Key highlights

The labor market showed continued signs of softening in September, with increased initial jobless claims and a higher unemployment rate

Consumer spending remained strong in September, with more Americans dipping into savings or taking on additional debt

While the once highly-anticipated recession remains elusive, the repricing of risk assets is happening – albeit at a more gradual rate than previously expected

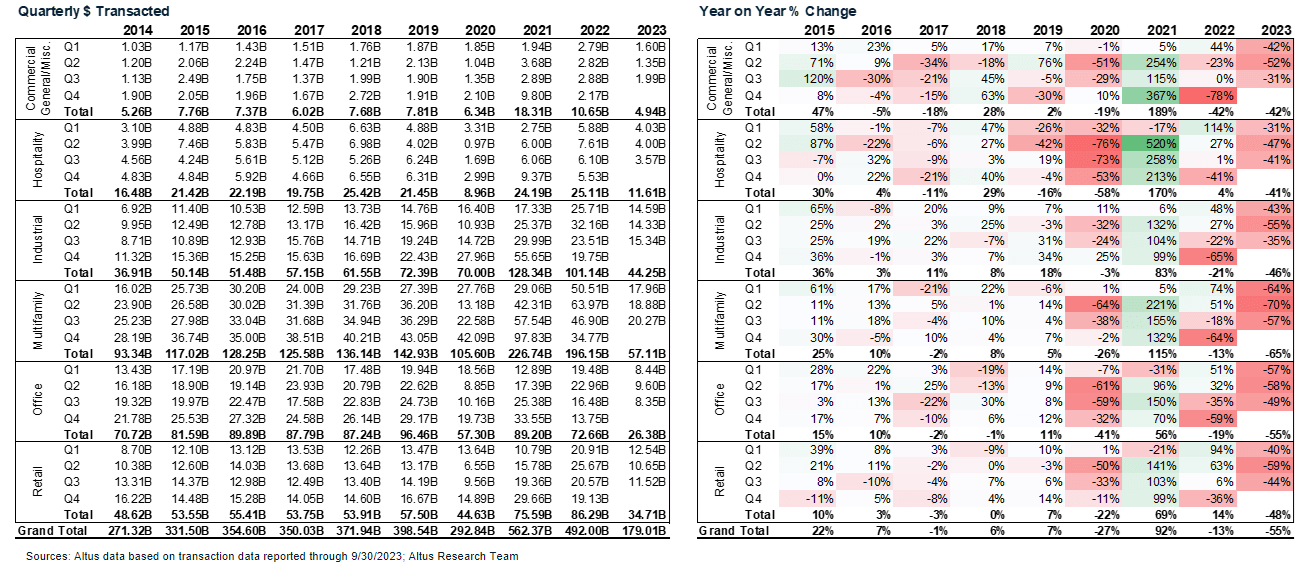

CRE investment activity has been devastated this year by the higher cost of capital, but signs of a bottom may be emerging

Are we there yet? Markets price in “pause”

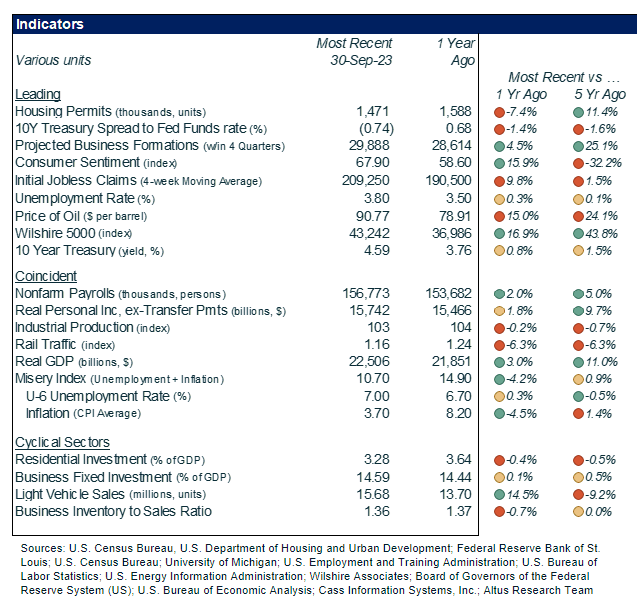

The labor market took center stage during the month of September, showing continued signs of softening. Multiple major auto labor strikes continued with no quick resolution in sight, and the results of the National Federation of Independent Business (NFIB) survey showed that finding quality labor is a pressing concern for smaller employers. The strikes contributed to an increase in initial jobless claims and a subsequent uptick in the unemployment rate. While overall negative, these concerning data points were largely outweighed by other macroeconomic releases demonstrating the continued strength of the consumer-led economy. The Bureau of Economic Analysis’s consumer spending data showed that Americans were able to either dip into savings or pull additional lines of credit to fuel their summer spending splurge – raising some concerning, albeit not immediate, issues. Consumers showed continued appetite for nearly everything except for housing, which continued to see price increases driven by very limited available supply on the market.

Leading up to and after the September 20th Federal Open Market Committee press conference and policy rate decision, the markets continued to price in optimism for a monetary policy shift as there was a growing consensus that the Fed was done with the hiking phase of the cycle. The market’s perception of the overall health of the economy continues to be more sanguine than that of the Fed, despite the latter’s continued guidance that does not rule out additional rate hikes. While the “soft-landing” narrative remains in place and is predominantly supported by robust economic data, there is still plenty of room for skeptics in the market as the full impact of the rate hikes (to date) have yet to be felt fully across the economy. However, even the skeptics are forced to admit that the possibility of a recession being declared in 2023 has nearly all but faded.

Figure 1 - Macro indicators for September 2023

Amidst the ongoing war in Ukraine, continued US-China tensions, and the US government shutdown, which was only nearly averted at the very last minute, political risk – both domestic and foreign – will likely continue to remain on the market’s radar as we close out the year. In the US, 2024 is a presidential election year, and coupled with the fact that the economy may be in a vulnerable position, the candidate rhetoric and proposed platform policies will likely weigh heavy on the minds of investors. While the Fed has yet to declare “mission accomplished” on the hiking phase of the monetary cycle, the markets seem to be pricing in the completion, and thus would be shaken if that’s not the case.

Absent a catalyst, the basis reset continues slowly

As we wade deeper into the fourth quarter, we can take stock of what this year has uncovered as well as what has yet to be uncovered. One of the biggest surprises of the year was the lack (or absence) of the highly anticipated catalyst event: the expected recession. While the cost of capital rose throughout the year due to monetary tightening and compounded by the Q1 banking crisis, overall credit quality (e.g., default and loss rates) across many sectors did not experience significant deterioration and is still within historically normal levels. Valuations from many sectors have normalized, or come closer to their multi-year historical averages; however, this is not the case for all sectors and it is clear that risk has not yet been fully repriced to the higher cost of capital environment. If the first nine months of 2023 were indicative of how the economy and the markets will perform in this higher rate environment, it seems fair to predict that repricing will be much more paste and gradual than previous concerns would suggest.

Figure 2 - Quarterly CRE investment activity ($ volume)

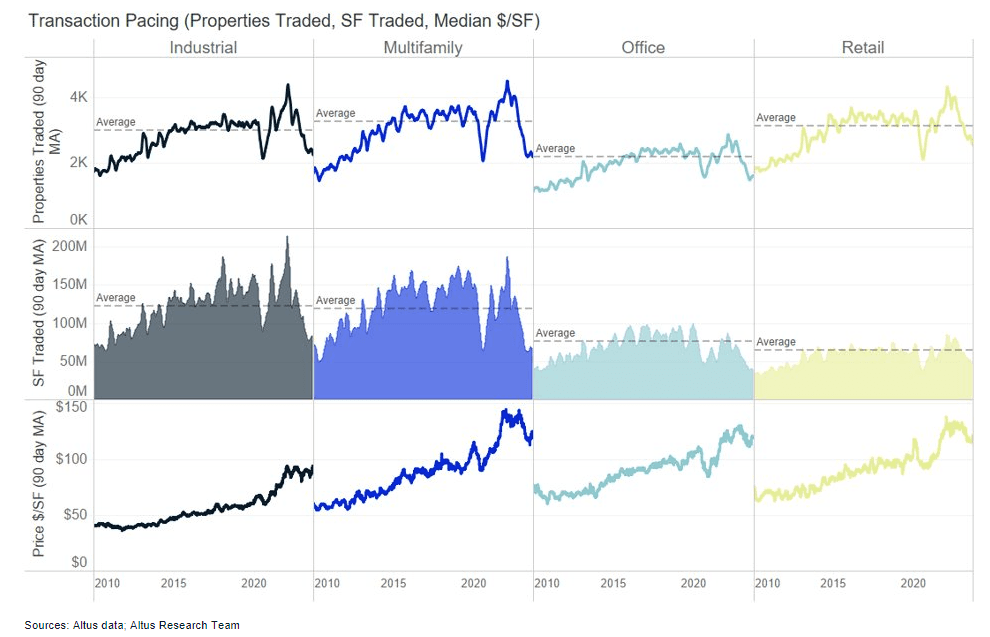

Signs of a bottom emerge

Perhaps the economy is robust enough to shift gears and operate in a higher-rate environment with less disruption than previously believed. Perhaps we'll see capital stacks reprice only as necessary when recapitalizations or transactions must take place. Such a scenario could be envisioned if the broader economy does, in fact, avoid a hard landing and distress is not widespread but plays out in a rolling, isolated fashion. If this is the case – and markets are correct in assuming that the Federal Reserve’s recent pause is the start of the next phase of the monetary policy cycle – real estate market activity would be expected to improve (or at least trend towards normalization). While the repricing of CRE assets has likely not fully been felt, as exhibited by continued consecutive value declines, the return or pick up of market activity will serve as a confidence boost to the asset class as a whole. And although it’s too soon to definitively state whether or not recent CRE transaction activity has, in fact, bottomed out – here’s to hoping.

Figure 3 - Transaction activity showing possible signs of bottoming

Here are the key developments that caught my attention over the past weeks:

Economy:

In its September 20th policy rate announcement, the Federal Reserve signaled a cautious stance, emphasizing its reliance on incoming economic data to guide future decisions on the path of interest rates. This cautious approach stems from concerns about inflation, which continues to remain elevated despite some recent signs of easing. The Consumer Price Index (CPI) rose 0.6% in August, the largest monthly increase since June 2022. However, short-term and long-term consumer inflation expectations declined, suggesting that consumers may be more optimistic about the prospects of inflation cooling down.

The U.S. Census Bureau released its annual Income & Poverty Report, revealing a continued decline in American household incomes. Real median household income before taxes fell to $74,580 in 2022, marking a 2.3% drop from the 2021 estimate of $76,330. This downward trend reflects the ongoing economic challenges, including rising inflation and supply chain disruptions.

The housing market grapples with the effects of higher mortgage rates. New home sales fell 9.0% in August compared to July, reaching an annualized pace of 662,000 units. This decline reflects the impact of rising mortgage rates, which have surpassed 7.75% in the month. Builders are responding to these challenges by offering discounts, with nearly a third of builders reporting discounts, up from a quarter in August. However, the effectiveness of discounting is likely to diminish as mortgage rates continue to climb.

Capital markets:

Market volatility increased over the month, as the VIX ended the month at 17.61. The rolling 60-day correlation between equities and bonds rose to 0.44, up from a month prior (0.4). The US Dollar was little changed compared to other major global currencies during the month approximately -0.5%.

Stocks ended the month little changed, with the US broad market indices ending the month flat at -4.9%. Performance across sectors was mixed, as Energy (+3.3%) and Communication Services (-2.6%) were leading, while Real Estate (-8.1%) and Utilities (-6.9%) were lagging.

The yield on the 10-year US Treasury security rose 51 bps during the month, settling at 4.69%. The risk-free yield curve remained inverted with the 10-year/3-month US Treasury pair ending the month at -0.93%. Corporate credit spreads tightened during the month, with spreads to US Treasury securities ending the month AAA (71 bps vs 77 bps a month prior) and BBB (175 bps vs 181 bps a month prior). Effective yield on high-yield corporate debt rose to 8.96%.

Commercial real estate:

Shares of US REITs ended the month down (-9.3%) trailing the US broad market indices, which finished the month down -5.3% from one month prior. Price to FFO multiples for REITs overall contracted during the month ended at 13.8x (down from 15.0x a month prior). Performance across REIT sectors was mixed, and the gap between top and bottom-performing sectors spanned 10.4%. The best-performing REIT sector for the month was Hotels (-4.3%), and the worst-performing REIT sector for the month was Diversified (-14.7%).

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights