How a soft landing could impact US commercial real estate

Now that the Fed has started lowering interest rates, commercial real estate market participants are shifting to another critical question – what’s next for the economy?

Key highlights

Survey results from Altus Group’s Q3 US CRE Industry Conditions and Sentiment survey (ICSS) show that market participants are evenly split on the likelihood of a recession within the next six months

If a recession arises, 58% of CRE ICSS respondents expect the next recession to be “shallow and short-lived”

Soft landings are rare: Princeton Economist and former Fed Vice Chair Alan Blinder cites five “softish” landings between 1965 and 2019

CRE ICSS survey results show greater optimism around commercial real estate, including an increase in the intent to deploy capital

Outlook on the landing will continue to play out as the rate-easing cycle continues to unfold through 2025 and, potentially, even into 2026

Interest rates are coming down – where do we go from here?

Now that the US Federal Reserve has made an important first move in lowering interest rates, commercial real estate market participants are shifting their attention from “when” rate cuts will start to another critical question – what’s next for the economy?

The Fed has a dual mandate of managing low inflation and full employment to keep the economy humming along at a steady pace. It faced the tough job of reining in runaway inflation, which is now approaching it’s 2% target. The much anticipated “soft landing” appears to be directly ahead.

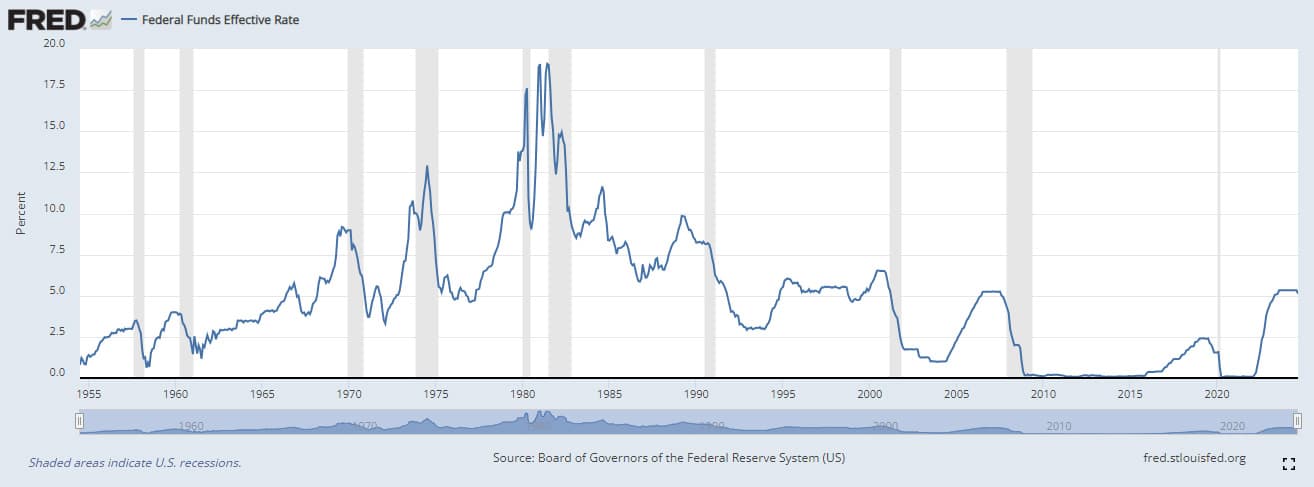

The direction of the economy is still playing out. In a speech in Nevada in August, San Francisco Federal Reserve Bank President Janet Yellen said the US economy seems to be "on a glide path for the proverbial soft landing." At the same time, historical data shows that since the late 1980s, a Fed rate cut after monetary tightening has consistently tracked with some form of recession.

Figure 1- Federal Funds Effective Rate vs. US recessions (Source: Board of Governors of the Federal Reserve System)

For those looking for clues on the state of the economy, the 50-basis point cut is sending mixed signals. “The 50-basis point cut could be interpreted in two ways,” noted Omar Eltorai, Research Director at Altus Group. “The negative interpretation is that the FOMC opted for a 50- versus 25-bps cut because they see signs that the economy is slowing down more than what they would like. The optimistic view is data shows that they're closer to their overall goals of wrangling inflation and keeping a full labor market.”

It remains to be seen whether the Fed can ease back on its restrictive monetary policy without causing a recession. In light of the September rate cut, it’s time for the rubber to meet the road on that landing. What’s the outlook for that landing, and how is commercial real estate positioned in the current environment?

CRE is divided on recession risk ahead

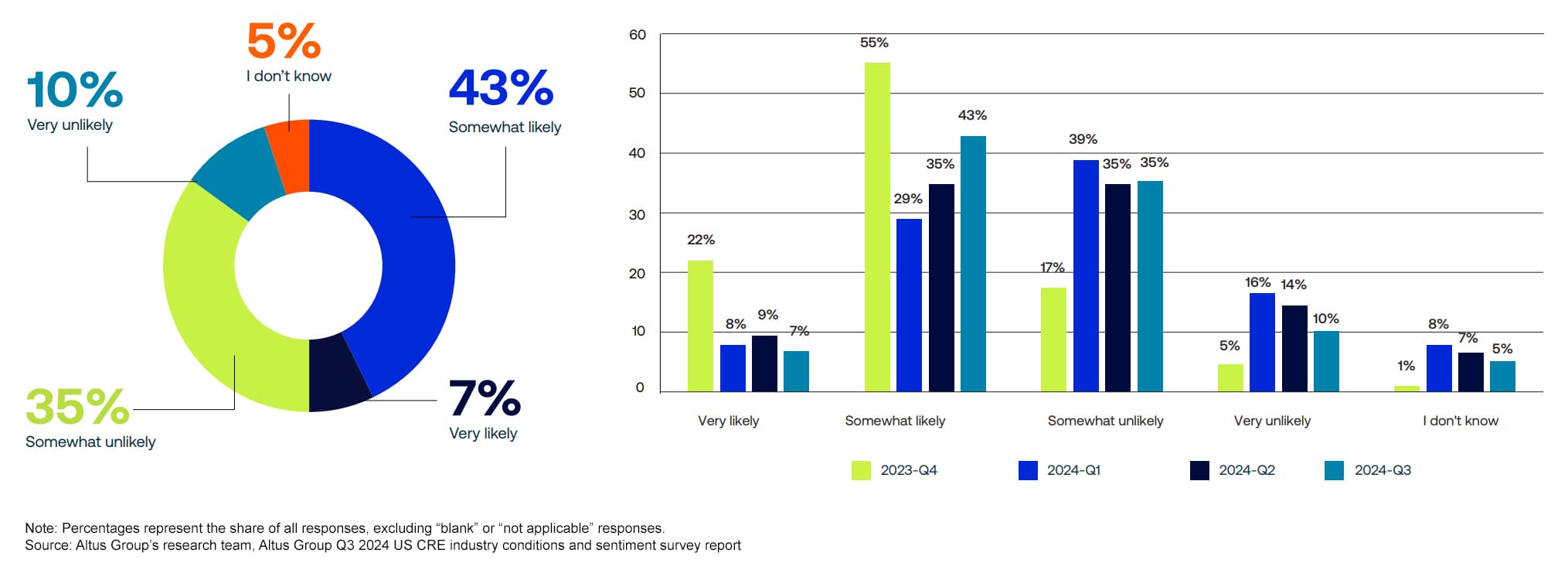

Survey results from the CRE ICSS show that market participants are still fairly split on the likelihood of a recession within the next six months. Forty-five percent think a recession is unlikely, while 50% think it is likely, and 5% indicated that they don’t know.

Views on the likelihood of a recession are slightly more pessimistic, ticking higher compared to 44% in the Q2 survey, where respondents thought a recession was likely and 37% in the Q1 survey. However, the outlook for a recession has dramatically improved compared to Q4 2023 when a strong majority, 77% of respondents, thought a recession was “somewhat” or “very likely.”

Figure 2 – How likely is an economic recession within the next six months?

One reason for the shift in sentiment is that there has been progress on inflation dropping further over the past year. At the end of 2023, inflation was still at 3.4%, whereas the August CPI had declined to 2.5% and the Fed has said that it expects September data to decline to 2.2%.

Most economists would agree that odds of a recession in the near term are relatively low because the overall economy is performing well. Employment, although cooling, is still strong; consumers are continuing to spend; and GDP growth has been holding relatively steady at 2.2%.

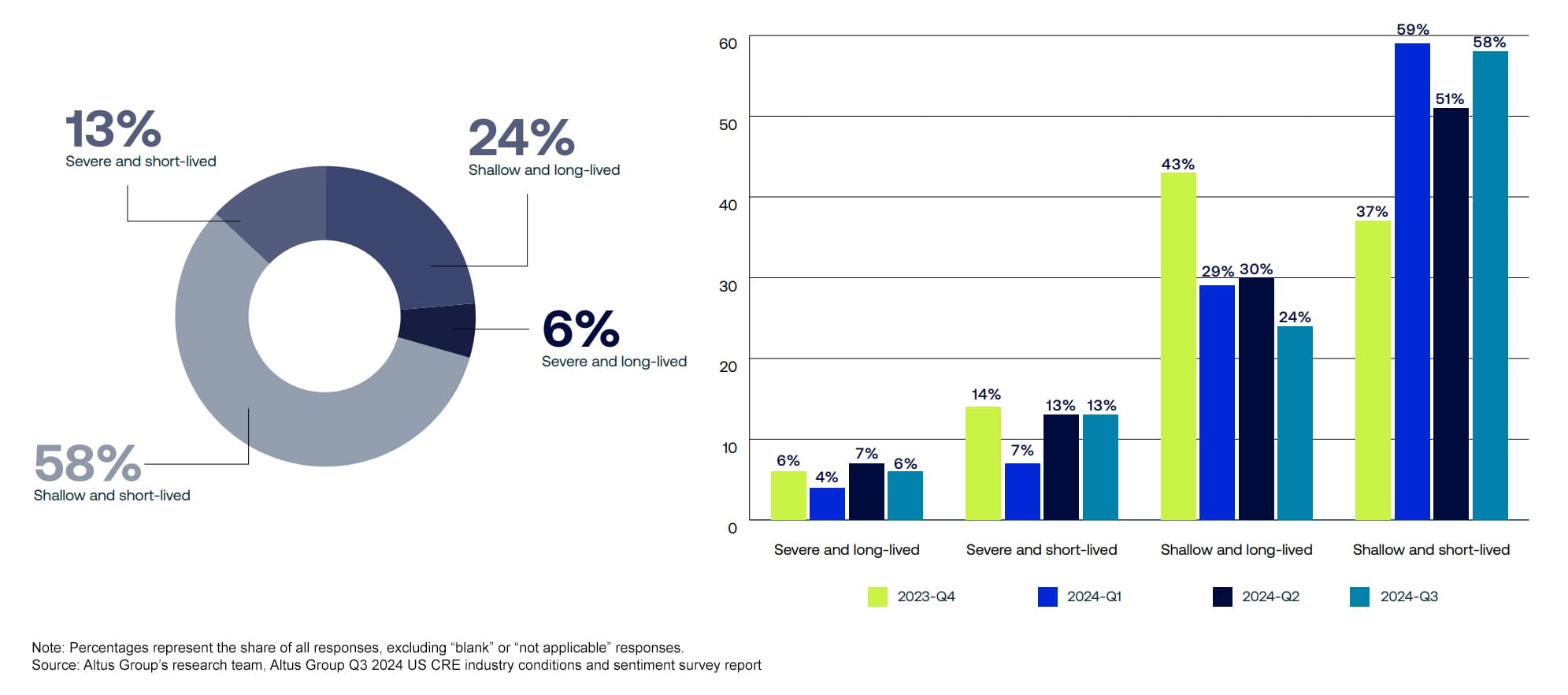

History tells us that a recession, at some point, is inevitable. However, another positive finding is that a majority of respondents (58%) expect the next recession to be “shallow and short-lived.” The current view reflects a 7% increase from Q2 and only 1 percentage point less than the Q1 2024 survey. The quarter-on-quarter shift was driven predominantly by respondents who shifted their expectations from “shallow and long-lived” to a short-lived scenario.

Figure 3 - What will be the depth and length of the next economic recession?

Lessons learned from past cycles

As Mark Twain once said, history doesn’t repeat itself, but it does rhyme. What does history tell us about the likelihood of a soft landing, and are there some lessons to learn from looking back at past recessions and how CRE was impacted?

It’s difficult to exactly pinpoint the number of “soft landings” in recent history because opinions vary on the exact definition. Princeton Economist and former Fed Vice Chair Alan Blinder cites five “softish” landings between 1965 and 2019. His view is based on a definition where the GDP declines by less than 1%, or the National Bureau of Economic Research (NBER) doesn’t declare a recession for at least a year after a Fed rate-hiking cycle.

An often-touted classic example of a soft landing is the monetary tightening conducted under Alan Greenspan in the mid-1990s. Following the 1990-91 recession, the Fed was concerned about a potential increase in inflation that could derail the recovery. During 1994, the Fed raised rates seven times, doubling the federal funds rate from 3% to 6%. It then cut its key interest rate, the federal funds rate, three times in 1995 when it saw the economy softening more than required to keep inflation from rising.

Fed policy is credited with strong economic performance for the remainder of the decade, according to the Brookings Institute. Inflation remained low, unemployment continued to trend downwards from about 6.5% in 1994, and real GDP growth averaged above 3 percent per year.

Although previous soft landings are not a script for what will happen if the current US economy goes through a soft landing, there could be some valuable lessons regarding the past behavior of the overall economy and CRE market. In addition, it’s important to note that, while the broad economy and CRE are linked, they do not always move together in lock step.

A look at how CRE is positioned

CRE saw a mini boom coming out of the pandemic recovery with huge price movements upwards as assets appreciated, and the industry also benefited from the spike in inflation. However, those trends started reversing over the past two years in the higher interest rate environment. Transaction activity slowed down dramatically, and capital costs and debt maturities have moved to the forefront. “While a lot of those headlines are not positive, a lot of those adjustments in valuations have flowed through,” says Eltorai.

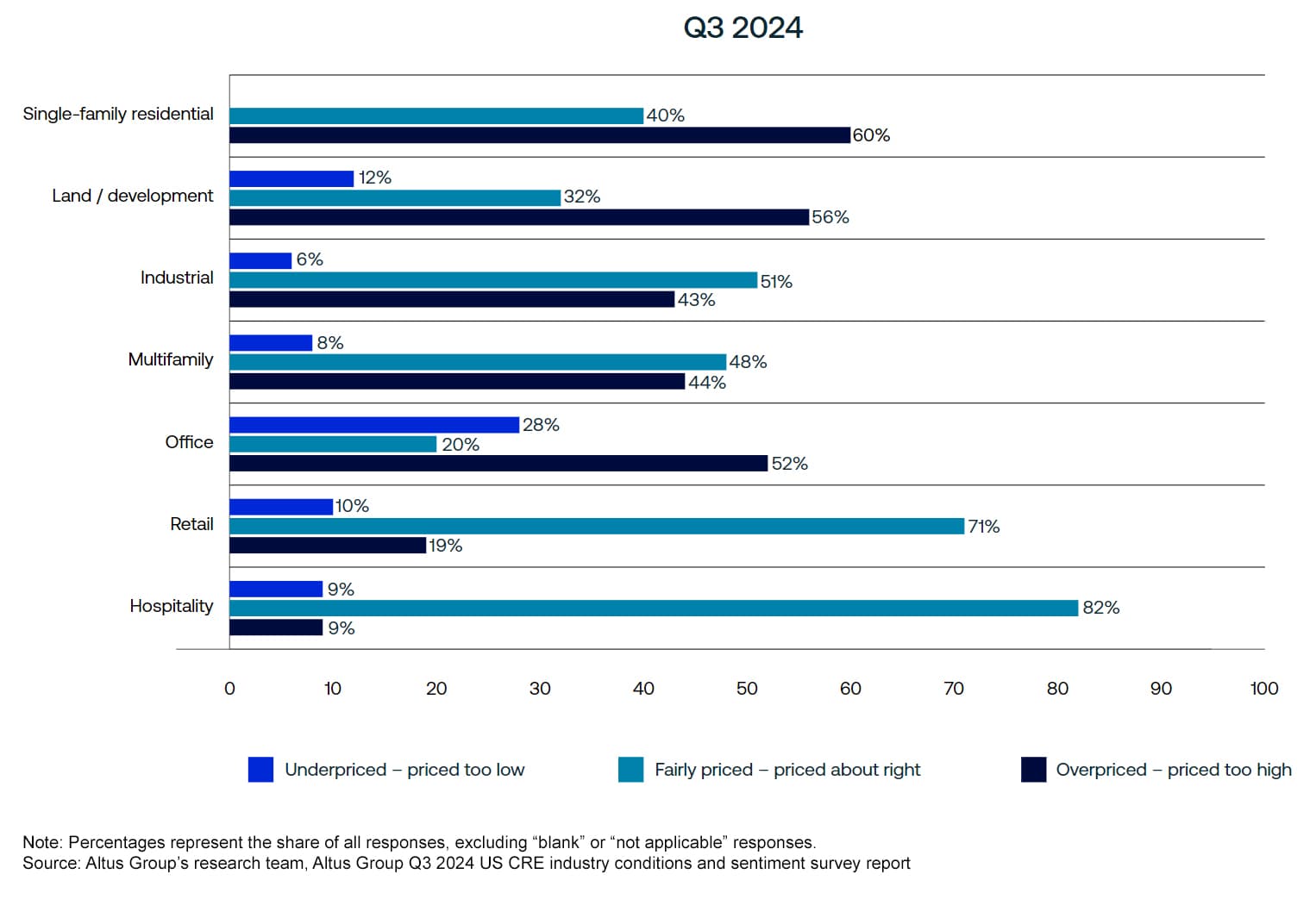

What that means if the US economy were to move into a shallow recession is that commercial real estate values likely wouldn’t move a huge amount because the down market has already been priced in. “We can see in the survey results that participants are starting to acknowledge the price adjustments that have taken place and that a lot of assets are being perceived as more fairly priced than they were in the past,” adds Eltorai.

Figure 4 - How would you characterize current pricing for the following property types?

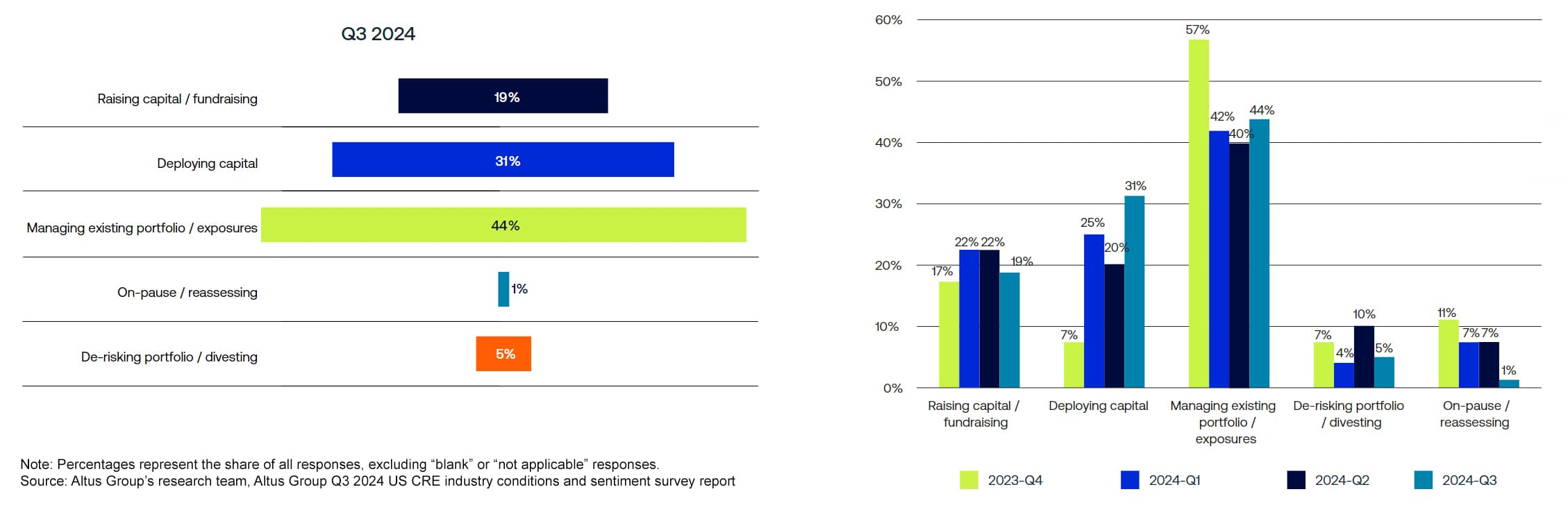

Although survey results do pick up on lingering uncertainty related to the economy, there also is a lot of optimism found elsewhere in the survey. Notably, there is an increase around buying appetite and intention to transact. Although most survey respondents are focusing on managing existing portfolios/exposures, 31% said that the primary focus of their team over the next six months will be on deploying capital. That represents a big jump from the 20% who held that view in the Q2 survey.

Figure 5 - What do you think your team’s primary focus will be over the next 6 months?

“Even if the expectation is that the macro environment could get a little bit bumpy, there is growing expectation that commercial real estate activity will pick up, and there is still quite a lot of safety in the underlying operating fundamentals in most CRE sectors,” says Eltorai.

A majority of respondents (79%) expect NOI growth to remain steady or increase over the next 12 months. In addition, while expectations for capital availability overall remain low, net expectations surged across all sources of debt and equity.

Landing is still playing out

A recession is not entirely off the table, but it does appear that the US economy is lined up for a soft landing and will avoid a recession. Sentiment among ICSS participants on the potential for a recession is more bearish compared to mainstream economists. If a recession does materialize, the view is that it will likely be shallow and short-lived, and most property sectors are positioned relatively well to weather the impact of a downturn.

History has shown that hitting a soft landing is rare, which speaks to the difficulty in getting all of the moving parts just right. However, there is still a wait-and-see element that needs to play out as the Fed moves forward with its rate-easing cycle. The Fed is going to continue to watch the economic data as it weighs decisions on when and how much to cut.

To be clear, the Fed’s 50 basis-point rate cut in September is only the first move in a longer rate-easing cycle that will continue to unfold through 2025 and, potentially, into 2026. A majority of FOMC members have said that they expect, at minimum, an additional 25 basis point cut at each of the two remaining meetings this year. Just as in the past, the timing and aggressiveness of the Federal Reserve's interest rate policies will play a key role in shaping the outcome of a soft or hard landing.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Altus Group

Author

Altus Group

Resources

Latest insights

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility