Multifamily outlook: Boom to bust or normalization?

Key highlights

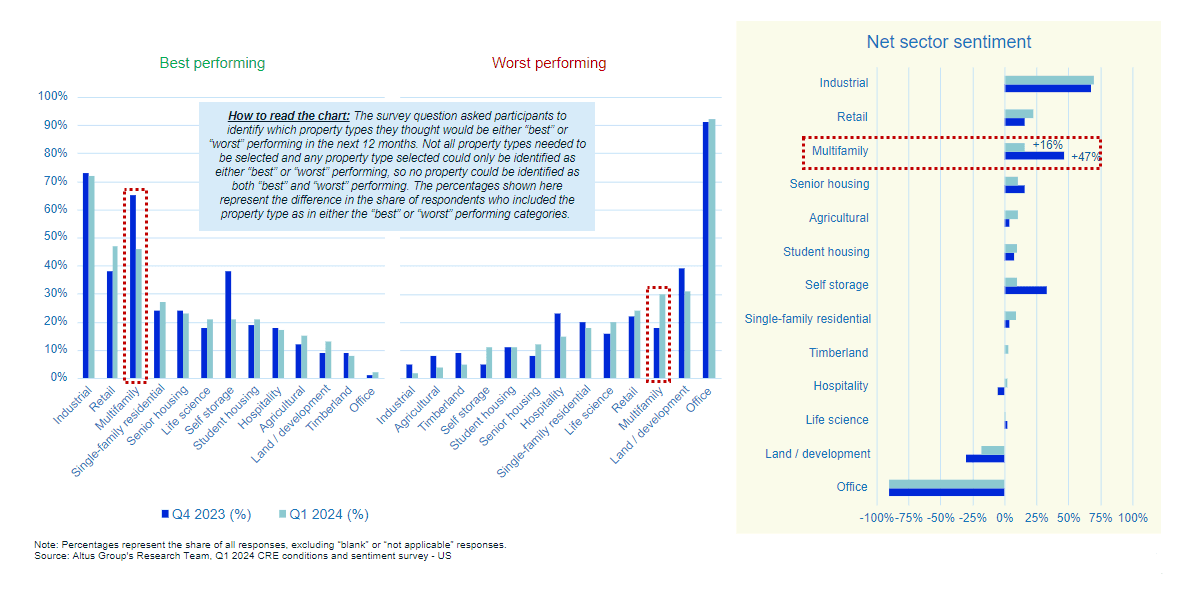

Altus Group’s Q1 results for the CRE Industry Conditions and Sentiment Survey showed a 31% negative net swing in sentiment in terms of expectations for multifamily property performance versus the past quarter

While multifamily properties are experiencing several headwinds, including rising construction and operating expenses, a surge in new supply, rising borrowing costs and, in some cases, falling rental rates, the most significant impact may be limited to a small portion of the overall market

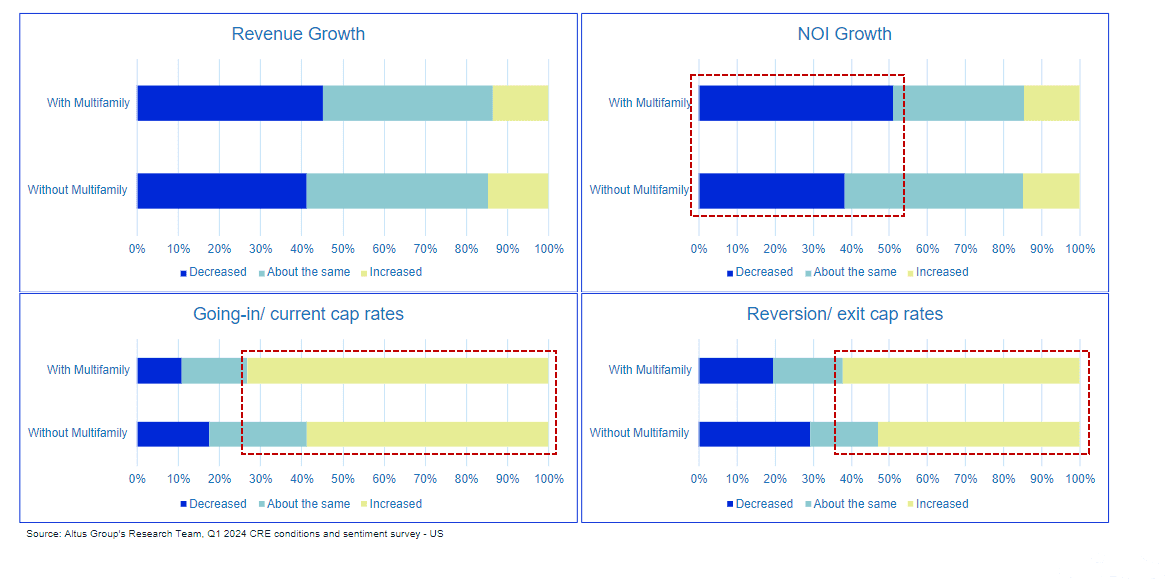

Roughly 40% of firms with at least some exposure to multifamily in their portfolios expect net operating income (NOI) growth to decrease over the next 12 months; 30% of those same firms anticipate cap rates to rise compared to just under 15% of firms without exposure to that part of the market

Souring sentiment

While office properties have been the biggest concern within commercial real estate (CRE) since the pandemic accelerated the shift to remote work, there’s now a growing sense that the multifamily sector could be next. Altus Group’s US Q1 results for the CRE Industry Conditions and Sentiment Survey showed a 31 percentage point negative swing in sentiment toward the multifamily sector versus the previous quarter.

Recent headlines reflect the shifting mood in multifamily, with stories warning of weakness in the sector due to rising construction and operating costs, a wave of new supply, and rising borrowing costs. Other headlines have focused on the sharp increase in distressed CLO loans. On the surface, the future seems bleak for multifamily, but the outlook for 2024 may not be as black-and-white. Unlike office, multifamily is not facing structural demand issues, as the American housing market has historically been under-supplied. Even as elevated mortgage rates pull back from their recent highs, sales of new and existing homes continue to slide and prices remain elevated, keeping many would-be buyers in the rental market.

Many parts of the multifamily market are slowing, which may signal a normalization after a period of double-digit rent growth during 2021 and 2022. Some of these changes may be the result of broader shifts in consumer habits and the economy. Although the US consumer overall is in a healthy position with low unemployment, the practice of job hopping, which fueled significant wage growth in recent years, has slowed. This is creating a headwind for multifamily properties – workers are deciding to stay put and are likely delaying housing decisions.

Figure 1 - Expectations for property type performance over the next 12 months

Growing headwinds

While the majority of the multifamily sector remains on solid footing, a small amount of distress in this part of the market – which could translate to thousands of units – shouldn’t be dismissed. According to Altus data, multifamily remains one of the largest property types within CRE: 18% of the industry’s total property count and square footage, and 27% of total dollar value invested. Any disruption could have enormous implications.

The sector is currently facing numerous headwinds – multifamily construction and operating costs have begun to accelerate again, and rising insurance premiums have been another sore point, particularly in high-growth coastal metros.

These factors are ultimately contributing to decreased expectations for net operating income (NOI) growth within portfolios that include multifamily properties. Close to half of US respondents to the US Q1 CRE Industry Conditions and Sentiments Survey, with multifamily in their portfolios, decreased expectations for NOI growth versus 12 months ago, while just under 40% of firms with no exposure said the same. Additionally, more than 70% of respondents with multifamily properties in their portfolio have increased expectations for cap rates; less than 60% that lack multifamily exposure said the same.

Figure 2 - Expectation changes compared to 12 months ago

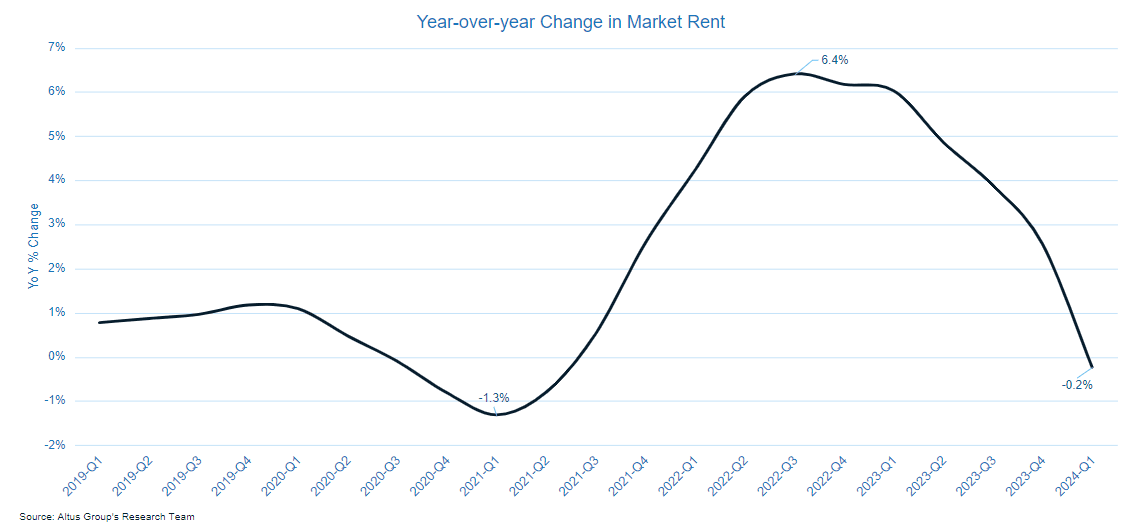

Rising costs are just one of the headwinds facing multifamily properties. Another is the rapid build-out of new units in recent years, having a dampening effect on rental rates. After seeing healthy growth between 2021 and early 2023, rents in many markets – such as in Austin – have started to fall as existing owners compete with an onslaught of new supply. This may distort the national story, as sunbelt markets drive much of the observed decline.

Figure 3 - Rent growth is now a concern

Looking ahead

As many as 40% of firms with at least some exposure to multifamily in their portfolios expect NOI growth to decrease over the next 12 months. In contrast, only a quarter of those without exposure to multifamily are preparing for a similar pullback. The expectations for cap rates amongst these firms are similar. Although cap rates for multifamily are already seen as rising faster than other parts of the market, the negative sentiment becomes more pronounced over the next 12 months. Looking a year out, more than 30% of portfolios with multifamily expect cap rates to rise versus just under 15% of firms without exposure to that part of the market.

Unlike office space, most multifamily buildings will likely have an easier time refinancing, particularly those properties with institutional owners with strong relationships with their lenders. But that won’t be the case for all the owners in this category.

Newly constructed multifamily properties with low underwritten cap rates may be at risk of failing to cover debt obligations at maturity. In turn, this could create future opportunities for buyers of distressed properties. Interest rates will be a contributing factor by lowering borrowing costs, but it will likely take more than the handful of rate cuts expected by the US Federal Reserve this year to have a material impact on the multifamily market. While rate cuts could spark some action in the sector, we might not see any big moves in this category until 2025.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Cole Perry

Associate Director of Research

Author

Cole Perry

Associate Director of Research