Key highlights

2023 was a roller coaster of a year, which taught us a lot about our collective psychology and the real economic drivers, but will likely reveal more valuable lessons in the months ahead

The past year’s economic and market performance was surprisingly strong and showed the shortcoming of predictions – but eliminated the value of the forecasting exercise

For CRE, 2023 was a year of scarcity – lack of capital contributed to a decline in market activity and dearth of clarity on returns and values

In contrast, and with the backdrop of stable or declining interest rates and normalizing markets, 2024 looks like it will be a year of “more” – more capital and financing to help drive more transactions (including distress), which will contribute to price discovery and value certainty

Four lessons and one reminder from 2023

2023 was a rollercoaster of a year in nearly every facet of the global economy – from politics to central banking, capital markets, business, technology, and (of course) commercial real estate. While the passage of time will likely uncover additional lessons from yester-year, 2023 has already taught us a lot. Four key lessons that I noted from this year include:

Monetary policy is not a solved game – central bankers across the globe started the year in a bold, lion-tamer stance battling inflation, but ended the year like funambulists, increasingly careful with each step

Unlike the tide, a rising cost of capital sinks some ships – while the overall level of financial distress remained low, there were multiple notable failures across industries. While the Q1 2023 banking failures (Credit Suisse, Silicon Valley Bank, First Republic, etc.) caught much attention and harkened back to 2008-09, other bankruptcies (WeWork, Rite Aid, Party City, Bed Bath & Beyond, Tuesday Morning, Lordstown Motors) demonstrated that the pressure was not isolated to any one industry

Don’t underestimate the strength of the US consumer – time and time again, the US consumer showed resiliency throughout 2023, even if it meant digging deeper into savings (and for many, adding new debt). While wealth and income inequality remained elevated, the collective US consumer continued to fuel the economy, pushing gross domestic product (GDP) well above forecasts

The promise and potency of the technology elixir – in less than a year after being launched, artificial intelligence and all the acronyms that color any conversation about the technology (AI, LLM, Chat GPT, GenAI, AGI, etc.) became a key part of the business vernacular. While business leaders and consumers are still searching for ways to incorporate these technologies into their processes and lives, the potential is being explored (raising hopes of productivity and profitability gains for some, and red flags for others)

In addition to these valuable (initial) lessons, 2023 served as a reminder that capital markets reflect the intersection of the real economy and collective psychology of all its participants (nations, regulators, companies, and individuals). The vast complexity of this dynamic intersection is difficult to understand, and even more difficult to predict with certainty.

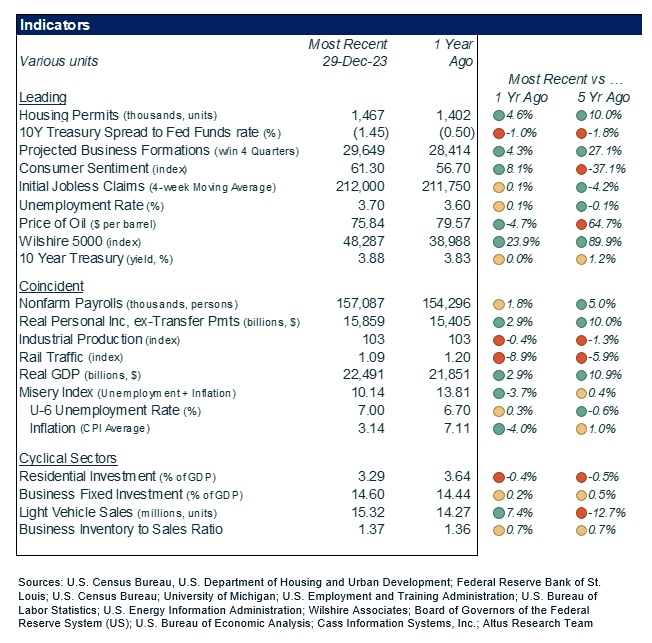

Figure 1 - December 2023 macro snapshot

Fluidity and utility of expectations

There’s a plethora of excellent quotes about the pitfalls and futility of prognostication and prediction, but one of my favorite sentiments hails from Yogi Berra: “It’s tough to make predictions, especially about the future.” This quip captures so much truth, and was uniquely exemplified by 2023. The past year’s economic and market performance was surprisingly strong – meaning that expectations from the start of the year proved wrong time and time again (I’ve written about this multiple times here, here, and here to name a few).

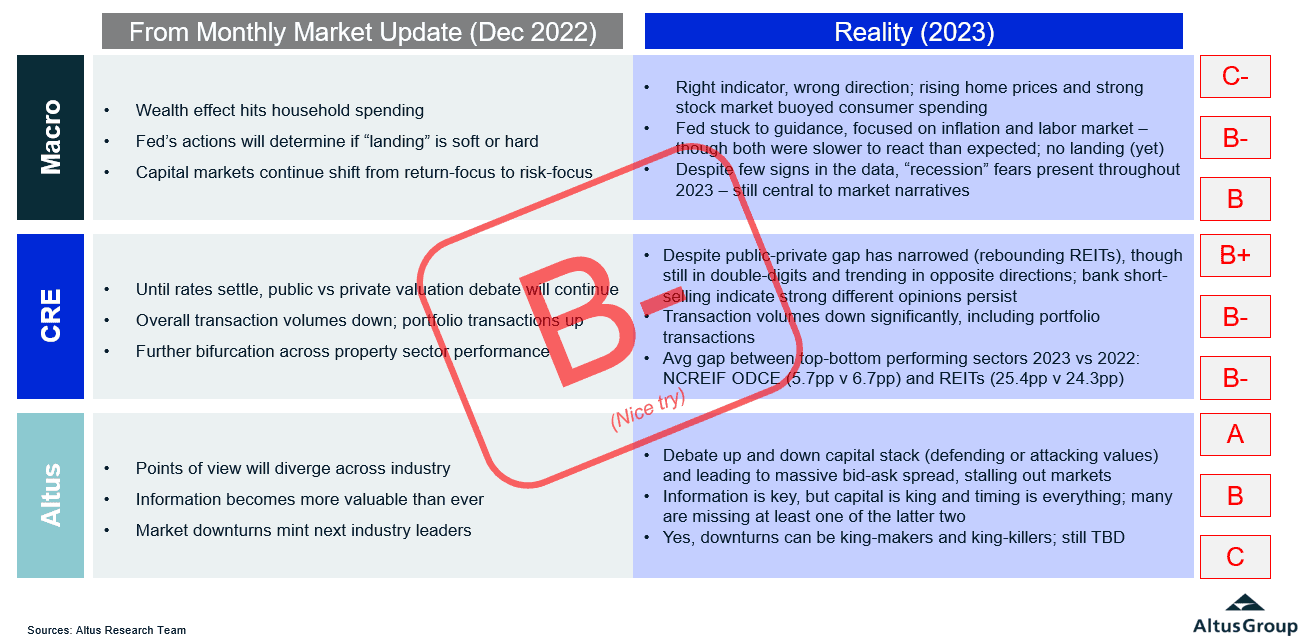

I believe predictions and forecasts should be judged on their timing (when was the forecast made and when was the event predicted?), accuracy (was the prediction aligned with reality?), and underlying explanation (were the underlying drivers of the forecast understood, or just a lucky guess?). And in 2023, most forecasts were wrong in each one of these categories. Looking back at my own forecasts heading into the 2023, I would give myself an unimpressive grade of B- (but tough graders would likely give me a C).

Figure 2 - 2023 themes in review

While expectations for 2023 proved wrong, the prediction exercise is still valuable, as it requires analysis of known information and relationships, along with contemplation of potential events and the underlying drivers of those events. So even if a prediction is incorrect, it can serve as a helpful exercise to take stock of known knowns and known unknowns.

With that said, some of the possible themes on my radar for 2024 include:

Macro and markets: | 1 - Fed declares “mission accomplished” by late-summer 2024, begins to signal cuts, following (not leading) other central banks 2 - Even though home prices remain high, consumer spending cools, as savings depleted and wage-growth reality sets in 3 - Capital markets remain fragile : rolling sector-level recessions (earnings ▼), refi of ZIRP and pandemic debt (defaults ▲), and politically charged year; this fragility means that any new material risk will drive volatility and can trigger systemic risk 4 - Markets normalize to longer-term historical levels, pre-dating the last 5 years, and cross-asset correlations decline – driving a greater need for diversification and pulling capital off the sidelines |

CRE: | 1 - Despite the Fed’s pause/cuts, overall cost of capital for CRE remains elevated as CRE default risk premium increases amidst rising distress 2 - Public-private gap narrows, as private valuations continue trending down reflecting the higher cost of capital, though not enough to appease all market participants (notable control changes in CMBS; bank skeptics; funds needing to deploy dry powder, etc.) 3 - Overall transaction volumes up on the year (though 2023 did not set a high bar), picking up pace with Fed clarity; both distress and non-distress up 4 - CRE capital landscape sees source-change, as funds need to deploy and foreign capital attracted by weaker USD (assuming no recession) 5 - Wu Tang Clan’s “C.R.E.A.M.” rings loud and clear; improving asset-level cash flows will be the critical driver for valuations and financing 6 - Demonstrated application of information will become more important for yield discovery (asset selection, property efficiency), valuation, and execution (conviction/thesis building, speed) |

Expect to see “more” in 2024

For CRE, 2023 was a year of scarcity. The scarcity of affordable capital contributed to a drop-off in transactions which contributed to a lack of clarity on future cash-flows, returns, and valuations. However, with the backdrop of stable or declining interest rates and normalizing markets, 2024 looks like it will be a year of “more” for CRE.

More:

Available capital and financing – even if still at elevated costs

Market activity and transactions – with greater clarity on financing costs and assumptions, volumes will pick up compared to 2023

Distress – while the majority of distress will be recapitalization/refinancing related, other distress will likely materialize from deterioration of property fundamentals (income growth unable to offset expense growth) absent a recapitalization event

Price and value certainty – even with higher levels of distress in the market, the pick up in transaction activity and resumption of capital availability will help provide close the bid-ask spread that gapped out in 2023

Taken together, the 2024 period is shaping up to be a year of more “normal” market functioning – which even if not a rosy outlook, seems oddly comforting. The 12-month forward view for CRE still looks like a roller coaster – with some visible twists, turns, and drops ahead – but having gone through the first major loop de loop, we have some assurance that the harnesses seem to work fine. Hands up, and here we go…

Here are the recent developments that caught my attention over the past weeks:

Economy:

In line with market expectations, the Federal Reserve maintained its pause on interest rate hikes and monetary policy changes in its last meeting of 2023, keeping the rate in the 5.25%-5.5% range. However, through both its commentary and Summary of Economic Projections, the central bank suggested three rate cuts in 2024, indicating a shift in monetary policy. On the news, investors adjusted their expectations for 2024 cuts from around three to nearly six.

November US employment data was stronger than expected, adding 199,000 jobs in the month, pushing the unemployment rate down to 3.7% from 3.9% in October. Wage growth held steady, ticking up 40 basis points (bps) on the month or 4% on the year. JOLTS data showed that job openings dropped to 8.7 million in October from 9.35 million in September, marking the lowest level of openings since early 2021 and signaling a cooling labor market. The ratio of openings to unemployed workers returned near pre-pandemic norms, at 1:3.

November US housing data was mixed – starts surged 15% on the month, while building permits dipped 2.5%, and existing home sales edged up 80 bps, ending a five-month decline. However, new home sales declined 12.2% in November.

US Q3 GDP was revised slightly lower to 4.9%, while the PCE price index softened to 2%. The Conference Board Leading Economic Index continued its decline, though consumer confidence experienced a surprising jump in December.

Iranian-backed Houthi attacks in the Red Sea disrupted global trade routes and prompted major shipping companies to reroute around Africa, bypassing the Suez Canal. Nearly a third of global container traffic and a significant fraction of global energy cargo usually goes through the Suez Canal. While the situation is still unfolding, it has garnered international attention and political cooperation. The rerouting is driving delays and higher costs for global trade.

Capital markets:

Market volatility remained stable over the month, as the VIX ended the month at 12.47. The rolling 60-day correlation between equities and bonds moved fell to 0.36, down from a month prior (0.41). The US Dollar was little changed compared to other major global currencies during the month approximately 0.1%.

Stocks ended the month higher, with the US broad market indices up 5.7% on the month. Performance across sectors was mixed, as Real Estate (+11.5%) and Industrials (+8.7%) were leading, while Energy (0.0%) and Utilities (+1.6%) were lagging.

The yield on the 10-year US Treasury security fell 53 bps during the month, settling at 3.84%. The risk-free yield curve remained inverted with the 10-year/3-month US Treasury pair ending the month at -1.61%.

Corporate credit spreads widened during the month, with spreads to US Treasury securities ending the month AAA (65 bps vs 55 bps a month prior) and BBB (150 bps vs 155 bps a month prior). Effective yield on high-yield corporate debt rose to 7.3%.

Commercial real estate:

Shares of US REITs ended the month up (5.5%) beating the US broad market indices, which finished the month up 4.3% from one month prior. Price to FFO multiples for REITs overall expanded during the month, ending at 15.7x up from 15.4x. Performance across REIT sectors was mixed, and the gap between top and bottom-performing sectors spanned 14.8%. The best-performing REIT sector for the month was Self Storage (+14.5%), and the worst-performing REIT sector for the month was Manufactured Homes (-0.3%).

Disclaimer: The opinions expressed in this article are solely those of the author and are not endorsed by Altus Group Limited, its affiliates and its related entities (collectively “Altus Group”). This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights