How CRE valuation experts are responding to a rise in foreclosures

With distressed CRE sales on the rise, valuation experts must dig into the details of each transaction to find true market value.

Key highlights

The higher for longer interest rate environment is fueling elevated levels of distress across the CRE market as debt service delinquencies evolve into a growing number of foreclosure sales

In times like these it can be a challenge for valuation experts who must leverage an “art vs. science” approach to better understand the different variables that are impacting a sale price

According to the Appraisal Institute, adjustments for conditions of sale should reflect the motivations of the buyer and the seller

Adjustments for conditions of sale are often subjective and very difficult to quantify, making it even more important to evaluate every transaction with a sharp lens

These same adjustments are also sometimes required on transactions where valuations have been elevated due to assumable or off-market debt financing

Exceptional times call for exceptional due diligence on valuations

Commercial real estate valuation is often a diligent, data-driven exercise to provide an unbiased opinion on the value of a property. But in some market environments valuation experts can be tested by various market conditions that can act to inflate or deflate values. In this insight we examine the challenges brought by distressed sales and cash equivalency adjustments, situations which require a mix of art and science to truly understand the underlying circumstances and arrive at a valuation.

A growing level of CRE distress is muddying the waters

In commercial real estate distressed sales are typically measured by the rise or fall in delinquent debt. If a property is delinquent with its debt payments for a certain amount of time and no other resolutions can be found, the lender has the option to foreclose on the property and sell it back into the market at a discount. In “normal” markets distressed sales are one-off deals that represent a small percentage of overall transactions. Many appraisers effectively remove these transactions from market analysis given the difficulty involved in quantifying the necessary adjustments. The argument is that these transactions are outliers to true market value and not indicative of market prices. When these “one-off” distressed sales start to comprise a larger part of the overall transaction market, it may create a bit of a tipping point where the number of them become too difficult to ignore or toss aside.

Levels of distress are starting to rise

The higher for longer interest rate environment and an overall challenging CRE market is beginning to fuel elevated levels of distress across the CRE market. The pain is especially acute for borrowers holding low-cost debt that, in some cases, is maturing in an environment where financing costs will nearly double. Many borrowers are working hard to modify or extend existing loans, but some are inevitably giving keys back to the lender.

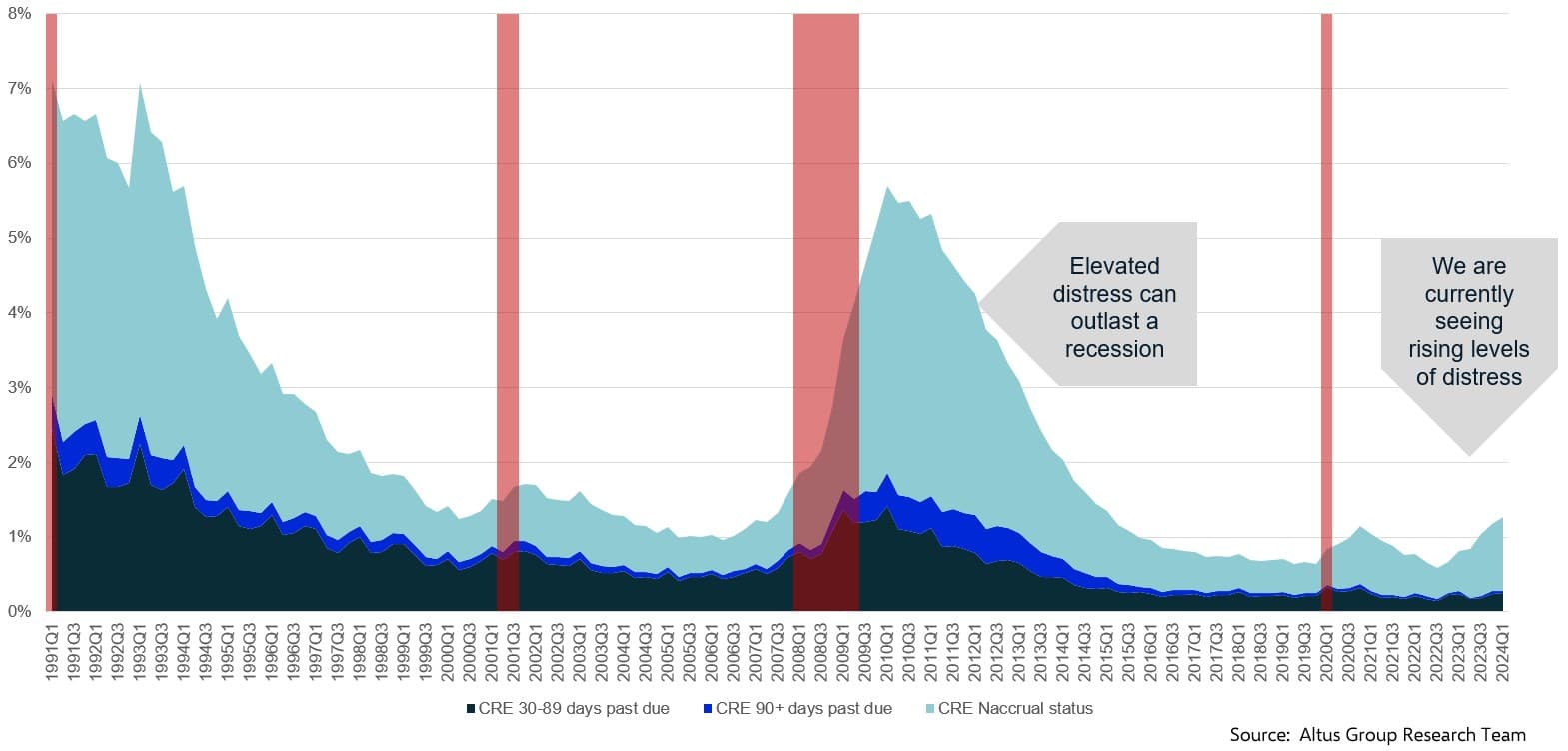

Figure 1 provides some historical perspective on CRE stress. The red marked sections represent recessionary periods since 1991 and the data shows rise and fall of distressed debt over that time – not in lock step with the challenging markets but at a sustained lag that builds over time. While not as high today, we are starting to see a rise in distressed loans in the marketplace.

Figure 1 - Historical CRE distress in banking: Measuring US market distress 1991 - 2024

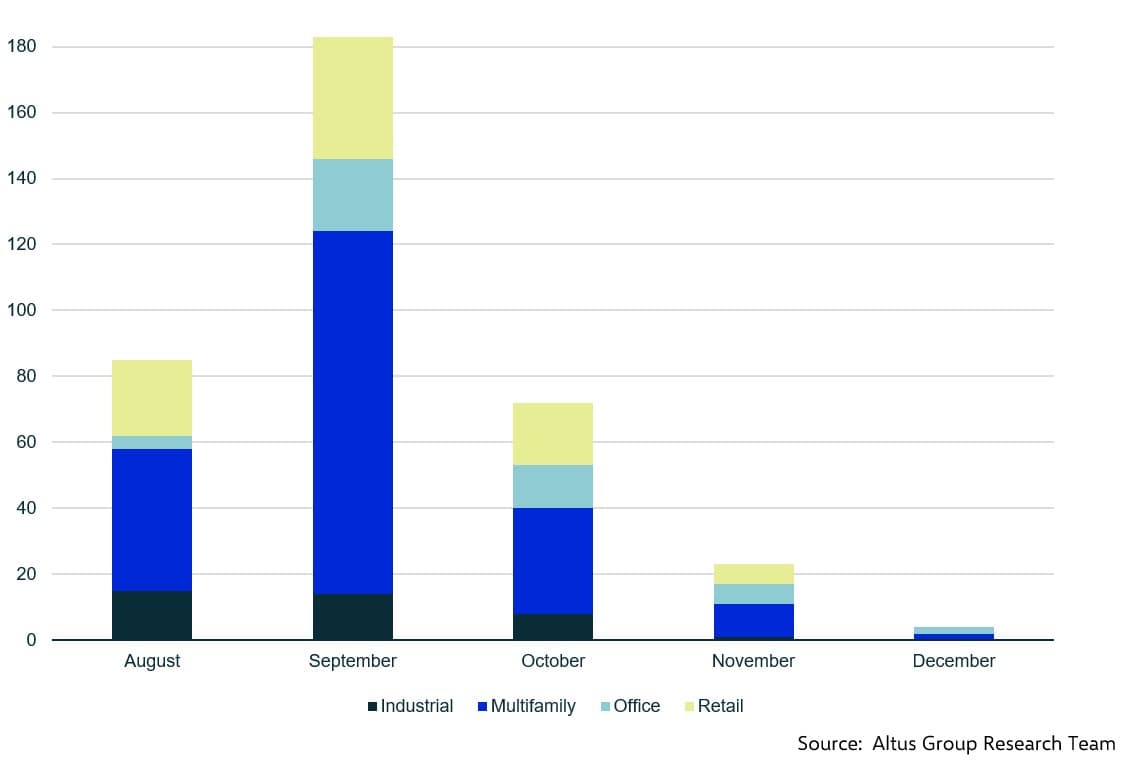

Altus research shows 368 foreclosure sales occurred in the US during the first half of 2024. The office sector reported the largest count at 170, followed by multifamily at 78, retail at 69 and industrial at 51. Figure 2 shows upcoming foreclosure auctions through the end of 2024.

Figure 2 - Scheduled upcoming foreclosure auctions in 2024 (as of August 5, 2024)

As the number of distressed assets grows, the transactions become hard to ignore. Navigating valuations in the current market requires diligence to:

Identify a distressed sale comparable;

Understand the underlying source of distress; and

Determine how the distress factors into value adjustment

Identifying the source of distress

CRE valuation experts need to peel back the layers of distress to better understand sale comparisons. Does a transaction price represent a market rate or distressed sale? It's also important to dig into the story behind a sale to better understand the motivations of the seller. Additionally, there are different situations for distress that can influence analysis, including financial, economic, or even the personal circumstances of a property owner.

A sale where a borrower needed to exit quickly but was still able to get some equity out of the deal could result in vastly different metrics compared to a bank selling a portfolio of foreclosure assets. The seller could be in a liquidity crunch or overleveraged. In some cases, the seller may be looking to sell an asset ahead of a loan maturity because they are facing challenges with the asset or in their ability to finance the loan.

In either case, the seller or bank is motivated to move quickly and oftentimes does not fully market the property to optimize their pricing. In valuation terms, the “comp” would need to be modified upwards using a conditions-of-sale adjustment.

According to the Appraisal Institute, adjustments for conditions-of-sale should reflect the motivations of the buyer and the seller. Adjustments for conditions-of-sale can be for either a concession or a price premium. A party to the sale should be interviewed to estimate the magnitude of this adjustment accurately. It’s important to be careful when using comparable sales that require these types of adjustments as they are often subjective and very difficult to quantify.

Properties with significant leasing risks where income doesn’t cover operating expenses could also be considered a distressed sale. However, it is debatable whether the price discount is attributable to the lease-up risk or borrower distress. Adjustments in this case could instead be for economic characteristics (low occupancy), but similarly it is difficult to quantify.

Accounting for upward adjustments

Price adjustments are not necessarily all lower. The debt structure can positively impact the sales price, such as an assumable loan with a below-market interest rate. In such cases, the comparable would need a downward adjustment for financing terms, often called cash-equivalency adjustments. Cash-equivalency analysis is a procedure in which the sale prices of comparable properties sold with atypical financing are adjusted to be equivalent with defined market terms.

Using a hypothetical example in today’s multifamily space, let’s assume the existing loan is fixed rate at 4%, is fully amortizing, and has a remaining term of 7 years. Today, however, let’s also assume a buyer would only be able to get a loan at a similar loan-to-value ratio with an interest rate of 6%. Using the cash-equivalency method, the buyer would be willing to pay roughly 5% more with the loan assumption due to the favorable financing.

Somewhat similarly in today’s challenged office market, some sellers are stepping in to offer seller financing to help get deals done, in which they act as the lender to buyer. In these situations, the interest rate being offered by the seller is likely less than what would be obtainable in the open market. However, it is a bit more difficult to know the true market rate in these scenarios given uncertainty in the office market and lower office loan volume.

Applying both art and science

Today, distressed sales are still a relatively small percentage of the overall market – likely less than 10% of total deal flow. Nevertheless, we are operating in an environment where fewer properties are transacting and distress is building. It may take several years for distress to be unwound and cleared out of the market.

The challenge for appraisers is that they traditionally use methodologies that rely on mathematical numbers and the “science” behind a sale to determine value. In an opaque market such as this, it requires combining both science and a bit more “art” to better understand the different variables that are impacting the sale price.

Conclusion

There are plenty of anecdotes of office buildings that have sold for 50 cents on the dollar. The question that needs to be answered is “why” a particular building sold for that price. Finding the answer may require a phone call to the broker to understand what’s really going on. In other words, valuation experts need to look under the hood to see what’s working and what’s not. That is the “art” that needs to be applied to help identify the full picture when assessing value. It’s important to work with experienced valuation experts who look beyond face value to understand the various factors that drive adjustments in value.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Robert Tafaro

Senior Director, Valuation Advisory

Author

Robert Tafaro

Senior Director, Valuation Advisory

Resources

Latest insights

Apr 17, 2025

EP58 - From volatility to opportunity - AEW's Justin Pinckney on the CRE debt landscape