Ottawa commercial real estate market update

Q1 2023: Investment activity in the Ottawa and Gatineau market is down 75% amidst rising interest rates.

Key highlights

Overall investment activity in Q1 2023 reached $383 million, representing a 75% decrease compared to Q1 2022

The multi-family sector once again recorded the highest investment volume at $133 million

Despite economic uncertainty, investors favoured the ICI land sector's resiliency and reported $85 million in investment dollar volume, up about one-third from last year

The office availability rate continues to climb upwards to 12.5%

The office asset class reported $41 million in dollar volume, an 86% decrease from Q1 2022

The industrial asset class reported just $35 million in dollar volume, down by 95% from Q1 2022 due to uncertainty around rising interest and net rental rates

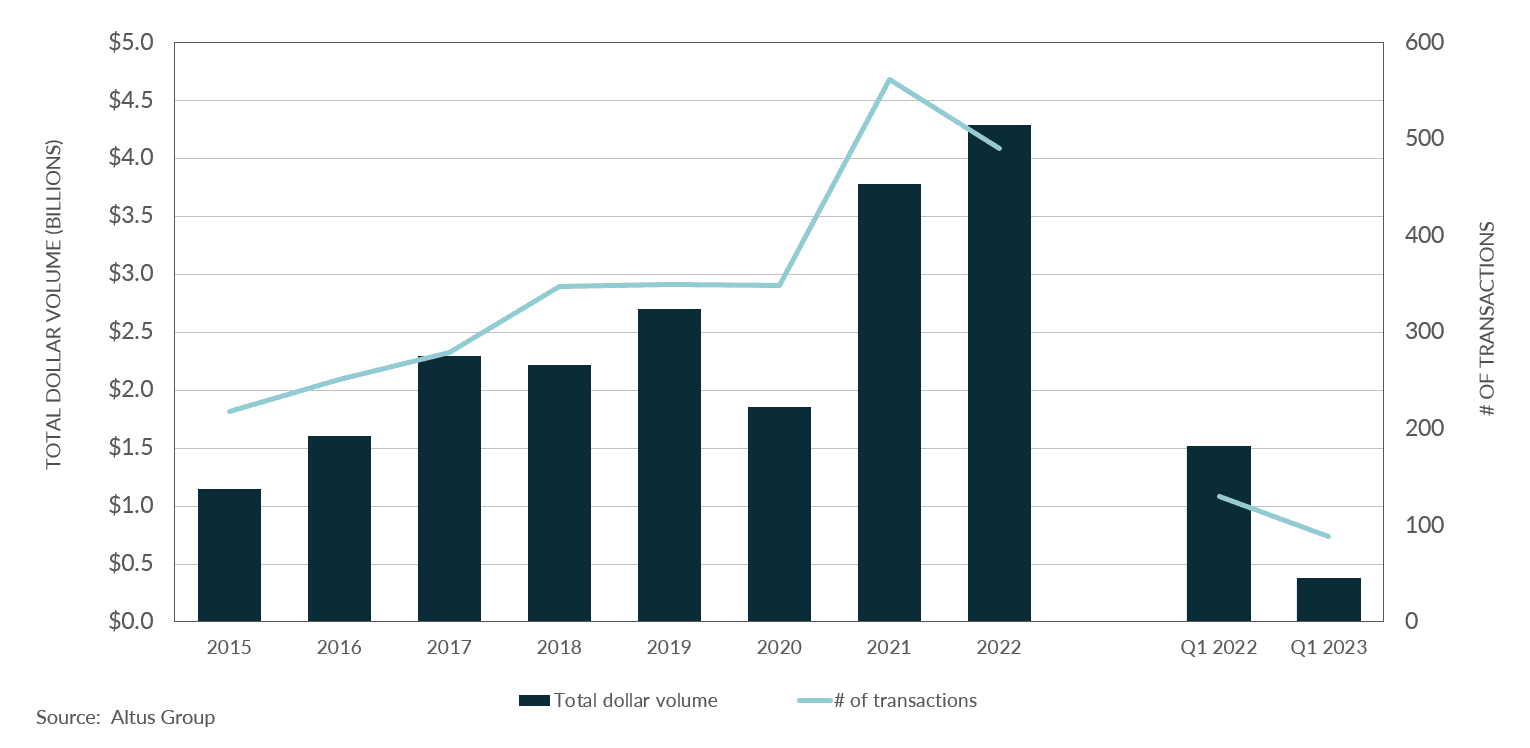

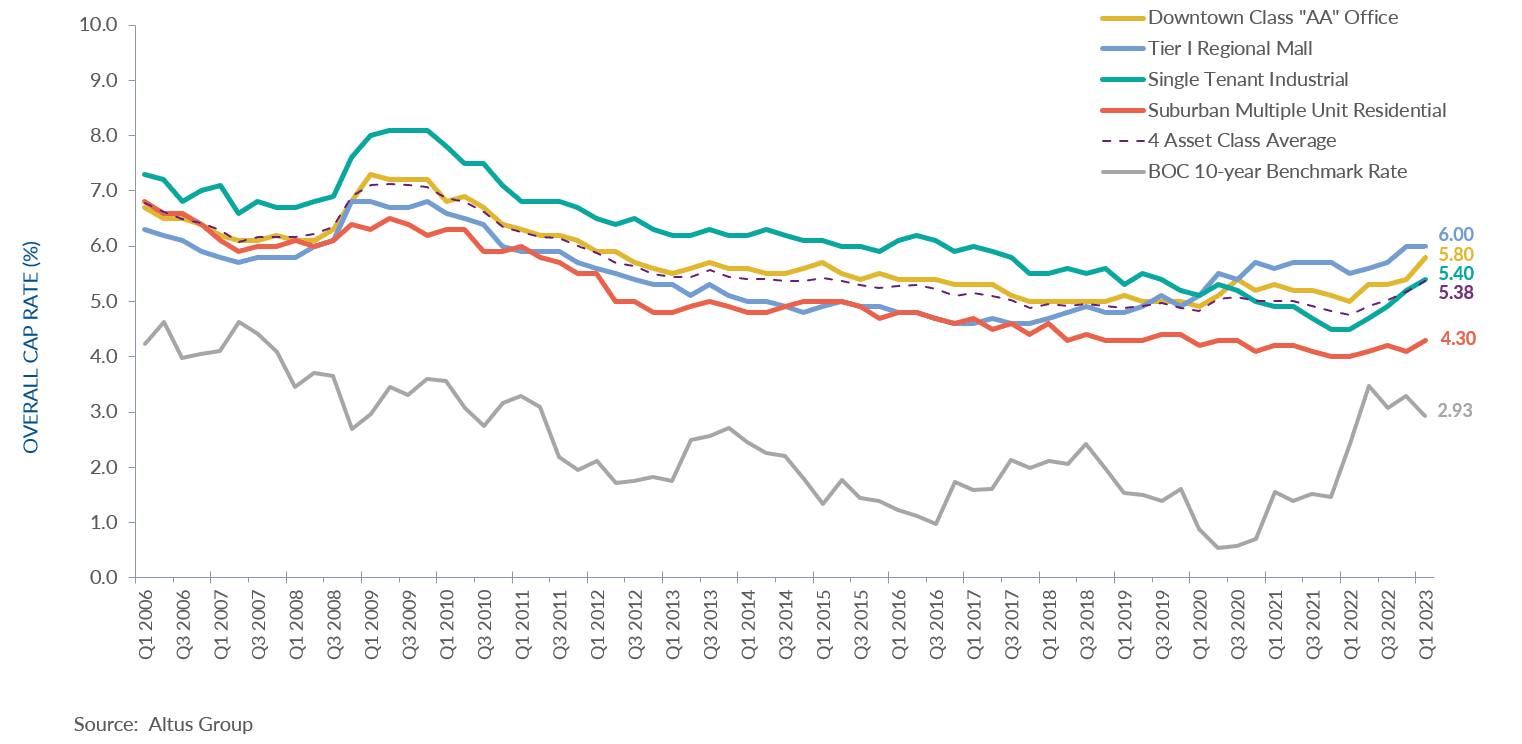

In Q1 2023, the Ottawa and Gatineau market was not immune to the slowing economy and rising interest rates which started in the latter half of 2022. As buyers and sellers navigated through a price discovery phase in 2022, the continued volatility of the macroeconomic environment has led many investors to approach the new year with heavy caution. Overall investment activity in Q1 2023 reached $383 million, representing a 75% decrease compared to Q1 2022. Moreover, the average cap rate for all assets increased at the start of the year. Single Tenant Industrial experienced the highest increase of 0.9% from Q1 2022 to 5.4% in Q1 2023, mainly due to higher interest rates.

Figure 1 - Ottawa & Gatineau Market Area Property transactions – All sectors by year

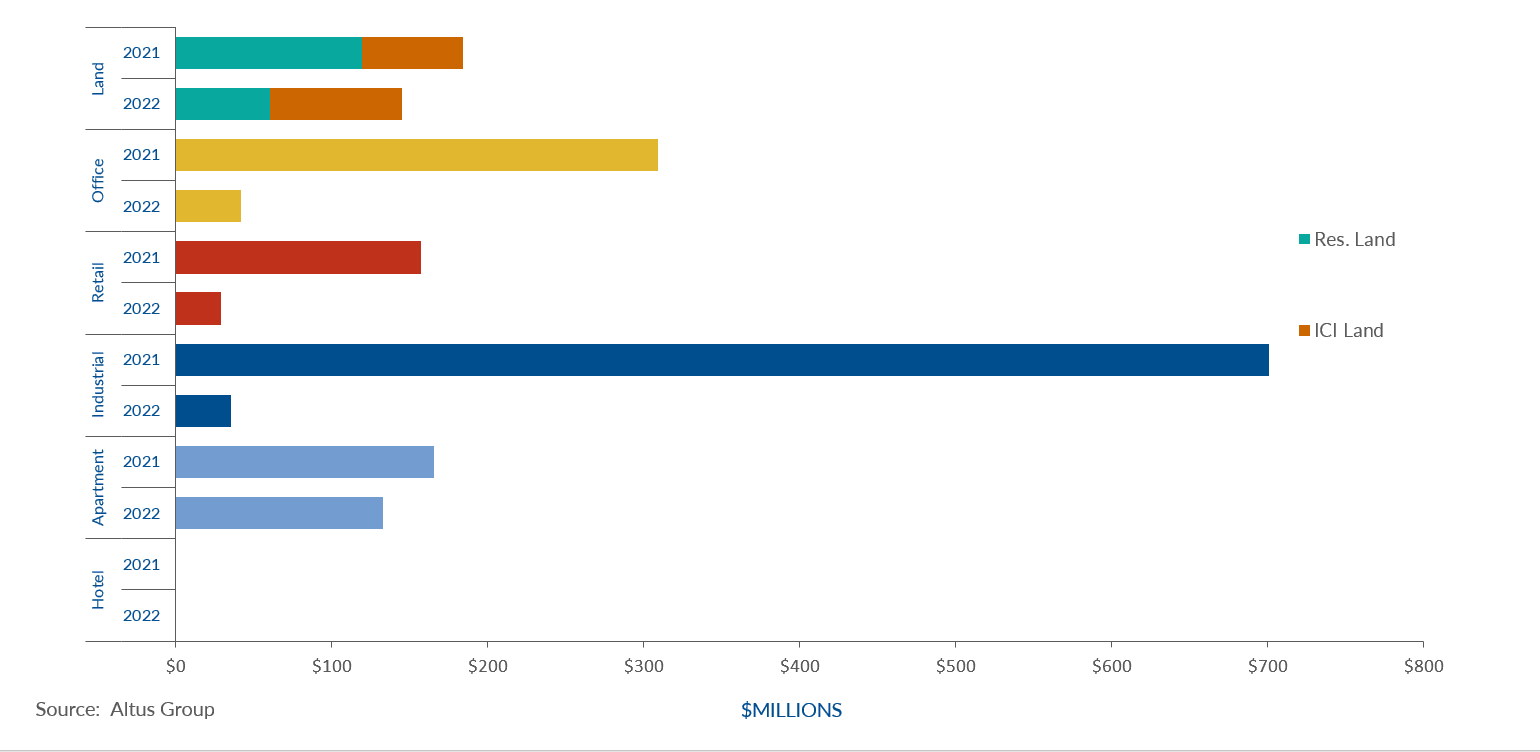

The multi-family sector once again recorded the highest investment volume at $133 million. In addition to strong population growth, as the federal government mandates a permanent hybrid model, many public servants working outside commuting distance have sought apartment housing to move closer to work, specifically suburban multiple-unit residential housing. Investors have anticipated the return-to-office and have chosen to retain their assets, attributed to a minimal 20% decrease in dollar volume year-over-year.

The land sectors (residential and ICI land) remained a popular investment in the Ottawa and Gatineau market. Despite economic uncertainty, investors favoured the ICI land sector's resiliency and reported $85 million in investment dollar volume, up about one-third from last year. The residential land sector contributed another $60 million of investment volume, which was half the level of Q1 2022.

As observed in other markets, return-to-office has stalled. Furthermore, labour disruptions related to the federal government’s approach to mandating return-to-office have resulted in landlords struggling to determine how much office space is appropriate. At the same time, investor optimism related to capitalizing on office acquisitions appears to be waning. To this effect, the office asset class reported $41 million in dollar volume, an 86% decrease from Q1 2022. Additionally, the office availability rate continues to climb upwards to 12.5%.

The industrial asset class reported just $35 million in dollar volume, down by 95% from Q1 2022 due to uncertainty around rising interest and net rental rates. However, demand for modern industrial assets in suburban Ottawa remained strong as new supply contributed to a 1.4% increase in availability rate from 2022. With rising costs and Ottawa’s limited and aging industrial inventory, leasing activity slowed by the end of 2022 and continued into 2023.

Figure 2 - Ottawa market area cap rate trends across 4 benchmark asset classes

Notable Q1 2023 transactions

The following are the notable transactions for Q1 2023 Ottawa commercial real estate market update:

1900 & 2000 City Park Drive – Office

This acquisition consists of a five-storey, 93,381 square-foot office building and the adjacent 3.8 acres of vacant land. It is also part of a long-term development play by Colonnade BridgePort with the subject property near the O-Train’s Blair Station. While a development application has yet to be submitted to the City of Ottawa Planning Committee for review, the property is widely expected to be utilized for high-density residential development.

800 Eagleson Road (Eagle Pointe), Kanata – Apartment

Representing the largest transaction of the first quarter, CAPREIT acquired Eagle Pointe, a newly constructed six-storey apartment building containing 143 units, for $61 million. This luxury apartment building offers units ranging from bachelor to three-bedroom suites, reporting a price per unit of $426,573. This acquisition by CAPREIT is the second newly constructed rental property they have acquired in the Kanata neighbourhood. In May 2022, CAPREIT acquired the stacked townhouse complex KoL Apartments for $43.7 million.

23 Bachman Terrace (Bachman Townhomes), Kanata – Apartment

With a sale price of $14 million, this 23-unit rental townhouse complex located in the Kanata neighbourhood was acquired by an Ottawa-based private investor. Before the sale, the vendor had submitted a Draft Plan of Condominium and a Draft Plan of Subdivision to establish freehold ownership for the 23 units. Upon approval of these applications, the new property owners will be able to sell each unit individually.

3430 Carling Avenue, Nepean – Residential Land

Purchased by Rohit Communities for a total consideration of $8 million, this 1.5-acre high-density residential site is one of three development projects Rohit is currently planning for the City of Ottawa. Before closing this transaction, Rohit submitted a Site Plan Application to the City of Ottawa to develop two six-storey apartment buildings, which would contain a total of 186 units and a gross floor area of 135,580 square feet.

Figure 3 - Ottawa & Gatineau Market Area | Property transactions by asset class (Q1 2022 vs. Q1 2023)

The Ottawa and Gatineau market continued to experience challenges related to rising interest rates and the volatile macroeconomic environment, which started in 2022. As a result, investors approached the start of 2023 with caution. According to Altus Group’s Investment Trends Survey for the first quarter of 2023, Ottawa is the second most preferred market by investors. As the nationwide slowdown in investment activity moves forward, the Ottawa and Gatineau market will continue to grapple with price discovery.

Authors

Jennifer Nhieu

Senior Research Analyst

Stephen Robinson

Team Lead, Market Research

Authors

Jennifer Nhieu

Senior Research Analyst

Stephen Robinson

Team Lead, Market Research

Resources

Latest insights