Key highlights

Altus Group releases its third installment of the Commercial Real Estate Industry Conditions and Sentiment Survey for the US, a quarterly survey of CRE professionals to gauge perspectives on current and future conditions for the industry.

US respondents indicating they expect to be deploying capital in the next 6 months surged from 7% in Q4 2023 to 25% in Q1 2024

The perception of overpricing in the real estate market has decreased by 21 percentage points from the prior quarter, indicating that current pricing may have adjusted to be more in line with what participants perceive as fair

The percentage of respondents expecting a near-term recession decreased significantly from Q4 2023, with the largest shift seen from "somewhat likely" to "somewhat unlikely" responses

Respondents expect lower debt financing costs and higher net returns to equity, with the biggest shifts seen in the Core-Plus and Value-Added strategies

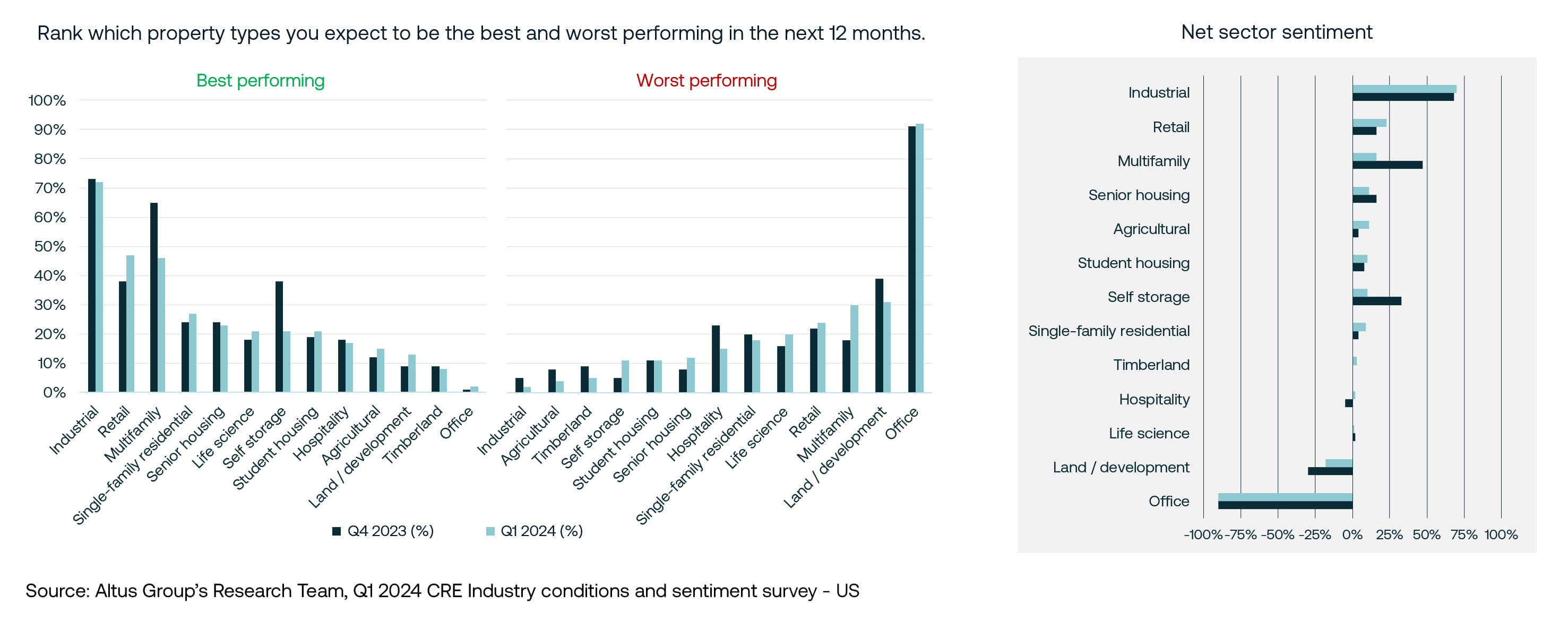

Survey participants continue to predict industrial property to perform the best and office to perform the worst, with multifamily and self-storage experiencing slips in favorability

Perspectives amongst US commercial real estate participants highlight some significant quarter-over-quarter shifts in Q1 2024 results

Altus Group conducted a survey across the US to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry. We are happy to announce that the Q1 2024 results for the US are now available for download.

The survey captured the individual practitioner's perspective, representing various functions and across the capital stack.

The Q1 installment of the US survey was conducted between January 23rd and February 9th, 2024. There were 256 respondents, representing at least 65 different firms.

Questions in the survey focused on two main topics: current conditions and future expectations. Percentages used throughout the US survey results are representative of the share of all US responses received for each question, excluding “blank” or “not applicable” responses.

View the top takeaways from the Q1 2024 results for Canada

Key takeaways from the Q1 2024 survey

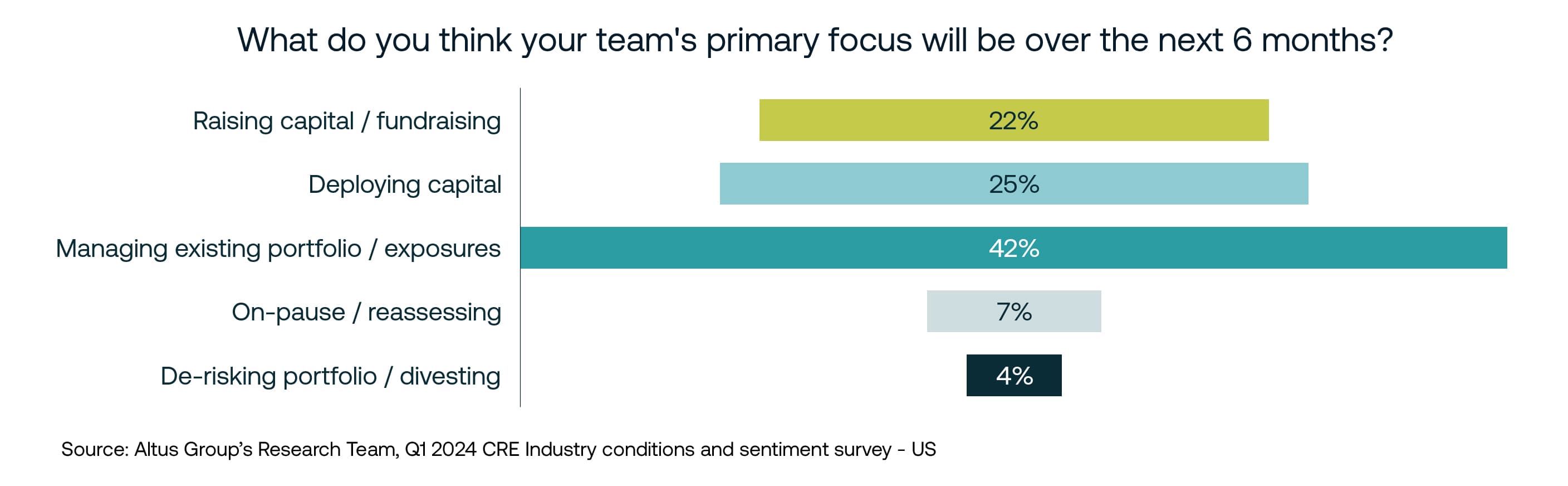

Near-term capital deployment increasingly primary focus

The percentage of US respondents who prioritize "deploying capital" as their primary focus over the next six months has increased significantly from 7% in Q4 2023 to 25% in Q1 2024. As a result, the proportion of survey participants primarily focused on managing their existing investment portfolios has decreased from 57% in Q4 2023 to 42% in Q1 2024.

Figure 1 - US survey results: What do you think your team's primary focus will be over the next 6 months?

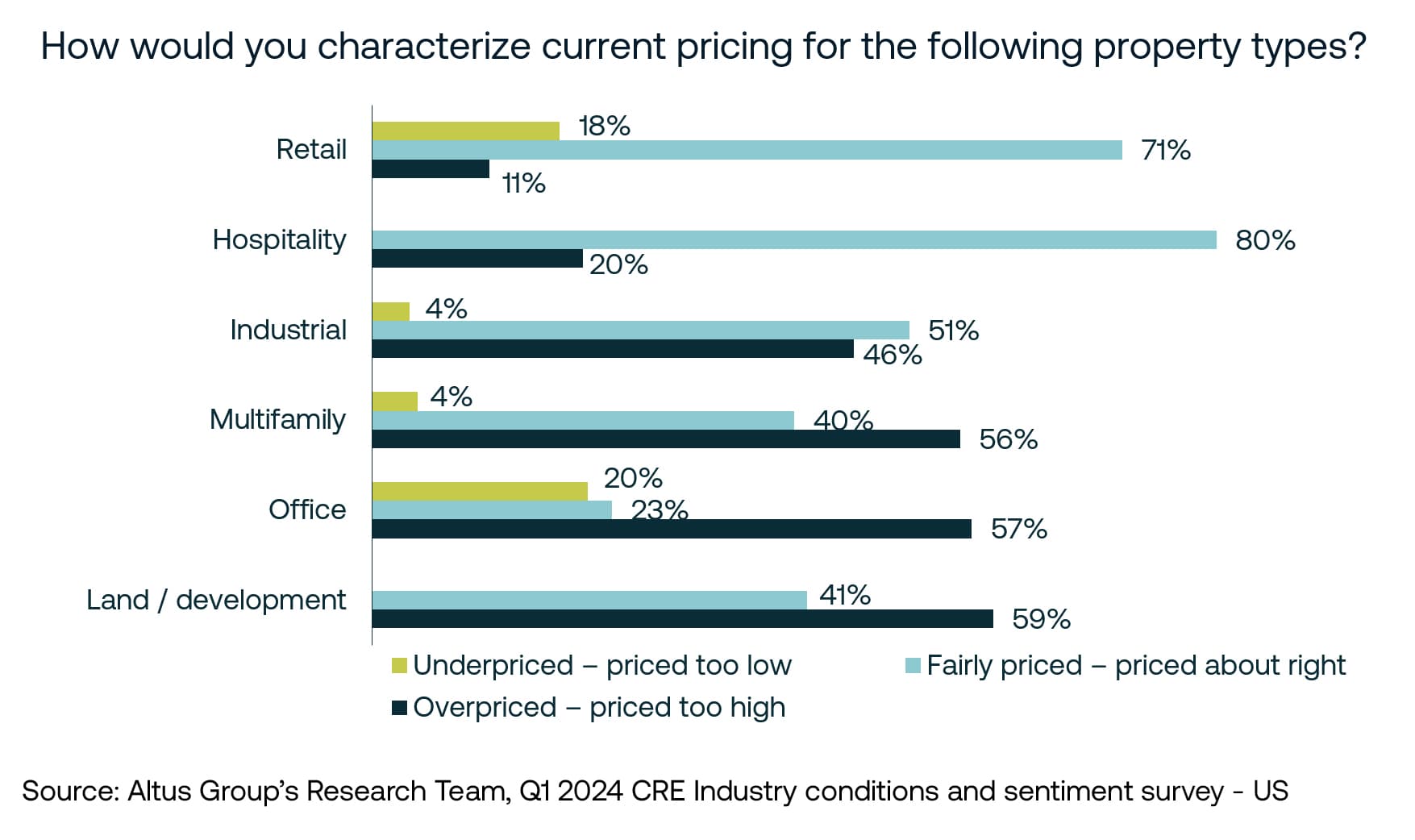

Share of survey participants perceiving “overpriced” properties sees a notable decline

A significant portion (41%) of survey participants still believe that the current pricing of all property types is overpriced. However, this percentage has decreased by 21 percentage points from the previous quarter. This suggests that either the participants' perception of what is overpriced has changed or the market has adjusted to align with the participants' perception of fair pricing. While a minority of respondents perceive properties to be underpriced, and even then, only across a few property types, the most recent quarter responses show that 40% or more would characterize current pricing as “fair” for all property types except office.

Figure 2 - US survey results: How would you characterize current pricing for the following property types?

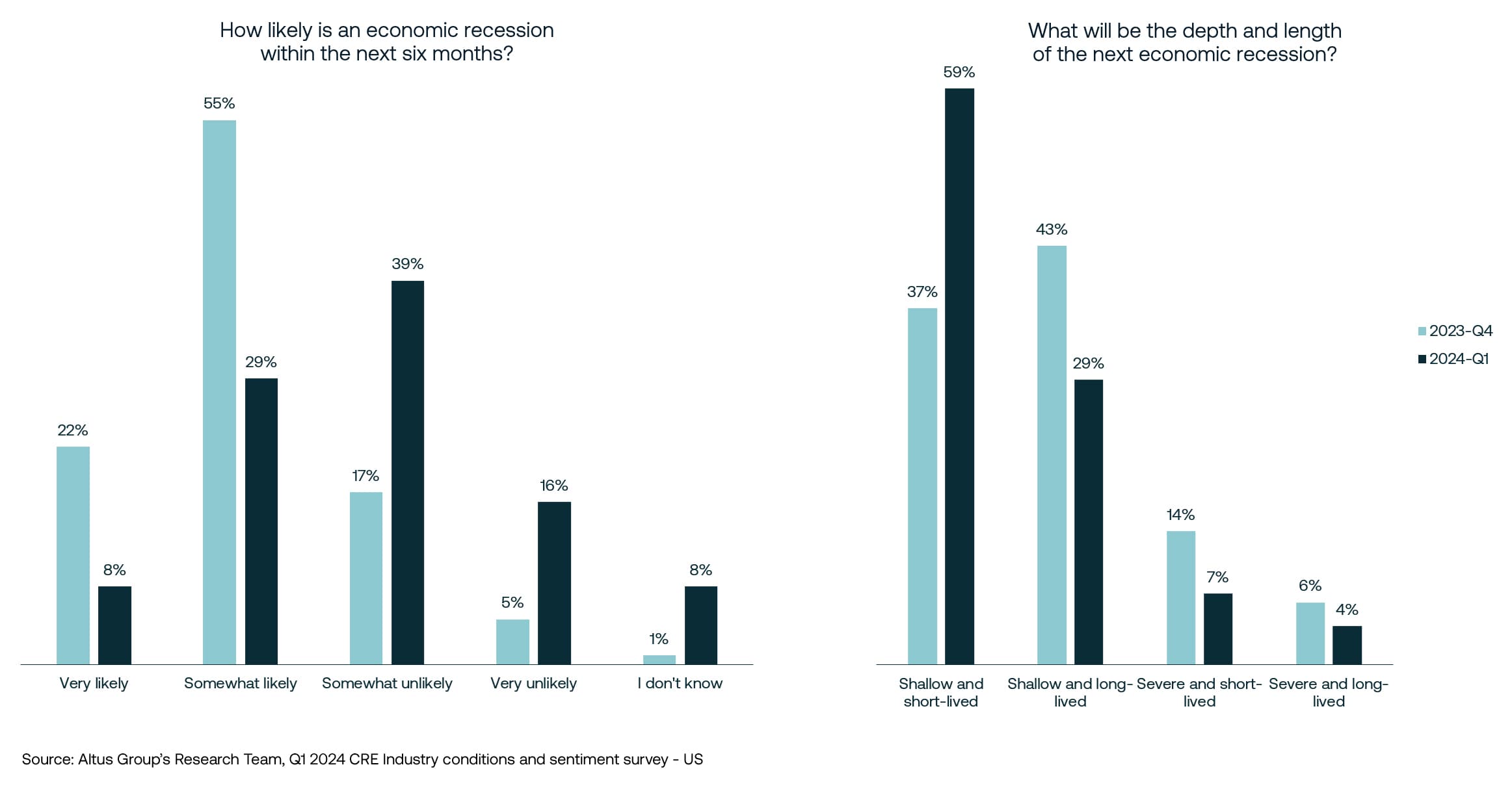

Recession concerns fade as likelihood declines and magnitude moderates

Thirty-seven percent of respondents believe that a recession is likely to occur in the next six months, with 8% considering it to be "very likely" and 29% considering it to be "somewhat likely". This represents a significant decrease from the previous quarter when 77% of respondents thought a recession was likely. Despite this question not being CRE-specific, this overall shift is possibly one of the most significant positive shifts in the survey results from last quarter.

The largest percentage point shifts regarding the likelihood of recession were seen from “somewhat likely” to “somewhat unlikely” responses and this shift was seen across all different strategies. While the shift is reflective of overall improved sentiment with the near-term macro backdrop, there was a notable increase in “I don’t know” responses, from 1% (across All Strategies) in Q4 2023 to 8% in Q1 2024, a shift which could be reflective of overall uncertainty about how to interpret the macro climate. The highest percentages of “I don’t know” responses were from the “Value-Added” and “Opportunistic” strategies, at 11% and 14%, respectively.

A majority (89%) of respondents expect the next recession to be shallow, however, the expected duration of the next recession remained split. While 59% of participants expected the next shallow recession to be short-lived, 29% believed it would be long-lived. This is a notable 23 percentage point increase to the “short-lived” camp and a 14 percentage point decrease to the “long-lived” camp from the prior quarter.

Figure 3 - US survey results: Recession expectations, depth, and length

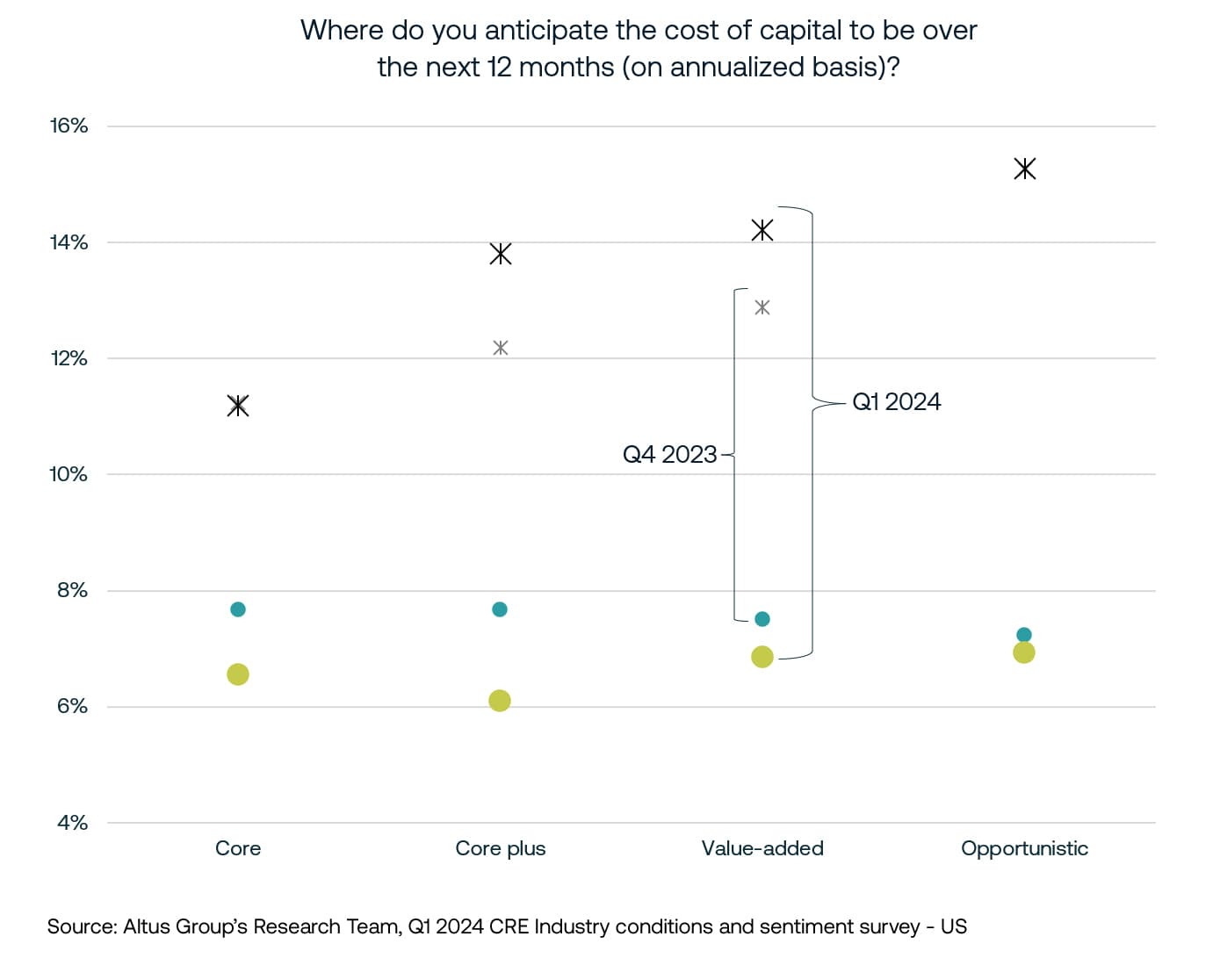

Expected decline in cost of debt lifts returns to equity

Respondents’ 12-month forward view of all-in, fixed-rate financing are range bound between 6.1-6.9%, across the main equity portfolio strategies. Compared to the prior quarter’s survey, this range was down by approximately 90 bps on average across all strategies. Expectations of lower debt financing costs over the next year was accompanied by an increase in net returns to equity (net levered IRRs), which across all strategies increased by 70 bps on average compared to the prior quarter. The biggest shifts were seen in the Core-Plus and Value-Added strategies, where in all-in, fixed rate interest costs fell 160 bps and 60 bps compared to the prior quarter, respectively. Anticipated net IRRs for Core-Plus and Value-Added strategies increased 160 bps and 130 bps on the quarter, respectively.

Figure 4 - US survey results: Where do you anticipate the cost of capital to be over the next 12 months?

Expectations quickly souring for multifamily and self-storage

Whereas survey participants still expect industrial to be the best-performing property type and office to be the worst over the next 12 months, retail has overtaken both multifamily and self-storage in terms of net favorability. In terms of net expectations sentiment across property types, the most notable shift occurred to multifamily which fell 31 percentage points to +16%, while self-storage fell 23 percentage points to +10%. Little change over the same period was observed for other sectors, though sentiment toward hospitality flipped positive from -2% to +5%.

Figure 5 - US survey results: Rank which property types you expect to be the best and worst performing in the next 12 months.

A request for your participation

Our ability to share valuable market insights depends on the active participation of industry professionals like you. As we gather a diverse range of voices, the richness of the data deepens, allowing us to segment responses and paint a more detailed portrait of the industry’s collective outlook each quarter.

Your participation is instrumental in shaping the narrative of the commercial real estate landscape, please support this survey program by sharing your perspective on our next installment of the CRE Industry Conditions and Sentiment survey.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights