Key highlights

By Q2 2023, all but three major office markets have a greater percentage of net rentable area expiring over the coming 3 years than they had before the pandemic

Trajectories for cumulative office space expiring within 10 years vary wildly across the major markets, with nearly 70% expiring in San Francisco but less than 50% expiring in Atlanta

Expiring leases can be beneficial in markets where market rents exceed in-place contracted rents; however, the spread has narrowed to historical lows in most major office markets analyzed, as office demand weakens

The office sector remains at a critical inflection point, as remote work policies have decoupled growth in demand for office space from growth in office-working employment. And after more than three years since the onset of the pandemic, occupancy rates in offices remain low. Kastle Systems reported office occupancy of 47.2% for the week ending on 8/20.

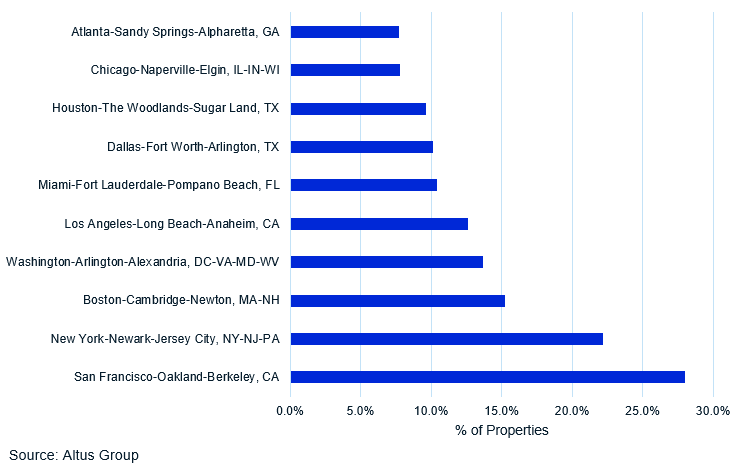

But the trajectory for office space varies significantly by tenant type and market, especially in the largest and most dynamic major metros. Legal and financial tenants were among the first to return to the office, partially propping up markets such as New York City. At the same time, however, technology tenants have lagged far behind, endangering markets like San Francisco, in which an estimated 28% of office properties have a technology-related tenant.

Figure 1 - Percentage of office properties with a technology tenant

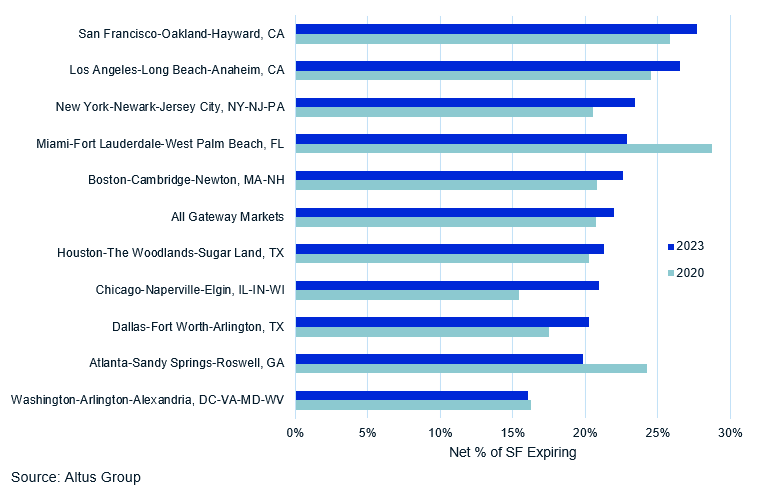

The office outlook for most major markets has soured, as planned lease expirations exacerbate the potential for an influx of office space supply hitting the market, which raises concerns about surplus space competing for less demand. Seven out of ten major office markets analyzed have a greater percentage of net rentable office space expiring in the coming three years (2023 to 2026) than they did before the pandemic (2020 to 2023). Among them, San Francisco has the highest three-year expected rollover rate from 2023 to 2026 at 27.7% of net rentable area (NRA). The Los Angeles office market is in a similar position, with an estimated 26.5% of NRA set to expire through 2026.

Chicago saw the largest increase in the three-year forward estimate of NRA expiring compared to 2020 – up 5.5% to 20.9% – putting it closely in line with the other major markets overall, which have 22.0% of NRA expiring between 2023 and 2026.

Figure 2 - Percentage of net rentable area expiring within 3 years

Three markets have seen declines in near-term rollover risk, including Miami, Atlanta, and Washington – all of which were among the largest recipients of net migration for major markets in 2022. Near-term rollover risk in Miami and Atlanta saw large decreases from 2020 to 2023, falling by 5.9% and 4.4% respectively. Meanwhile, Washington DC saw a slight decrease of .2%.

A difficult longer-term challenge

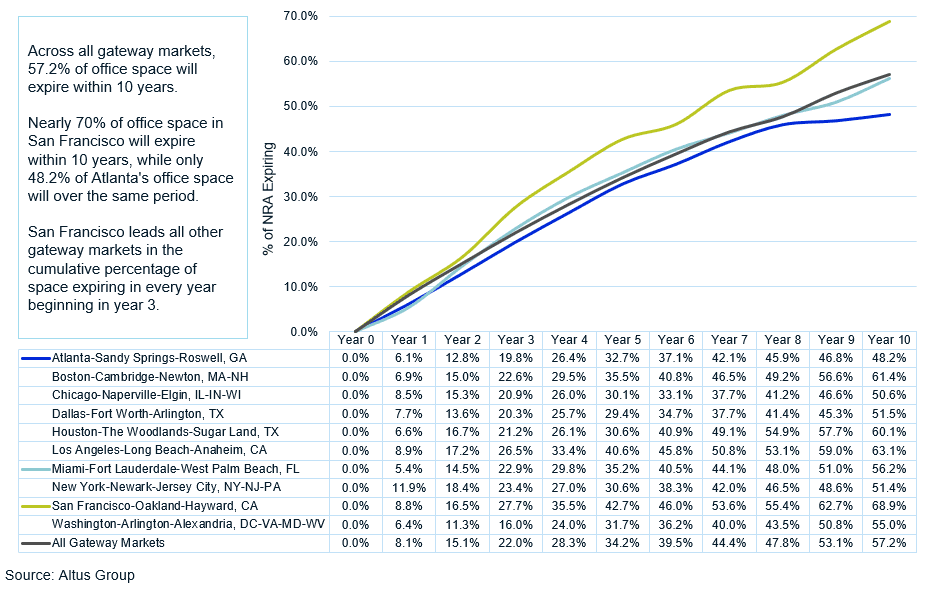

Understandably, the widespread adoption of a remote and/or hybrid work format affects the long-term demand for office space. While all leases will expire eventually, looking beyond the near-term rollover rates through 2026 can help to illustrate which major markets have more (or less) attractive longer-term supply-demand dynamics. Nearly 70% of currently leased San Francisco office space and 63.1% of Los Angeles office space is expected to roll over the next 10 years. On the other hand, less than 50% leased office space is expected to expire over the next 10 years in Atlanta. Miami’s office market more closely resembles major markets as a whole over this timeline, with 57.2% of NRA expiring within the next 10 years.

Figure 3 - Cumulative percentage of net rentable area expiring within 10 years

The potential silver lining

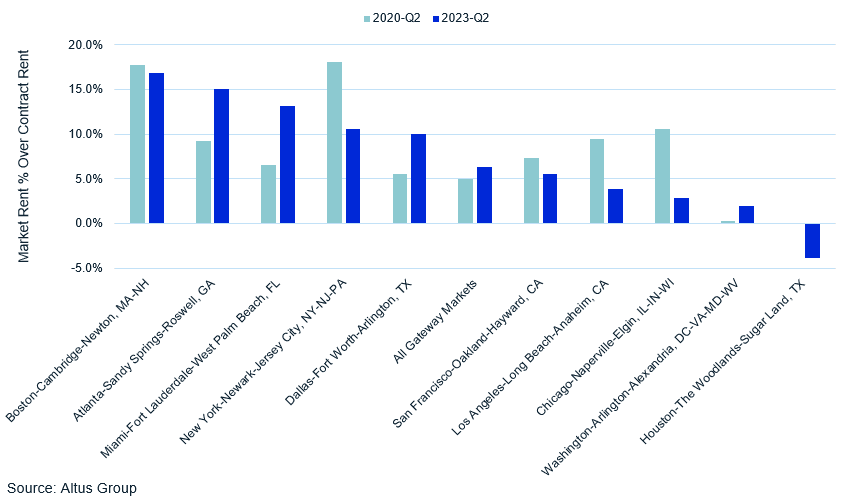

Expiring leases can be beneficial for office owners in markets where rents exceed in-place contracted rents – assuming the property will be able to fill the space under the expired lease with a new lease at the higher market rental rate.

Boston commands the largest market-to-contracted rent spread in Q2 2023, at 16.9%, while Houston is the only major market in Q2 2023 in which market rent is lower than in-place contracted rent, with a spread of -3.9%. The Washington, Chicago and Los Angeles office markets have all seen spreads dip below 5%, while other major markets continue to command 10% or more in market rents above in-place contracted rents.

Figure 4 - Market rent spread over in-place contract rent between Q2 2022 and Q2 2023

Since 2020, the spread between market rents and in-place contracted rents widened in Atlanta (+5.7%), Miami (+6.7%), Dallas (+4.5%), and Washington (+1.6%), while it narrowed in Boston (-0.9%), New York (-7.5%), San Francisco (-1.8%), Los Angeles (-5.6%), Chicago (-7.6%), and Houston (-3.9%).

Putting it together

The adoption of remote and hybrid work habits has significantly shifted the demand for office space, but doomsday calls for the office sector are likely hyperbolic. Recent parallels in retail and hospitality offer some insight into the potential future of office; the rise of e-commerce has not eliminated retail, just as short-term rentals (i.e., Airbnb) have not eliminated hotels. However, in both cases, these disruptors have fundamentally changed the supply and demand for associated commercial space.

Turning to the office sector, those markets in which near-term rollover risk is high and market rents do not significantly exceed in-place rents will likely struggle more as supply increases and is not met by an offsetting increase in demand. Three markets to watch are those with smaller market-to-contract rent spreads in Q2 2023 and three-year NRA expirations above 20%, including Chicago, Los Angeles, and San Francisco. It stands to reason that work-from-home will not eliminate the need for the office but rather force the sector to adapt.

Author

Cole Perry

Associate Director of Research

Author

Cole Perry

Associate Director of Research