Key highlights

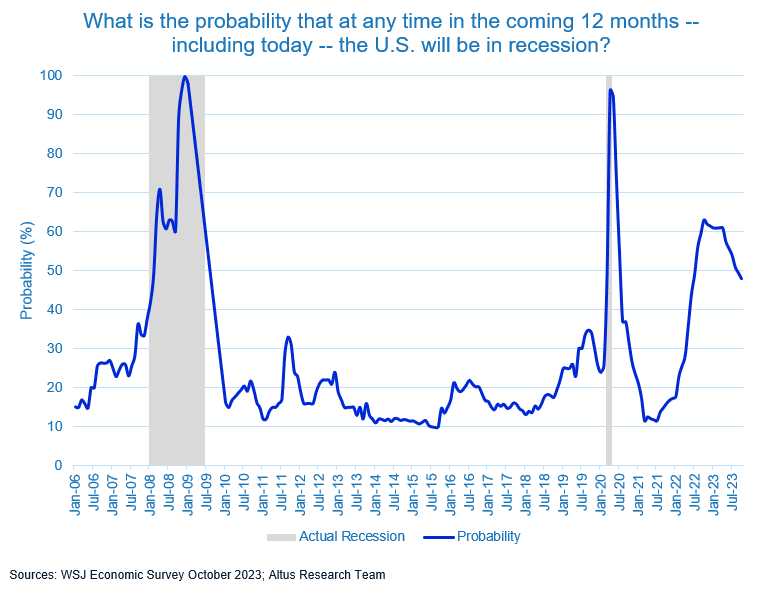

Coming into 2023, economist expectations for the probability of a recession were comparable to recession expectations on the eve of the global financial crisis; however, the recession remains elusive – and a strong economy prevails

The futures markets is pricing in the end of rate hikes, following Fed Chair speech

The market implied probability of a 25 basis point interest rate hike at the November 1 Fed meeting fell from 11.5% on the day before the speech to 0% the day after

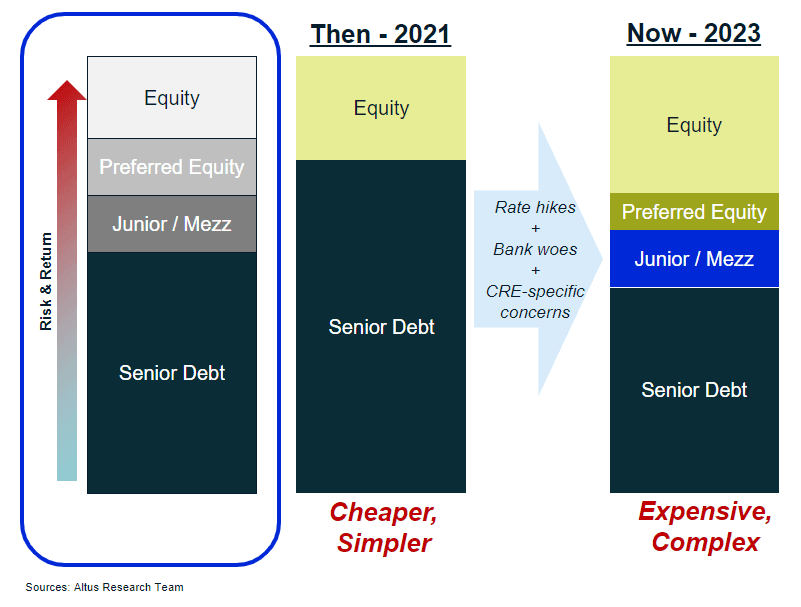

Whether there are additional hikes or not, the full extent of the interest rate rises to date have not been priced in across all assets, including CRE, and a basis reset is still happening – albeit gradually – and transforming capital stacks

Reminder: Economics is a soft science

Confounding – that’s how I would describe this year in a single word. We entered 2023 seemingly certain that it would bring about the post-post-pandemic recession, yet here we are in Q4 and realizing those expectations were way off. Coming into the current year, economist expectations for the probability of a recession were comparable to recession expectations in summer of 2008, on the eve of the global financial crisis (GFC). Since peaking in Q4 2022, the consensus expectation for a US recession in the next 12-months has fallen on a more robust economic picture, suggesting that a recession appears to have been avoided – at least in 2023.

Figure 1 - Economist’s expectations for a recession

As analysts, economists, and bankers begin to write their 2024 outlooks, the recession scenario that so many anticipated for 2023 is being pushed out further, or generally softened to capture the stronger-than-expected economic engine that the US economy has demonstrated through the last 10 months. However, many of these strategists and prognosticators still find themselves in the “higher-for-longer” camp – anticipating that while the worst may have been avoided thus far, the higher rate environment may continue to raise challenges and is unlikely to change quickly, as inflationary pressures remain.

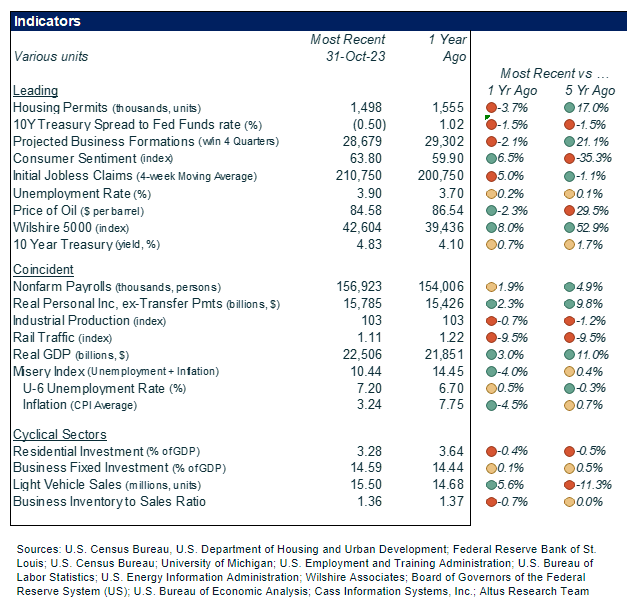

These outlooks for the year ahead are more tempered than the ones written last year, largely because the macroeconomic backdrop remains mixed and the Federal Reserve (Fed) continues to remind the markets that there is still progress to make on taming inflation.

Figure 2 - Macro indicators for October 2023

Progress made, but destination not reached

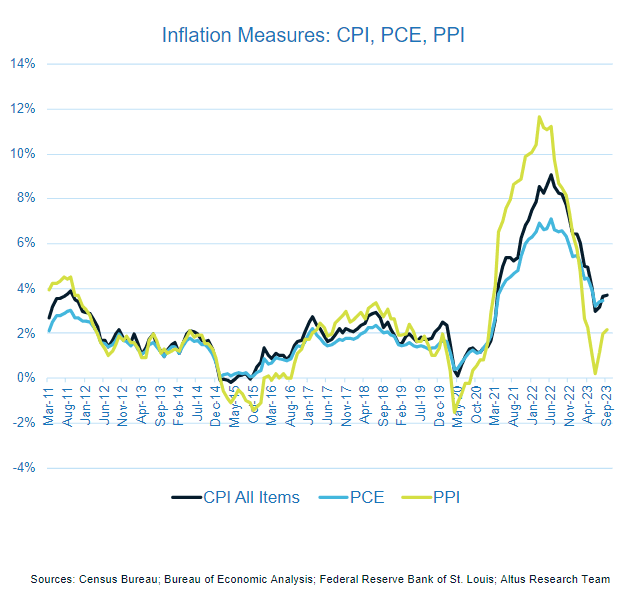

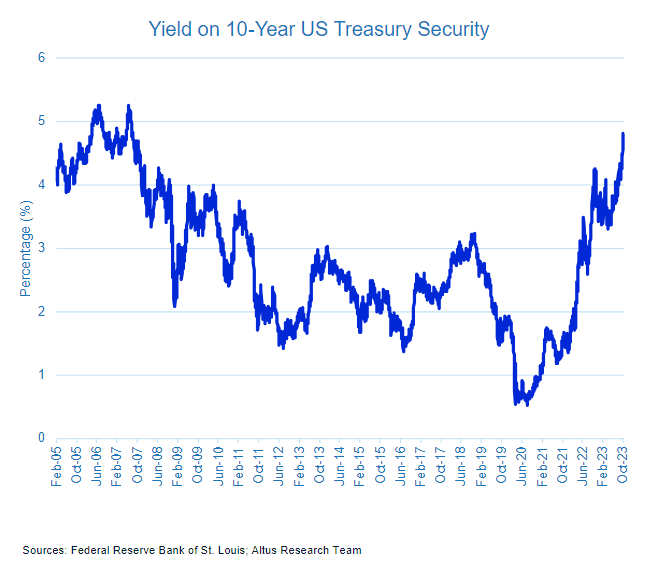

Inflation continues to be a focal point for investors, as it is “public enemy no. 1” for the Fed and a primary consideration for policy rate decisions. Multiple inflation metrics have begun ticking back up in recent months, or at least showing slowing declines, reinvigorating the debate about when the Fed will/should declare “mission accomplished” and transition to the next phase of the monetary policy cycle – cuts. However, inflation is not the only market metric recently on the rise. The yield on the benchmark 10-year US Treasury Security continued its climb through the month, touching 5% in interday trading – a level not seen since 2007.

In a October 19 speech at the Economic Club of New York, Fed Chair Jerome Powell noted that higher yields in the bond market could help to slow inflation. While the Chair’s speech did not remove the possibility of additional rate hikes, the futures markets seemed to interpret it that way. The market implied probability of a 25 basis point interest rate hike at the November 1 Fed meeting fell from 11.5% on October 17 to 0% on October 20. Despite the market’s renewed collective confidence that the Fed is done with rate hikes, the Fed has not yet confirmed that that is the case, and it would not be the first time this year that the Fed did not meet the market expectations.

Figure 3 - Inflation measures: On the up and up

Even though the market seems to show more collective confidence pertaining to the trajectory of interest rates and monetary policy, the recent runup in yields has many concerned about how restrictive the market environment will be going forward. Many borrowers (corporates, CRE, consumers) were able to refinance during the post-pandemic period when interest rates were at historic lows, much of this outstanding debt will mature in the coming years. By itself, a large amount of debt coming due (maturing) is not concerning; however, it becomes concerning when the benchmark risk-free rate is near 5% .In this scenario, those who face refinancing will likely be doing so in a rate environment where their same loan will be multiples higher than the maturing debt. This might also mean that fewer borrowers who need to refinance will be able to demonstrate their ability to service the higher costing debt. If they are unable to put up more equity to remove the debt burden (in CRE-speak, “cash-in refinancing”), they will fail to refinance, resulting in elevated loan modifications for the lucky ones and defaults for the less fortunate. This line of thinking would suggest lenders would see higher levels of delinquencies, defaults, and charge-offs; which in turn, would likely erode their appetite to make new loans, further restricting credit to those who need to refinance.

Figure 4 - The treasury yield reaches worrying heights

Capital stack repricing, driving basis reset – though not all at once

Over the last 19 months, as the Fed has raised interest rates 11 times, capital costs across all industries and sectors have risen. However, the full extent of these interest rate hikes has not been seen across all risk assets equally. More liquid parts of the capital market, like stocks and bonds, have seen significant repricing this year, while less liquid counterparts have been much more muted.

While lower volatility is often an attractive attribute of these less liquid investments, that does not mean they are immune to higher cost of capital. The full effect of repricing to the higher rate environment will be felt when the full capital stack is reflective of the current market environment.

For less liquid segments of the capital markets, such as CRE, the repricing of the capital stack is happening, but not all at once. A significant basis reset or repricing of CRE is happening, though gradually, as transaction activity remains muted. And as the CRE basis resets, it is transforming many capital stacks.

Figure 5 - Capital stack basics: Then and now

This delayed repricing for CRE can be largely attributed to the lack of catalysts to force a repricing (e.g., major event that would reprice all at once). First, many CRE borrowers were able to either borrow to acquire or refinance during the post-pandemic low-rate environment and still have remaining term on their debt. Second, the high-rate of interest, compounded by a pull-back of key lending sources (i.e., banks), over the last year has significantly dampened transaction activity, decreasing confidence in pricing/valuation and lending volumes.

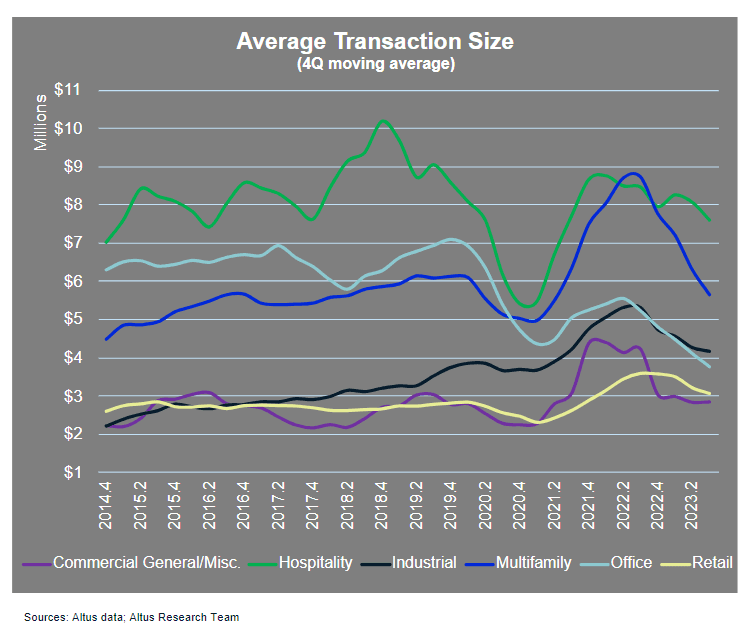

Evidence of the CRE basis reset happening can be seen across indicators that track and measure CRE prices and values (NCREIF ODCE Index, REIT share prices / NAVs), which have fallen since rate hikes began, but may still have further to go. And as the new capital stack is more complex and more expensive, it is driving investors towards smaller transactions – which require less costly capital. Current average transaction sizes are 13-35% below their most recent post-pandemic peaks.

Figure 6 - Average transaction size declines

It is likely premature to estimate the magnitude or timing of completion of the CRE basis reset and capital stack repricing to the higher cost of capital environment, but it does seem clear that there is still a ways to go. However, 2023 has been full of surprises, so perhaps the year has another up its sleeve.

Here are the recent developments that caught my attention over the past weeks:

Economy:

In a surprising turn of events, the US economy added a robust 336,000 new jobs in September, significantly exceeding expectations. While the unemployment rate remained steady at 3.8%, wage growth was muted, rising 0.2% month over month and 4.2% year over year. This unexpected surge in job growth, combined with a jump of roughly 600,000 in job openings in August and persistently low levels of weekly jobless claims, suggests that the US labor market remains robust, contradicting the Federal Reserve's expectations of a cooling labor market.

For most of 2023, the US services sector has demonstrated resilience while the manufacturing sector has contracted. However, Purchasing Managers’ Indices indicate a reversal of this trend in September. The manufacturing PMI rebounded to 49 from 47.6, while the nonmanufacturing index slipped to 53.6 from 54.5 the month before. The nonmanufacturing new orders index took a particularly hard hit, falling to 51.8, the lowest level in a year, from 57.5. This suggests that demand for services may be starting to soften.

Consumer prices in the US rose 0.4% in September from August, slightly exceeding expectations, while core inflation, excluding food and energy, increased 0.3%. Year-over-year, prices rose 3.7%, unchanged from the month before, while core inflation rose 4.1%, slightly lower than the 4.3% recorded in August. However, the so-called super core measure – core services except for housing – which is closely watched by the Federal Reserve, rose 0.61% month over month, its third consecutive monthly increase. This suggests that inflationary pressures may persist. A new report by The Wall Street Journal revealed that Americans 65 and older accounted for 22% of total spending in 2022, the highest percentage of any age cohort. This trend is likely driven by the growing number of seniors and their increasing wealth.

The Congressional Budget Office estimated that the US budget deficit reached $1.7 trillion in fiscal year 2023, which ended in September. Spending on mandatory programs such as Social Security, Medicare, and Medicaid increased 11%, while outlays for interest on the public debt jumped 33%. The minutes of the Federal Open Market Committee's September meeting reinforced the message that interest rates will remain elevated for an extended period to combat inflation.

Capital markets:

Market volatility remained modest; the VIX ended the month at 18.14 near where it started. The rolling 60-day correlation between equities and bonds moved fell to 0.29, down from a month prior (0.44). The US Dollar was little changed compared to other major global currencies during the month (approximately 2.3%).

Stocks ended the month little changed, with the US broad market indices ending the month flat at -3.4%. Performance across sectors was mixed, as Utilities (+0.5%) and Information Technology (-0.3%) were leading, while Energy (-6.0%) and Real Estate (-4.6%) were lagging.

The yield on the 10-year US Treasury security remained stable 19 bps during the month, settling at 4.88%. The risk-free yield curve remained inverted with the 10-year/3-month US Treasury pair ending the month at -0.71%. Corporate credit spreads remained little changed during the month, with spreads to US Treasury securities ending the month AAA (68 bps vs 71 bps a month prior) and BBB (178 bps vs 175 bps a month prior). Effective yield on high-yield corporate debt rose to 9.38%.

Commercial real estate:

Shares of US REITs ended the month down (-0.9%) beating the US broad market indices, which finished the month down -1.6% from one month prior. Price to FFO multiples for REITs overall stayed flat during the month, ending at 13.8x. Performance across REIT sectors was mixed, and the gap between the best and worst performing sectors spanned 13.7%. The best-performing REIT sector for the month was Regional Malls (+6.3%), and the worst-performing REIT sector for the month was Self Storage (-7.4%).

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights