Key highlights

The Fed is tightening monetary policy at a pace not seen in decades. Although many aspects of the economy appear healthy, inflation is the primary reason for this aggressive action. Inflation could take 9-10 months to return to the historical average or the Fed’s target if it follows the historical average monthly downward move (69 bps)

Recent history suggests that, as an asset class, CRE is moderately well-positioned to face prolonged periods of inflation due to its demonstrated ability to protect (and expand) profit margins

CRE’s recent negative expense ratio betas (to Median CPI) and positive jaws ratios demonstrate how the asset class has captured much of inflation’s upside over the last decade

Recent history suggests that inflationary environments may be more supportive of further cap rate compression for CRE; however, in reality, it is more complicated than that

Fed’s rapid pace of tightening

In its latest effort to manufacture a soft landing for the US economy, the Federal Reserve (Fed) raised interest rates by 75 basis points (bps) in its latest meeting on July 27. The move lifted the target Federal Funds Rate to 2.25-2.50%, was supported by all Federal Open Market Committee (FOMC) voting members and was in line with market expectations.

Having increased the target range’s lower limit by 225 bps in just over four months, the Federal Reserve is tightening monetary policy at a pace not seen in decades. Although many aspects of the economy appear healthy, inflation is the primary reason for this aggressive action.

Stubbornly high inflation

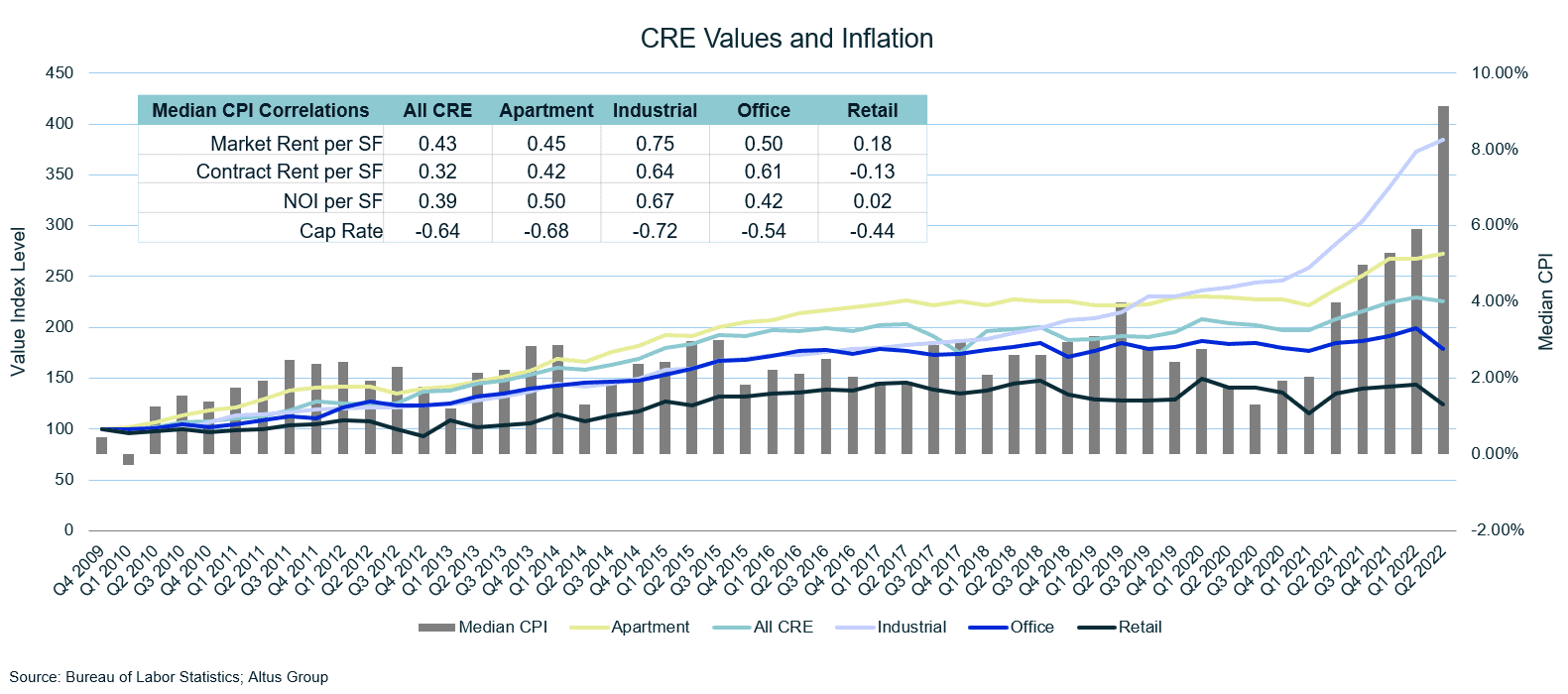

The Bureau of Labor Statistic’s June 2022 median Consumer Price Index (CPI) release showed inflation at an annual rate of 9.1%, the highest monthly figure in at least 40 years and well above the 2.9% long-term average. While the markets react to the Fed’s rate hikes and try to anticipate the speed and degree of tightening, inflation persists. Even if the June median CPI release marked peak inflation and is beginning to turn the corner and fall, it will likely take months before it is close to the Fed’s 2.0% objective.

Over the last 40 years, the average monthly downward move in median CPI has been 69 bps, suggesting that inflation could take 9-10 months to return to the historical average or the Fed’s target. However, the anticipated economic toll of getting to that lower inflation level is uncertain and has been the cause of much market volatility in 2022.

CRE decently positioned for persistent inflation

Although higher costs and lower availability of credit are likely to decrease the price discovery and investment activity across commercial real estate (CRE), recent history suggests that the asset class is moderately well-positioned to face prolonged periods of inflation.

While rising interest rates may negatively impact asset valuations, lease structures that allow owners/operators to capture the upside of inflation, expense management, and continued strong capital demand for CRE assets help to explain why CRE operating performance is unlikely to suffer even if inflation stays higher for longer, all else equal.

It is important to note that this article is looking at inflation in isolation when there are many other factors at both the macro-level (e.g., cost and availability of financing, labor market) and micro-level (e.g., local market situation, property idiosyncrasies) that could be the main determining factors of property performance, as is always the case.

Capturing rent inflation

Positive inflation is harmful when it erodes the purchasing power of earnings and alters otherwise stable budgets so much so that it leads to adverse outcomes.

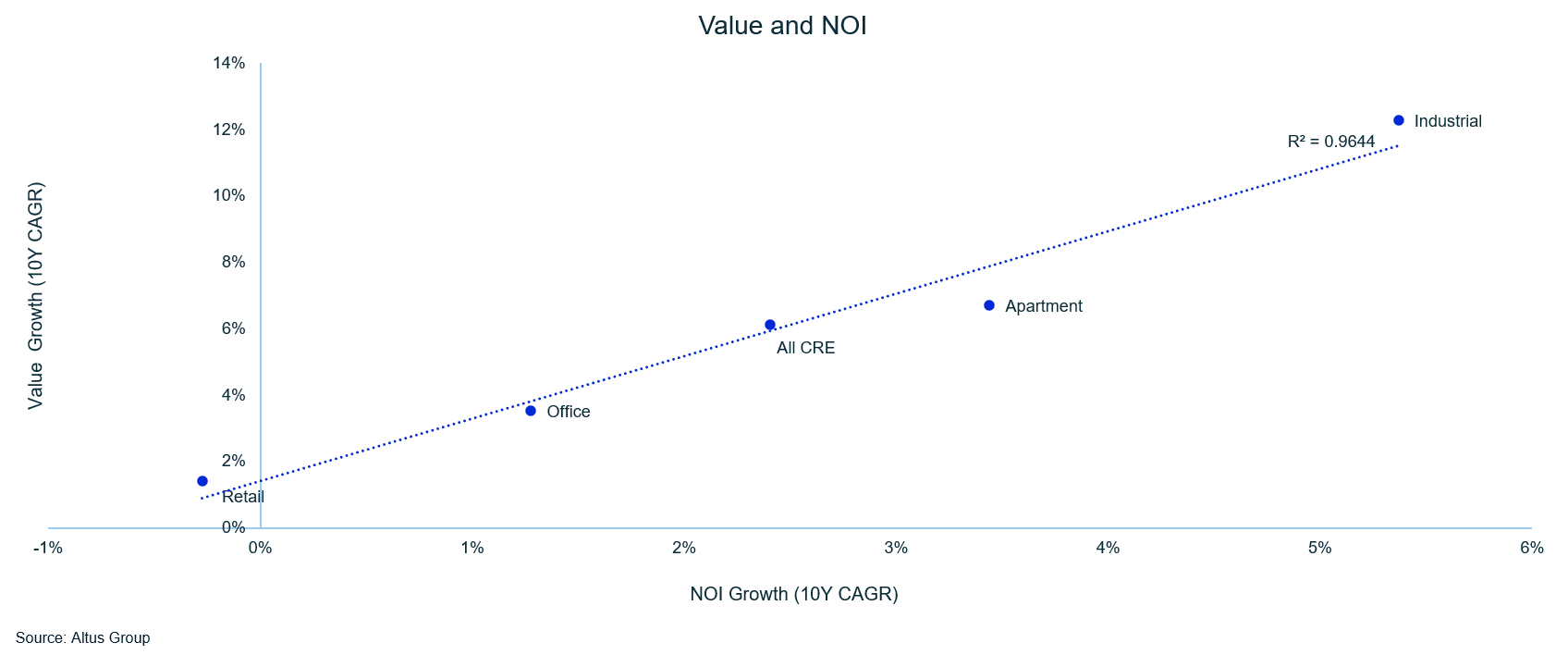

However, if earnings can adjust sufficiently with inflation and expenses can be managed (or better yet fixed), then the harmful impact of sustained positive unexpected inflation can be largely mitigated. And for CRE over the last decade, the ability to grow net operating income (NOI) has been rewarded with outsized value appreciation.

The first place inflation is seen in CRE markets is in market rents (asking rents). Market rents can adjust, or reprice, to inflation the quickest because they are often the most competitive (e.g., competing with other available space in the market) and least constrained, as contractual rents usually are.

Lease structures also play a significant role in determining the ability of a given property’s income to reprice and keep pace with inflation. Short-term leases (<2 years) are standard for some property types, such as apartments. Often where longer-term leases are common, contractual terms such as step-ups and percentage rent help to keep rental revenue pacing with or even beating inflation. Combined, these lease features help protect properties' real rent yields.

It is essential to keep in mind that local market supply/demand dynamics, asset quality, and property specifications still play significant roles in determining the pace and degree to which market rents can adjust to inflationary pressures; these factors were not taken into account in the analysis that follows. The analysis was completed on an aggregate basis and did not use a same-store basis; additional analysis using the same-store methodology may result in different results.

Expense efficiencies support NOI conversion

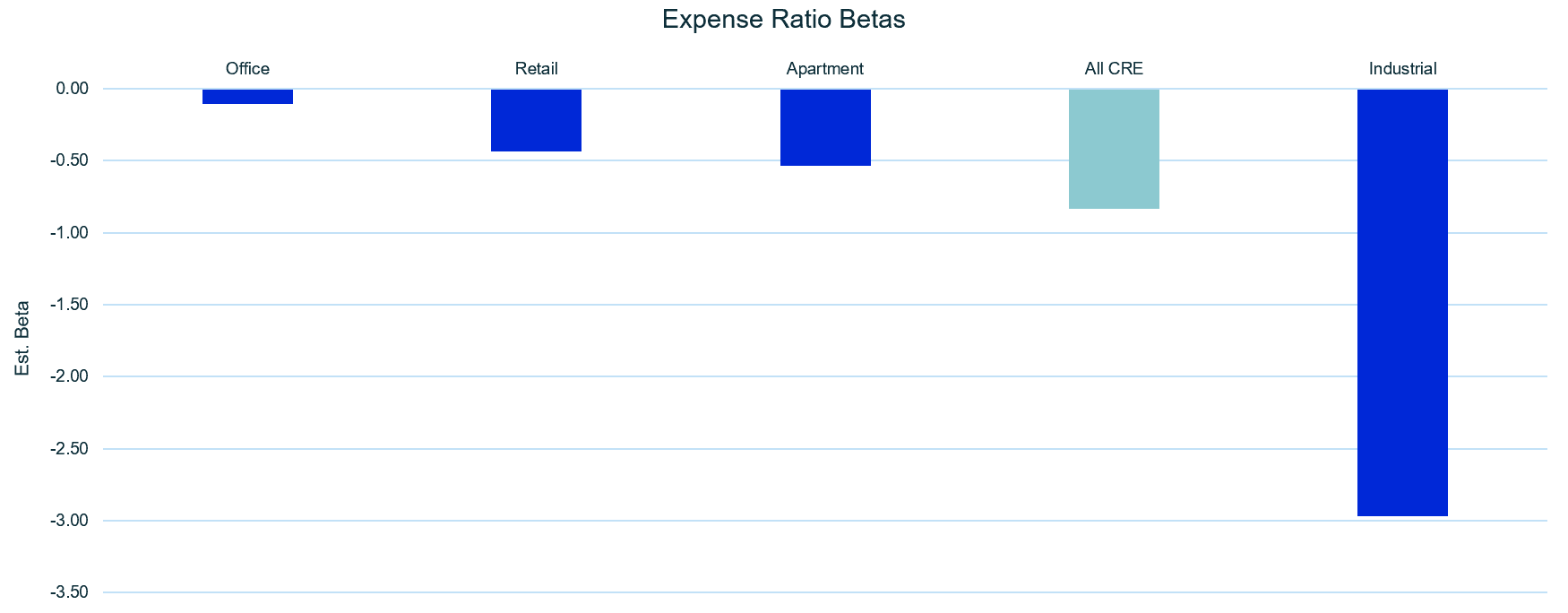

To turn observed market rent increases into value, owners/operators of properties must first capture these price increases as NOI. Looking at an approximation of expense ratios, expenses divided by income, is one way of observing the efficiency of doing just this across property types.

The calculated expense ratio betas shown in the chart above measure the degree to which expense ratios have moved relative to median CPI for the observed period. For example, for every 100 bps of inflation, expense ratios across All CRE fell by approximately 83 bps.

The negative betas suggest that all property types have been able to reduce their expense ratios when inflation despite positive inflation, though to varying degrees. It suggests that industrial has significantly brought the All CRE expense ratio beta down. While these calculated betas reflect the past relationship, they are unlikely to remain stable.

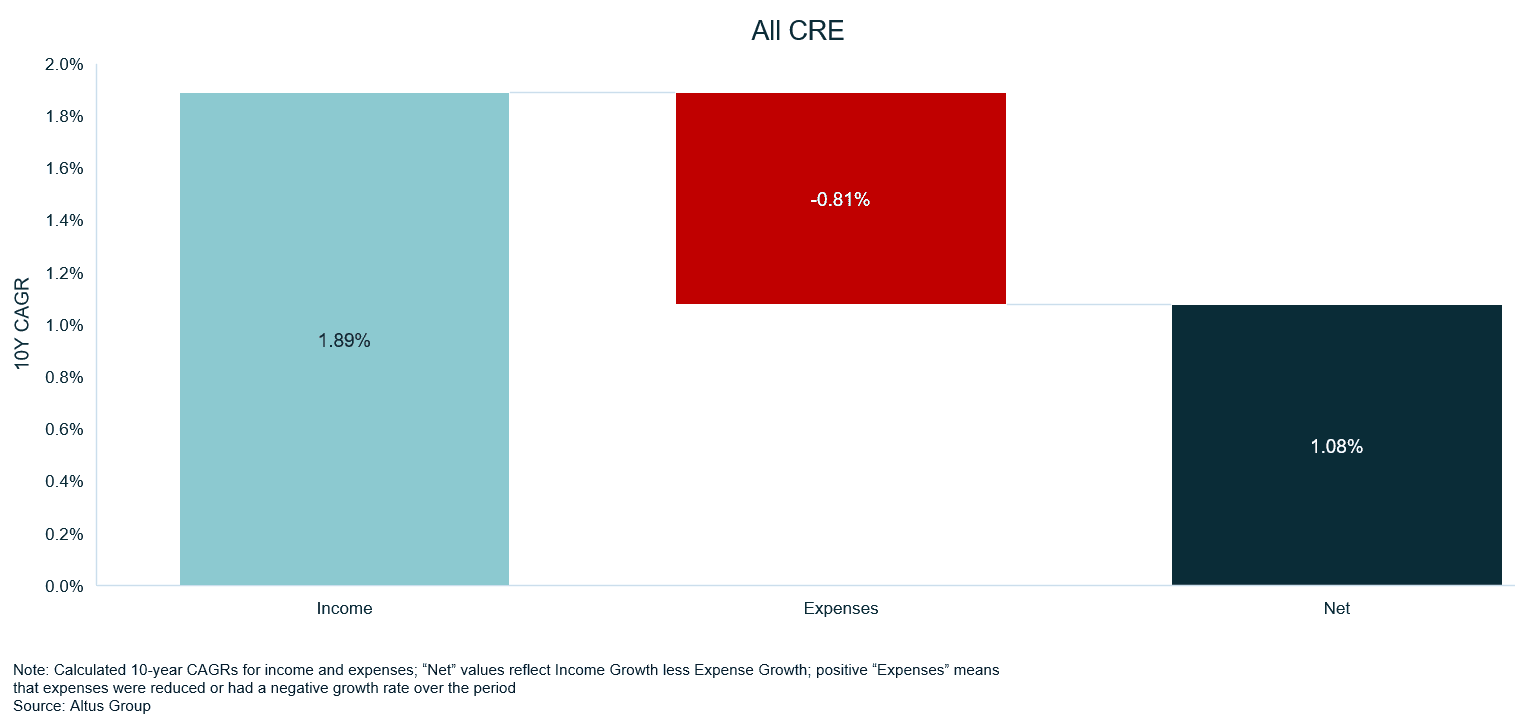

Jaws mostly positive

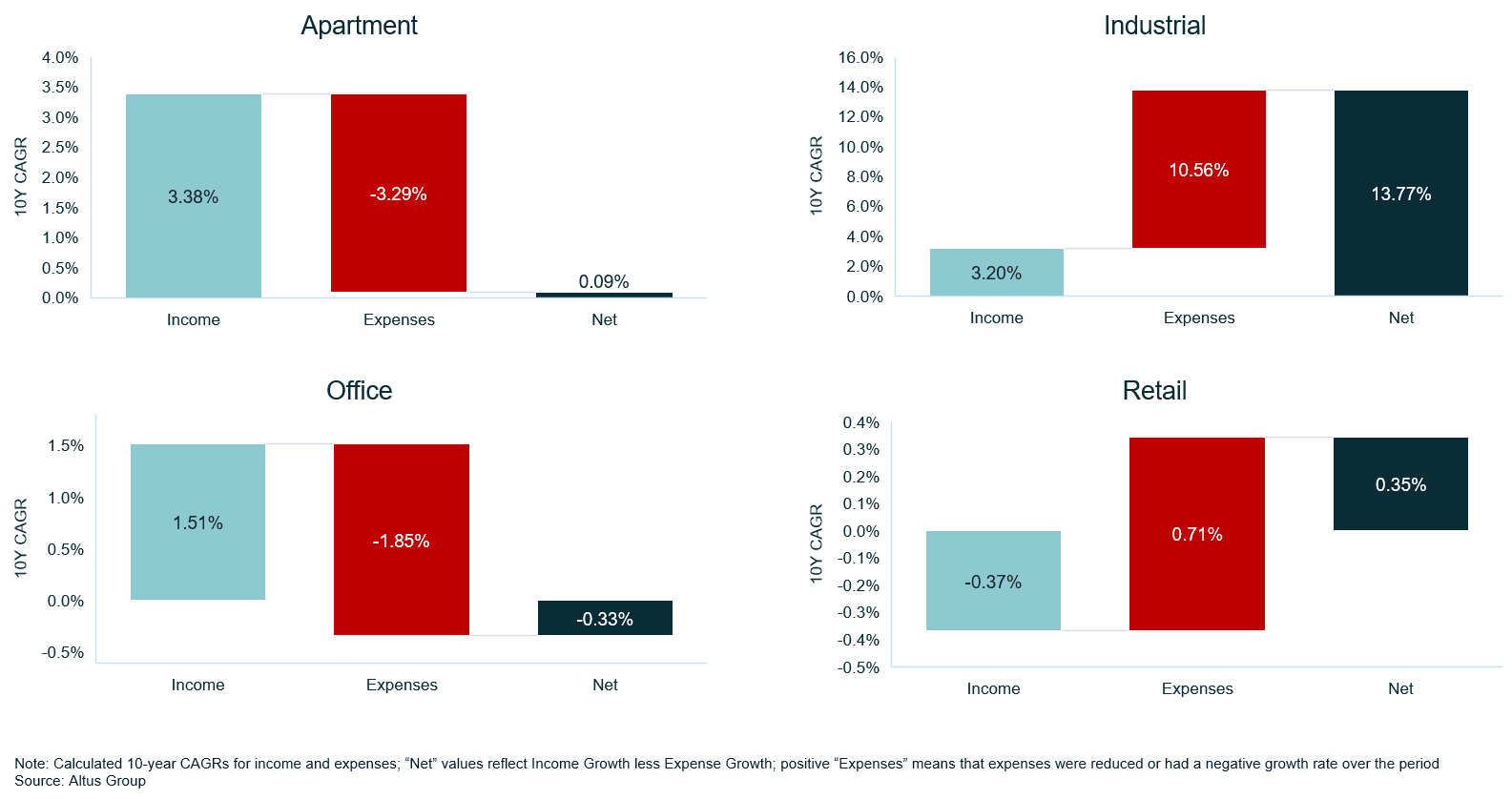

To see what contributes to these expense ratio betas, we look at the difference in income and expense growth over the past decade (“jaws ratio”). Looking at these jaws ratios, we can see how income growth has kept pace with expenses. For a property to protect its profitability, its income growth needs to be equal to or greater than expense growth. This can be accomplished either by growing income, shrinking expenses, or a combination of both.

Over the last ten years, income across All CRE has increased at a pace of 1.89% per year, while expenses have only grown at a pace of 81 bps per year. This has resulted in better margins across the asset class. Again, this average experience across the asset class was not representative of the different property types.

Apartments saw the most significant income growth rates offset by nearly similar expense growth. While the annual income growth of 3-4% across different apartment property subtypes was common, the composition of subtypes shifted over the observed period, and the proportion of higher-expense high-rise and luxury properties increased.

Industrial saw income compound by 3.20% per year, while expenses fell by a more significant 10.56% per year for the sector, leaving the property type with a net growth rate of 13.77% per year. Contained within these numbers is a critically important shift. The substantial rate of change for industrial expenses was driven by a once-in-a-lifetime shift in consumer behavior and the adoption of online retail, which benefited the industrial sector, but also significantly increased the portion of lower-expense properties (e.g., warehouse and distribution centers), which displaced the more expensive R&D and flex properties.

In aggregate, office properties experienced positive income growth of 1.51% per year, but those gains were more than entirely wiped out by expenses growing by 1.85% per year. And while retail experienced income contracting by 37 bps per year, expenses contracted by nearly double the pace, 71 bps per year, leading to positive jaws ratio for the property type in aggregate.

Deflating cap rates to continue

Cap rates have come down significantly over the past decades largely due to a greater capital allocation to CRE across institutional managers and falling real rates. While the cap rate compression is more strongly correlated with yields, cap rates have been negatively correlated with median CPI. This recent trend would suggest that inflationary environments may be more supportive of tight cap rates than lower inflationary environments. In reality, it is likely more complicated than that.

While the relationship between cap rates and inflation, as depicted in the charts below, looks strong, the fact that inflation was tightly range-bound and market yields were falling or flat for the majority of the observed period means that this area needs more analysis before drawing conclusions.

The cap rate compression over the past decade may be due to CRE’s track record of protecting profit margins while still being higher yielding than other bond proxies. The sustained low cost of capital allowed for more capital to compete for each property, pushing cap rates down even further than property fundamentals would historically support. However, with rising rates pushing up the cost of and limiting the availability of capital (e.g., less leverage available), competition for assets may decrease, and cap rates may see a sustained trend reversal – as many markets have started to see in 2022.

What's next?

As an asset class, CRE has demonstrated its ability to protect profit margins in inflationary environments over the recent past – and the capital markets have rewarded it handsomely with higher multiples and lower cap rates. If the recent historical relationship with inflation were to hold, the prospects of prolonged above-target inflation may appear to benefit the asset class. However, inflation is not the only variable at play. The CRE market may see its relationship with inflation redefined through the next phase of the economic cycle.

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights