Key highlights

The Canadian economy is still feeling the impact of higher-than-welcome inflation, and the corresponding spike in interest rates, but any coming recession will probably be mild.

The demand for office assets is a wild card, as workers and companies hash out their hybrid work plans.

Industrial has its own set of issues, namely constrained supply and strong-ish demand.

Interest rates will impact housing development and sales to a degree, but Canada has seen far worse housing markets than 2023 will probably be.

It has been a bumpy ride for the Canadian real estate market in recent years, with the prospect of downward pressure on most properties as inflation and higher interest rates put their imprint on the market, according to the speakers at Altus Group's Canada State of the Market webinar.

Still, with some exceptions, the downs will probably be milder for some property types, such as industrial, than others, such as office – a legacy of the pandemic. Housing will take the brunt of higher interest rates, but not spiral into a deep slump.

Overall, the health of Canadian real estate depends in large part on the wider economy. Among the various macro factors influencing the direction of the economy, none has been more important than inflation and the response by the central banks of the world.

The inflationary environment has a number of antecedents. The response to the pandemic damaged supply chains, which hampered the supply of goods worldwide. The emergence from lockdowns in 2021 ramped up demand for those goods. Combined with war in Europe and other geopolitical tensions and uncertainties, the world, including Canada, suffered a round of inflation in 2022 the likes of which haven't been seen in more than a generation.

Inflation reached a recent peak in Canada at an annualized rate of 8.1% last summer, and since has slowed to just under 6%.

The drive to bring inflation down has been almost as disruptive to the Canadian economy as inflation itself, the panelists said. Before the inflation spurt, the Bank of Canada's Target Overnight Rate has been cruising along at 0.25% since the beginning of the pandemic. The bank has raised the rate eight times in the last year, kicking up the cost of money more quickly, than in a generation.

Mortgages have gone up just as swiftly. Eighteen months ago, borrowers could sometimes pay around 2%. More recently, that rate averages nearly 7%.

“When mortgage rates go up, we have a couple of different potential effects on housing,” Altus Group Vice President and Chief Economist Peter Norman said. “All of those give us pause for caution about the forecast for housing and the forecast for real estate in general.”

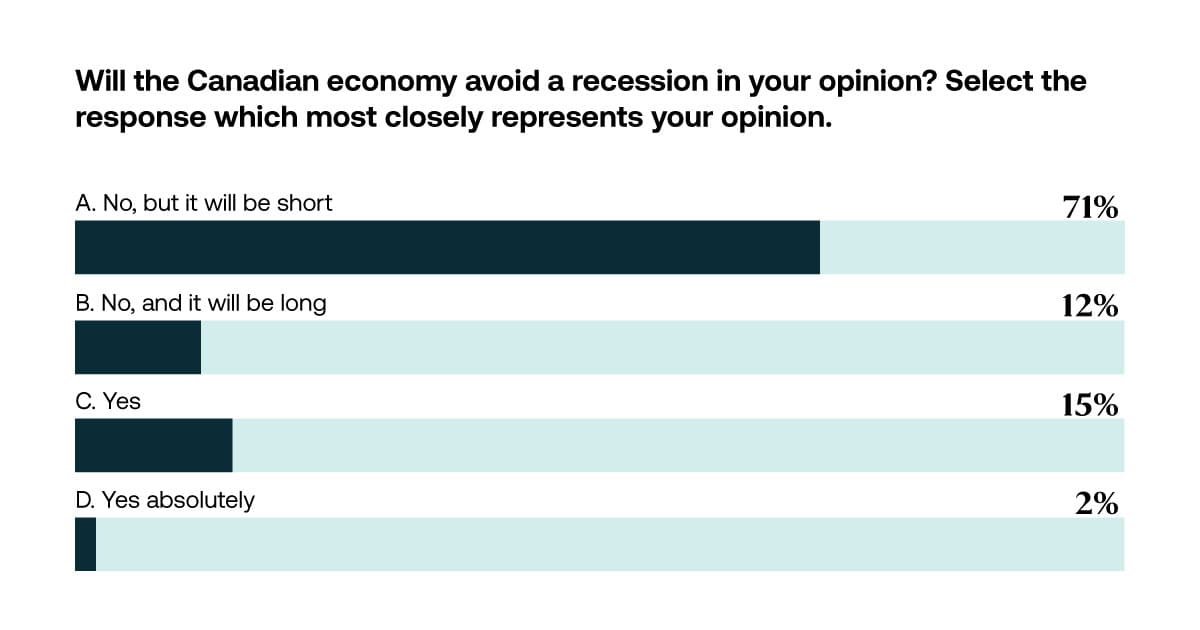

The prospect of a recession also looms over the Canadian economy. The first of three poll questions for the audience found that a majority of the respondents (71%) believe that Canada is going to suffer a recession, but that it is going to be relatively short. Smaller numbers think the recession will be long or there will be no recession in the near future (12% and 15%, respectively).

There will be strengths and weaknesses in regional Canadian economies, with slow growth in Alberta but still probably the strongest growth, and Ontario with the weakest growth. All of the provinces are likely to see slower growth when compared with the 2021 and '22, however.

The slings and arrows hitting commercial real estate

The legacy of the pandemic on the Canadian office market, as on markets around the world, is hard to overstate. No one talks of a five-day, in-office workweek anymore, at least for workers with mobility. Now the question is what shape the hybrid schedules will take, and the answer – which is still to be worked out – will have a long-term impact on office space occupancy rates and office asset valuations.

The benefits of coming to the office include belonging and social identity, as well as emotional health for a lot of workers, and sharing a workspace at least some of the time is an essential ingredient in career development. Also, the office is a centralized place to get coffee. (Seriously, more is being spent on coffee machines now to lure workers back in.) On the other hand, there are still downsides to coming into the office, such as long commutes, the risks to safety and well-being of a regular commute, and the costs associated with it. Many workers now see traditional five-day workweeks as a schedule that disrupts work-life balance.

While office workers and their employers weigh the many pros and cons of working remotely versus in the office, the net effect is that lots of companies are eyeing opportunities to reduce their office space going forward.

There was an been an uptick in office leasing nationwide in 2022, but availability rates for office space are still historically high. In Toronto and Montreal, the Q4 2022 rates were 16.5% and 17.7% respectively, both of which represent a gain of more than a percentage point from a year earlier, according to Altus Group data. Some cities are having an easier time of it, such as Vancouver with a 10.4% availability rate, and Quebec City with a 10.6% rate, though those two are up from last year.

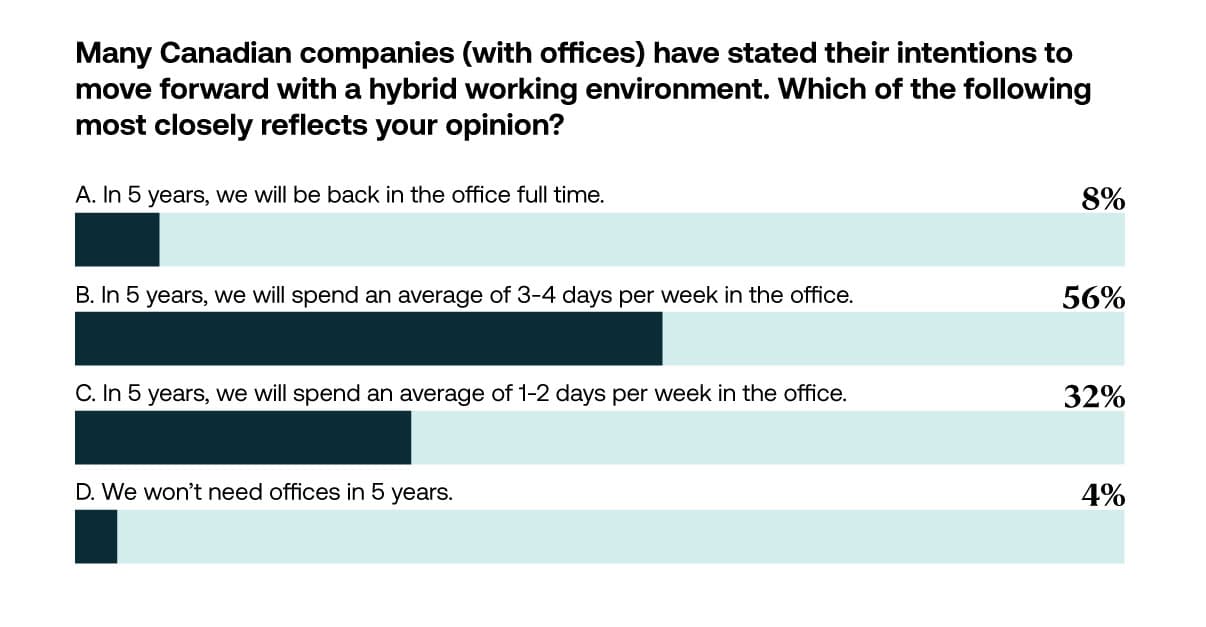

The second poll question asked about the Canadian office of the future, five years from now. A majority, 56%, said three to four days a week in-office. Somewhat fewer, 32%, expect schedules to be one to two days a week in-office. Few (8%) believe the five-day week will return, and even fewer (4%) believe the need for centralized office space will vanish.

The Canadian industrial market has a different set of challenges. One is how much higher rental rates can go, and how much of recent rent hikes tenants can really pass along to consumers and clients. Currently for the most modern industrial properties, rents range between $20 and $26 per square foot.

Development costs are also up, including materials but also labour, the price for which continues to grow, especially in tight markets like Toronto and Vancouver.

Toronto and Vancouver are in fact the tightest industrial markets, each with a 1.2% availability rate in Q4 2022, a rate that didn't budge from a year earlier for Toronto and was up only 10 basis points for Vancouver.

Demand is still strong enough that much new industrial space is leased well before its completion. In Toronto, for example, more than 20 million square feet is underway, with only about two-thirds of that still available. Nationally, the prelease rate is even higher, with about half of the 40 million square feet under way already committed.

“Despite the recent slowdown, e-commerce is expected to remain strong,” Altus Group Vice President of Data Delivery, Ray Wong said, supported by continued demand for industrial.

Demand for all commercial property types as an investment took a hit in 2022, and sales will continue to be sluggish this year. The culprit: the higher cost of borrowing.

Investment sales were particularly robust Canada-wide in the second half of 2021, with $48.3 billion in assets trading hands. By the second half of 2022, that figure had shrunk to $26.9 billion. The uncertainty of some asset values is also having an impact on deal volume, as potential buyers and sellers do their dance of price discovery, with neither side always agreeing on price, at least for a time.

The great housing reset? Not yet.

It has been a bumpy time for residential sales and development in Canada, especially as interest rates swelled last year. But so far housing hasn't been in for a great reset, according to the speakers.

In 2022, the number of existing house sales dropped steeply from well over 650,000 units to fewer than 500,000. That might sound like a reset, but actually the volume is roughly a retreat to 2019 levels – historically a healthy year for home sales – and is only somewhat less than 2020, which sales expanded to more than 550,000 units.

Any development reset that will happen in 2023 will mostly be because of falling starts in Ontario, which is estimated to fall from 51,000 units in 2022 to 43,000, and to British Columbia, where starts might be down as much as a third from the 30,000 units started in 2022.

Interest rates are impacting development, but not catastrophically. They have spiked before, and only sometimes dampened residential construction.

“This is no 1995 for housing construction,” Norman said, referring to the lowest point for Canadian housing development in the last half-century which followed a similar rate hike, at only about 110,000 new units, compared with 261,000 units in 2022. “It's just a bit of a cooling that's taking place right now,”

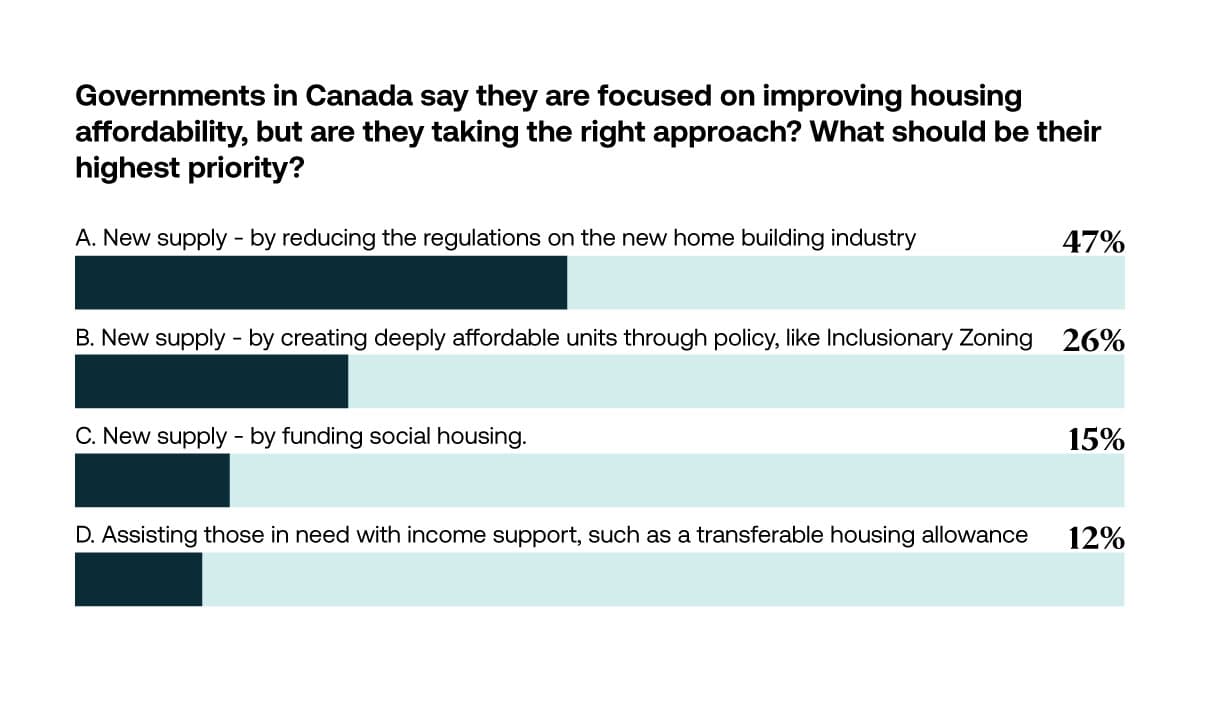

Affordability will remain an issue for Canadians in the coming years, a prospect that was the subject of the final poll question. Namely, what should governments do to improve the situation?

Nearly half of the respondents (47%) lauded a free-market approach, which would have government pare back regulations to let the industry build more product. Fewer, but still a significant 26%, believe new supply ought to create through policy, such as inclusionary zoning, while 15% said direct government funding of development would help, and 12% favoured assistance to those who have trouble paying for their dwelling space.

Canadian real estate, residential or commercial, may not be headed for a reset or anything as transformative as the Great Financial Crisis, but it is still headed through a rough patch, the panelists concluded, as inflation stays a little high, capital costs a lot more, and geopolitical uncertainties remain. The rest of the year will tell whether the inflationary genie can be put back in the bottle. Even so, there are deals to be done this year in places where fundamentals are still strong, and possible improvements to the economy ahead, especially if inflation subsides.

Authors

Ray Wong

Vice President, Data Solutions

Peter Norman

Vice President and Economic Strategist

Authors

Ray Wong

Vice President, Data Solutions

Peter Norman

Vice President and Economic Strategist

Resources

Latest insights