The discounted cash flow (DCF) is the bedrock of valuation in the commercial real estate industry. While other methods such as income capitalization and price per square foot analysis are useful, the DCF is by far the most robust valuation method available to real estate professionals.

Because of this robustness, the DCF model can be complex, incorporating property-level, macroeconomic, and real estate market information, as well as preferences that are specific to the investor performing the analysis. Other papers in the Insights series address many of these topics.

While a thorough examination of each of the components in a DCF is beyond the scope of this article, we will review the process at a high level to illustrate parts of the process that an analyst needs to consider.

What are the major components of the DCF model

Below we discuss the major components used in constructing a proper DCF model. It’s imperative that each of the following components be included in the valuation analysis in order to account for all of the circumstances that will affect the property’s long-term financial return.

Property performance

Revenue and expense projections for the future should be based both on current operations and on the analysts’ view of the property’s potential to generate revenue in the future.

Current leases should be carefully reviewed to determine how revenue generated from current tenants will extend into the future. Then assumptions should be made, largely based on market fundamentals (discussed below) along with the strategy of the ownership of the property, as to how and at what level revenue will be generated in the future.

Expenses should also be analyzed carefully, with special attention paid to large capital expenditures that will be needed to replace or maintain the quality of the property. For example, assuming net cash flow (subtracted from the net operating income (NOI) after debt service and capital expenditures) will continue unchanged in the future is unlikely if there are major equipment replacements or major repairs that will be needed for the property.

Market fundamentals

As mentioned in the previous section, future projections of revenue and expenses should be made based on trends in the real estate market and general economic conditions. To illustrate, we’ll discuss some of the market fundamentals that are helpful in getting an idea of future conditions.

Rental Rates

The rent that a tenant is willing to pay is largely dependent on the prevailing “market rate.”

But this rate changes over time due to multiple factors. When projecting future revenue for a property, rental rate trends in the market and submarket should be reviewed carefully to estimate the direction and momentum those rates are likely to take.

In markets where the rental rate has been trending downward, analysts may want to reduce the projected revenue generated from future leases that may be signed at rates below those of existing and current leases.

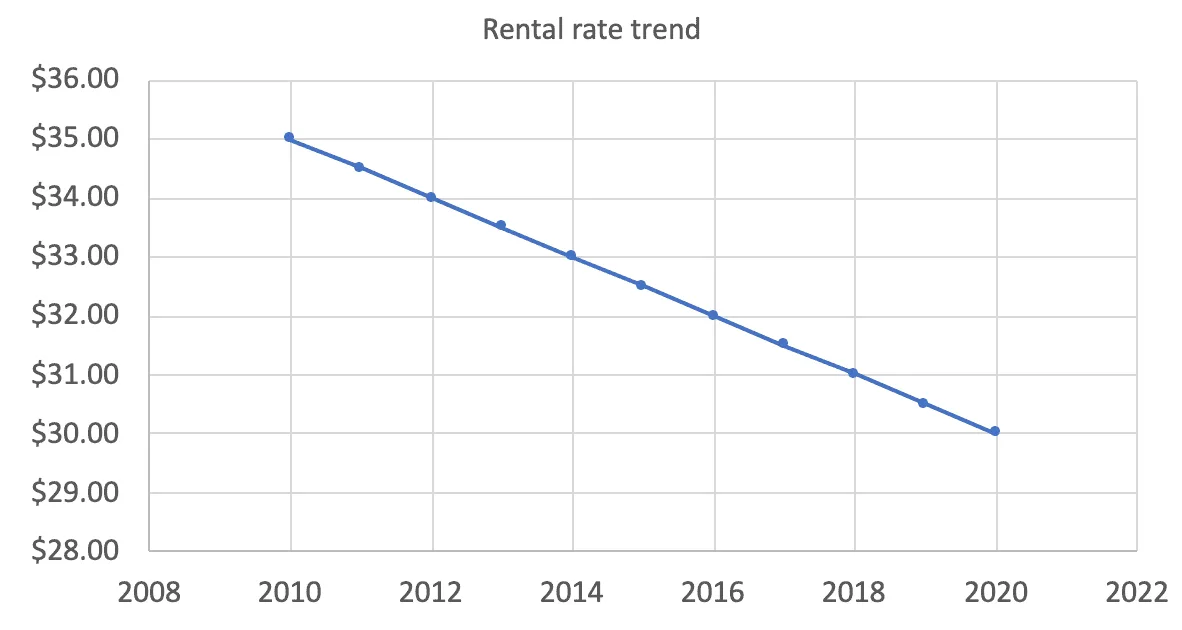

For example, the chart below shows a declining rental rate trend over time. If there are current leases that were signed in 2016 at roughly $32 per square foot, it should not be assumed that future leases will be at the same or greater levels per square foot.

Therefore, the overall revenue generated by the property may be lower in the future due to declining rental rates. Of course, the opposite situation could also be present, indicating rising rental rates and an opportunity to increase revenue in the future.

Occupancy trends

Changes in occupancy could be based on macro- or microeconomic trends, the supply of available space to rent in a market, or numerous other factors. When new properties are built and introduced to the market (adding more available space to rent) without a commensurate increase in the number of tenants looking for space, occupancy in a market tends to fall and owners often begin to compete for tenants by lowering rental rates or offering more concessions.

Changes in occupancy trends are often a leading indicator of changes in rental rates. As mentioned above, when the amount of available space increases, the rental rate tends to fall. The opposite relationship is also present, resulting in rental rates rising as the amount of available space gets closer to full occupancy.

Absorption

Absorption and occupancy are closely related, with absorption representing the amount of space that is leased within a given period of time. Absorption is an indication of leasing activity in a market. High absorption rates in relation to available space shows an active leasing market, while low absorption rates represent little leasing activity.

There are two types of absorption: net and gross. Gross absorption measures the total amount of space that was leased in a given market. Net absorption measures the total amount of space that was leased in a given market minus the total amount of space that was vacated in that same market. While gross absorption is helpful to review, net absorption provides a much better indication of what direction a market is moving.

New supply

Any new properties planned or under development could represent a risk to existing properties, for several reasons. One is that new properties will increase the amount of available space in a market that could upset the supply/demand balance in that market and lead to erosion of occupancy and rental rates. The other is that new developments often include modern design and amenities that are attractive to tenants. Older properties can have a difficult time competing for tenants if the older property is physically to functionally obsolete in comparison to the new property. New developments and land available for new development should be analyzed carefully to determine the likelihood of future competition that could be introduced in a market.

Financing fundamentals (LTV, interest rate and NCF)

Unless a property is purchased with absolutely no leverage (mortgage debt), which is very rare, the property will have a debt service payment that must be deducted from the final net cash flow that the property achieves. This debt will usually include a senior loan and sometimes mezzanine debt and/or preferred equity financing.

Return metrics

The ability for the DCF to display numerous return metrics is one thing that sets it apart from other methods of valuation. These metrics include NPV, IRR, and the equity multiple calculations. NPV and IRR, which account for time value of money applications, are covered in detail in other insights articles, so we won’t go into detail here.

The items above are the major components of the DCF, but there are numerous subcategories of analysis that must be performed within each one. Additionally, none of the components should be viewed in isolation. They are all interconnected and related, one depending on the other in order to refine and revise assumptions to accurately reflect the performance of the property over time.

What are the advantages of discounted cash flow (DCF)?

While the income capitalization and sales comparison approach to valuation are good for understanding the market value of a property at a specific point in time, the DCF approach allows an analyst to understand the value of the property over the entire expected hold period.

The DCF includes cash flows over the hold period, as well as any profit from the sale of the property in the future, addressing factors that are not included in the income capitalization or sales comparison approach.

In addition, the robustness of the DCF model forces analysts to consider all the factors that will define the long-term value that is received from the property. Just because something is not included in a model does not mean it won’t come back to bite you.

In fact, it’s often the factors that are not considered or not considered well that end up causing major problems for a property down the road. While it’s impossible to accurately predict the future, a well-constructed DCF analysis should allow investors to think about and incorporate as many factors as possible.

What are the disadvantages of discounted cash flow (DCF)?

Investment and pricing decisions are often made based on the outcomes of DCF models. These models, however, are only as good as the assumptions that are made for the different components of the model. For example, if analysts project rental growth rates that turn out to be significantly higher than actual growth rates, the overall return to the investor could therefore be significantly lower than what was projected.

The effective application of the DCF valuation method is highly dependent on the skill of the analyst to provide accurate assumptions. Often, experts are needed to provide guidance on market trends, favorable financing, and other inputs needed to construct a high-quality DCF model.

Conclusion

Using the DCF method to value commercial real estate is preferred amongst industry professionals. The comprehensiveness of the assumptions and the accounting for the long-term performance of a property reduces risk from unknowns and provides a much better idea of the investment value of a property.

In addition, simulations can be run to get an idea of investment returns under different property, economic, and financing conditions that may arise in the future. Performing a “worst case,” “base case,” and “best case” scenario analysis can be extremely helpful in making educated investment decisions, a process that is much more valuable using the DCF method than other approaches.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Josh Panknin

Director, Real Estate AI Research & Innovation at Columbia University Engineering

Author

Josh Panknin

Director, Real Estate AI Research & Innovation at Columbia University Engineering

Resources

Latest insights