Gains in office and retail drive further stabilisation in European commercial real estate valuations

Valuations for the European CRE market finally turned a corner towards positive performance in Q3 2024.

Key highlights

All sectors represented in Altus Group’s Pan-European Valuation Dataset recorded valuation increases for Q3 2024, with the lagging European office market moving into positive territory

Retail posted the strongest gains of all the sectors thanks positive performance across all subsectors, with diminished yield effects and strong cash flow

Industrial valuations registered another modest quarterly gain as rather positive cash flow effects were somewhat offset by a drag from yields

Residential valuations continued to stabilise as strong occupancy in key markets supported rental growth

All property valuations show promise in Q3 as offices rebound and retail outperforms

Each quarter, Altus Group analyses the performance of an aggregate dataset of core Pan-European open-ended diversified funds, representing €29 billion in assets under management. The funds cover 17 countries and span the industrial, office, retail and residential property sectors. In this insight, Capital Economics interprets the trends evident in the valuation dataset for Q3 2024 and provides further commentary on the broader European property market.

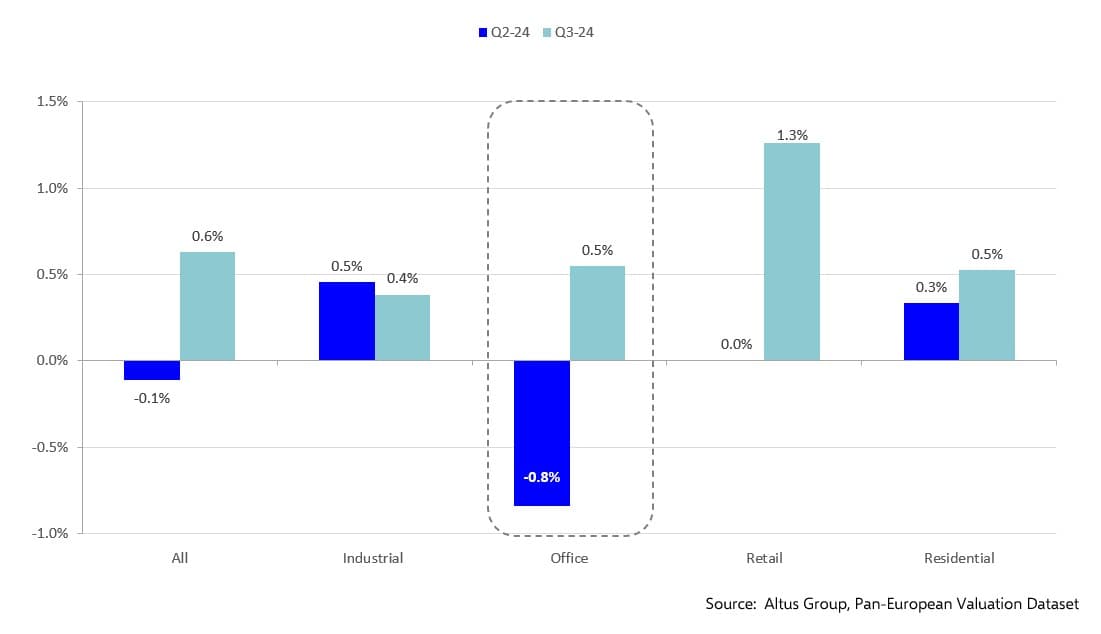

Figure 1 - Quarterly value appreciation by sector

Valuations for the aggregate all property category in Q3 2024 rose 0.6% quarter-on-quarter, supporting the early evidence from Altus Group’s Pan-European dataset in Q2 2024 which indicated that commercial property had stabilised as an investment sector.

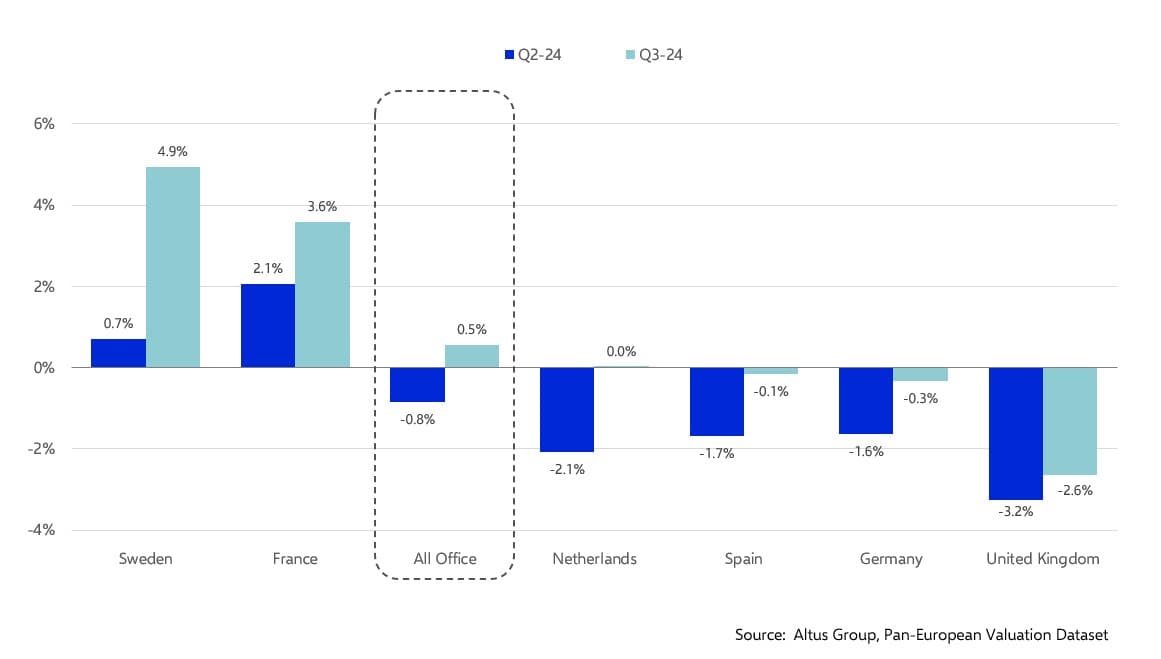

Figure 1 encapsulates the story in Q3. Valuations in office turned positive for the first time since Q2 2022. Retail valuations registered a robust increase while both industrial and residential posted further additional gains in Q3.

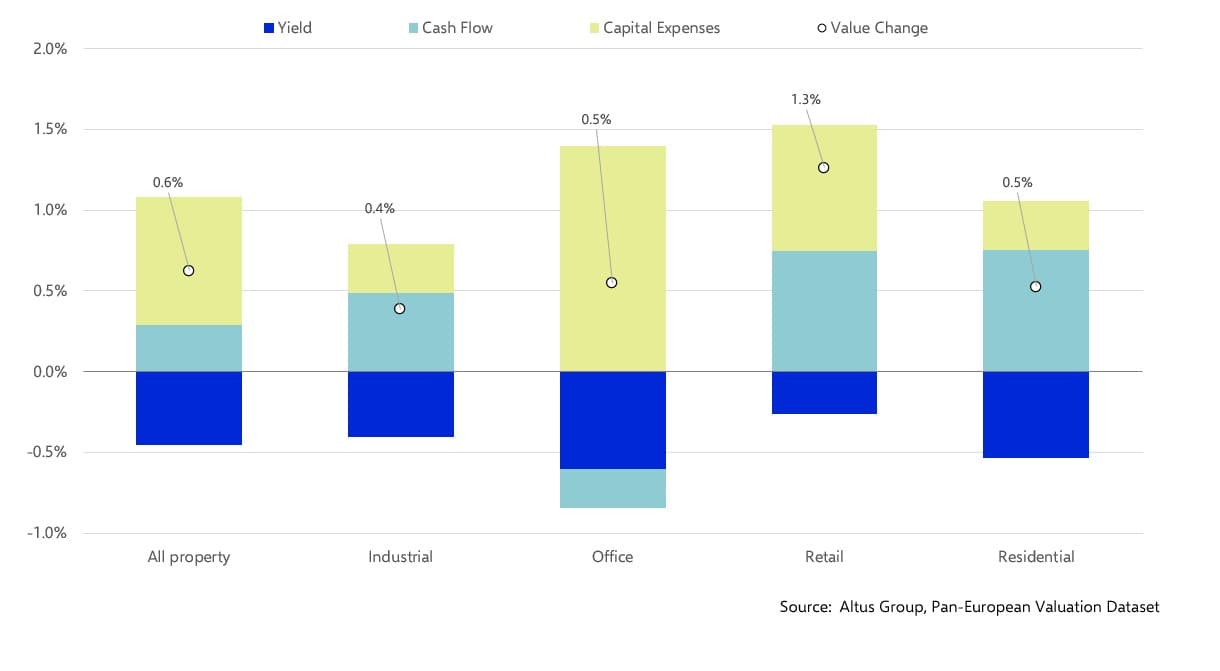

The drivers of valuation performance across the sectors vary somewhat, as illustrated in Figure 2. Across the board, capital expenses were a positive contributor to valuations but were the most important driver of values in the office sector. Yields continued to weigh on values in all sectors, but with widespread consensus that the European Central Bank will lower interest rates further this year, the effect of yields on valuations can be expected to fade further. Cash flow was a positive influence in all sectors except for offices, which Capital Economics attributes to ongoing weakness in occupier demand for space as companies rationalise their requirements.

Figure 2 - Contributions to all property and sector valuations in Q3 2024

Retail outperforms due to stronger than average cash flow impact and lower yield effects

Altus Group’s Pan-European Valuation Dataset indicated that retail valuations overall climbed by 1.3% quarter-on-quarter for the three months ended September 2024, marking the largest sectoral gain registered in Q3. Capital Economics notes that inflation is falling across Europe, allowing consumer purchasing power to rise, which is somewhat contributing to stronger occupier demand in the retail property market. Given the strong increase in nominal wages so far in 2024, it is perhaps surprising that retail performance has not been more robust. Capital Economics points out, however, that consumers in Europe are still saving at relatively high levels, despite higher income growth, which explains why occupier demand has not bounced back to the extent that stronger income growth might support at this point in the cycle.

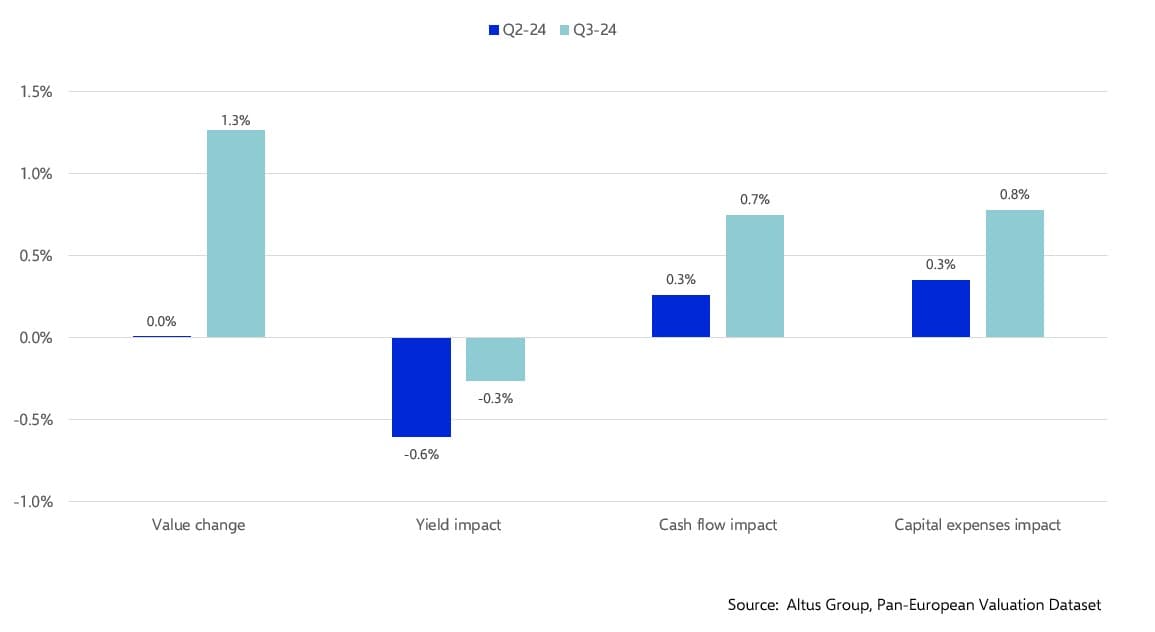

Figure 3 - Quarterly change in retail property values and contributions Q2 2024 and Q3 2024

For further in-depth observations read: Pan European Valuation Dataset – Expert Analysis Q3 2024.

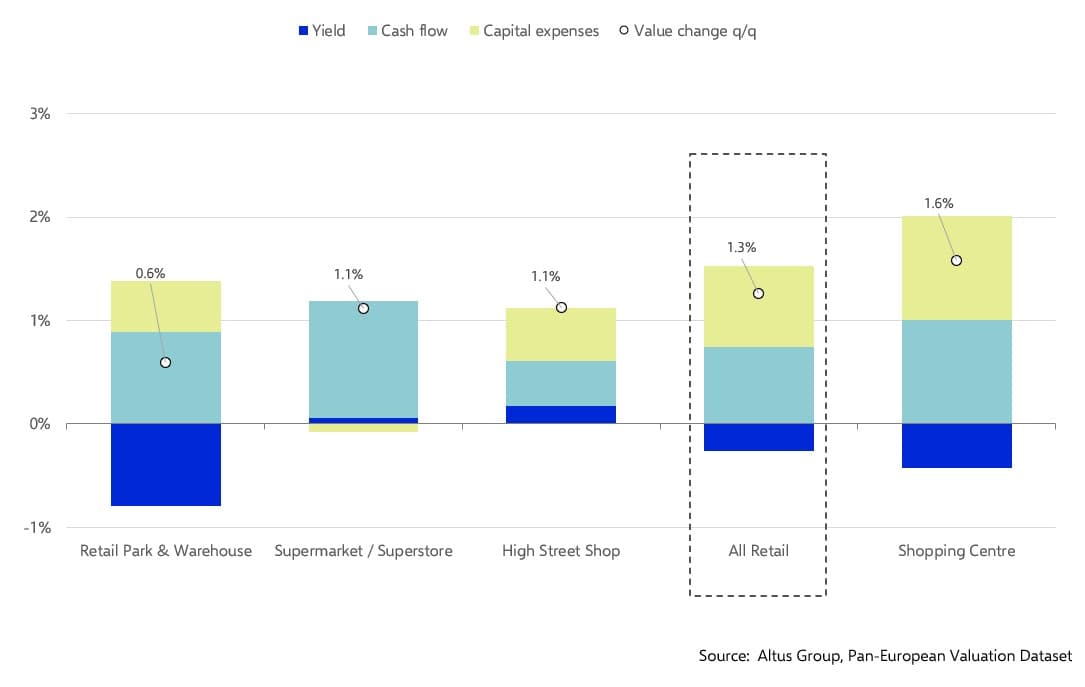

The valuation dataset shows that the performance across the retail subsectors was somewhat more even during the last three months, tying in with what Capital Economics is seeing in terms of the ability of consumers to spend more. The strongest value gain registered in the dataset in Q3 was in the shopping centre category, with an above-average cash flow, a lesser drag from yields and a boost related a lower level of budgeted capital expenditure. The yield impact, however, was still a relatively strong negative influence for retail park & warehouse.

Figure 4 - Contributions to retail valuation by subsector in Q3 2024

The dataset indicated that the cash flow impact was the greatest positive influence on the valuation of supermarket/ superstore, followed by shopping centres, then retail park & warehouse. In all three of these subsectors, the Altus data showed that occupancy improved markedly during Q3.

Capital Economics anticipates that the worst of the pandemic drag on retail arising from competition from online vendors has now passed. The big picture, however, is that the share of online shopping is expected to continue to expand across Europe and the UK, which will continue to weigh on occupier demand, preventing the retail sector from staging as strong of a rebound as might have occurred in the past.

Office valuations turn positive in Q3 but with a mixed set of influences and wide variation in performance at the country level.

The Altus dataset indicated that the office sector, in aggregate, posted a quarter-on-quarter gain of 0.5% in Q3 2024, for the first positive performance since Q2 2022. The investment return on appreciation, when you take into account the amount of capital spending during the quarter, was still technically negative within the office sector.

The key countries represented in the dataset also showed significant variation both in terms of the quarterly change in valuation as well from where the main impacts emerged.

Figure 5 - Quarterly change in office valuations, total and by country

From a country perspective, the Altus dataset signalled that the Q3 gains in both Sweden and France represented the third consecutive rise in quarterly valuations in those two markets. Sweden is somewhat of an anomaly in the dataset since vacancy was extremely high in 2022 and has fallen since that point (though still remains comparatively elevated). This is generally the opposite of the case in most other major European office markets.

Capital Economics notes that France has experienced steady job growth thus far in 2024 as the economy is less vulnerable to remote working than other parts of Europe. Economic growth is diverging across Europe, resulting in less robust employment growth and weaker demand for office space in both Germany and the Netherlands. Spain’s economy has been expanding solidly, though that has not yet shown up in the office sector valuations, which the Altus dataset showed were slightly weaker in Q3 compared to the prior three months.

There are a variety of forces interacting to influence valuations in the UK office market. The dataset points to continued high vacancy rates and further gains in yields in Q3. The Bank of England cut rates by 25 bps at its 7 November meeting, an action which was widely anticipated. That said, the new UK budget, which is certainly designed to promote stronger economic growth in the next few years, includes higher government spending, which will take hold almost immediately, alongside tax increases to close the budget gap, which will take longer to work through the economy.

This combination could cause inflation to rise or, at the very least, keep it from falling further. In Capital Economics’ view, if this turns out to be the case, the pace of future interest rate cuts could slow, causing yields to continue to weigh on UK valuations. This is particularly the case in office markets where there are wide disparities between prime and non-prime space, as well as regional variations in key markets around the country, which may cause a lengthier process of adjustment to a new, lower level of office space around the country.

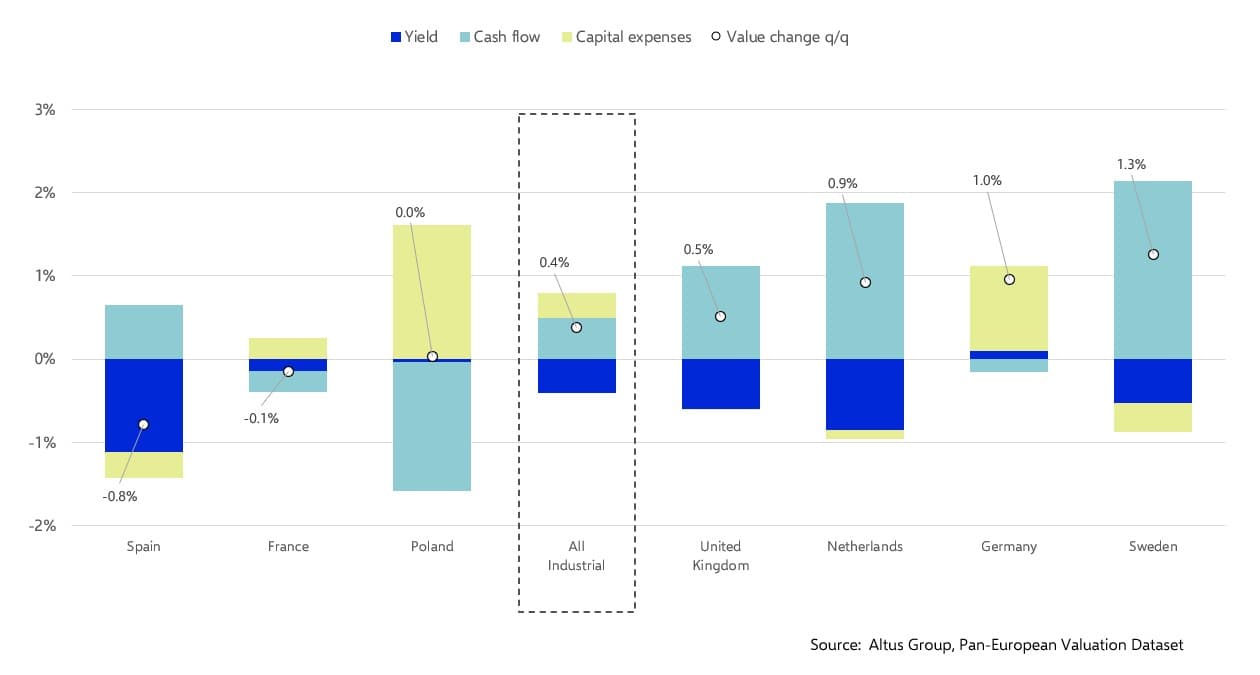

Industrial valuations post another modest quarterly gain as cash flow strength is somewhat offset by a drag from yields. Industrial property in the dataset posted another modest quarter-on-quarter gain in Q3. In aggregate, there was a relative balance between negative yield impact and lower budgeted capital expenses. The gain for the quarter came from rising cash flow, suggesting that the sector’s relatively low vacancy rates are supporting solid rental growth.

Figure 6 - Contributions to industrial valuations in Q3 2024, total and by country

At the country level, the dataset points to cash flow as a generally a positive influence on valuations in Q3, with France, Poland and Germany the notable exceptions to that pattern. Yields exerted a negative influence during Q3 in Spain, UK, Netherlands and Sweden, even though central banks are already reducing rates.

Capital Economics’ view is that the European industrial property market will become more balanced in the near term. The development of new industrial space slowed beginning in Q3 2023 so there is now less new supply coming into the market. Thus, the issue now is how fast individual markets are able to absorb that new space. Industrial property generally benefits from the structural shift to online retail, which will continue to gain share in the future. However, certain markets, such as Poland, are still transitioning to a higher level of online retail which is increasing the demand for space and uptake is not quite keeping pace. German cities are experiencing reductions in their supply pipeline, helping to support valuations. Spain currently has an excess of industrial supply, but demand hasn’t caught up yet. UK industrial is still struggling with an excess of space, which may weigh on rental growth through the rest of 2024.

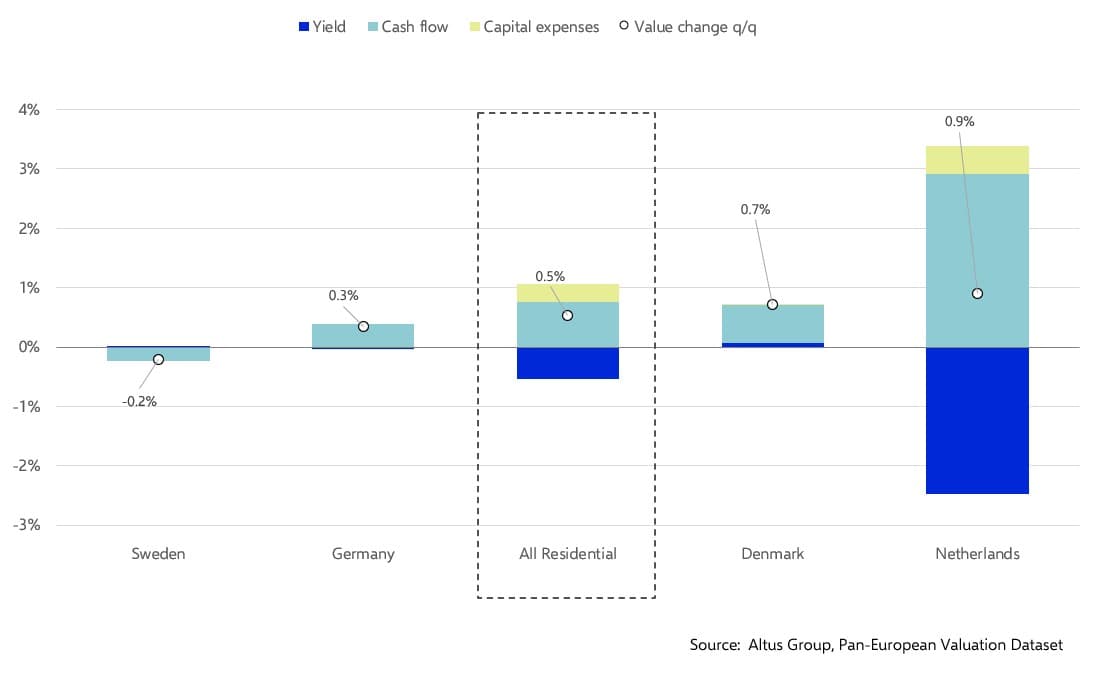

Residential valuations rise due to above average cash flow effect

Values in the residential property sector posted a second consecutive quarter-on-quarter gain in Q3 according to the Altus dataset, pointing to a clear stabilisation of values in the sector.

Figure 7 - Contributions to residential valuations in Q3 2024, total and by country

The primary influence on sector valuations was cash flow, which was positive in all the key markets except Sweden, where there was a marginal decline versus Q2. The Netherlands exhibited the strongest gain in values in Q3, with a strong negative effect from yields which was more than offset by robust cash flow and lower levels of budgeted capital expenses.

Conclusion

Altus Group’s Pan-European Valuation Dataset in Q3 2024 indicated that commercial property, as an investment sector, is slowly starting to turn the corner. Strong gains in retail and a positive result in office sector valuations mark a turning point for commercial real estate in Europe. Wage gains in Europe and UK are likely to support consumer spending on both in person and online retail, which is a positive development for both the retail and industrial sectors. High savings rates among consumers and a relative decline in interest rates may prevent a strong rebound in European and UK commercial real estate, despite more favourable financing conditions and decent economic growth prospects.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Altus Group

Capital Economics

Authors

Altus Group

Capital Economics

Resources

Latest insights