Montreal commercial real estate market update - Q3 2025

Montreal’s CRE market saw mixed momentum in Q3 2025, with multifamily strength offset by weaker industrial and land investment.

Key highlights:

By the close of the third quarter, Montreal reported a 13 % year-over-year contraction in overall investment activity, with nearly $6.6 billion in dollar volume transacted

The multifamily sector demonstrated stability, with investment volume up 17% year-over-year to $3.3 billion, representing 51% of the market’s total transaction volume

The industrial sector recorded $967 million in dollar volume transacted, a significant 52% year-over-year decrease

Despite a 33% year-over-year decrease, the retail sector investment remained strong by historical standards, with $879 million in transactions

The office sector recorded $459 million in dollar volume transacted, representing a notable 31% year-over-year increase

The land sector recorded $859 million in dollar volume transacted, marking a 13% decrease

The residential land sub-sector recorded $406 million in dollar volume transacted, while the ICI land sub-sector recorded $453 million, up 6% year-over-year and down 25%, respectively

By the close of the third quarter, commercial investment in Montreal contracted, down 13% year-over-year

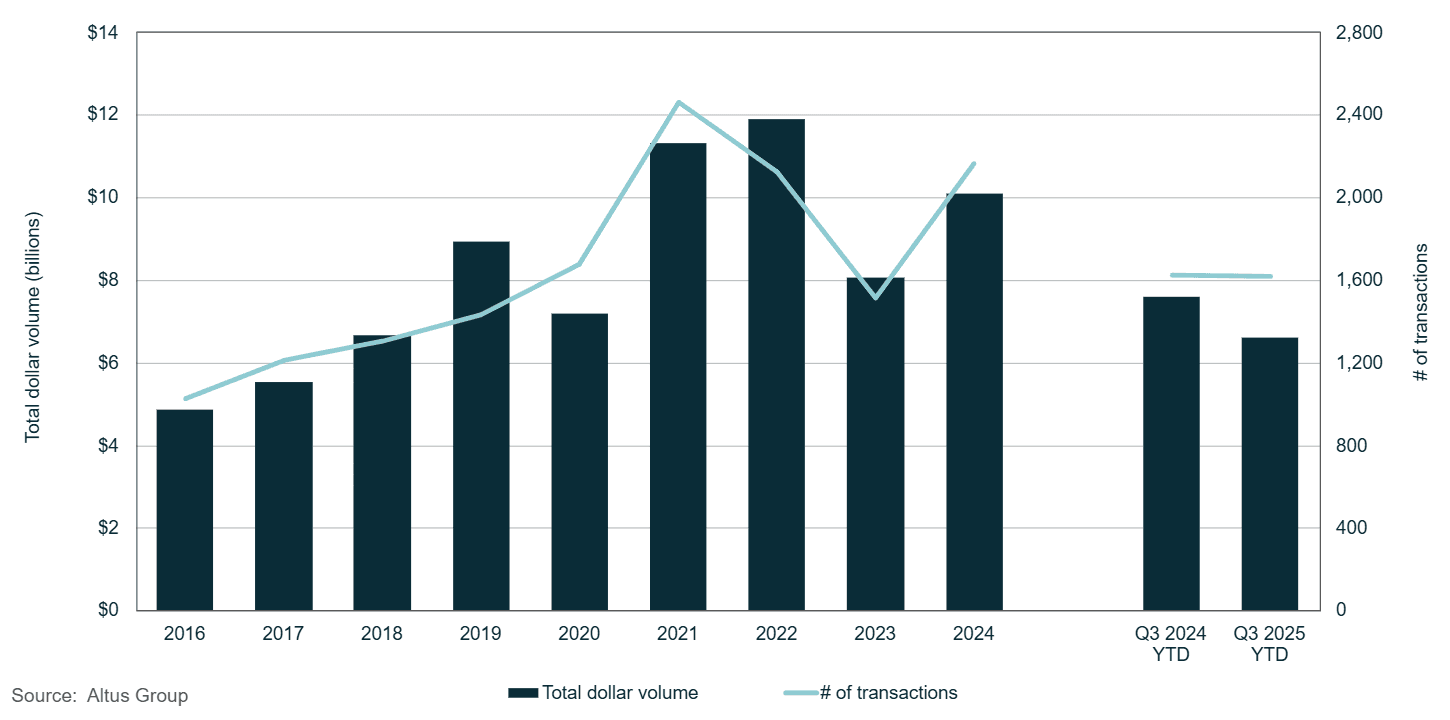

The Montreal commercial real estate market observed a slowdown in investment by the close of the third quarter. The total dollar volume transacted approached nearly $6.6 billion, which represented a notable 13% decrease year-over-year (Figure 1).

Figure 1 - Montreal property transactions – All sectors by year

The primary factor contributing to this decline was a pull-forward of investment activity in the second quarter of 2024. The anticipation of an increase in the now-cancelled federal capital gains inclusion rate accelerated deal closures ahead of the proposed implementation. This reactive surge created an anomalous spike, making year-over-year comparisons appear disproportionately subdued, and masking underlying conditions.

Beyond this fiscal policy distortion, broader uncertainty also weighed on the market. Unpredictable US tariff policies and the prospect of renewed trade protectionism created apprehension about committing capital to long-term real estate ventures. The prolonged hesitation in investment activity and the deterioration of consumer confidence prompted the Bank of Canada (BoC) to lower its overnight rate by a further 25 basis points to 2.25% on October 29th, 2025. This marked the second consecutive rate cut after effectively continuing the easing cycle that had commenced on September 17th. Several key economic indicators backstopped the rate reduction:

The labour market had seen some deterioration despite an uptick in the October data

The country’s Gross Domestic Product (GDP) contracted by 0.4% in the second quarter compared to the previous quarter, primarily due to a significant decline in exports

An upward trend was observed as the Consumer Price Index (CPI) increased to 2.4% in September from 1.90% in August, indicating persistent cost pressures

In response to these market conditions, investors adopted a risk-adverse approach, deferring major investment decisions until greater clarity emerged in the economic and political landscape. This capital deferral led to reduced transaction volumes. Other investors strategically reallocated their portfolios, redirecting their focus towards asset classes perceived as less susceptible to market fluctuations.

Despite the modest recovery observed in the second quarter, investor sentiment for the Montreal market plunged in the third quarter, dropping to last place with a negative momentum ratio, according to Altus Group’s latest Investment Trends Survey (ITS).

Multifamily

The multifamily sector maintained its position as the dominant asset class. Investment activity reached $3.3 billion in dollar volume, representing a 17% year-over-year increase. This resilience underscored the fundamental demand for rental housing, despite broader market caution and general economic uncertainties.

Investment growth in the multifamily sector was maintained by a particular set of market dynamics, where different forces balanced each other out. Elevated construction costs consistently acted as a barrier to new projects, limiting the amount of new rental housing entering the market. At the same time, a reduction in borrowing costs, attributable to the softening of interest rates, provided critical support for property values and actively encouraged the completion of property transactions. This tight supply of new units, alongside favourable access to capital for acquisitions, collectively underpinned the sector’s stability and robust investment performance.

While the Island of Montreal continued to maintain the highest overall share of investment volume at nearly $2.3 billion, which demonstrated continued confidence in the dense, urban core, a notable shift was observed in the surrounding regions. The Laval region experienced the most pronounced year-over-year growth in multifamily investment, recording $416 million transacted, an exceptional 193% increase. This surge was primarily attributable to Boardwalk REIT’s acquisition of an apartment portfolio. Developers and investors remained active in Montreal’s suburban regions, reflecting confidence in higher-density growth strategies supported by relative affordability and expanding local populations.

Industrial

The Montreal industrial sector recorded the sharpest adjustment in capital deployment, dropping by 52% in investment volume to nearly $967 million. This reflected a shift in investor confidence, driven by several critical factors. These included the disruptive nature of US tariffs, encompassing both those already imposed and those pending completion. Additionally, softer domestic economic conditions also contributed to this change. Given that a considerable portion of the region’s industrial activity is geared towards export markets, the sector was rendered especially vulnerable to escalating trade uncertainties. This environment of caution and reduced confidence led to a significant decline in transaction activity within the sector.

Weakened demand for certain product types, particularly large-bay buildings associated with major logistics operations, was the main contributing factor to the rising availability rate. According to Altus Group’s latest Canadian industrial market update, Montreal reported an 8.1% availability rate, marking an increase of 40 basis points year-over-year. This indicated a significant shift in equilibrium, further evidenced by nine consecutive quarters of negative net absorption. Furthermore, the volume of available sublet space remained high at 2.9 million square feet, suggesting that some existing tenants were actively right-sizing or consolidating operations due to economic and trade pressures.

In the third quarter, three fully leased industrial buildings were completed, totalling 653,000 square feet, reflecting ongoing, selective demand. The construction pipeline contracted to 17 buildings with nearly 4.3 million square feet underway, roughly 59% of which was still available for lease, which may increase availability rates slightly upon completion. A rebound in overall industrial demand is contingent upon improvements in broader Canadian economic factors, specifically clearer trade policies with the US, a strengthening in retail sales figures, and an improvement in employment statistics, all of which influence the need for logistics, warehousing, and production space.

Office

The Montreal office sector distinguished itself in the third quarter by recording a 31% year-over-year increase in investment volume, totalling $459 million in dollar volume transacted. This was largely driven by the flight-to-quality trend, which has substantially increased demand for premium, well-located Class AAA office space. Class A transactions accounted for the majority of activity, comprising 52 deals and encompassing 1.2 million square feet of space. Following this, Class B office space comprised 25 transactions, totalling 537,298 square feet. This trend indicated that investors and occupiers were pivoting towards assets perceived as more resilient. These properties offered superior amenities and were considered better positioned to attract and retain tenants within a competitive environment.

Montreal recorded its second consecutive quarter of positive net absorption in the third quarter. This market rebound was driven by the rightsizing of tenant footprints, increasing return-to-office mandates from major employers, and limited new development, which collectively contributed to reducing the available supply and filling existing vacancies. According to Altus Group’s most recent Canadian office market update, Montreal’s overall office availability rate decreased by 60 basis points to 17.2% year-over-year. This decline, coupled with increased investment activity, has contributed to a notable improvement in overall market health and a gradual rebalancing of supply and demand. However, it is important to note that the rate remained elevated compared to pre-pandemic levels, suggesting that market recovery was still underway.

No new office completions were delivered in the third quarter. Furthermore, only two office buildings totalling around 121,500 square feet were under construction. Of this relatively small future supply, 32% was still available for lease. This indicated that while demand persisted for new, modern office space, occupiers remained selective, consistently prioritizing prime, well-located options over the general inventory. Consequently, the constrained development pipeline was expected to support a contraction in availability over the coming months, as minimal new inventory was scheduled to enter the market to compete with the existing inventory.

Retail

Montreal’s retail sector experienced a gradual acceleration in investment momentum by the third quarter of 2025, totalling $879 million in dollar volume transacted. This figure, however, represented a 33% decrease year-over-year. It is important to contextualize this year-over-year comparison, as Montreal’s retail sector recorded its highest investment ever tracked in nearly a decade during the third quarter of 2024. Therefore, while recent transaction volume appeared to show a substantial decline, the year-to-date volume demonstrated sustained investor interest when measured against historical investment benchmarks, a trend that was consistent among other major Canadian markets. This sustained interest suggested that, despite prevailing economic headwinds, capital remained allocated for strategic retail acquisitions.

According to Altus Group’s latest Canadian Investment Trends Survey, food-anchored retail strips were the most popular product within the Montreal market amongst investors. These defensive assets continued to be highly valued for several critical reasons: their resilient qualities stemming from the necessity of services provided; their consistent consumer demand; the resultant reliable cash flow; and their demonstrated ability to withstand economic downturns and e-commerce pressures. This stability and predictable performance positioned them as a cornerstone investment for many investor portfolios over the past several years, effectively offering a safe haven in an uncertain market environment. However, the increased demand for these high-performing assets exacerbated an existing inventory shortage. This scarcity led current property owners to hold onto existing assets, resulting in fewer prime retail properties being actively marketed for sale. and thereby hindering transaction volume.

Land

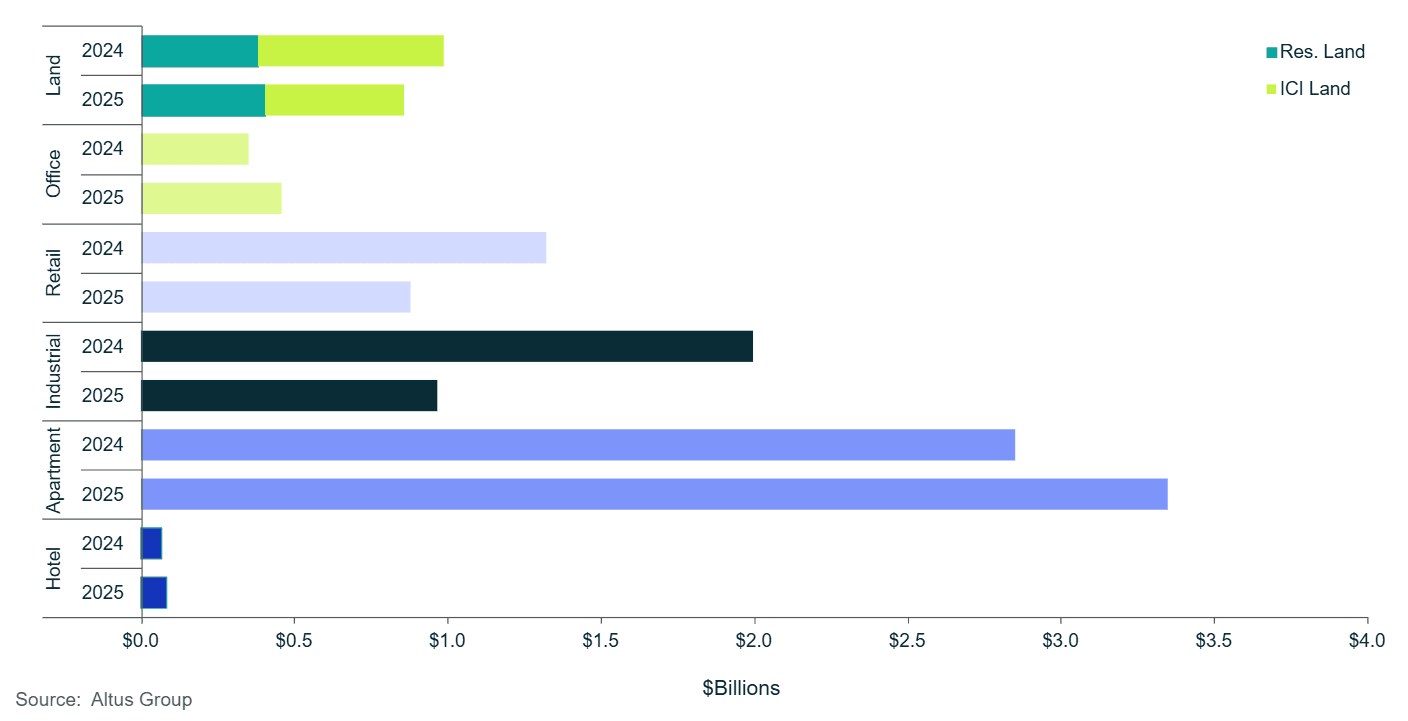

The land sector in Montreal, encompassing both residential and ICI land, experienced a contraction in investment activity. The total transaction volume for the third quarter reached nearly $859 million, a 13% decrease year-over-year. This downturn indicated a more cautious investment climate and reduced development activity across the region, reflecting the broader economic uncertainties and higher borrowing costs.

A closer analysis revealed that the ICI land sector was largely responsible for this downturn, with transaction volumes totalling nearly $453 million. This represented a notable 25% year-over-year decrease, reflecting a slowdown in commercial and industrial development plans. Developers were likely delaying new projects given the softening demand and higher cost of capital.

Conversely, the residential land sector experienced a modest increase in activity, reporting nearly $406 million in dollar volume transacted, a 6% year-over-year increase. This suggested that housing demand persisted, but developers have adopted a more cautious approach to acquiring land for new residential projects. This decline in overall land transactions was indicative of an industry-wide shift toward caution, reflecting that developers and investors had begun prioritizing a conservative approach to future development as they absorbed the implications of changing economic realities and market fundamentals.

Figure 2 - Property transactions by asset class YTD (Q3 2025 vs. Q3 2024)

Notable transactions for Q3 2025

The following are the notable transactions for the Q3 2025 Montreal commercial real estate market update:

7213 Cordner Street, Montreal (LaSalle) - Industrial

The sale of 7213 Cordner Street secured the position as the priciest transaction recorded within Montreal’s industrial sector during the third quarter. The property was sold in July for over $30 million. This transaction involved an industrial building spanning nearly 140,000 square feet, which translated to a price per square foot of $221. At the time of the sale, the facility was fully occupied by the paper-based packaging solutions company, SupremeX. Following the date of the sale, SupremeX immediately executed a sale-leaseback for a ten-year term. This transaction was part of a larger, multi-provincial portfolio that included a property in the Greater Toronto Area (GTA), 400 Humberline Drive in Etobicoke, ON. In a mirroring arrangement, SupremeX also occupied the GTA property and entered a sale-leaseback for a ten-year term. The total price for this combined portfolio was $53 million. Both locations housed manufacturing processes, but the LaSalle facility additionally served as the company’s corporate headquarters.

3405-3421 Le Carrefour Boulevard (Central Parc 1), Laval – Apartment

The sale of 3405-3421 Le Carrefour Boulevard, known as Central Parc 1, was recorded as the priciest transaction in Laval’s apartment sector during the past quarter. This residential building formed part of a larger multifamily complex that included Central Parc 2 and 3. Central Parc 1’s transaction closed at roughly $97 million, while the entire portfolio totalled $249 million. This portfolio price represented a value of $460,000 per unit for the 541 residential units, and the transaction was concluded at a capitalization rate of 4.5%. The properties were acquired by the Alberta-based investor, Boardwalk REIT, with the stated intention of expanding its presence in the Montreal market. The Trust publicly noted that Montreal was a desirable market that continued to exhibit “strength, resilience, and relative affordability.” While the transaction involved three completed buildings, the total development was initially planned to conclude with six buildings in all, totalling approximately 1,100 units.

1550 Metcalfe Street/1555 Peel Street (Les Cours Mont-Royal), Montreal (Ville-Marie) – Office

The office component of Les Cours Mont-Royal (1550 Metcalfe Street/1555 Peel Street) was sold in mid-September 2025. This transaction was valued at $25 million, representing a price per square foot of $97, and ranked as the third most expensive office transaction of the third quarter of 2025. The building was originally the site of the Mount Royal Hotel, which was famed as the largest hotel in the British Empire when it was built in 1922. This specific transaction involved only the office portion of Les Cours Mount-Royal, which is otherwise a major shopping centre in the heart of downtown Montreal. Although the office portion carried a vacancy of roughly 100,000 square feet, approximately 40% of its area, the Montreal-based purchaser, MTRPL, publicly expressed confidence that the occupancy level can be “relatively stabilized in two years.” Current tenants included the City of Montreal and McGill University.

700 Beaumont Avenue, Montreal (Villeray-Saint-Michel-Parc-Extension) - Industrial

Located in Montreal’s Villeray-Saint-Michel-Parc-Extension borough, this industrial building sold for over $16 million, representing a price per square foot of $188. The building was owned and fully occupied by Brault & Bouthillier, a provider of children’s educational products and consulting services. After the date of sale, Brault & Bouthillier entered into a sale-leaseback agreement, allowing them to continue operations in what was identified as their “mission-critical facility”. Colliers, who represented the seller, emphasized that this deal reflected “the strength of Montreal’s industrial market and the continued investor appetite for long-term, net-leased assets, in prime urban locations.”

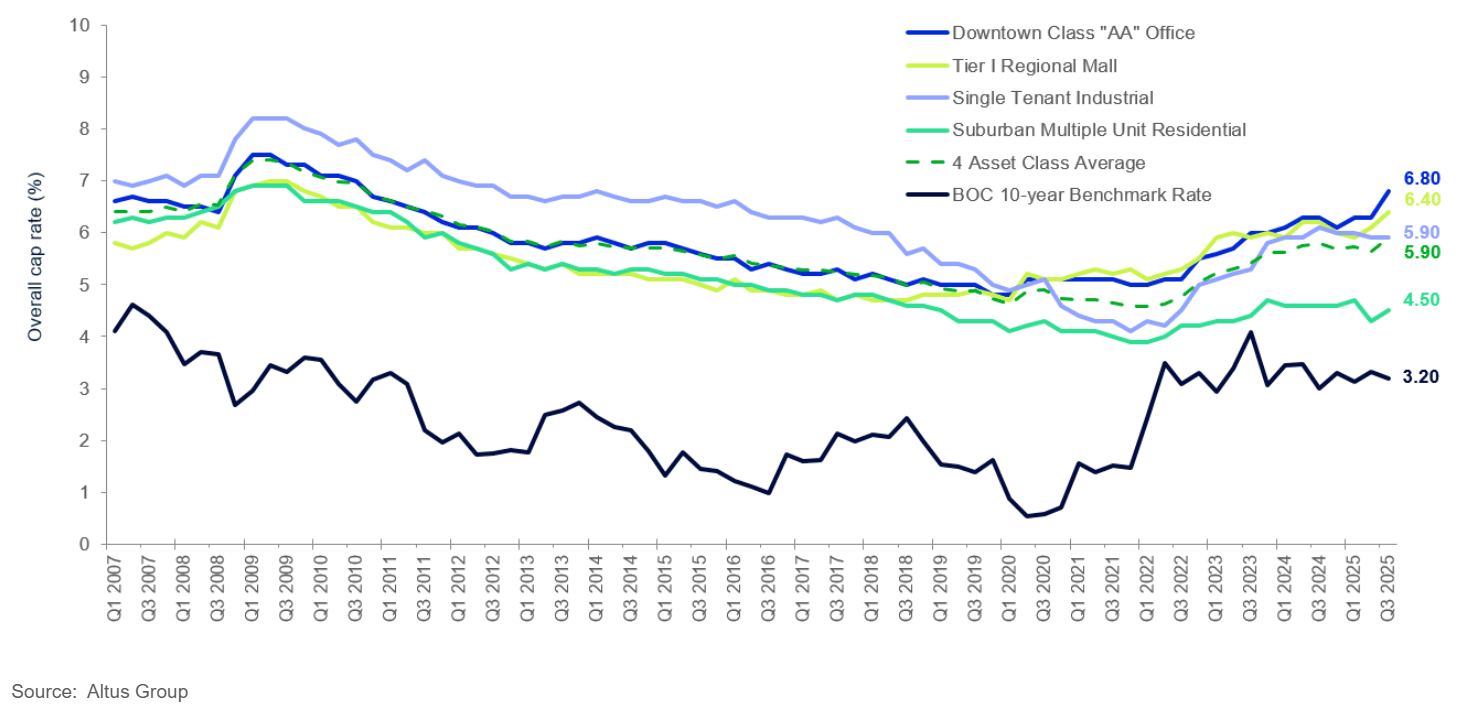

Figure 3 - Montreal OCR trends across four benchmark asset classes

Source: Altus Group

Looking ahead

The third quarter of 2025 closed a period defined by market adjustments and a stark bifurcation of capital. While overall investment declined 13%, sector performance underscored a clear shift toward defensive and resilient assets. The multifamily sector’s continued dominance, reinforced by substantial suburban growth in areas like Laval, underscored the enduring demand for housing and its stability as a primary asset class. Similarly, the office sector’s increase in investment activity, driven by the flight-to-quality trend toward premium Class AAA space, highlighted occupiers’ strategic commitment to high-quality environments despite elevated vacancies overall. Conversely, the sharp contraction in the industrial sector and the slowdown in land transactions reflected heightened caution regarding export-driven activity and the rising costs of development capital, respectively.

Looking ahead, the market’s recovery is expected to hinge on several key factors. The BoC’s initiation of a rate-easing cycle, evidenced by two consecutive rate cuts, suggested that financing costs might gradually improve, potentially stimulating transactional activity in the coming quarter and alleviating some development cost pressures. However, a full market rebound is contingent upon greater clarity surrounding US trade policy and a demonstrable strengthening of domestic economic indicators, including GDP and employment. The continued scarcity of quality inventory across the most sought-after asset classes, particularly food-anchored retail, Class AAA office, and stable multifamily, was expected to maintain upward pressure on valuations for prime properties.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Daniel Marro

Senior Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Daniel Marro

Senior Market Analyst

Resources

Latest insights