Europe’s industrial sector is showing signs of positivity, but can it be sustained?

Valuations for industrial properties in Europe reversed course in Q2 2024 posting positive results for the first time in two years, prompting questions whether expanding commerce can help continue this momentum.

Key highlights

Industrial property valuations in Q2 2024 posted modest gains after several quarters of negativity, although it remains to be seen if key performance drivers will sustain that change of course

Warranted expansion of online shopping into central and eastern Europe combined with tightening European labour markets should only increase demand for industrial space

International trade is a driver of demand for logistics properties, however regional European data is mixed with some ports exhibiting higher trade volumes than others

Industrials show a performance improvement

Each quarter, Altus Group analyses the performance of an aggregate dataset of core Pan-European open-ended diversified funds, representing €29 billion in assets under management. The funds cover 17 countries and span the industrial, office, retail and residential property sectors.

In this insight, Capital Economics takes a deeper dive to explore the prospects for European industrial property, particularly the euro-zone.

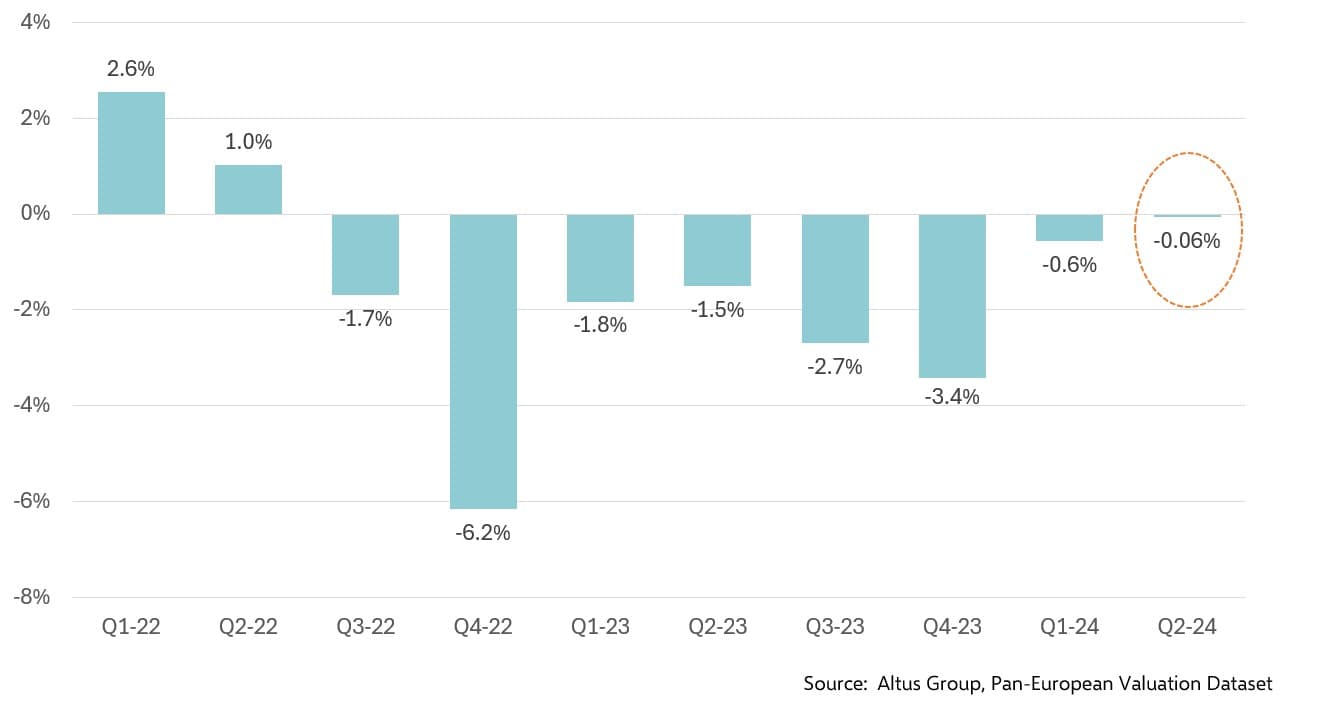

Valuations for industrial property in Q2 reversed course and posted their first gain since Q2 2022. The Altus dataset indicates that valuations as of Q2 2024 are roughly 90% of the level registered in Q4 2021, when it began tracking the sector.

Figure 1 - Quarterly change in valuation – all industrial property average

In reviewing the data for occupancy and rent for the industrial average, it is not immediately evident why valuations increased in Q2. High occupancy supported rentals growth throughout 2022 but, in 2023, as more property became available to the European market, growth was on a downward trend which extended into Q2.

Figure 2 - Industrial sector rent growth and occupancy by quarter, sector average

Although additional property completions have come into the market thus far in 2024, causing occupancy to tick down slightly in Q2, occupancy is significantly higher than a year ago. Furthermore, the amount of industrial space under construction across Europe has continued to moderate, which Capital Economics expects will support rental growth in the coming quarters.

This raises the question as to whether a turnaround is yet firmly in place for the industrial sector.

For further in-depth observations read: Pan European Valuation Dataset – Expert Analysis Q2 2024

Market signs support expansion of online shopping

The performance of industrial sector property is strongly tied to the level of online shopping because it promotes demand for warehouses and logistics services related to “last mile” delivery. JLL recently reported that e-retailer take-up is still running about 20% below pre-pandemic averages. However, we believe that the underlying trend towards increased online shopping will find support from the tightness in European labour markets. With job growth in 2024 expected to increase by 0.8% compared to 2023 and unemployment hovering close to historical lows at 6.5%, wage growth was robust last year and is remaining solid this year as well. On top of growth in total incomes, inflation is subsiding, lowering costs especially of food and goods, so consumers will increasingly have more disposable income available for online shopping. Although in certain markets e-retailing already has a substantial market share, there are other markets, especially in central and eastern Europe, where there is room for further expansion.

Exports should work to boost demand for logistics properties

The other key factor for industrial property is international trade, which is normally a significant driver of euro-zone economic growth. After one of the weakest years on record in 2023, there have been signs that international trade is now improving in Europe. In the euro-zone, both goods exports and imports rose 0.5% in quarter-on-quarter (q/q) terms in Q1 2024. This marked a second consecutive quarterly rise in exports and the first rise in imports since Q3 2022. While these increases were relatively modest, it is welcome news since trade had one of the weakest years on record in 2023, with exports falling 0.6% year-on-year (y/y) and imports dropping by 1.2% y/y. Although the recovery in trade in 2024 will likely be gradual, prospects for improved volumes represent a positive development for the demand for logistics space surrounding the region’s ports.

The reporting of trade statistics somewhat lags actual activity, but the timelier business surveys show a clear improvement in regional trade. In particular, the manufacturing export orders component of the Purchasing Managers’ Index (PMI) has rebounded strongly in recent months. Another useful barometer is data from the PortWatch project. This dataset is very timely and uses satellite-based data to create estimates of merchandise trade on commercial ships which can then be used as a proxy to track the trends in current export and import volumes.

In examining the PortWatch data, Capital Economics notes some divergence in trade activity across the euro-zone. Iberian ports are experiencing large increases in activity while some of the EU’s busiest seaports, namely Rotterdam, Hamburg and Antwerp, show declines in trade volumes. Based on Capital Economics’ own forecasts of economic activity in 2024, the headwinds to industrial occupier demand are likely to be more significant at the major German, French and Belgian ports since these economies are expected to have the least improvement in their export volumes. By contrast, the outlook is more upbeat for trade in the Netherlands and Poland, which is expected to boost the demand for logistics space in Rotterdam, Amsterdam and Gdansk.

Although the trade outlook at northern ports may be less rosy, some have experienced strong rental growth because the supply of property is constrained. As an example, Hamburg industrial property has vacancies of close to 0%. This has driven up rents for industrial property, despite relatively weaker cargo volumes and Germany’s overall sluggish economic growth.

Capital Economics projects euro-zone exports to increase by 1.5% in 2024, while imports are forecast to be similar to 2023 levels. As a result, increasing trade volume will likely be a positive factor in boosting demand for logistics and warehouse space and industrial property, overall.

Conclusion

There are many reasons to be optimistic about Europe’s industrial commercial real estate sector, however it is apparent that some regions are poised to fare better than others. Only time will tell if recent modest performance gains will translate into sustained growth for the sector.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Altus Group

Capital Economics

Authors

Altus Group

Capital Economics

Resources

Latest insights