations basically handcuffs them from doing their job well."

Complexity

A slower leasing market, reduced liquidity and fewer sale transactions have made estimating commercial real estate values more complex and laborious. This is especially true for closed-end funds, which have significantly higher leverage than open-end funds. Bank appraisals and loans add another layer of complexity.

Yes, activity is down for sales and leasing. That does not mean there is no activity or perhaps the lack of activity in certain markets is also indicative of value levels and should be incorporated within valuations. Understanding activity that has occurred is critical. As an example, the referenced cap rate for one sale may be displayed four different versions (Trailing Cap Rate, Broker Yr 1, Buyer underwriting, Seller underwriting). These nuances are critical to vet the current market appetite.

Consistency

Consistent procedures and controls are essential for accurately stating a portfolio’s value and making informed investment decisions.

But for many funds, valuations are a manual, time-consuming process, often utilizing a variable range of traditional tools such as Excel and SharePoint. Many organizations don’t have written procedures on how they perform valuation tasks, resulting in informal approaches often determined by personal preferences. Ultimately, it creates a process that isn’t necessarily repeatable.

"Many organizations don't have written processes on how they perform valuation tasks, so it can change substantially from person to person."

Transparency

Economic uncertainty contributes to investor uncertainty, which can impact confidence in asset valuations and lead to mistrust or disputes.

Today stakeholders are carefully scrutinizing investments and want to see greater clarity and transparency of communications and reports. Yet for many funds, valuation data is not easily accessible or exchangeable, which restricts transparency across the portfolio of assets, and limits the use of information for strategic analysis.

Objectivity

With high interest rates, tight credit markets and unyielding inflation impacting commercial property prices, valuation objectivity has become a leading concern for investors and auditors.

When internal managers who may be involved in the acquisition or management of an asset are also conducting valuations of these assets, insufficient separation of duty can create credibility issues.

Investors do not want to be concerned about possible conflicts of interest when asset values are determined and reported. The same is true for auditors, who wish to see reliable, appropriate evidence when reviewing investment valuations.

For further insights watch this recent webinar:

2. Reporting

Investor reports are typically the most important communication tools for building trust and confidence in a fund. These also serve as valuable guideposts for fund managers, providing an opportunity to consider strategy from the perspective of those who are investing.

Given heightened investor and auditor vigilance and the more demanding responsibilities of asset managers, funds are increasingly challenged to defend their valuations, and back them with timely financial and performance reports that suitably reflect today’s investment complexity.

In the past two years, more investors are requiring granular and asset level information for their subject relative to a wider peer group. Yes, office values have declined in San Franscisco but how much in this portfolio relative to comparable properties and more importantly what is the variance? These types of comparative analytics are critical for investors maintaining positions in existing funds and future capital contribution considerations.

"It's critical that a fund’s valuations reflect the current market conditions, which are obviously challenged right now, so that their investors truly understand the market price."

3. Forecasting

Reliable forecasts enable a fund to stay agile and productive. Forecasting is more important than ever during market upheaval, so a deficiency of precision represents a significant risk. It is also more formidable, requiring more data to predict trends and turning points.

Knowing what data to use, where to access that data, how to capture it and how to assess it – all are challenging in today’s environment.

Many closed-end funds are increasingly moving to innovative and robust valuation processes that are more closely attuned to shifting market conditions and stakeholder expectations.

A better path forward

With economic headwinds, market volatility and tighter financial conditions continuing to impact markets, the risks associated with the valuation of financial assets and liabilities will need to be carefully managed.

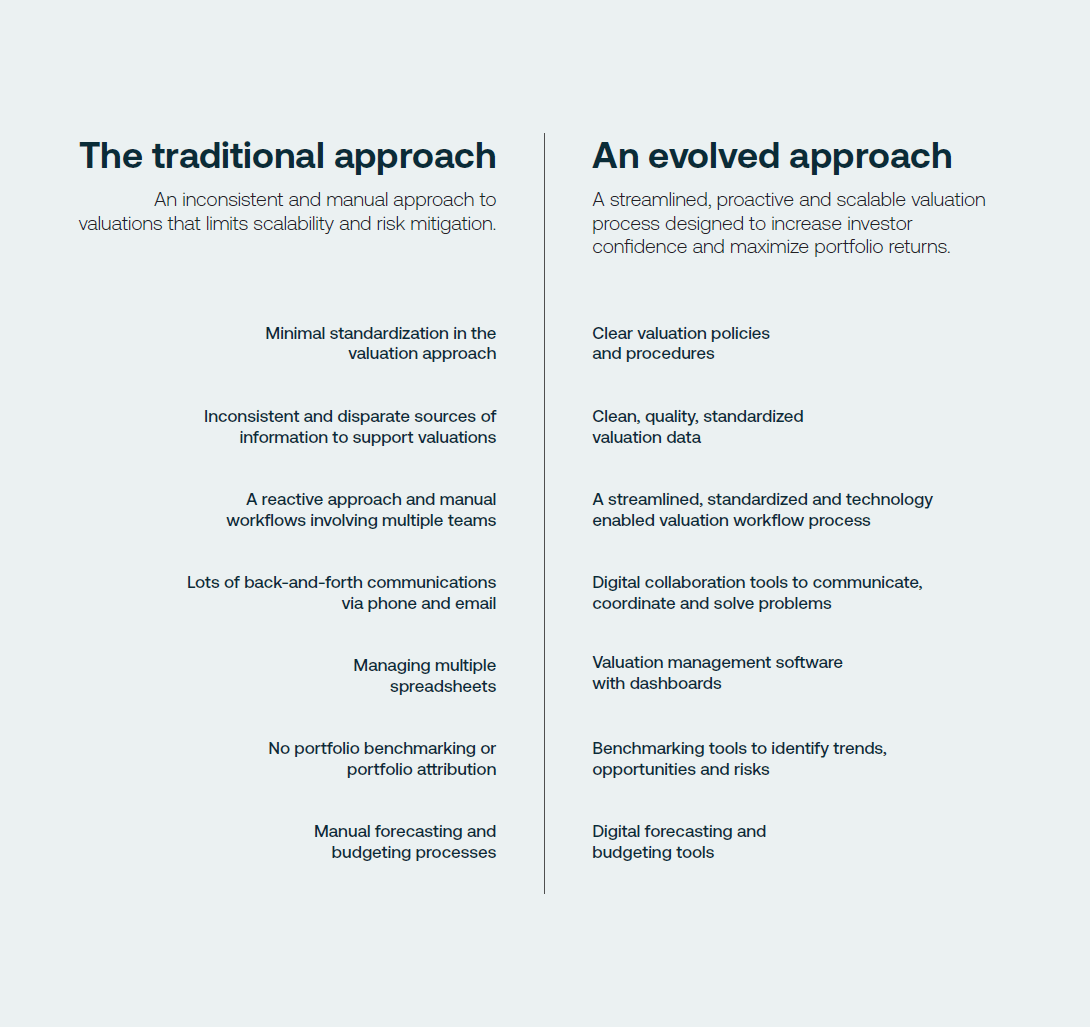

Closed-end funds should use this time to consider the strengths and weaknesses of existing valuation policies and processes. Consider how an evolved approach, which looks like Figure 1, could strengthen clarity, consistency, objectivity and transparency.

Clear valuation policies and procedures and a transparent framework to guide the process.

Clean, quality, standardized valuation data clearly supports the business valuation and facilitates productive analysis. The right data enables the extraction of valuable insights – from the most granular property level to global market intelligence. The organization profiles the data required, and when necessary, supplements internal sources with data supplied by a third party for additional asset and fund intelligence.

A streamlined, standardized technology-enabled valuation workflow process eliminates time-consuming manual data work and model building. This minimizes ambiguity and guesswork, keeps work proceeding smoothly, elevates productivity, and improves the quality of the end product.

This process includes clear, documented expectations and defined responsibilities for tasks and decisions. It also includes a detailed schedule of key activities, start dates and projected completion dates, including planned buffers to optimize the timeline.

Digital collaboration tools help individuals communicate, coordinate and solve problems; remove obstacles to efficient workflow; and improve engagement and performance.

Valuation management software features dashboards to facilitate transparency and expedite decision making. These incorporate clear views of valuation history, benchmarks, analytics, performance attribution and key performance indicators, as well as the underlying calculations.

The latest valuation management tools provide end-to-end integration of the entire process including workflow, analytics, and document management to optimize productivity.

Benchmarking tools identify trends, opportunities and risks. These enable viewing of an investment universe in the context of the whole market with regular consolidated valuation benchmark overviews. They enable refining fund data by property type, sub-type and sector and comparisons with anonymized peer groups. As well these tools enable viewing global portfolio assets in a standard currency and trends in asset assumptions and compare current period values in real-time.

Digital forecasting and budgeting tools produce fast, more accurate estimates of future values, tax liabilities and cash flows. This facilitates confident, forward-thinking decisions to frame real estate portfolios for the future.

Closed-end funds need to be open to a new approach.

Those funds that don’t reinforce their valuation processes could face the prospect of losing credibility with current and potential investors, and ultimately, the competitiveness of their offerings. Credibility is essential for investors to trust in, not only the stewardship of the fund, but also their commitment to delivering consistent returns.

Those that elevate their valuation processes will mitigate risks, create long-term value and enjoy the confidence of investors – today and in the years ahead.

Figure 1 - The traditional approach vs. An evolved approach

Want to be notified of our new and relevant CRE content, articles and events?

Authors

John Greenwood

Senior Director

Authors

John Greenwood

Senior Director

Resources

Latest insights