CRE industry conditions and sentiment survey - US Q3 2024 results

Gain insights into the market sentiment, conditions, metrics, and issues affecting the US commercial real estate industry.

Key findings from Q3 2024 results

Capital sources: Capital availability expectations rose across all debt sources in Q3, most notably net expectations for capital from insurance companies is up 17 percentage points to 14% from Q2.

Priority issues: Compared to Q2, the order of the highest priority issues remained unchanged except for a 16 percentage point decrease in concern for insurance costs, dropping this issue by two positions.

Best performers: Multifamily property performance expectations rebounded sharply by 24 percentage points, with 69% now considering it among the “best performing” asset types.

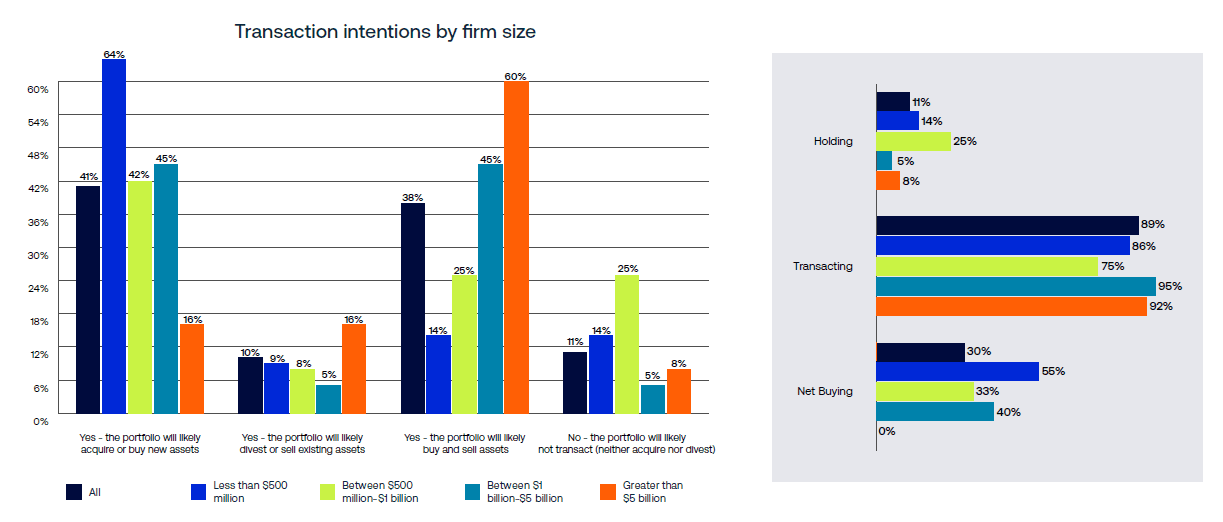

Transaction intent: A significant majority (89%) of respondents noted that they plan to transact (buy and/or sell) in the next 6 months, the highest level recorded by this survey series.

Capital conditions: Survey respondents anticipate that the cost of capital and all-in rates will decline, while the availability of capital will increase over the new 12 months. Conviction varied across the changes.

Gain insights into the market sentiment and conditions affecting the US commercial real estate industry.

Market conditions

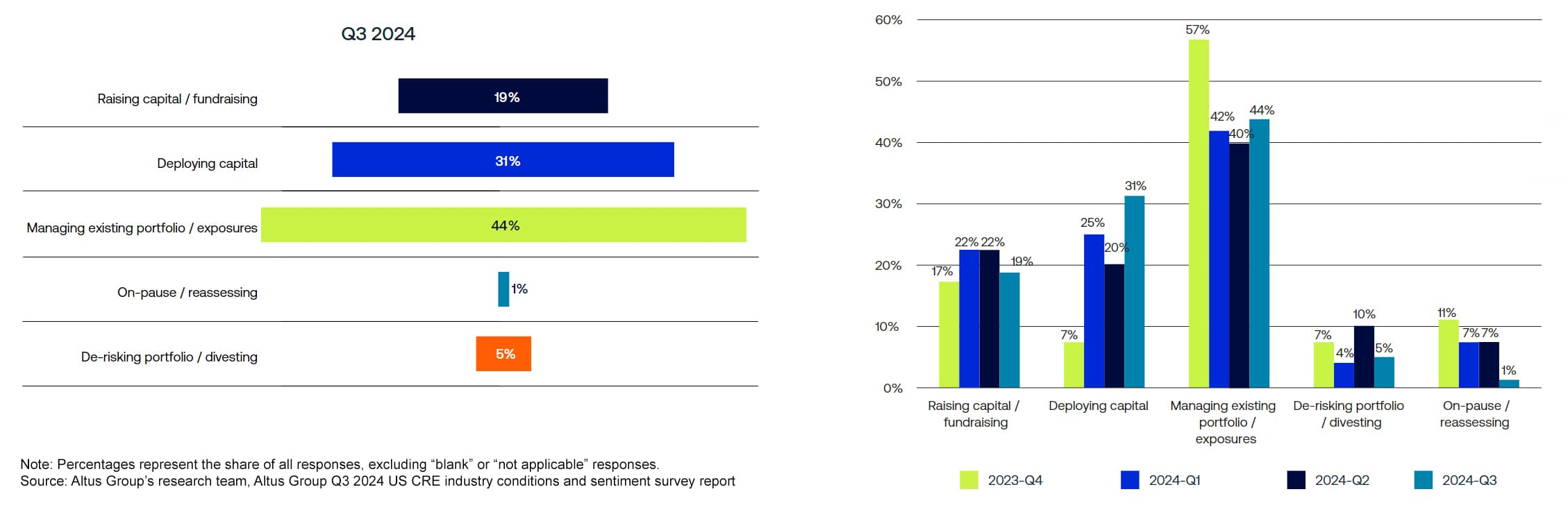

Current focus

Respondents are gearing up to put capital to work. The percentage who cited “deploying capital” as a primary focus over the next 6 months surged 11 percentage points – from 20% in Q2 to 31% in Q3. The percentage of those who cited being on pause or de-risking portfolios dropped 5 and 6 percentage points respectively.

What do you think your team’s primary focus will be over the next 6 months?

A plurality of respondents say cash flow expectations have stabilized, while expectations for increased cap rates have de-intensified. While most respondents (51%) have similar expectations for capital expenditures relative to 12 months ago, they remain split on revenue and NOI growth. In Q3, 27% stated that they had moderately or significantly increased expectations for revenue growth, while 30% said they had moderately or significantly decreased expectations. A similar 28% and 31% respectively said the same for NOI growth.

How have your expectations for your portfolio changed compared to 12 months ago?

Majorities have increased expectations for going-in cap rates, but the percentage experiencing a “significant” increase in expectations has dropped precipitously over the past four quarters (from 42% in Q4 2023 to 8% in Q3 2024).

Expectations for going-in/current cap rates

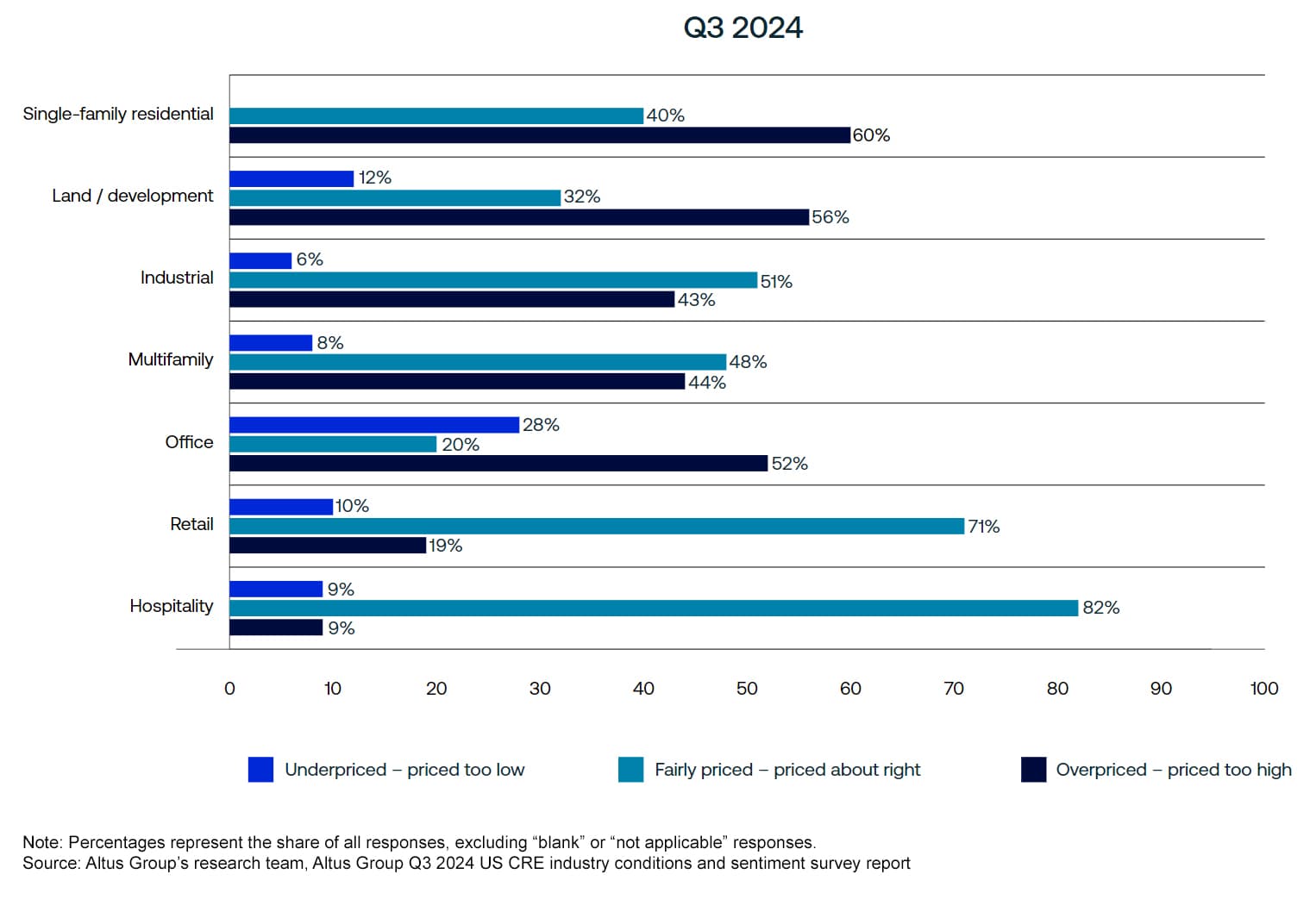

Competition and pricing

Respondents expect their peer firms to be increasingly competitive. More than one in four respondents stated that the level of competition within their firm’s peer group was “fierce”, up 5 percentage points quarter-over-quarter and 10 percentage points from Q4 2023. Relatedly, the percentage describing the level of competition as “balanced” slipped to 68%, a 4 percentage point drop quarter-on-quarter.

How would you describe the level of competition among your firm’s peer group?

Perception of current pricing shifts towards “fairly priced”. Across the largest property sectors, participants increasingly describe current pricing as being “priced about right”. The majority of respondents across seven of the 11 sectors chose the “fairly priced” characterization. While single-family residential and land/development were still described as being “overpriced” in Q3, hospitality and multifamily saw significant swings from “overpriced” to “fairly priced” from Q2.

How would you characterize current pricing for the following property types?

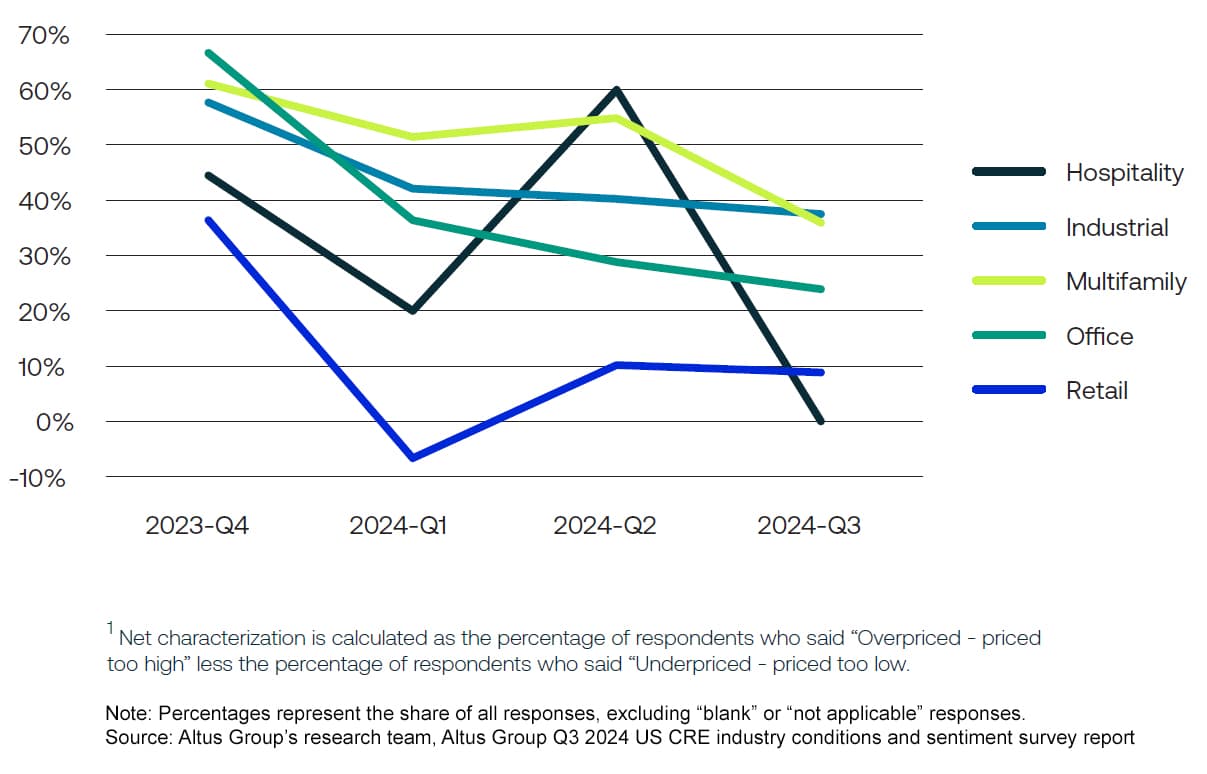

Net characterization of current pricing

What all-in interest rates are you seeing in the market?

All-in cost of debt increases across loan terms. The average all-in interest rates across the five main property sectors (hospitality, industrial, multifamily, office, retail) moved up on the quarter for 5-year and 10-year loan terms. The average interest rate on 5-year floating rate debt moved up the most (+77 bps) to 7.73%, while both 5-year and 10-year fixed rate interest rates moved up 28 bps and 22 bps, respectively.

5-Year Floating Rate (%)

5-Year Fixed Rate (%)

10-Year Fixed Rate (%)

However, the majority of this change was a result of higher interest rates reported for hospitality. Excluding hospitality from the averages, only the average interest rate for 5-year floating rate mortgages moved up on the quarter (+20 bps), while the reported interest rate for 5-year and 10-year mortgages fell slightly, -3 bps and -8 bps respectively.

What senior debt financing terms are you seeing in the market?

Lower loan proceeds reported for office and hospitality. Reported terms for senior debt financing revealed modest adjustments from Q2 to Q3. While most property sectors saw minor changes to the max loan-to-value (LTV) reported, office, hospitality, and student housing all saw declines of 3 percentage points or more on the quarter.

Maximum LTV (%)

Reported minimum debt service coverage ratios (DSCR) for office and hospitality also increased on the quarter by an average of 7 bps across 5-year and 10-year products.

Minimum DSCR (x)

Combined, the lower max LTVs and higher DSCRs reported for office and hospitality suggest that lenders are becoming more cautious with these sectors, and lower proceeds for these types of collateral. Although the max LTV for retail remained largely unchanged compared to Q2, respondents noted an average increase to min DSCR of approximately 9 bps.

5-Year Floating Rate (%)

5-Year Fixed Rate (%)

10-Year Fixed Rate (%)

Reported current market gross IRRs

Targeted gross IRRs increase, with the exception of multifamily and self-storage. Compared to Q2, the Q3 reported midpoint for gross IRRs targeted by new funds increased across all the property sectors, with the exception of self-storage and multifamily. The largest QoQ increases were seen in hospitality (+321 bps vs Q2) and student housing (+277 bps).

What are typical ranges for the returns you are seeing across the current market for new funds?

New fund gross IRRs have been trending upwards over the last four quarters for the major property sectors, with the exception of office which had a midpoint gross IRR of 14% in Q4 2023 and a Q3 2024 midpoint of 13.4%.

Gross IRRs targeted by new funds

Range of Gross IRRs (high end less low end)

Market sentiments and expectations

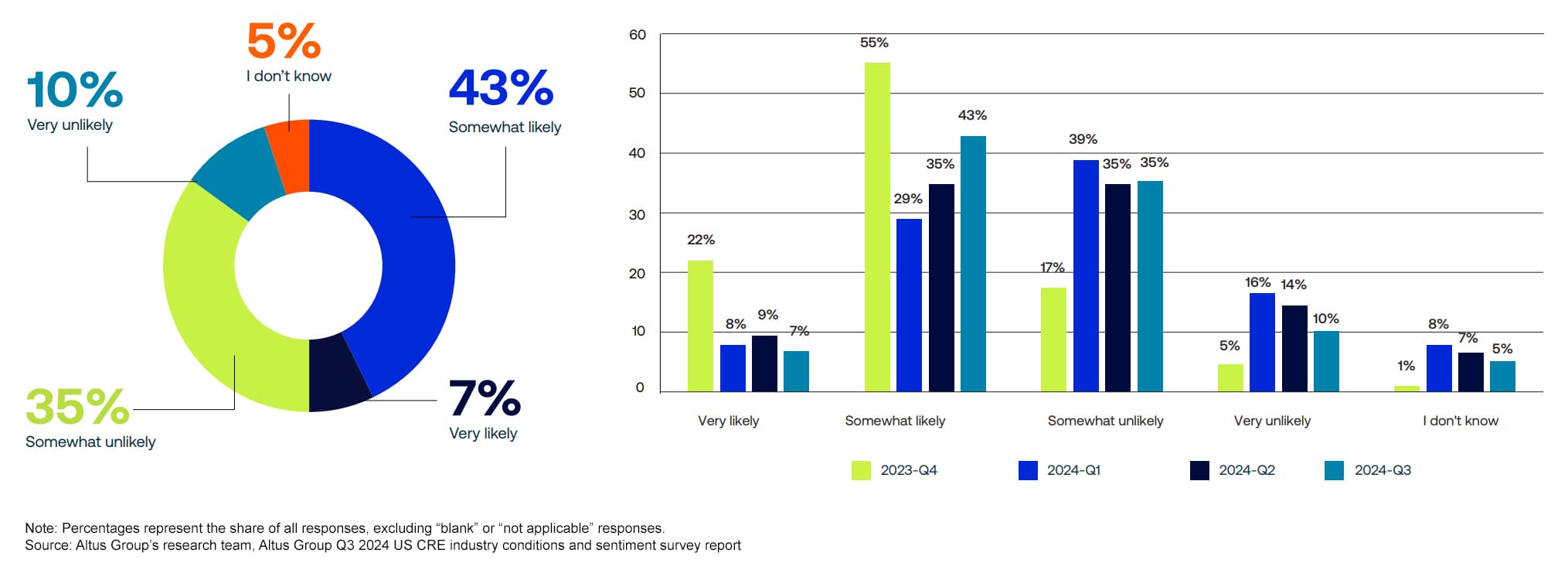

Recession expectations

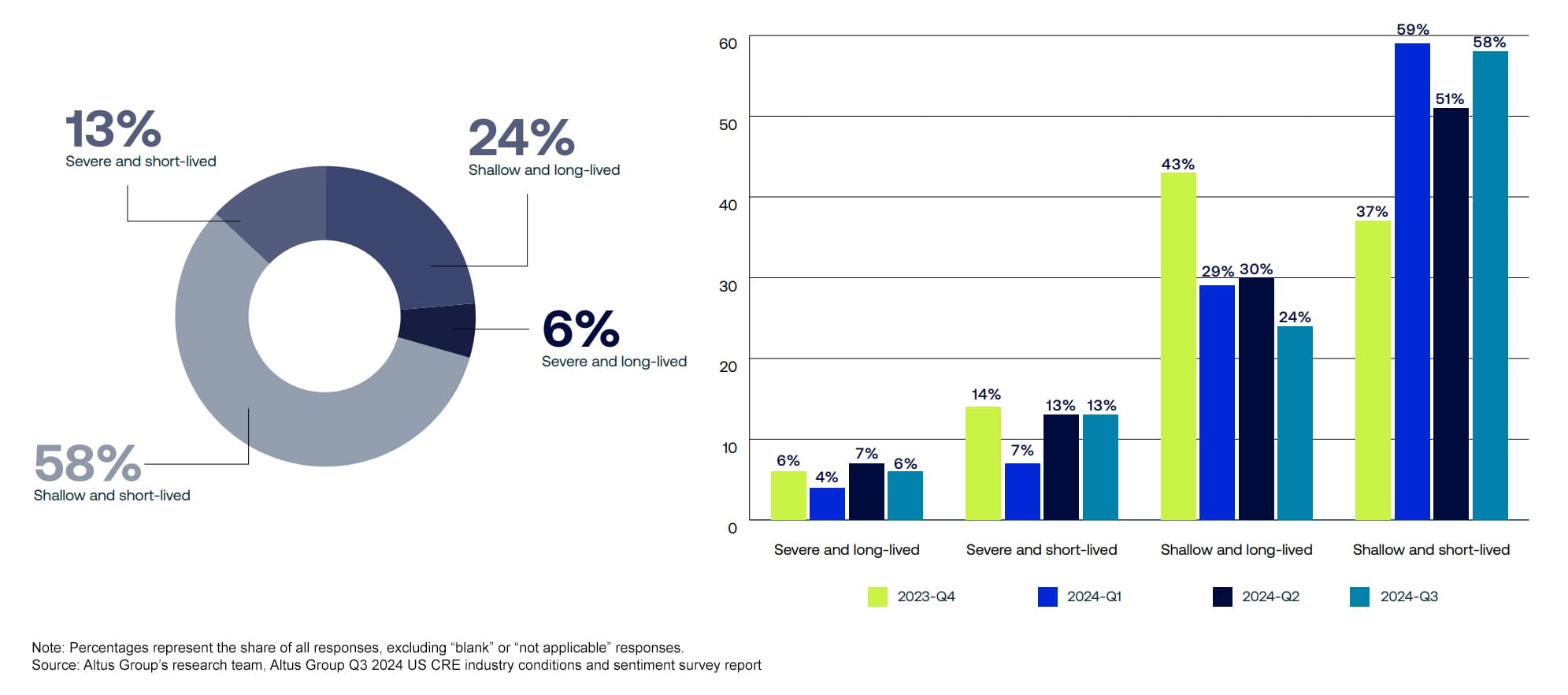

Recession expectations moderate, though don’t disappear. Forty-three percent of respondents expect a recession to be “somewhat likely” over the next 6 months, up from 35% in Q2, though down from the 55% who said the same in Q4 2023. Participants seem to have moderating views on a near-term recession, as both extremes of the spectrum (“very likely” and “very unlikely”) saw declines QoQ.

How likely is an economic recession within the next six months?

CRE industry expecting next recession to be shallow. A clear majority, 58% of respondents, anticipate that the next recession will be shallow and short-lived, a 7 percentage point increase from Q2 and only 1 percentage point less than the Q1 2024 survey. The QoQ shift was driven predominantly by respondents who shifted their expectations from “shallow and long-lived”.

What will be the depth and length of the next economic recession?

Cost of capital expectations

Capital cost expectations moderate across strategies. Expected net levered IRRs over the next 12 months continued to moderate, coming down by an average of 136 bps QoQ across the four main equity strategies: core, core plus, value-added, and opportunistic. Meanwhile, 12-month forward expectations for all-in, fixed-rate financing across these strategies also moderated, though to a lesser degree (-14 bps average across strategies).

Where do you anticipate the cost of capital to be over the next 12 months (on annualized basis)?

Net levered IRRs

Interest rate (all-in, fixed rate)

What changes do you anticipate to the following key metrics over the next 12 months?

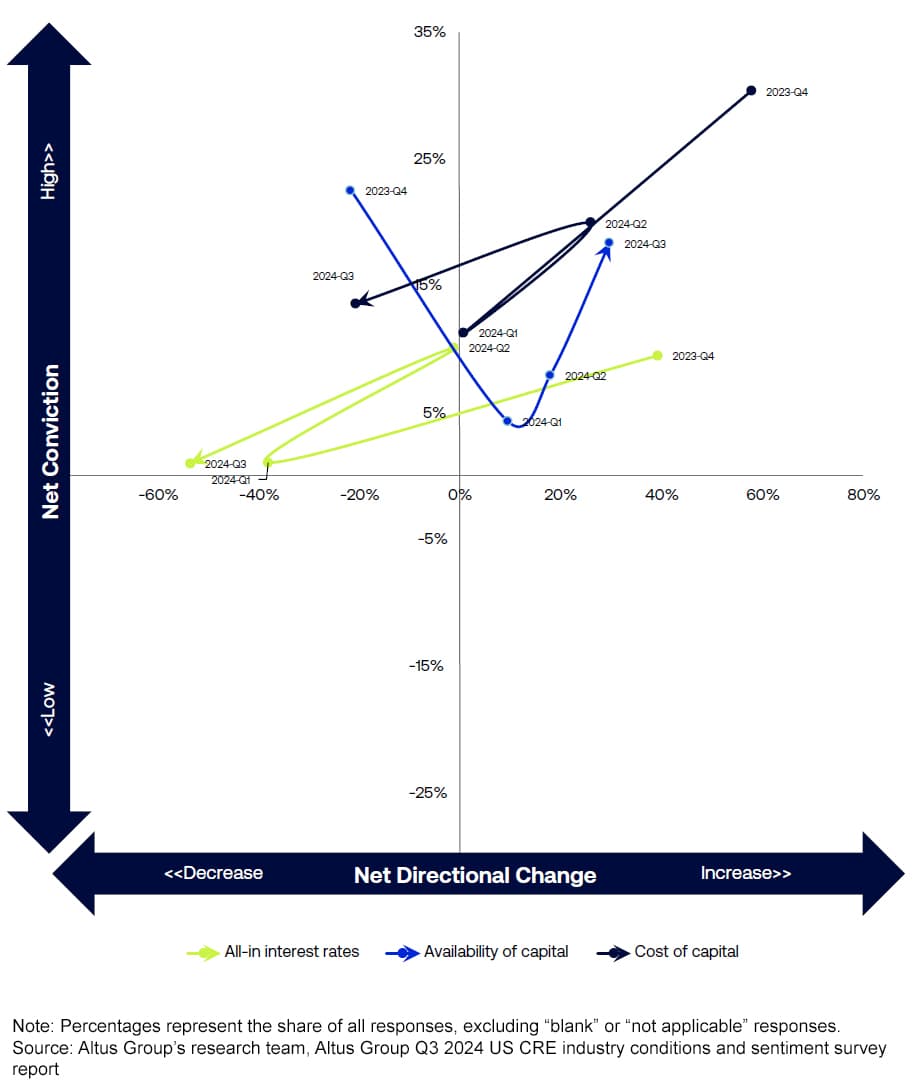

Key metric expectations whiplashed from prior quarter on shift in cost of capital. Respondents’ expectations for capital conditions (cost of capital, interest rates, availability) whiplashed over the last four quarters. Respondents expect the cost of capital and all-in interest rates to decline over the next 12 months, though with much less conviction than in prior surveys. However, the results show growing conviction around increased availability of capital over the next year.

What changes do you anticipate to the following key metrics over the next 12 months?

Migration of net direction vs net conviction - Capital: Interest rates, availability, cost of capital

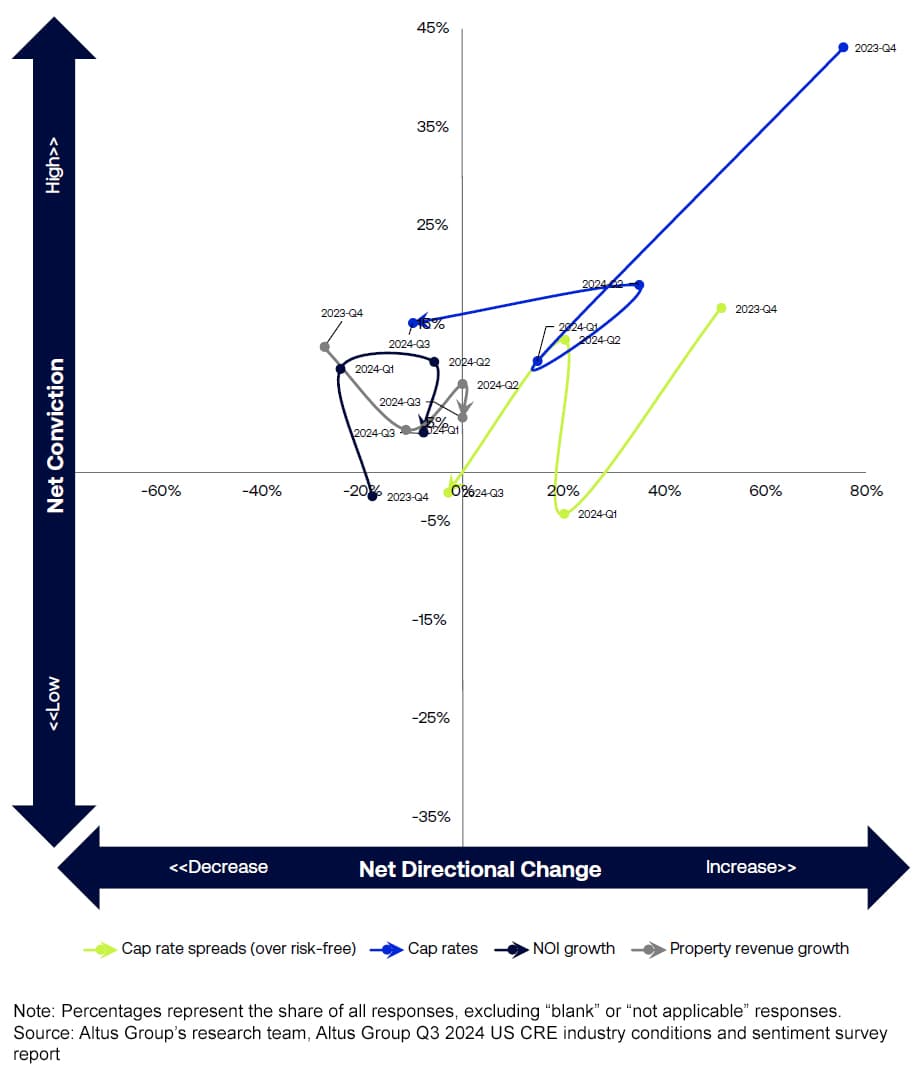

Waning conviction was also seen around property cash flow (revenue growth, NOI growth) for the next 12 months, which respondents expect to generally remain stable. Cap rates (spreads and absolute) are anticipated to decrease slightly over the coming year.

Migration of net direction vs net conviction - Fundamentals: Revenues, NOI, cap rates

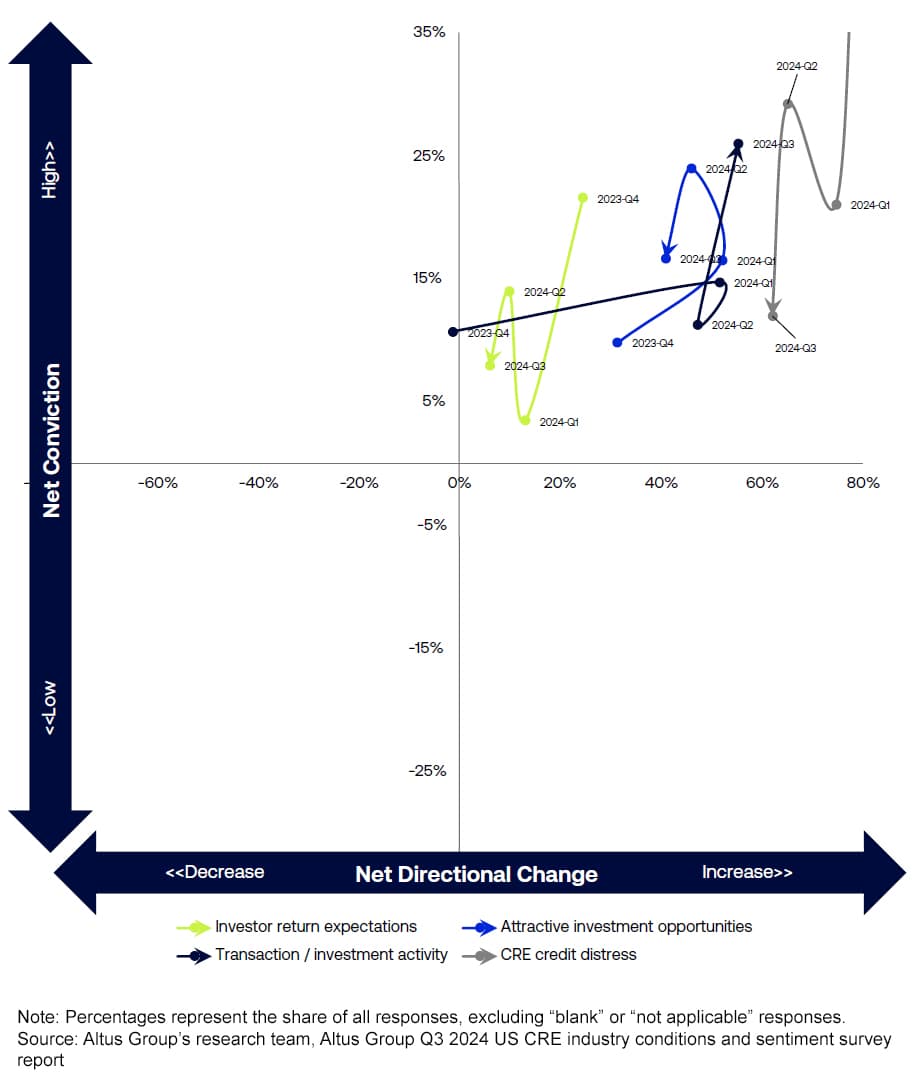

Finally, respondents were less confident than in prior surveys, but still anticipate that CRE credit distress will increase, along with attractive investment opportunities, and to a lesser extent so will investor return expectations. Bucking the declining confidence trend, respondents were increasingly convinced that there will be increased transaction activity over the next 12 months – this had the highest collective conviction.

Migration of net direction vs net conviction - Investments: Returns, distress, activity

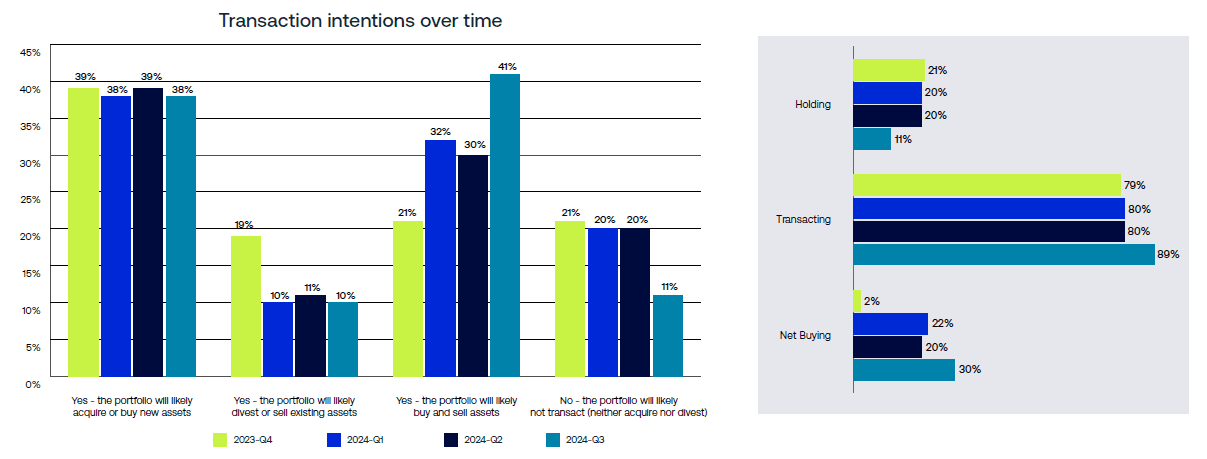

Transaction intentions over next 6 months

Near-term transaction intentions rise notably. Respondents’ near-term transaction intentions continued to increase through Q3. A significant majority (89%) of respondents noting that they plan to transact (buy and/or sell) in the next 6 months, the highest level recorded. The smallest institutions (less than $500 million) reported that they intend to be net buyers, while 60% of the largest institutions (greater than $5 billion) reported that they plan to buy and/or sell.

Over the next 6 months, do you anticipate any transactions in your portfolio?

Comparison of quarterly near-term transaction intentions (all firm sizes)

Geographic footprint expectations

US respondents cite firms’ intentions to operate in more markets in the near future. Nearly 40% o respondents reported that their firms plan on operating in more markets/metros within one year than they do currently. While 10% of firms with exposure to CRE of between $500 million - $1 billion expecting to consolidate operations into fewer metros, no large firms ($5 billion or more in exposure to CRE) shared this view.

A year from now, how many markets (metros, cities) do you think your firm / fund will be operating in?

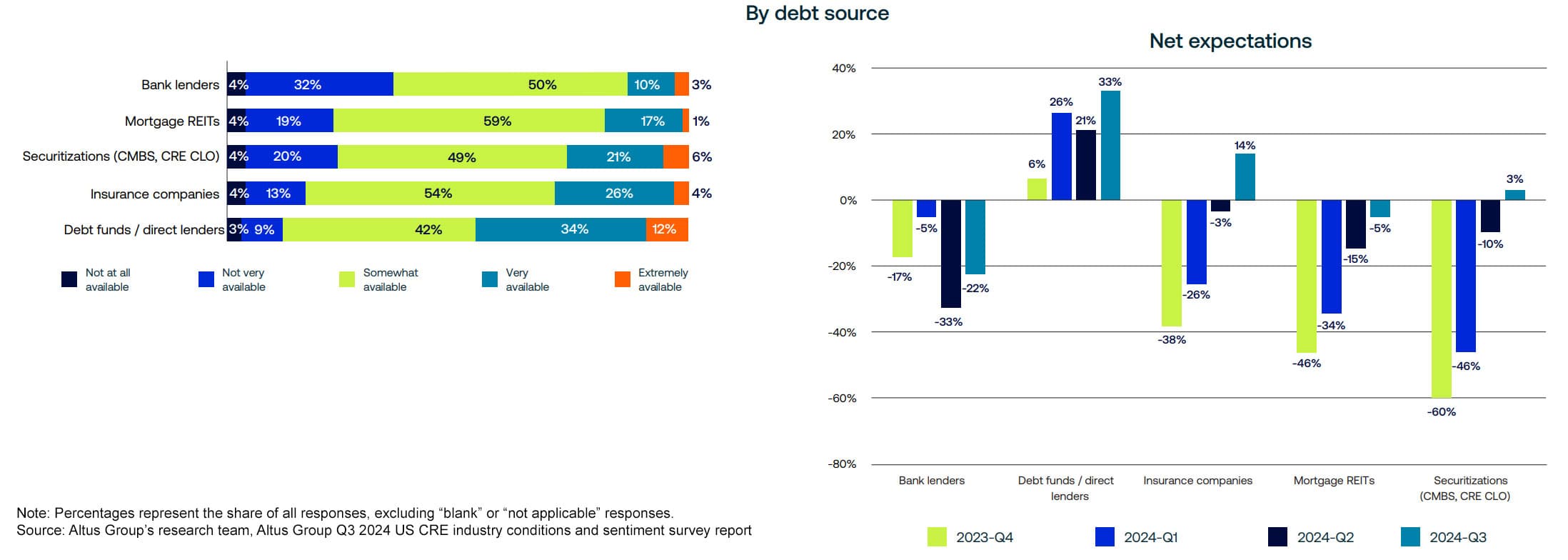

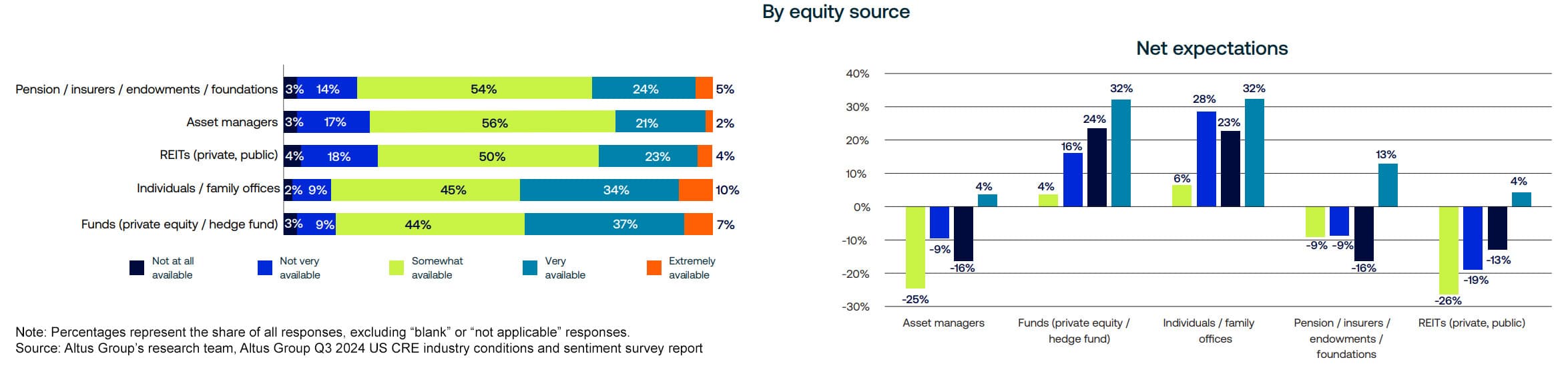

Capital availability

While expectations for capital availability overall remain low, net expectations surged across all sources of debt and equity. Only bank lenders and mortgage REITs remain in negative territory, with a net -22%, and -5% expecting the sources to be available within the next year. Responses over the past four quarters have shown vast improvements in net expectations for debt capital from life insurers and securitizations, which have improved 52 percentage points and 63 percentage points respectively since Q4 2023.

What are your expectations for the availability of debt-sourced capital over the next 12 months?

What are your expectations for the availability of equity-sourced capital over the next 12 months?

Expected operating environment

Respondent expectations for the operating environment have stabilized. Sixty-nine percent anticipate a “somewhat challenging” environment, and 17% expect an “extremely challenging” one within the next 12 months, the same as the prior quarter.

What best describes your expectations for the operating environment over the next 12 months?

Expectations for property type performance

Outlook for the industrial sector weakens, multifamily rebounds, and consumer-facing sectors see rising concern. While Q3 marked the third consecutive drop in the percentage citing industrial as a potential “best performer,” slipping 9% from 67% to 58% from the previous quarter. Multifamily sentiment, on the other hand, has rebounded sharply, with 69% now considering it among the “best performing” asset types, a 24-point improvement, while the percentage seeing it as a potential "worst" performer dropped from 21% to 10%.

Concerns are emerging in consumer-facing sectors. Retail and Hospitality saw a decline in the share of respondents citing them as potential “best” performers (-16% and -8%), while their “worst performer” ratings remained relatively flat. Office saw slight improvement – while 85% still expect it to be among the worst-performing sectors, the fraction was down 8 percentage points from Q2.

Rank which property types you expect to be the best and worst performing in the next 12 months.

Net expectations deteriorate most for hospitality; nontraditional sectors such as life science and self-storage see double-digit declines. The change in net expectations (the share of responses indicating a sector may perform “best” less responses suggesting a sector may perform “worst”) was most pronounced for the hospitality sector, for which net expectations deteriorated by 19 percentage points. The sector was followed by self-storage (-12%), industrial (-11%), and life science (-10%). Multifamily sector sentiment rebounded 10 percentage points, the only such improvement in the double digits in Q3.

Change in net expectations since Q2 2024

How to read the chart

The survey question asked participants to identify which property types they thought would be either “best” or “worst” performing in the next 12 months.

Not all property types needed to be selected and any property type selected could only be identified as either “best” or “worst” performing, so no property could be identified as both “best” and “worst” performing.

The “net sector sentiment” shown on the chart represents the difference in the percentage of respondents who identified the property type as the “best” less the percentage who identified it as the “worst”.

Priority issues over the next 12 months

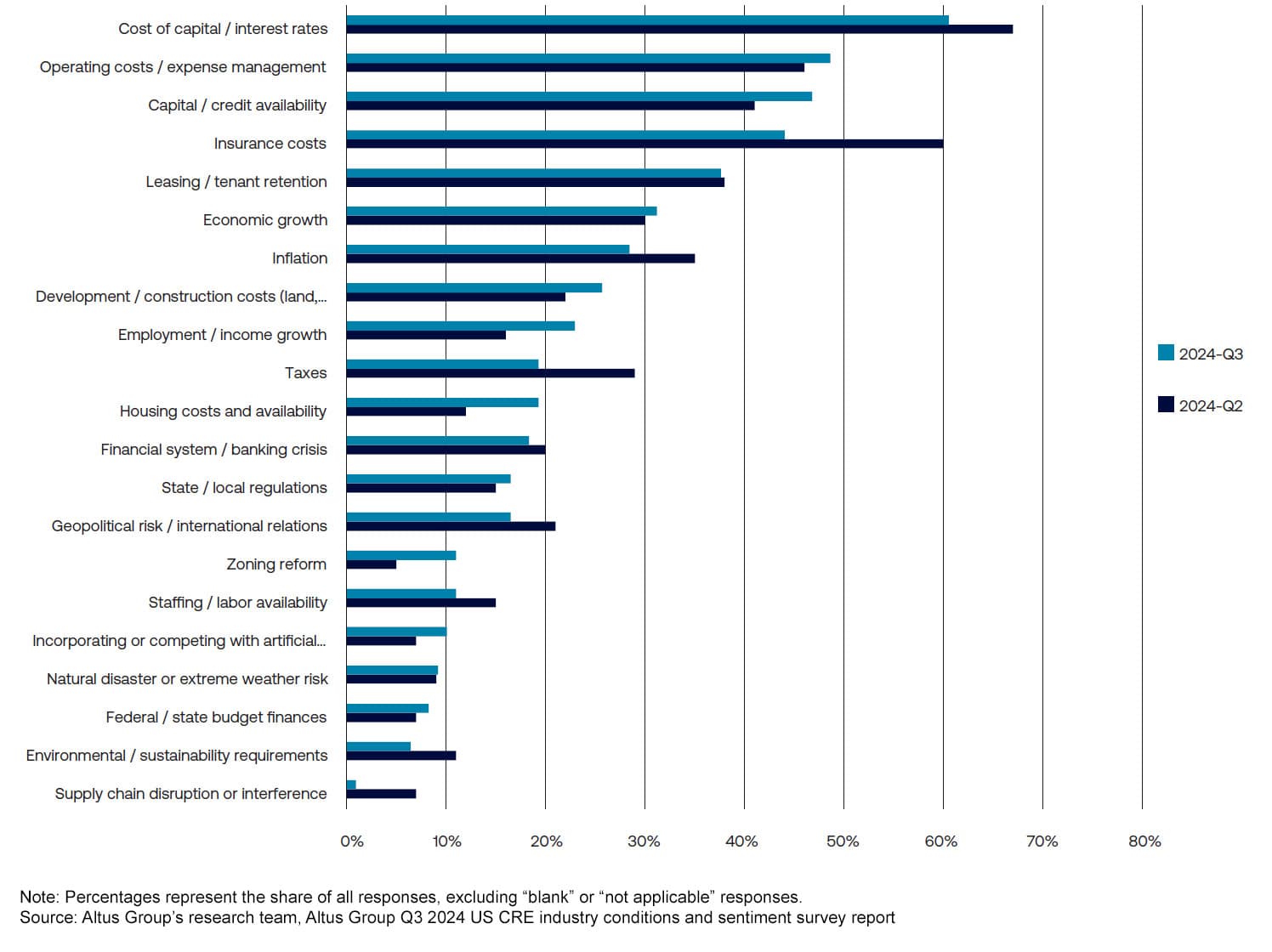

Cost of capital waned as a concern while capital availability grew; major property-specific concerns were still noted by nearly half of US respondents. Cost of capital remained the top concern of respondents for the fourth consecutive quarter, with 60% of respondents citing it as a priority - the only issue identified by a majority during Q3. Capital availability was also a significant concern, ranking third at 47%, and showing a notable increase (+6%) quarter-over-quarter.

Property-specific issues were also widely acknowledged. Operating costs were a priority for 49% of respondents, reflecting a 3 percentage point increase from Q2. Concerns about insurance costs were noted by 44% of respondents, although this represented a 16 percentage point decrease from Q2. Tenant retention remained a steady concern, with 38% of respondents identifying it as a priority, unchanged from the prior quarter.

Priority issues over the next 12 months

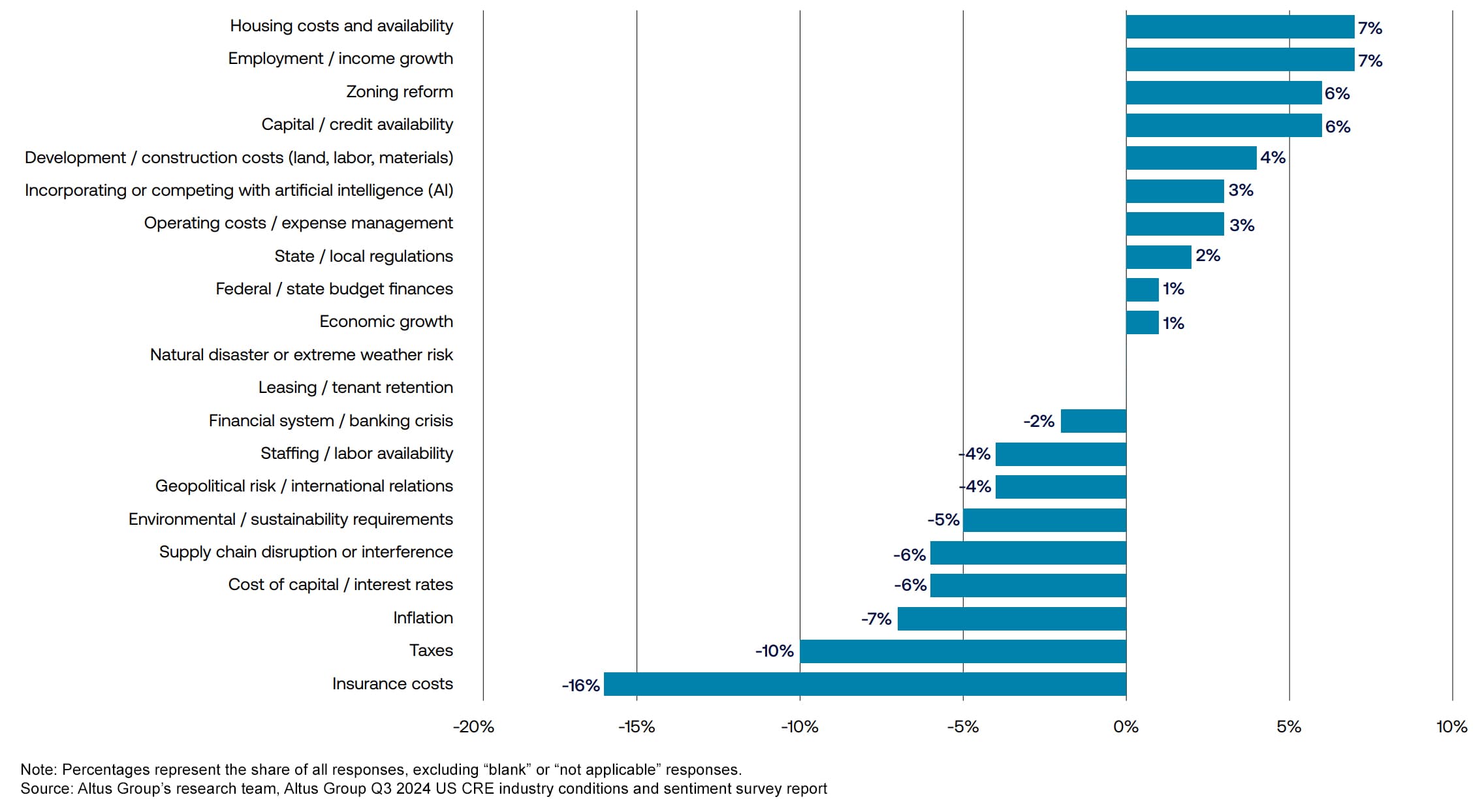

Community-related concerns rise to the forefront, while some property-level concerns such as taxes and insurance costs fade. Community and region-level concerns saw a notable uptick in Q3, with housing issues coming to the forefront. Housing cost and availability rose by 7 percentage points, employment and income growth also increased by 7 percentage points, and zoning reform was up 6 percentage points.

Priority issues over the next 12 months – change since Q2 2024

Among property-level concerns, the percentage of respondents citing “insurance costs” declined 16 percentage points in Q3, the most out of any issue, while the share concerned about taxes declined nearly 10 percentage points.

Artificial intelligence (AI)

Opinions regarding the impact of artificial intelligence on the CRE industry did not change substantially overall during Q3. Broad majorities still see potential benefits of AI in CRE. However, there was a notable uptick from the prior quarter (+5%) in the percentage of respondents expressing AI skepticism, arguing that AI is unproven technology with an unknown impact to CRE.

Percentage of CRE professionals who believe “AI is unproven technology”, by years of experience

About the report

Altus Group is pleased to share the results of our Commercial Real Estate Industry Conditions & Sentiment Survey with survey participants and partners. This survey was conducted by the Altus Group’s Research Team in an effort to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry.

The survey captures the individual practitioner’s perspective, representing various functions and across the capital stack. Participation in the survey is voluntary and responses will remain confidential.

Download previous reports

Survey size and methodology

Altus Group’s Research Team surveyed industry participants across the US from July 11 to August 6, 2024. There were 196 respondents, representing at least 74 different firms. Questions in the survey were optional and explored two main topics: current conditions and future expectations. Percentages represent the share of all responses received for each question, excluding “blank” or “not applicable” responses.

Firm CRE exposure ($USD)

Respondent characteristics

Altus Group’s Research Team surveyed industry participants across the US from July 11 to August 6, 2024. There were 196 respondents, representing at least 74 different firms. Questions in the survey were optional and explored two main topics: current conditions and future expectations. Percentages represent the share of all responses received for each question, excluding “blank” or “not applicable” responses.

What property types does your firm primarily focus on?

How would you describe your firm’s primary investment strategy?

How many years of experience do you have in the industry?

Authors

Omar Eltorai

Director of Research

Cole Perry

Associate Director of Research

Authors

Omar Eltorai

Director of Research

Cole Perry

Associate Director of Research

Resources

Latest insights

Nov 28, 2024