Is a more stabilized environment on the horizon for commercial real estate?

A panel of Altus valuation experts discuss commercial real estate industry sentiment and what that might mean heading into the second half of 2024.

Key highlights

Altus Group conducts a quarterly CRE Industry Conditions and Sentiment Survey of US and Canadian industry professionals to track current market sentiment, conditions, and issues impacting commercial real estate

In a recent webinar, we invited some of our valuation experts from the US and Canada to react to the Q2 results and share what they have been hearing directly from clients

Survey results and client conversations confirm that there is an understandable amount of caution throughout all sectors of the CRE market, however many firms are readying themselves for improved operations in a more stabilized environment

When it comes to performance, retail is seen as a “sleeper sector” poised to do well if consumer spending remains strong

Examining the trends that impact valuations

In the webinar, we brought together the expertise of Senior Directors for Valuation Advisory Robert Tafaro (Chicago office) and Alexander Jaffe (Irvine, California office) to discuss and share their perspectives on the results. They were joined by Robert Santilli, a Director of Valuation Advisory from our Canadian Halifax office, and Cole Perry, Associate Director of Research. The discussion covered various topics pertinent to valuations and the alignment between what the survey results say and what our experts hear from clients first-hand.

Results were based on our Q2 2024 questionnaire, which addresses current sentiments on various commercial real estate industry topics. The upcoming Q3 industry survey is also currently open for participation.

Have we reached the commercial real estate valuation “bottom”?

Robert Tafaro, speaking to the US market, emphasized that “cap rates have expanded materially, with valuations generally supported by recent market transactions.” He also highlighted that interest rates appear to have stabilized, with a looming federal rate cut anticipated. However, traditional office markets remain outside this sphere, with a sizable bid-ask gap indicating further price discovery. Some sector softening is still seen due to short-term oversupply, but he expects real estate to return to strong NOI growth over the coming year.

Alex Jaffe highlighted the difference in short versus medium and long-term outlooks, with positive sentiment for longer investment timelines being seen, making it tricky to time market re-entry. The CRE space could get crowded quickly, as we saw after the 2008 Global Financial Crisis.

In Canada, this bottom also seems in sight outside the office sector, where fundamentals are slowly improving, valuations are reduced, and the underlying asset quality will determine any further softening. Canada hasn’t experienced the same downward movement in values as the US, although the industrial and multi-residential sectors have softened a little, with some possible cap rate expansion.

Our survey results note that the number of respondents who believe the multi-residential market is overpriced has increased considerably.

A focus on improving operations

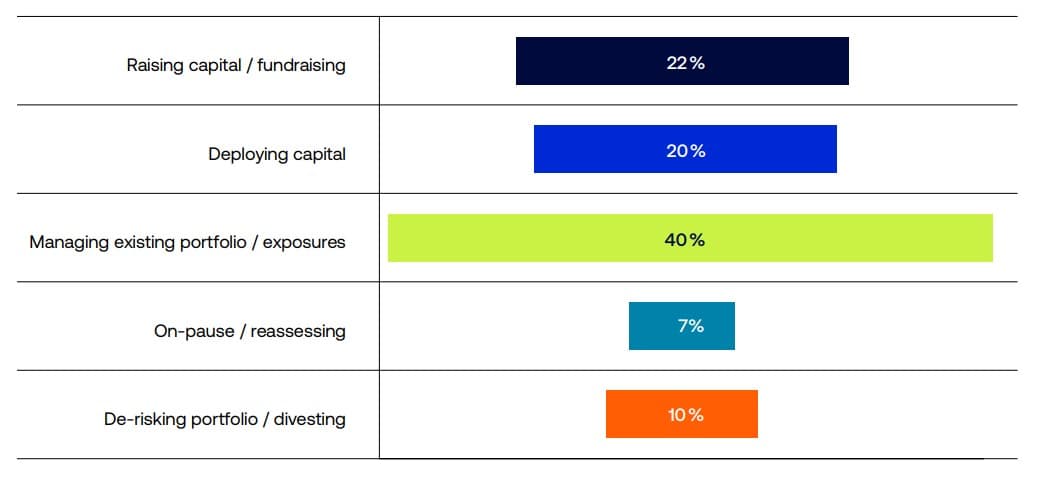

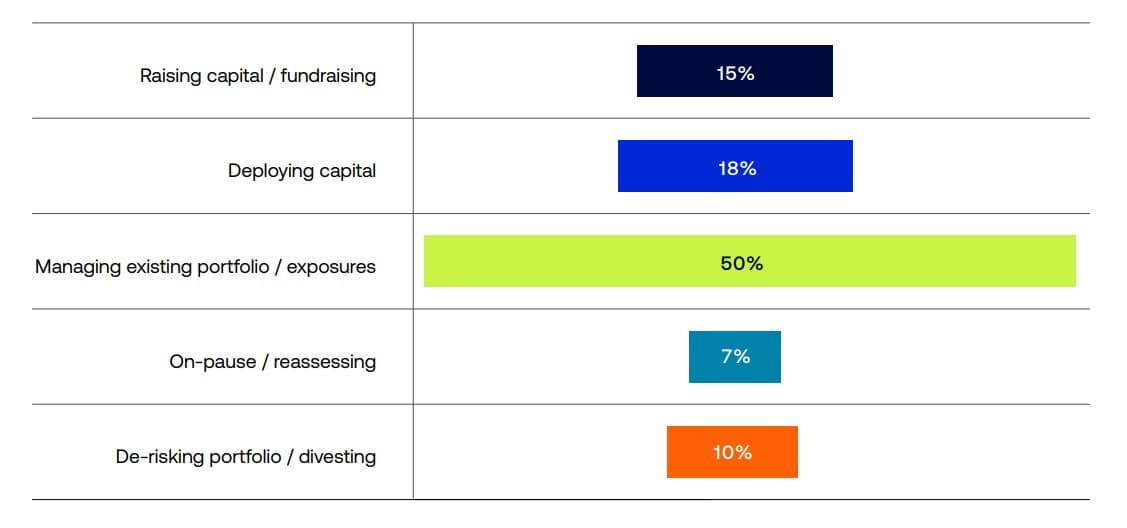

In the Q2 survey results, Altus saw 40% of US respondents and 50% of Canadian respondents indicate that their primary near-term focus will be on managing their existing portfolio and exposures. This was nearly flat, with little change quarter-over-quarter for both countries.

Figure 1 - US Survey Current Focus – What do you think your team’s primary focus will be over the next 6 months?

Figure 2 - Canadian Survey Current Focus - What do you think your team’s primary focus will be over the next 6 months?

Robert Santilli noted that “improving operations is now the focus for clients. It’s something of a basis point game… getting creative is imperative.” As valuation multiples reduce, getting the most out of properties, driving NOI, and lowering expenses is key. While some institutions are holding out on further improvements, many are again considering acquisitions, although the current focus is optimization. Robert Tafaro sees similar sentiments in the US, emphasizing that clients want to position their portfolios to overperform once the market truly returns to normal.

The survey showed a jump in those willing to spend capital between Q4 2023 and Q2 2024 (from 7% to 20%). Instead of hyper-focusing on pending interest rate cuts, with inflation moving in the right direction and fundamentals staying relatively healthy, the institutional outlook is generally positive in the US as well.

Understanding sentiment around transaction intentions

During the webinar a poll was conducted to ask sentiment around transaction intentions for the near future. About a third of respondents anticipate buying and selling, a quarter of them are focusing on acquisitions, and 17% are planning to sell. Interestingly, 27% do not intend to transact at all. The majority of US respondents (80%) plan to transact in the next six months, similar to Q1 2024. In Canada, this dropped from 71% to 65%.

Figure 3 - Poll question: Over the next 6 months, do you anticipate any transactions in your portfolio?

Alex Jaffe, speaking to these changes, noted that there have been news headlines suggesting a significant amount of market stress and therefore lots of discount purchase opportunities. “To be honest, we haven’t seen it in most of the core portfolios we work with.”

Jaffe added that “This is one of the benefits of having a large core portfolio and diversified mix of assets. You don’t have to reshape the entire investment thesis.” Effectively, investors can move between sectors and better absorb market changes. This is tougher for single sector funds and strategy funds.

Robert Tafaro expanded on this, noting that now interest rates have stabilized and rate decreases are expected, “investors generally can feel more comfortable about underwriting deals. Additionally, we are hearing there are more interested buyers bidding on properties … especially for industrial and multi-family, which is a good sign.”

In Canada, Robert Santilli also expects to see more transaction activity in the remainder of the year, with investors shifting from net sellers to net acquirers and reducing office sector exposure where prudent. He expects high-grade industrial and retail to rise in prominence, with more buying activity overall.

Perception that the overall market is overpriced

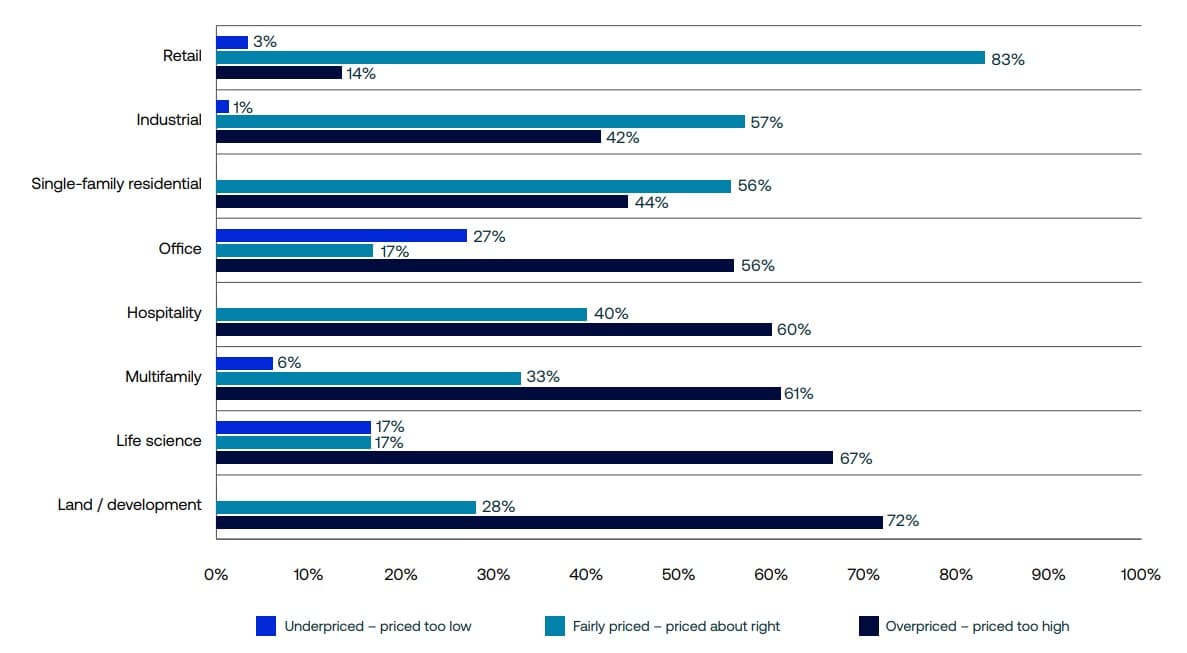

Cole Perry then dug deeper into respondents’ feelings on current pricing across property types. Here, the Altus Q2 2024 survey showed that, for the US market, respondents think that Land/development, Life science, Multi-family, Hospitality and Office sectors are currently overpriced, as shown by the longer black bars in Figure 4.

Figure 4 - Poll question: How would you characterize current pricing for the following property types

In contrast, respondents felt that single-family residences (56%) and industrial sectors (57%) are fairly priced. Notably, a resounding 83% believe retail is fairly priced. Alex Jaffe explained that, while buyers are still hunting discounts, sellers are not willing to transact at significantly lower prices. However, bid activity is up, making for more competition and offsetting the potential for those hoped-for deep discounts, which are slightly at odds with the survey results.

Property type performance

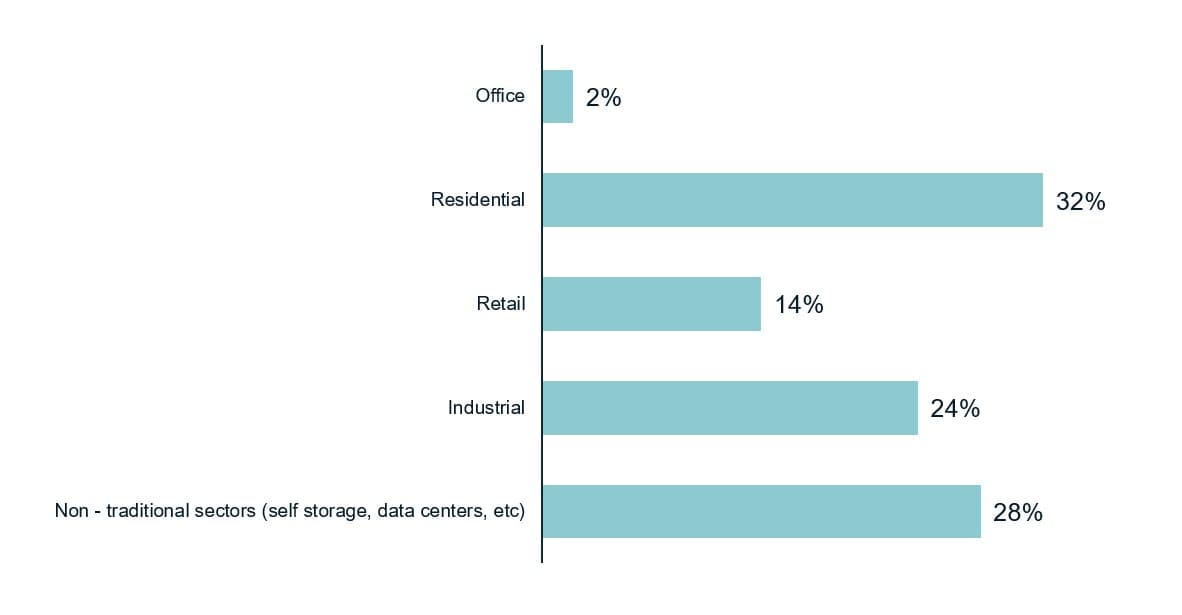

The discussion on property performance prompted another poll asking which property type you believe will be the strongest performer over the next year. About a third of respondents believe residential will be the best performer, with non-traditional sectors surprisingly also being popular. Industrial took a quarter of the poll results, with retail sitting at 14% and office generally discounted.

Figure 5 - Poll question: How do you think different property types will perform over the next year?

This roughly aligns with the survey results, where US expectations improved for all housing sectors and dropped for industrial. Robert Tafaro indicated that “we’re seeing a shift away from office investment and other sectors and increased investor appetite for alternative or niche sectors.” These include self-storage, senior housing, and student housing. Alongside a recent reclassification of these niche sectors by NCREIF, this suggests increased demand for these sub-sectors.

Retail is seen as a “sleeper sector” but hinges on consumer spending. In both the US and Canada, grocery-anchored retail properties have performed strongly and should continue to do so. The impact of the looming housing crisis in both countries on the residential sector is also relevant and may soon drive a peak in that sector.

The impact of AI

The Altus survey shows that AI skepticism in the industry has reduced significantly. Two-thirds of respondents now believe AI has practical benefits for the CRE industry, roughly 20% believe it will be a disruptive transformation force, and only 18% believe it to be a threat.

This is in line with our experts’ experiences. Historically, real estate is a sector that is slow to embrace technological advances, but Cole Perry believes predictive analytics will create an exciting shift in the landscape. Within real estate, there is a growing number of AI use cases, including using data to identify trends and help investors, managers, and appraisers make better decisions and move the industry forward.

In summary, while many of the metrics analyzed suggest signs stabilization in the market the panel agreed that any sort of optimism relies on improving fundamentals. A scenario where interest rates stay higher for longer than anticipated (and therefore higher debt costs) would add risk to the market – something to watch over the next several quarters.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Altus Group

Author

Altus Group

Resources

Latest insights