Montreal commercial real estate market update – Q4 2023

Q4 2023: Economic activity slowed after the first half of 2023, as investors navigated the high-interest rate environment.

Key highlights

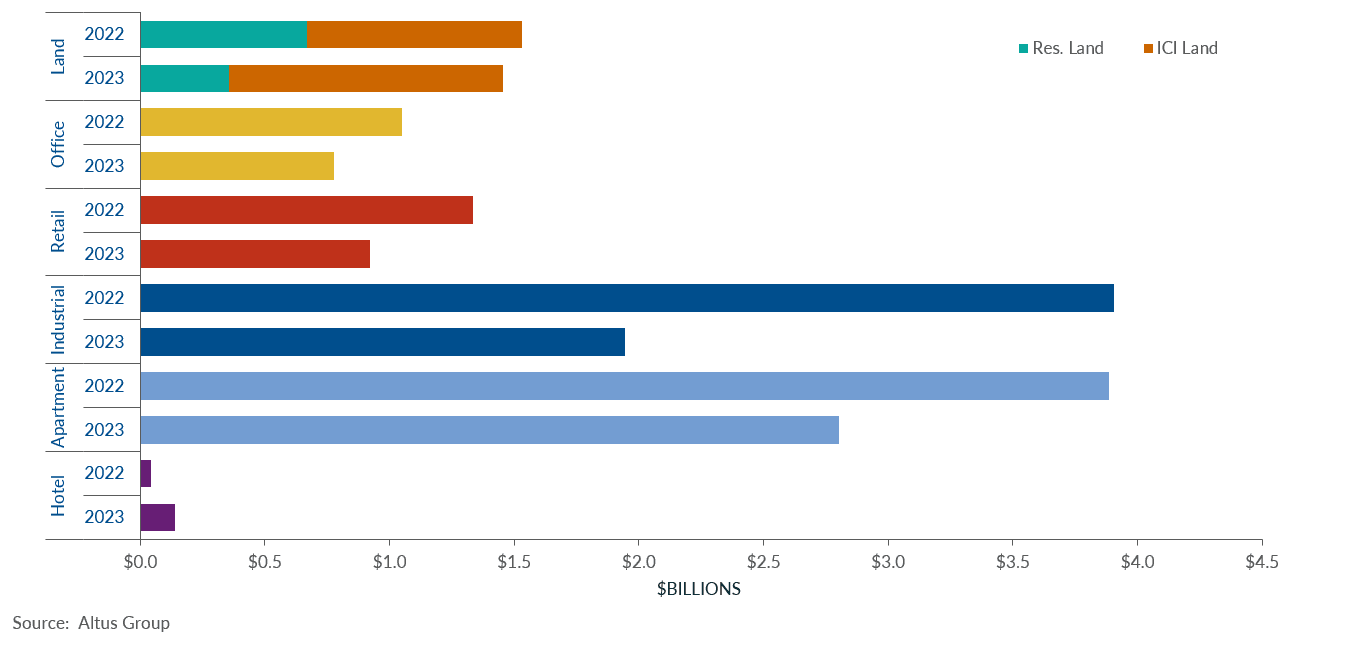

The Montreal market saw $8 billion in dollar volume transacted in 2023, a 32% decline compared to 2022

The multi-family sector posted $2.8 billion in dollar volume transacted, a 28% decrease year-over-year (YoY)

The industrial sector reported $1.9 billion in dollar volume transacted, a 50% decrease YoY

Residential and ICI land sales recorded $1.5 million in dollar volume transacted, a minimal decrease of 4.9% YoY

Office leasing activity remained sluggish, with $775 million in dollar volume transacted, a 32% decrease YoY

The retail sector reported $923 million in dollar volume transacted, a 31% decrease YoY

To read the latest Montreal CRE Market update, click here.

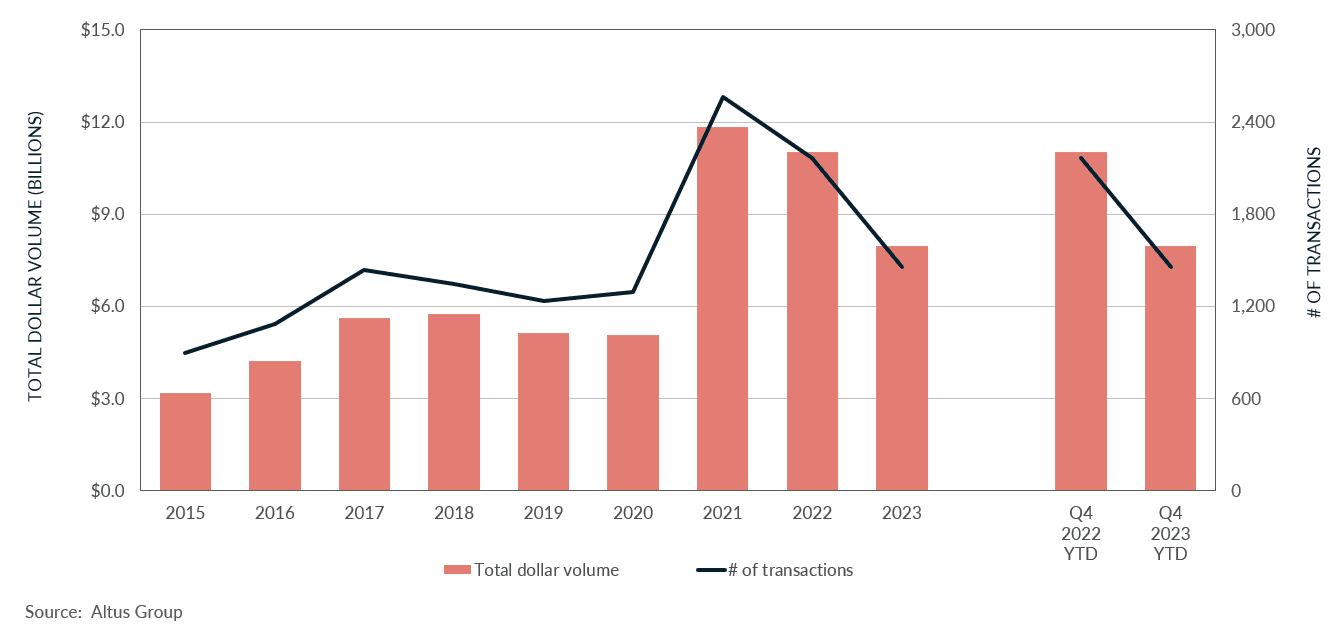

Transaction volume in the Montreal market is down by nearly one-third compared to 2022

Economic activity slowed after the first half of 2023 as investors navigated the high-interest rate environment. Commercial investment activity in Montreal contracted in response, with $8 billion in dollar volume transacted in 2023, a 32% decline compared to 2022. All sectors reported a pullback in transaction activity, except for ICI land and hotel. Furthermore, according to Altus Group’s most recent Canadian CRE Investment Trends Survey, Montreal’s preferred products include food-anchored retail strips, multi-tenant industrial, and suburban multiple-unit residential.

Figure 1 - Property transactions – All sectors by year

The multi-family sector posted $2.8 billion in dollar volume transacted, a 28% decrease year-over-year (YoY). While the demand for new rental housing remained consistent, weaker construction activity was observed in the housing market due to the higher interest rate environment and increased construction costs. With the lingering effects of elevated interest rates expected to carry onto the first half of 2024, investors remain cautiously optimistic with the anticipation of rate cuts.

The industrial sector reported $1.9 billion in dollar volume transacted, a 50% decrease YoY. To this effect, Altus Group’s most recent Canadian industrial market update indicated that Montreal's industrial availability rate observed a 1.8 percentage point YoY increase to 5.5% as of the fourth quarter of 2023. However, it is important to note that despite the elevated availability rates, the market remained undersupplied in terms of newer modern facilities built to include design factors businesses seek, such as higher ceiling heights.

Residential and ICI land sales recorded $1.5 million in dollar volume transacted, a minimal decrease of 4.9% YoY. Residential land posted $356 million, while the ICI land posted $1.1 million, a 47% decrease and a 27% increase YoY, respectively. While the Montreal market has historically favoured residential land, the relentless demand for industrial space has increased ICI land sales despite surging land and construction costs.

Office leasing activity remained sluggish, with $775 million in dollar volume transacted, a 32% decrease YoY. Altus Group’s Canadian office market update for Q4 2023 revealed that Montreal’s office availability rate flattened at 18.2%. Despite diminished office space requirements – largely due to increased rightsizing efforts in response to the continued popularity of hybrid work – Montreal saw two long-awaited office building completions, totalling approximately 1.3 million square feet with 100% pre-leased. These buildings include the National Bank Building and Victoria sur le Parc, both designated Class-A buildings and tied to be Montreal’s third tallest buildings. In addition, 309,906 square feet of office space are under construction, with nearly half pre-leased.

The retail sector reported $923 million in dollar volume transacted, a 31% decrease YoY. A trend observed for major cities across Canada is Canadians rediscovering their local neighbourhood as an inadvertent effect of the pandemic and flexible work arrangements. This trend is reflected in Altus Group’s most recent Canadian CRE Investment Trends Survey, which ranked food-anchored retail in Montreal as the second most preferred product/market combination in the fourth quarter of 2023.

Figure 2 - Property transactions – Property transactions by asset class (2022 vs. 2023)

Notable Q4 2023 transactions

400-480 Armand-Frappier Boulevard, Laval – Office

One of the highest-priced office transactions for Q4 2023 concluded in November. Having been sold for $36 million, this office complex boasts 200,000 square feet over four buildings, ranging from $8 million to $12 million per building. The purchaser, HarveyCorp, who acquired this complex from Cominar REIT, intends to invest in the property for life science purposes for its future tenants. This is part of a growing trend in this area of Laval as it adheres to the city’s BioTech City or Cité de la Biotech project. This complex is located beside laboratories and science-based companies such as Moderna and Charles River.

300-330 Sainte-Croix Avenue, Montreal – Retail

The 85,000 square foot building sold for a total of $18 million and with a price per square foot of $212. This transaction by Loblaws is also part of a portfolio that includes one other property on Montreal’s North Shore (Blainville). The portfolio was purchased for approximately $29.5 million and contains a gross leasable area of approximately 130,000 square feet, representing an aggregate price per square foot of $227. The current occupant of 300-330 Sainte-Croix Avenue is the Asian grocery store, T&T Supermarché, which is owned by Loblaws. This is the largest Asian grocery store chain in Canada and the only one in the entire Greater Montreal Area. It is currently the largest T&T in all of Canada.

14005-14105 Sherbrooke Street East, Montreal – Apartment

The largest apartment deal of Q4 concluded in Montreal’s Rivière-des-Prairies-Pointe-aux-Trembles borough in early November. They were previously owned by the Ontario company Greenwin, the 40-year-old, eight-building apartment complex sold for $102 million. With its 200,000 square feet and 720 units, this represents a price per unit of just under $142,000. The purchaser, Mainbourg, and its financial partners, notably the Government of Quebec, The City of Montreal, Desjardins Bank, and others, aim to calm the waters as the city faces an increase in unaffordable rent.

8550 Montview Road, Town of Mount-Royal – Industrial

Located in the industrial park of the Town of Mount Royal, the property sold for just over $53 million, its 234,093 square feet represented a price per square foot of $227. Having purchased the property two years prior, the vendor Brasswater had signed a long-term lease with the multinational food company Kraft Heinz Canada for 12 years. This well-located property, built in 1975, sits just south of the interchange on Highways 40 and 520, allowing easy access to and from. A 20-minute drive west brings you to Montréal-Pierre Elliott Trudeau International Airport, while roughly the same distance southeast brings you to the heart of downtown Montreal.

De Richelieu Road, Saint Basile-le-Grand, ICI Land

Montreal’s South Shore municipality of Saint-Basile-le-Grand saw the highest-selling transaction in the past 12 months. With an incredible price tag of $240 million, the price per acre sits at $565,107 for its 425 acres. Northvolt battery plant is planned (Nothvolt Six) and will be Canada's first fully-integrated battery manufacturing plant. The arrival of the Swedish battery manufacturer is thought to bring roughly 3,000 jobs to the region, with the first phase of construction coming before the end of 2023. The company aims to commence operations in 2026 and reach full capacity by 2028. The project will include a manufacturing plant and a recycling plant, thus covering the whole scope of battery production.

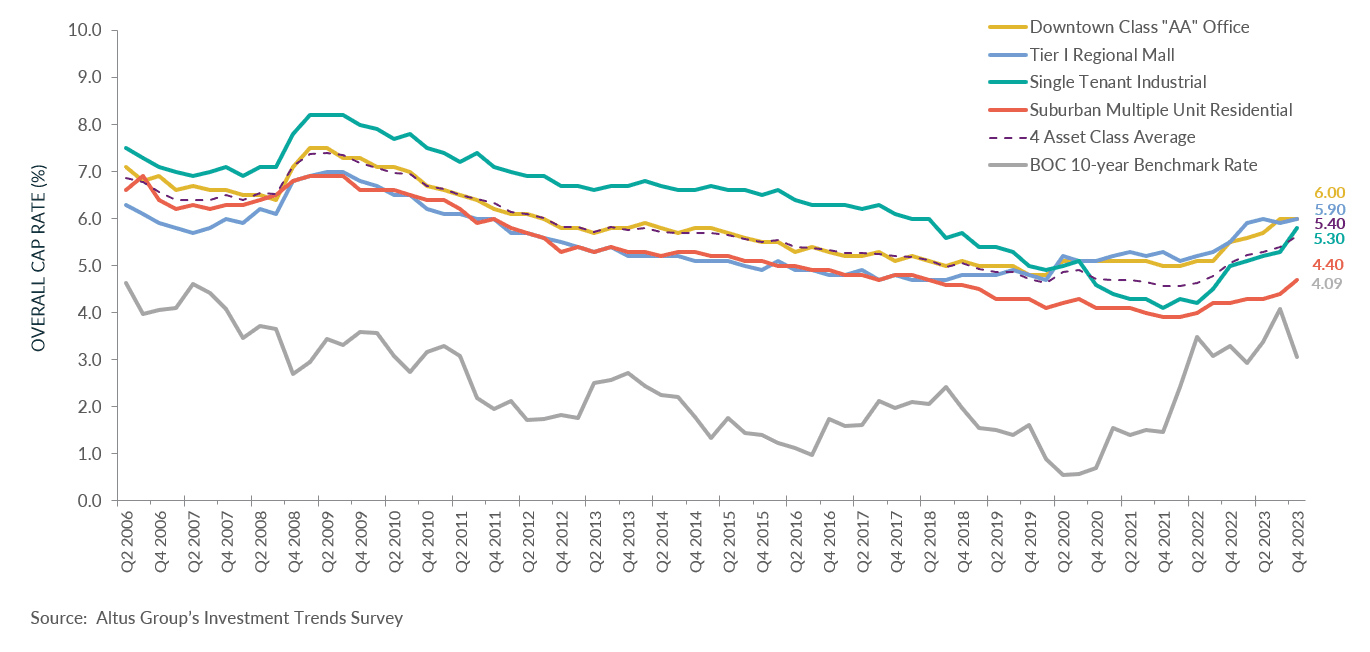

Figure 3 - OCR trends across 4 benchmark asset classes

As macroeconomic challenges introduced by higher interest rates and inflationary pressures persisted throughout 2023, transaction activity in the Montreal market has pivoted to stable, low-risk areas of real estate, such as multi-family and industrial, which accounted for 35% and 29% of the total dollar volume in 2023, respectively. With the anticipation of interest rate cuts later in 2024, investors have remained cautiously optimistic as they adjust to elevated but stabilized interest rates.

Author

Altus Group

Author

Altus Group

Resources

Latest insights