Key highlights

While 49% of respondents to the US Q2 2024 CRE Industry Conditions and Sentiment Survey do not anticipate a near-term recession, those who believe a recession is likely within the next six months increased by 7 percentage points from the previous quarter

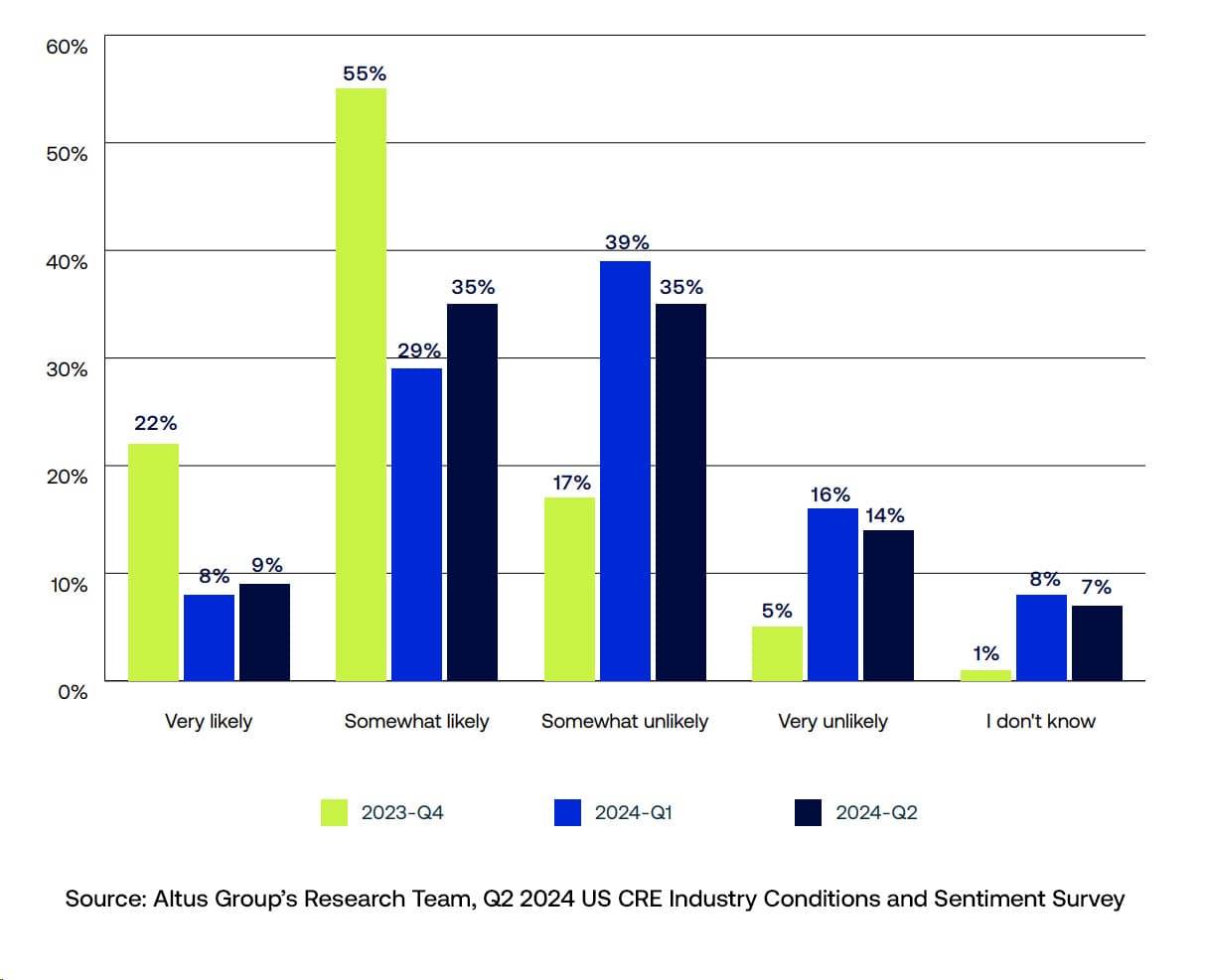

The majority of the industry (70%) currently sits in the "somewhat likely" or "somewhat unlikely" camp, indicating a prevailing uncertainty

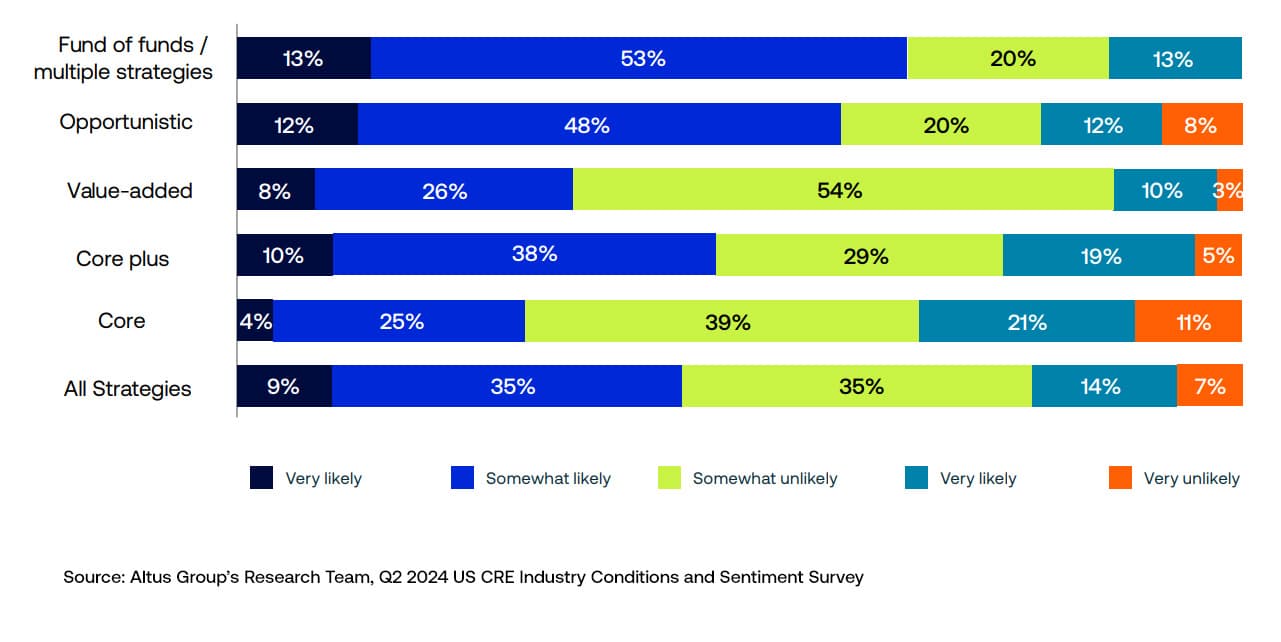

Core strategy respondents remain the least expectant of a near-term recession, while those with fund of funds and opportunistic strategies are the most expectant. Despite this, all strategies saw quarterly increases in recession expectations

The portion of respondents who are unsure ("I don't know") remained small but saw quarter-on-quarter increases in core and core plus strategies

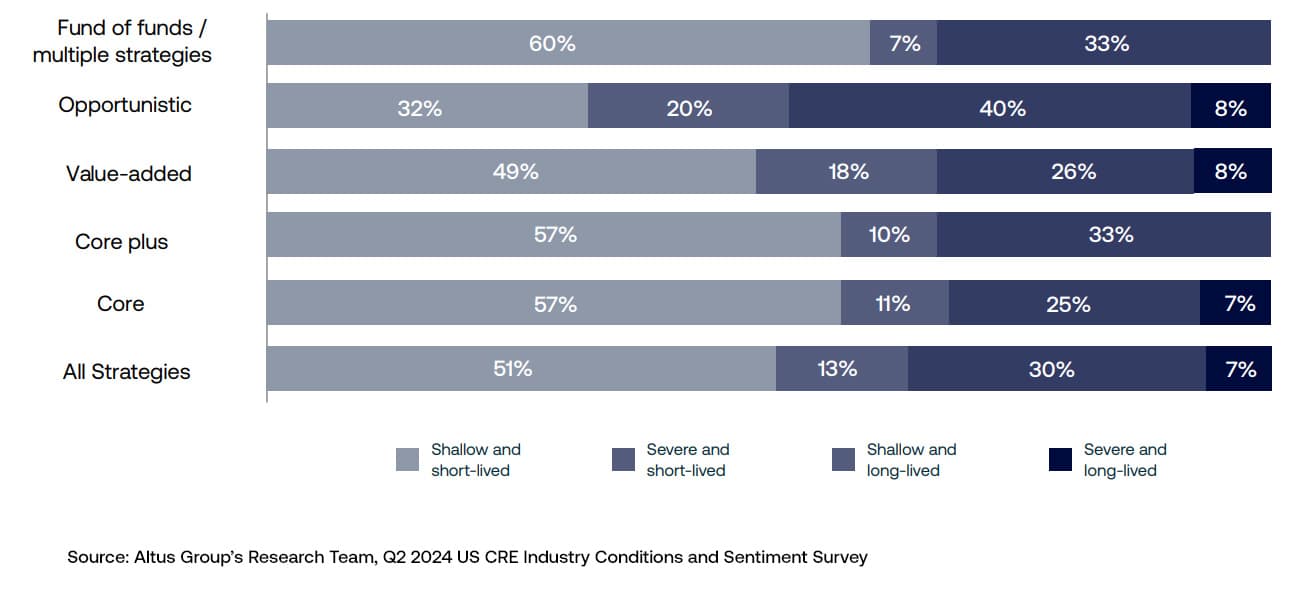

Expectations regarding the severity of the next recession have shifted, with 80% of respondents expecting it to be shallow (either "shallow and short-lived" or "shallow and long-lived"), down from 89% in the prior quarter. There was an increase of 9 percentage points in those expecting the next recession to be severe, with notable increases in core and opportunistic strategies

Assessing recessionary concerns in the US commercial real estate market

The commercial real estate (CRE) industry has always been an indicator for broader economic trends. Our recent US CRE Industry Conditions and Sentiment Surveys have provided insights into the sector's expectations regarding potential recessionary pressures. In this article, we will examine our latest Q2 survey findings and compare their results to prior quarters to better understand how and why the most recent sentiment around a potential recession has shifted.

Recession expectations among US commercial real estate professionals

Looking back at previous quarters, our last survey (Q1 2024) findings presented an optimistic picture, with the majority of respondents not expecting a recession in the near term. There was a large decline in the number of CRE professionals who thought a recession is likely to happen within the next six months compared to our Q4 2023 results. Different strategies within the industry, including core, fund of funds, and opportunistic, showed varying levels of concern, but overall, there was a trend towards reduced fears of a recession.

Figure 1 – How likely is an economic recession within the next 6 months?

In contrast to the previous quarter, our Q2 2024 survey indicates a slight increase in recession concerns among CRE professionals. Although most respondents (49%) still do not expect a recession in the near term, the number of those who believe a recession is likely within the next six months has increased by 7 percentage points (pp) compared to the prior quarter.

Severity of the anticipated recession

Expectations regarding the severity of the next recession have shifted, though the broad majority (80%) of respondents expect the next potential recession to be shallow (either "shallow and short-lived" or "shallow and long-lived"), this sentiment has declined by 9 pp over the previous quarter. In contrast, there was an average increase of 9 pp across all strategies in those expecting the next recession to be severe (either “severe and short-lived” or “severe and long-lived) and an 11 pp increase in core, and 10 pp increase in opportunistic strategies.

Figure 2 – What will be the depth and length of the next economic recession?

Prevailing uncertainty

The majority of Q2 survey respondents (70%) currently lean toward “uncertain”, with most respondents falling into the "somewhat likely" or "somewhat unlikely" categories in terms of expecting a recession. When broken down by different fund strategies, we found that core strategy respondents were generally less concerned, while those with fund of funds and opportunistic strategies have become more expectant of a near-term recession. All strategies saw an increase in recession expectations in the Q2 survey, indicating a broader trend of rising concern.

Figure 3 – How likely is an economic recession within the next six months? (by investment strategy)

Our Q2 survey also showed an interesting trend in the "I don't know" responses to our recession expectation question. While the overall portion of respondents who are unsure remained small, there were increases in core and core plus strategies, again suggesting a growing uncertainty among these strategies.

According to Deloitte’s recent Q2 2024 United States Economic Forecast, they highlight similar perceptions of the market through their prepared forecast scenarios. Their economists expressed an overall positive near-term assessment of the economy based on a strong first-half performance, and regulatory measures that have made it increasingly likely that a recession will be avoided. However, they note slowdowns from first-half economic drivers, such as job growth and consumer spending, and risks mentioned in the Federal Reserve Financial Stability Report noting “near-term risks to the stability of the financial system: higher-for-longer interest rates; worsening geopolitical conflict and spillovers; and strains on real-estate markets, particularly office real estate”, generate some level of skepticism to counter their optimism. These same points could also serve as a strongly plausible explanation for why so many CRE respondents are hovering between “somewhat likely and “somewhat unlikely” in our Q2 survey.

Implications for the CRE Industry

Shifts in sentiment between our Q1 and Q2 2024 surveys underscore the complex and evolving nature of recessionary concerns within the CRE industry. At the start of 2024, there was high optimism from Wall Street for multiple interest rate cuts, with six cuts forecasted, it dwarfed the three cuts initially mentioned by the FOMC at the end of 2023. This aligned with significant improvements in positive short-term recession and transaction sentiment between our Q4 2023 survey and our Q1 2024 survey. Fast forward to the present, we're past the middle of the year, and there have been no cuts implemented. With the mismatch between investor expectations and the current reality, it should be no surprise that there has been some pullback in positive sentiment about the likelihood and severity of a recession, but it hasn't been deep, or widespread. It seems that the CRE investment community has either quickly come to terms with interest rates staying higher for longer, and/or is still holding onto some optimism buoyed by other positive economic drivers and an improving trajectory for inflation.

One additional item to note, in parallel to recession sentiment, transaction intent has also remained significantly elevated throughout the first half of 2024. However, this intent has not materialized into significant increases in transaction activity compared to 2023.

With our Q3 2024 US CRE Industry Conditions and Sentiment Survey now actively collecting fresh responses, we’ll soon see how resilient the industry’s optimism continues to be, and whether it will translate to improved market performance in the back half of 2024.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights