Longer amortizations as a short-term solution to Canada’s housing affordability crisis

The 2024 federal budget proposes a 30-year amortization period for uninsured mortgages for newly built homes to 30 years – will this have an impact on housing affordability?

Key highlights

The 2024 federal budget proposes to extend the amortization period for insured mortgages for newly built homes to 30 years

The limited scope of the proposal is meant to improve home affordability without artificially stimulating the housing market

Some homebuyers and developers will likely benefit from the change, but the impact will largely be limited to areas that are already considered to be affordable

The proposal could shave a few hundred dollars from the home buyer’s monthly mortgage costs, although a lower interest rate would have a larger impact on affordability

The extended amortization period can be viewed as a short-term fix, as price growth in the market could negate the benefit from the extended amortization rate within a year

No easy fix for first-time homebuyers

Not enough supply and pent-up demand – that, in a nutshell, describes the Canadian housing market, at least when it comes to many of the country’s larger urban areas. Of course, identifying the problem is easy, but finding the fix is a challenge developers and governments at all levels are under pressure to accomplish. First-time homebuyers find themselves caught in the middle, with prices rising faster than they can save, threatening to put homeownership further out of reach.

In the latest attempt to remedy the issue, Ottawa included a proposal in the 2024 federal budget to increase the amortization period for insured mortgages on newly built homes from 25 to 30 years. The move is meant to help more first-time homebuyers qualify for an insured mortgage by reducing their monthly mortgage payments and extending the repayment period. Last year, 230,000 home purchases – or 30% of all homes purchased with a mortgage – were funded through insured mortgages. Within the same period, we saw 117,000 sales of new homes compared to 445,000 of existing ones, according to the Canada Mortgage and Housing Corporation (CMHC).

The limited scope of the proposal is indicative of the delicate state of the housing market. As much as the government wants to boost supply and make homes more affordable, it also doesn’t want to introduce changes that could unintentionally upset the market by opening the door to a surge of buyers that could push prices even higher.

The move is meant to improve affordability, but it could be just a short-term fix. While the tweak to amortizations for new homes could help clear some of the inventory being built now, it’s not necessarily a major change from a long-term perspective. That’s not to say the proposal won’t have any impact. Builders and homebuyers will benefit, but any new developments initiated by developers to take advantage of this change could be in cities that are already seen as being more affordable and where there might be less of a need for a longer amortization, which would limit the potential of this program to a small population of prospective new buyers.

Affordable markets have limited supply

The extended amortization period is expected to have a more substantial impact on affordability in the condo apartment market, making homes that would have been unaffordable accessible to first-time buyers. Still, Canada’s most expensive communities, such as the Greater Toronto Area (GTA), parts of the Greater Golden Horseshoe, Vancouver and surrounding regions, will largely be excluded from this shift because the average sale value of a new home exceeds the maximum qualifying sale price for mortgage insurance of $1 million.

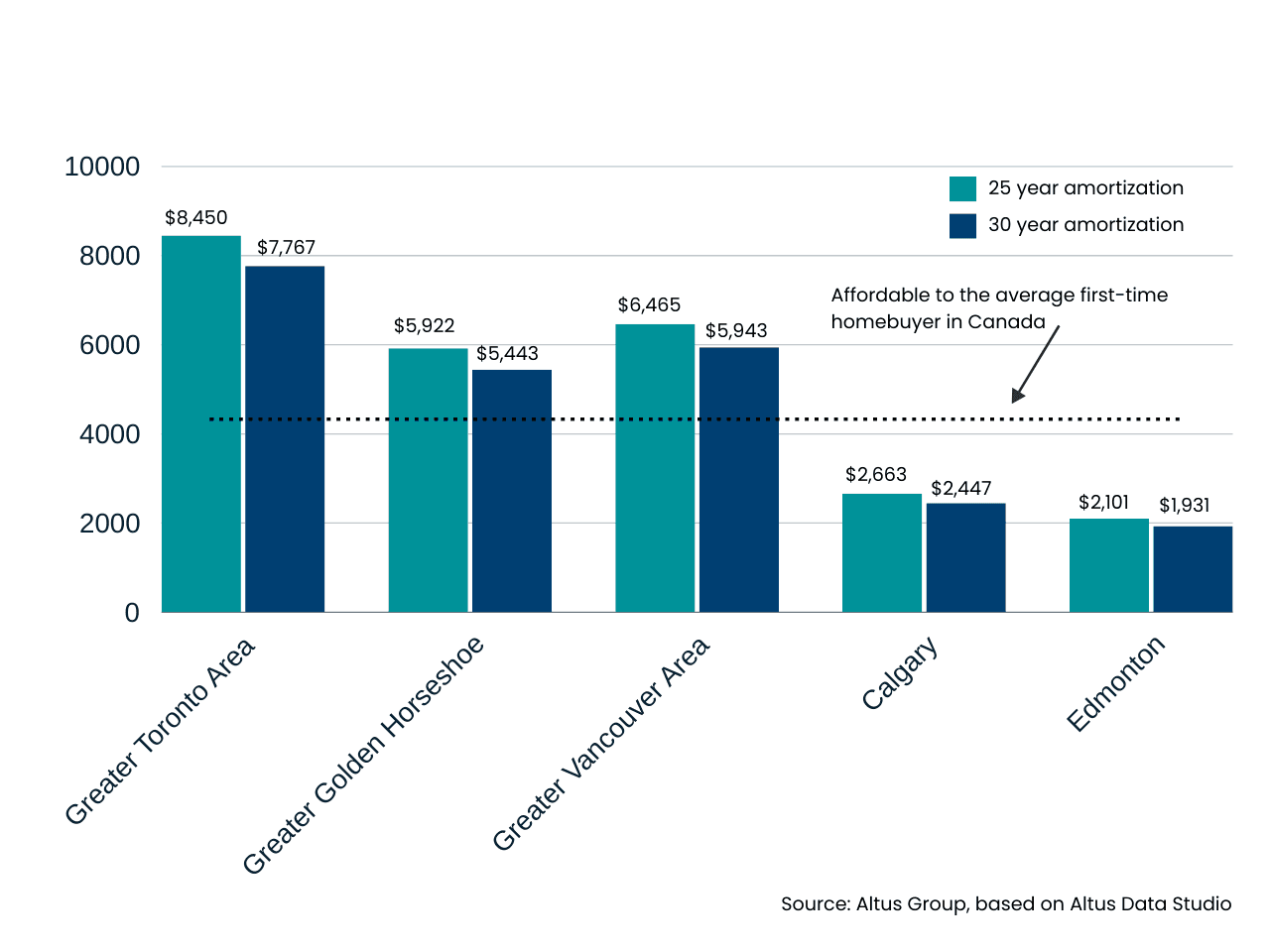

Instead, first-time buyers looking to take advantage of a 30-year amortization are more likely to find opportunities in smaller cities, where sales are weakest and low-rise homes remain relatively affordable. As such, the benefits of a longer repayment period will be less pronounced. For instance, in Calgary, where home prices are lower compared to the GTA, extending the amortization to 30 years would only reduce monthly mortgage payments by approximately $200, as opposed to nearly $700 in the GTA.

Figure 1 - Average monthly mortgage payments for the purchase of an average priced home in the new home market (Low rise, Q1 2024, select CMAs)

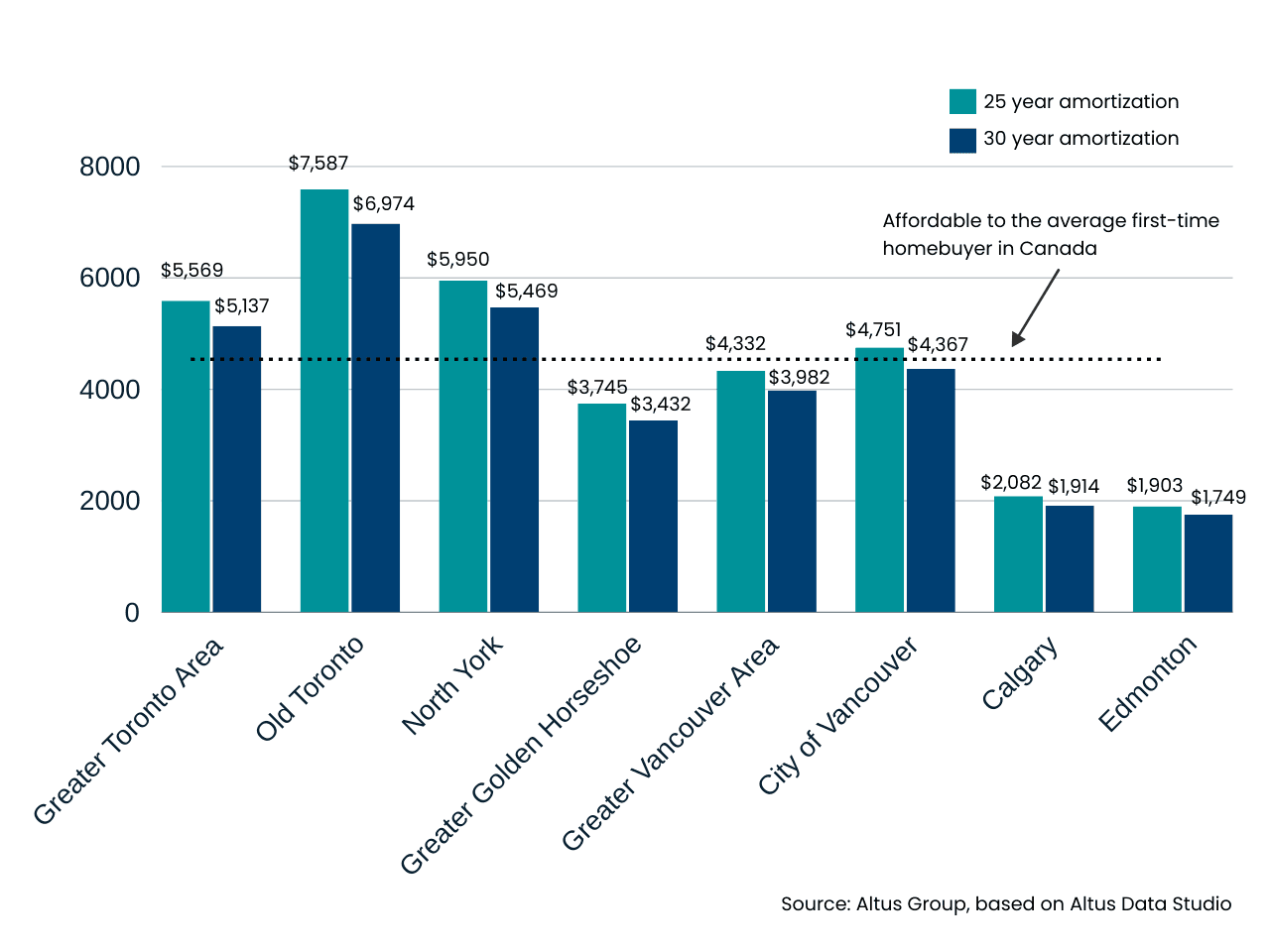

Figure 2 - Average monthly mortgage payments for the purchase of an average priced home in the new home market (Apartments, Q1 2024, select CMAs)

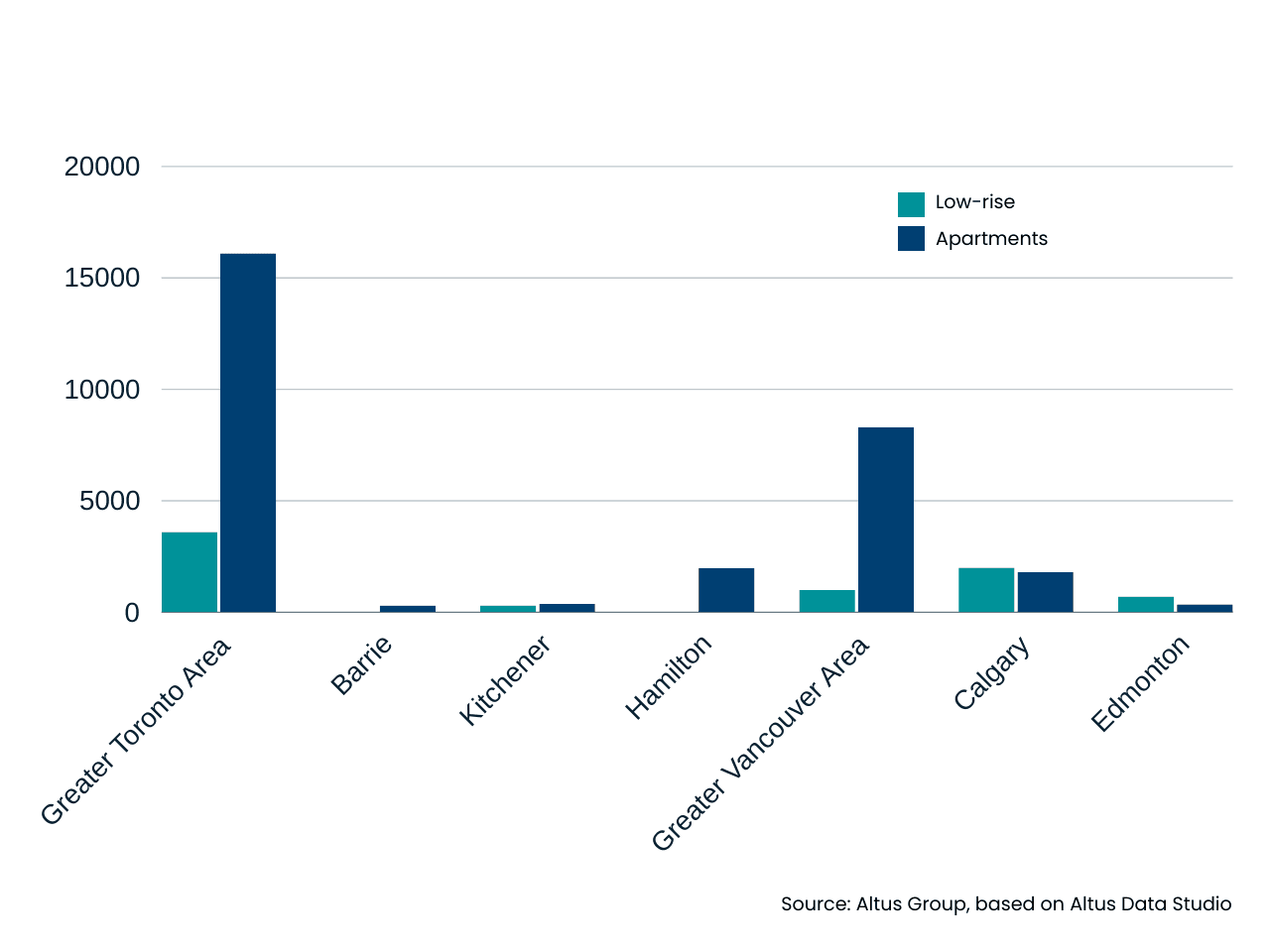

Paradoxically, the regions where a 30-year amortization rate is expected to have the greatest impact also currently have lower levels of new builds coming to market. Altus data indicates that the greatest inventory of new homes for sale is in high-priced centres like the GTA, where some 16,000 apartments and nearly 4,000 low-rise units are available. Roughly 80% of that apartment inventory in Toronto is concentrated in expensive neighbourhoods in downtown Toronto and North York. Contrast that with 327 new units in Barrie, Ontario, a bedroom community about an hour north of Toronto where homes are more affordable.

Developers could shift their plans by ramping up projects in areas they believe could appeal to more first-time homebuyers, although that may not be enough to help those already looking for an affordable home right now. New developments can take years to get through the approval and construction phase. That might be too long for millennials, who account for the majority of first-time homebuyers, since many are also at a stage of their lives where they’re starting families. Instead, they may be more motivated to look to an affordable market rather than a market that could be made more affordable by a slightly longer amortization period.

Figure 3 - Inventory of new homes for sale across key regions in Canada

Interest rates trump longer amortization periods

It’s important to note that while a longer amortization period may lower the monthly cost of a mortgage, the lifetime cost of owning a home will be higher. Mortgages with a 30-year amortization will pay down the principal at a slower rate, which, in turn, increases the interest cost over the mortgage term. Those monthly savings could be put at risk if the homeowner needs to renew at a higher interest rate.

Still, high interest rates are a more important factor for affordability than longer amortization rates. For instance, the payment on a 30-year amortization rate for an average condo apartment in Toronto at a 5% interest rate would be $5,137, or about $600 less than the monthly cost of a 25-year amortization. In contrast, lowering the interest rate by two percentage points to 3% on a 30-year amortization rate would reduce costs by $1,000 a month.

Bank of Canada's recent policy rate cut to 4.75% – and the potential for future rate cuts – will be helpful in bringing some affordability back into the market over the next year.

Given that the time required for new projects to materialize, increased demand may drive up new home prices first, potentially offsetting the affordability benefits of the extended amortization period. A mere 6% increase in the average sale price of a new home could nullify the impact of the additional five years of amortization on monthly payments. With some markets seeing increases of that magnitude, it’s reasonable to believe the proposed change’s impact may only last for one to three quarters. As much as the amortization change could incentivize developers to accelerate projects further along the planning process, it may not stimulate additional projects down the road.

Looking for answers

The increase in amortizations for new buyers is not happening in isolation. In 2023, the federal government introduced the First Home Savings Account (FHSA), a tax-free account that allows prospective buyers the ability to save up to $40,000 toward the purchase of a home in Canada. This year, Ottawa followed that up by allowing Canadians to withdraw as much as $60,000 from the Registered Retirement Savings Plan (RRSP) under the Home Buyers’ Plan (HBP), up from $35,000.

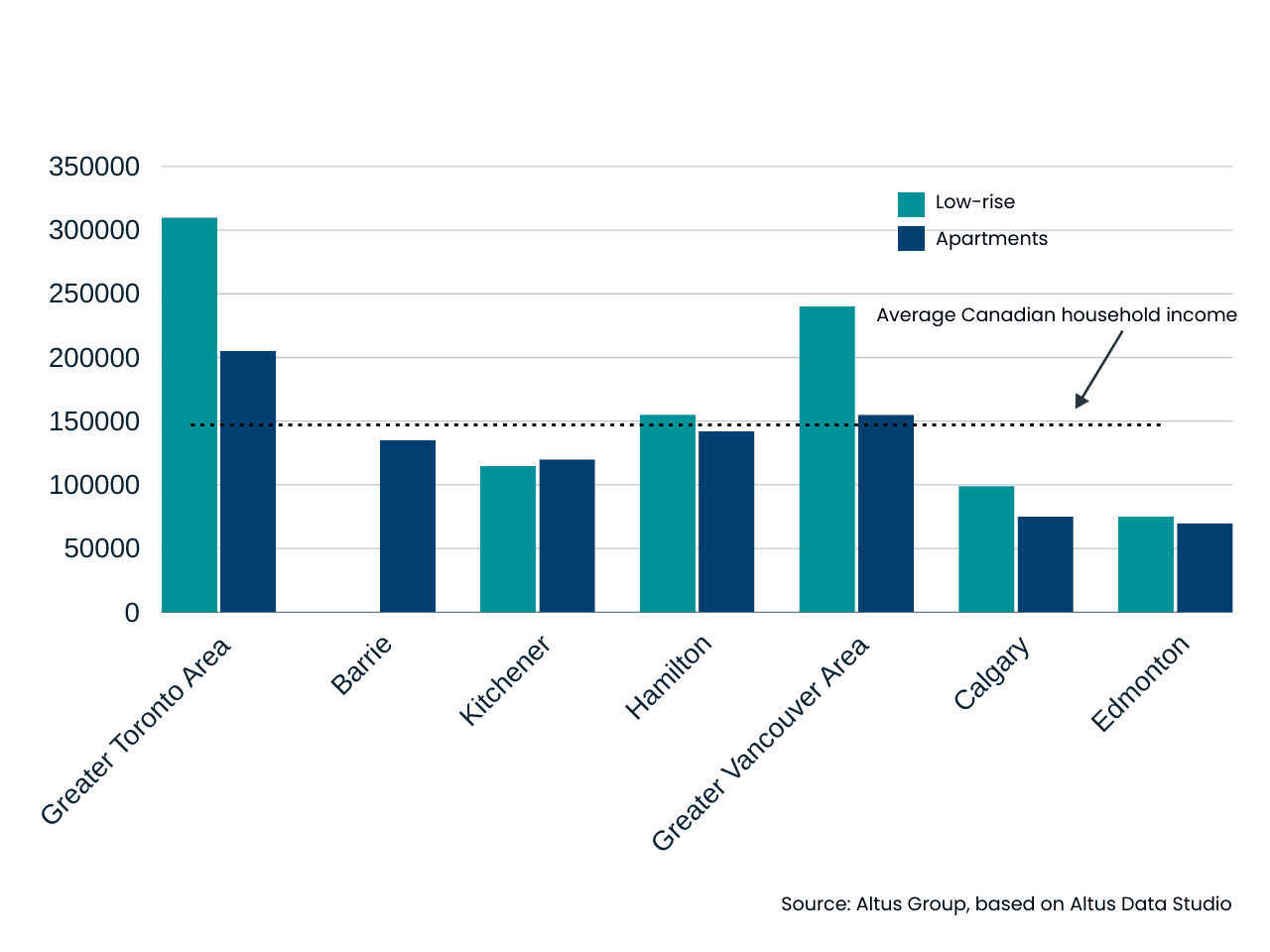

Together, these changes will remove barriers to many first-time buyers, but it will take time. Altus data shows that the average household income to buy a home in many parts of Southwestern Ontario tops $100,000, soaring above $200,000 in the GTA. The Greater Vancouver Area is the next most expensive, requiring household incomes above $150,000.

Figure 4 - Average income needed to purchase a new home across various regions in Canada

Given the FHSA only allows Canadians to contribute up to $8,000 per year, no Canadian will be able to take full advantage of the account until 2028 at the earliest. While RRSP contributions are not restricted in the same manner, many who have taken advantage of the HBP in the past have not had savings in the account beyond what they could withdraw for a home.

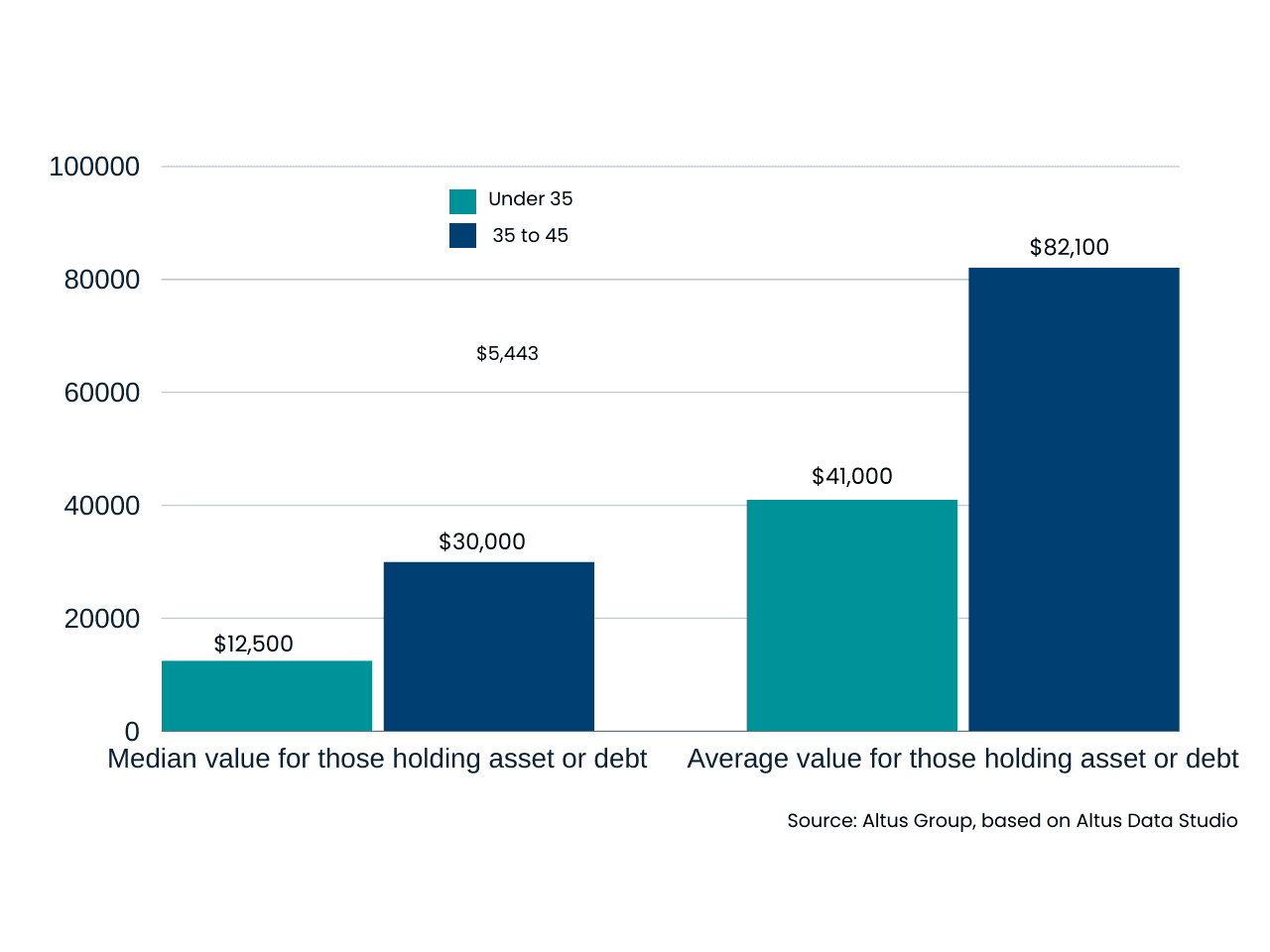

The median household in the first-time homebuyer age category holds between $12,000 and $41,000 in assets, so there isn’t exactly money to draw on immediately to make a purchase. Young people could boost their RRSP contributions, which will increase their after-tax income for the 2024 tax year, but the financial benefit of those savings won’t be realized until 2025.

Figure 5 - 2019 Canadian household RRSP savings by age

Conclusion

Only 62% of insured mortgages have an amortization period of more than 20 years, which makes sense given that homebuyers who qualify for an insured mortgage have been restricted from taking out loans longer than 25 years. Taking on longer loans could impact a homeowner’s financial stability, which limits their ability to build equity in their home which makes them more susceptible to interest rate changes. Statistics Canada has found that there is a direct relationship between how much equity you have in your home and bankruptcy.

Ultimately, if the federal government wants to support homeownership, fostering a conducive environment for a diverse range of affordable housing options, along with potential job creation, in areas where building and land costs are more affordable, should be the overarching objective.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Diana Petramala

Director, Research, Valuation & Advisory, Economic Consulting

Author

Diana Petramala

Director, Research, Valuation & Advisory, Economic Consulting

Resources

Latest insights