The looming shift in the European pension fund landscape – Rethinking operational models

With the increasing shift to defined contribution models for pension funds, the need for daily valuations of real estate assets in those portfolios has become more pressing.

Key highlights

European pension funds are increasingly shifting from defined benefit to defined contribution models, with notable growth in France, Norway, and Sweden, and mandated transitions in the Netherlands by 2028

This transition creates a pressing need for daily valuations of real estate assets in pension portfolios, requiring fund managers to adapt their operational practices

Effective daily pricing of real estate funds require robust methodologies for both income projection and appreciation estimation, supported by timely monitoring of material events

Fund managers face challenges in valuation practices, governance, and data management, necessitating investment in the right technology and standardised procedures

Historical data from established markets shows that while rental income remains relatively stable, appreciation projections require careful monitoring and frequent adjustments to maintain accuracy in daily valuations

European pension funds are shifting to a defined contribution future

Globally, pension funds have long operated under the defined benefits structure. As the needs, wants, and even demographics of retirees and pension users change, along with the economic climate that surrounds them, we’re seeing a notable shift in the European financial landscape towards the defined contribution model instead.

With these shifts comes a need for fund managers to adapt their operational models to better serve these evolving needs. As a leading provider of asset and fund intelligence for the CRE market, Altus has brought together our European valuation experts to analyse the factors behind this shift, estimate its potential impact on the industry, and unpack how European fund managers can best adjust their positions to adapt to this new landscape, particularly through embracing daily valuations and the value of the right dataset.

The impetus for change: What is driving the shift?

Under the older defined benefit structure, plan sponsors guarantee fixed retirement payouts. These are typically determined on the basis of salary, length of employment, and the retiree’s age.

Today, however, we are seeing substantial shifts in retirement demographics. The problems of ageing populations and low birth rates in many European countries are news to no one. Paired with the extended low-interest rate environment and increased capital requirements on plan sponsors, this has put the defined benefit model under heavy pressure. As people live longer in retirement, we have even seen struggles in payouts arise.

In the United States, the defined contribution plan, popularly known as the 401(k) model, has been the go-to retirement structure for the past two decades. These plans offer significantly more liquidity and flexibility for buy-in/buy-out choices, making them more versatile for these shifting demographics in a difficult economic climate.

A similar trend is now gaining traction in Europe. The number of new members joining defined contribution plans increased by 115% between 2021 and 2022, with the majority of growth in France, Norway, and Sweden. The UK, meanwhile, already has the plans commonly available, with wide adoption.

The Netherlands has also recently enacted the Future of Pensions Act fund reform. Under this, plan sponsors must actively transition from defined benefit to defined contribution models before January 1, 2028. With €1.2 trillion in accrued benefits at stake, this looming reform and rising trend makes it critical for pension fund managers to reassess their current operational models, including the impact defined contribution has on alternative asset classes.

As we see this shift to greater liquidity take hold, the need for more current, preferably daily, valuations has become more important than ever. These valuations must be able to react to critical events, including pandemics, wars and martial action, market trends, tenant bankruptcy, and shifting economic policies and tariffs..

What does this shift mean for the real estate industry?

Daily pricing has been the normal course of business in public markets, such as traditional stocks and bonds, for a while now. However, this focused change to the direct contributions model introduces considerable operational challenges, especially for those pension administrators and fund managers active in traditionally illiquid markets, of which real estate is a notable one. The need for greater liquidity and transparency increase drastically, introducing some key challenges:

Valuation best practices: Valuation best practices for real estate vary in process (internal, external), scope (full, limited scope), and frequency (quarterly, semi-annual, annual). Whilst fund type, regional practices, and investor requirements influence the valuation process, the results reflect similar definitions of market value.

Material events and estimates: Naturally, we don’t need to revalue every property every day, as one might with stocks and bonds. However, material events must be closely monitored, and any potential impact on valuations correctly assessed. This requires the valuation process to support timely, accurate tracking of both properties and market events, such as new leases, market shifts in estimated rental value (ERV) and pricing, and so on. Materiality thresholds must also be kept in mind — in a fund with a net asset value (NAV) of €1 billion, for example, a value event of €1 million would only impact the NAV by 0.1%.

Governance: Detailed valuation policies and procedures are also essential to formalise and document daily activities, roles, and responsibilities. In short, ensuring overall transparency of the daily valuation process for all third-party stakeholders, whether they are auditors (internal and external), investors, or regulators. Moreover, it is not uncommon for limited partners to struggle to access the data of underlying investments due to factors such as low-percentage ownership and control. These different requirements need to be carefully considered when drawing-up valuation policies.

Data and technology: This makes the ability to collect and process accurate, reliable valuation data in a timely manner essential. In short, it’s important to have effective data management systems that can form the core of a daily pricing ecosystem.

Together, these key factors create a pressing need for stronger, better, and faster data to better support the shifting valuation needs of the defined contribution model.

What are the current best practices for real estate funds?

The methodology and key principles of daily pricing are primarily based on income and appreciation projections. These seek to provide both accuracy and consistency, while still ensuring overall feasibility and timely delivery. This includes the following:

Income projection

Fund-level income and expenses (excluding property valuations) must be updated based on the daily accrual of budgeted fund-level income and expenses. Alternatively, they can be based on the monitoring of any material property and market events that may impact the fund-level budget.

Appreciation projection

Underlying property valuations can be updated based on one of three methodologies:

Daily property and market event tracking

Quarter-end valuation estimates (plus any specific property events), or

Increasing the frequency of underlying property valuation

Valuation frequency

Daily valuations rely on the quarterly (or monthly) valuation of underlying properties. In practice, the quarterly draft valuations are usually due 45 to 60 days before quarter-end. Material events are then incorporated through the quarter-end, resulting in the same level of accuracy as the quarter-end or final property valuation.

Monthly valuations are due 30 to 35 days before each month-end. The initial accrual, prior to the valuation due dates, is based on market evidence as well as discussions with market participants. Historical trends can also provide important guidance, although we must always remember that the future may differ from the past.

It is important to note that capital contributions and distributions represent the subscription and redemption of shares and do not impact the net asset value of the fund.

How can we estimate daily net asset values accurately?

For a long-reaching historical reflection of such daily net asset values in practice, let’s turn briefly to the North American market, where the defined contributions model has some longevity.

The NCREIF NFI-ODCE is the primary index for real estate private equity funds in the US. We can see in Figure 1 that the quarterly total returns of this index have varied significantly between quarters over the past thirty years. This begs the question of how we can accurately estimate daily share prices?

Figure 1 - NCREIF NFI-ODCE total returns – September 30, 1994 to September 30, 2024

As shown in Figure 2, quarterly income tends to be predictable for diversified core real estate portfolios with stabilised properties. Even Class B and C apartments tend to have stable income because additional supply requires government subsidies.

Since 1994, the quarterly income yield of the NCREIF NFI-ODCE index has changed by more than 20 basis points only twice and has, overall, decreased with interest rates. The spike in the income return in Q2 2009 was primarily due to declines in value.

Figure 2 - NCREIF NFI-ODCE income returns – September 30, 1994 to September 30, 2024

Quarterly appreciation tends to be more volatile, especially during periods of uncertainty. We see this in the NCREIF NFI-ODCE index during the Great Financial Crisis (Q2 2008 – Q2 2010) or during the period of interest rate volatility experienced pre- and post-pandemic (Q2 2021 – Q2 2024), shown in Figure 3.

Figure 3 - NCREIF NFI-ODCE appreciation – September 30, 1994 to September 30, 2024

Appreciation projections occur only one quarter ahead. So, we would typically begin the quarter with an estimate based on the prior quarter results as well as discussions with appraisers and other market participants. The initial estimate is adjusted as new data becomes available. Draft valuations are typically due in the earlier stages of the quarter.

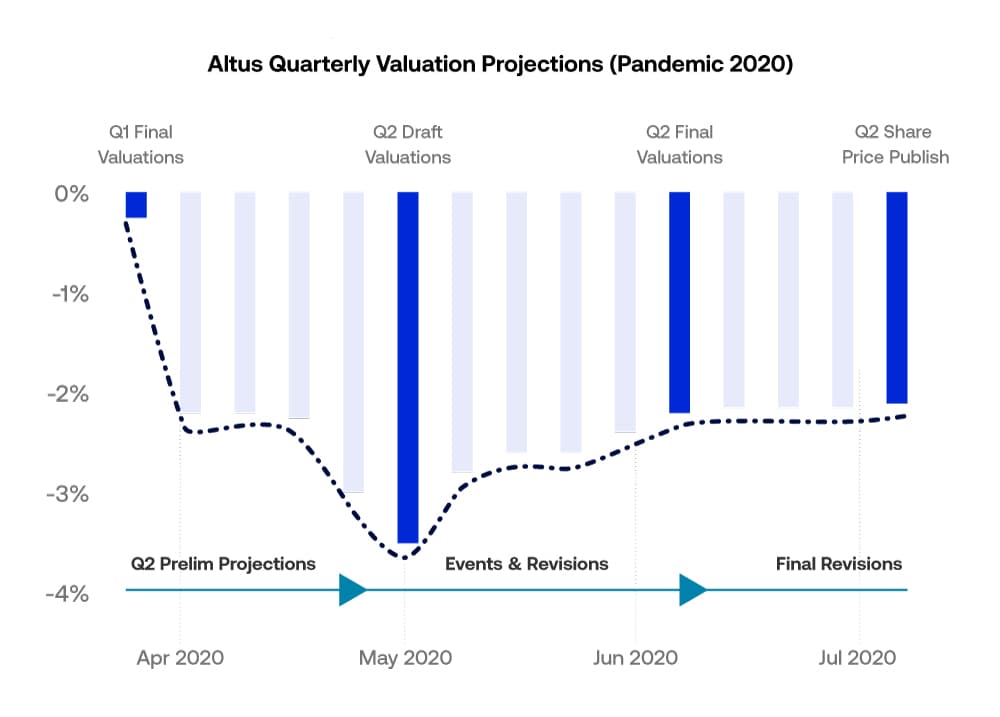

Below is an example of how appreciation projections were adjusted during the Q2 2020 quarterly valuation cycle. During the pandemic, government stimulus across state and local governments was a moving target, resulting in draft values being materially lower than the final values, as shown in Figure 4.

Figure 4 - Altus Group’s quarterly valuation projections (Pandemic 2020)

What does this mean for European fund managers?

Ultimately, the objective of daily pricing is to mark the fund balance sheet to market through income and appreciation projections. We’ve now seen how that can work in practice. Acute knowledge of local generally accepted accounting principles (GAAP), such as the US GAAP or IFRS, as well as local market standards, is fundamental.

This goes double for Europe, where it is common practice to report on different types of net asset values (i.e. local GAAP, trading, INREV etc.). This accounts for different use cases, such as accounting, investor reporting, and trade purposes. Each case has its own set of requirements and adjustments, be it debt mark-to-market, deferred taxes, special assumptions, and so on.

This makes day-to-day operations much more complex for fund managers facing increased scrutiny from investors. Investors who demand more and more consistency, enabling them to benchmark performance accurately and transparently on a global basis.

Embracing daily valuations

Daily pricing of real estate fund shares may seem like a complex task. However, the intrinsic stability and predictability of real estate rental income allow for reasonable income return projections in most cases.

The ability to project appreciation effectively is slightly more complex and depends on consistent event monitoring as well as timely access to accurate Pan-European market data. Internal teams must be fully aligned and coordinated, ready to address events in a timely manner and mitigate valuation volatility as much as possible.

Having robust valuation policies and procedures and a specialised team to oversee the day-to-day process is therefore key to ensuring the right level of governance is in place.

As we see more and more pension plans transition to the defined contribution model, it’s likely we will see more external valuation managers arise to assist pension fund management in fulfilling these daily pricing requirements. However, without the right data — transparent, fair, and wholly accurate — the task can seem gargantuan, and finding reliable ways to source and access that data for daily valuations will be paramount.

If you are seeking to position yourself ahead of these looming changes and adapt to the coming market shifts proactively, feel free to reach out to the Altus Group team today. Our Pan-European Valuation data set, part of valuation management in Europe for a considerable number of key funds, has given our team plentiful experience in collecting, managing and reviewing valuation data across the main sectors and locations, and our experts are always happy to answer any questions you may have.

Want to be notified of our new and relevant CRE content, articles and events?

Subject matter experts

Robby Tandjung

Executive Vice President, Valuation Advisory

Julien Sporgitas

Vice President, Valuation Advisory

Alan Waggoner

Director, Valuation Advisory

Subject matter experts

Robby Tandjung

Executive Vice President, Valuation Advisory

Julien Sporgitas

Vice President, Valuation Advisory

Alan Waggoner

Director, Valuation Advisory

Resources

Latest insights