As a continuation of our series on how to mitigate risk for your infrastructure projects throughout the asset lifecycle, this article considers maintenance and renewal during the operational phase.

Whether you are a developer, an institution, government, a private corporation, or a commercial enterprise, if you own infrastructure, you need to maintain it effectively and allocate sufficient funds to do so.

Deciding how to best and most effectively spend your budget is key, but can lead to deferred maintenance, as a disproportionate amount of funds often get allocated to seemingly more pressing priorities. The consequences of continually deferring maintenance are serious, will lead to business continuity issues and, at worst, health and safety compromises.

What is facilities maintenance and why does it matter?

Facilities maintenance usually refers to maintenance in the built environment. It also includes lifecycle maintenance, which is capital-replacement or any maintenance at a larger scale, determined by some capitalization, frequency or other replacement, obsolescence, or upgrade threshold.

Appropriate maintenance ensures that a facility is kept in an optimal operating state, supporting the objectives of the owners, inhabitants, and users, so that operational activity and business can be conducted without interruption.

However, as our properties age and require investment and recapitalization, these goals have proven to be difficult to attain in many environments and market sectors. In addition, the impact of reduced facilities and lifecycle maintenance on energy utilization is also significant and increasingly under the spotlight, as low energy consumption, carbon-neutral or net-zero energy in facilities become increasingly important.

Why does maintenance get deferred?

In general, funds are allocated based on greatest need. There is usually insufficient funding for all of the needs and wants of an enterprise, usually split between operating and capital.

Maintenance does not generate revenue, or is not seen to contribute visibly or actively to the outcomes of an enterprise – until it fails. Because its benefits are not immediately measurable, more pressing operational or capital needs often compete with – and win – at the expense of maintenance and lifecycle, and the result is deferral.

While maintenance dollars may get allocated at the planning stage, they are still a target for cuts, especially when budgets get tighter through other cost increases or reduced revenue, and not much thought is given to the future impact of the cuts.

The scale and cost of deferred maintenance

Many organizations find themselves in a significant amount of trouble with growing deferred maintenance. For instance, Memorial University in Newfoundland reported in 2019 that its deficit forecast was close to $500 million. The University of Toronto recently reported deferred maintenance of almost $1 billion, and the Toronto District School Board has around $5 billion. It is also estimated that Canada has an infrastructure deficit of $570 billion which shows the problems are huge and widespread – and left unchecked, the cost of deferral will continue to grow exponentially.

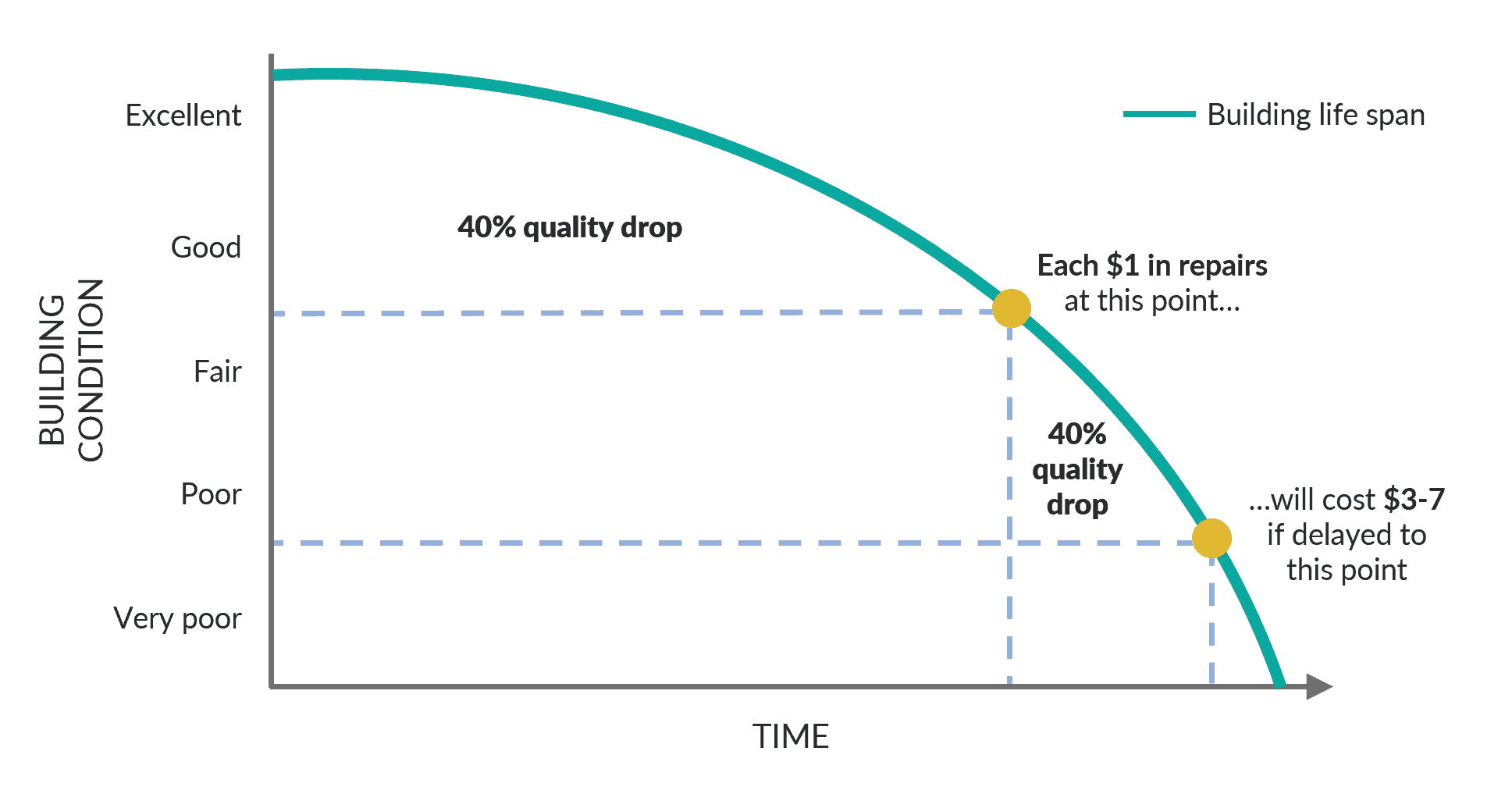

One of the biggest challenges with deferring maintenance and lifecycle replacement, is that the impact is often not seen for a very long time – essentially a slow-burning fuse. Too often, new infrastructure is procured without much thought to its preservation, because – like most aging processes – the impacts are not observable from one day to the next. This is likely the rationale for Ontario Regulation 588, requiring all Ontario municipalities to have asset management plans in place for all their core and non-core assets.

Understanding the impact of deferred maintenance on lifecycle

Simpy put – when decisions are made to put off the cost of today until tomorrow, it exposes an organization to increasing risk. This risk can be difficult to quantify, so it is sometimes overlooked or not given enough weight in business planning. However, as maintenance continually gets deferred, the need for lifecycle replacement will advance, thereby requiring higher funding levels earlier.

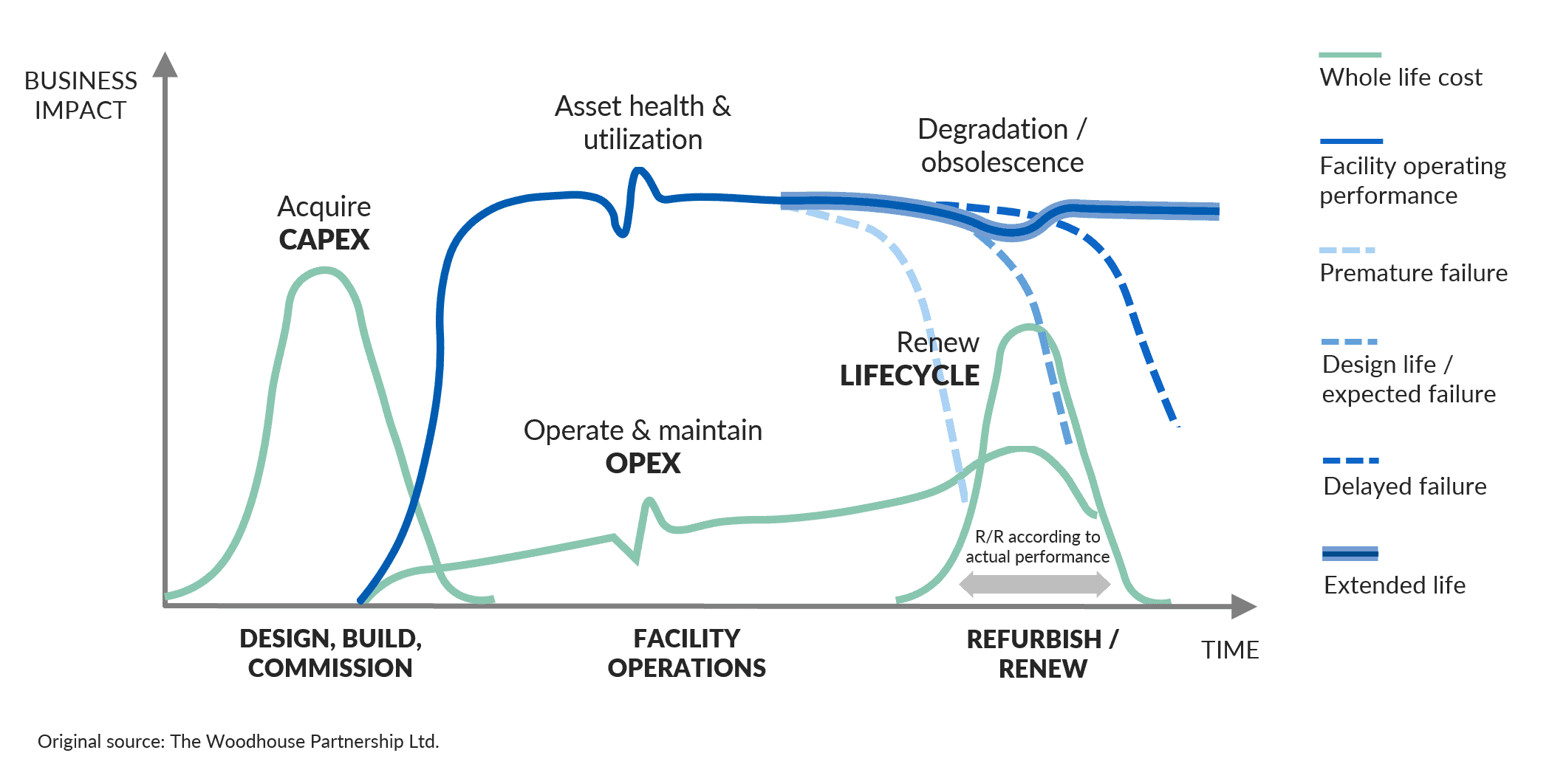

In Figure 3 (source: The Woodhouse Partnership Ltd.), we see the lifecycle of a facility simplistically represented, with its operating performance in blue, and the whole life cost elements in green. The blue line represents the operating level of the facility, which will eventually start to deteriorate, and thus will require lifecycle intervention. This intervention will be premature if maintenance is deferred; the intervention will be delayed with good preventive maintenance. Deferral is therefore a false economy as it will likely lead to premature lifecycle replacement.

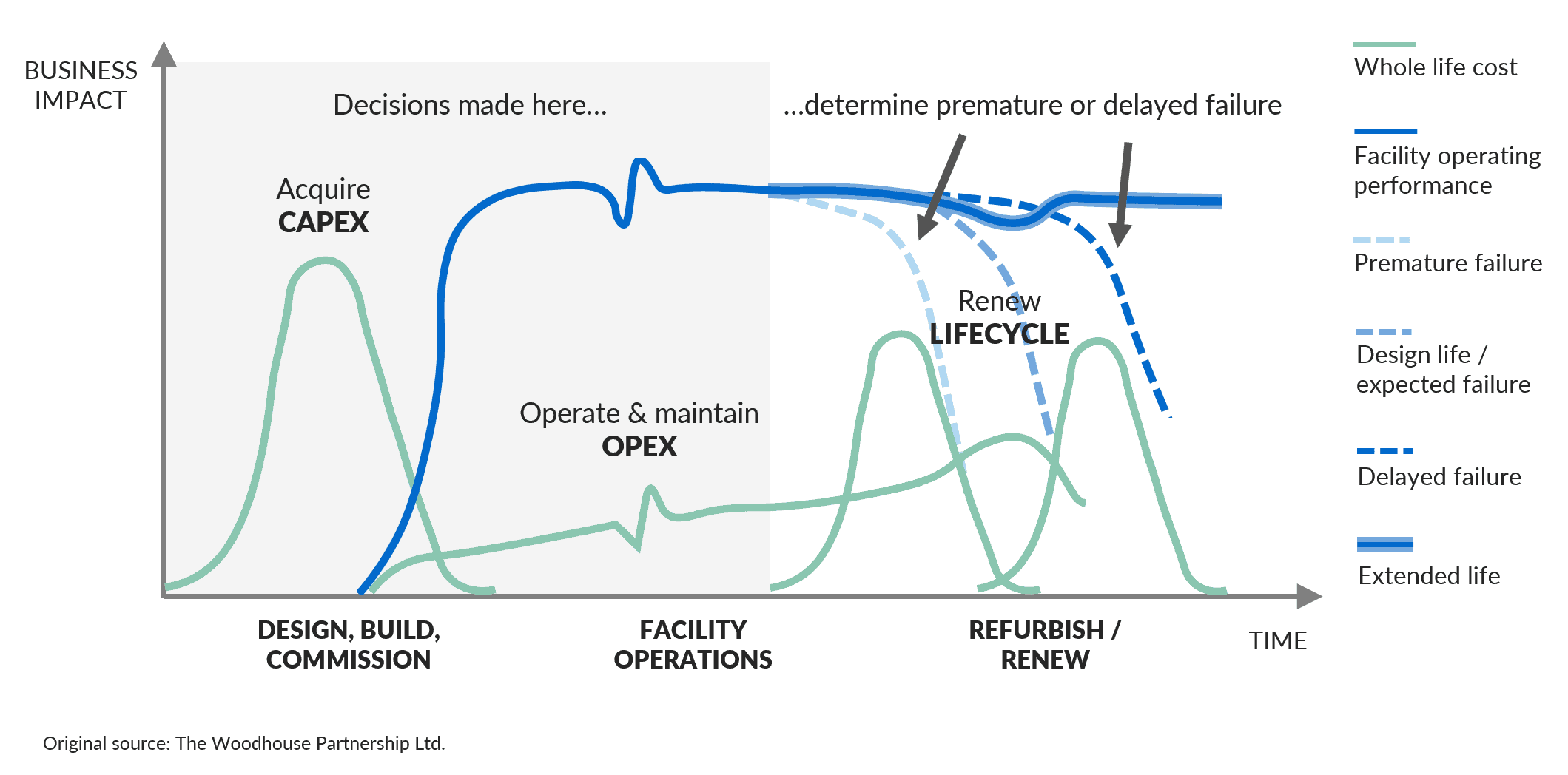

To further illustrate this idea, Figure 4 shows that it’s not just the deferred maintenance, or decisions made during operations, that can cause premature failure, but also the decisions made at inception, design, construction, and commissioning. Operating and maintenance costs can fall somewhere in the range of 70-80% of the whole life cost of a facility, though in the past, these have not been considered during the design and construction phases of a new facility.

But what about existing facilities? What can you do to optimize the life span of a building and help prevent premature failure?

Optimizing maintenance

There are many ways you can try to reverse the deferred maintenance trend, but successful outcomes usually occur when maintenance, lifecycle, and energy are all under the responsibility of a single entity.

Because maintenance hasn’t been considered a core function in many organizations, it hasn’t attracted as much management focus as core activities, so internal maintenance initiatives often fall short without an executive champion.

Outsourcing can achieve competitive fixed maintenance pricing aligned to performance standards and provide a level of expertise not found internally, but can also create tension between maintenance (provider responsibility) and lifecycle (owner/client responsibility). It is very difficult to outsource lifecycle along with routine maintenance, so the owner/client continues to hold lifecycle, and needs to recognize that this is just one element of a more comprehensive asset management strategy that still needs to deal with deferral.

At the other end of the spectrum, a Design, Build, Finance, and Maintain (DBFM) in the Public Private Partnership sector has a complete risk transfer, with the maintenance portion generally being an outcome-based performance contract. In a DBFM, maintenance, lifecycle, and energy performance are all transferred to a service provider for an extended period. In this instance, the service provider maintains the facility at an optimum operating level for the extended life of the building. DBFM can be considered a ‘gold standard’ in asset management, but is not the solution for all; they are more difficult and more expensive to put in place for smaller facilities, ‘brownfield’ sites, or facilities already in the operating phase.

The keys to success

In conclusion, whether you choose DBFM, to fully or to partially outsource services, or carry out the functions in-house, carefully considered facilities maintenance within a holistic asset management strategy will reduce your building’s exposure to risk. It is critical in ensuring a business and its operations can function optimally, and for the long term.

As we enter a new world in which no one yet knows the true impact of a global pandemic on real estate, it’s more important than ever to make the best use out of scarce maintenance funding, and ensure the proper application of maintenance is made without falling into the trap of false economies. The most important thing is to ensure the appropriate maintenance is carried out as best and as proficiently as possible.

Find out what the 7 keys to ensuring success are and the steps you should be taking in order to effectively mitigate risk and improve your outcomes.

Author

Altus Group

Author

Altus Group

Resources

Latest insights