Positive signs beginning to emerge in Europe for CRE investors

Analysis of European markets leveraging Altus Group’s Pan-European Valuation Dataset Trends Analysis - Q2 2024

Key highlights

The Altus Group Pan European Valuation Dataset posted a small decline of –0.06% in valuations in Q2 2024, with positive signs in many sectors outside of the office sector

Industrial sector valuations posted the strongest gain among the sectors where positive contributions from cash flow outweighed the ongoing drag from yields

Although job markets remain relatively tight throughout the region, office vacancy remains stubbornly high except in the most prime locations

Retail sector valuations are improving, driven by outperformance in the retail park and wholesale subsector, and there is potential for higher disposable income growth to boost activity at high street shops and shopping centres

Residential sector valuations rose in Q2 and are likely approaching a bottom since occupancy is rising and the contribution from yields has levelled off

For the latest Pan European Valuation Analysis Headline Trends, click here.

All Property: Major sectors post valuation increases in Q2, except office

Each quarter, Altus Group analyses the performance of an aggregate dataset of core Pan-European open-ended diversified funds, representing €29 billion in assets under management. The funds cover 17 countries and span the industrial, office, retail and residential property sectors. In this insight, Capital Economics interprets the trends evident in the Altus valuation dataset for Q2 2024 and provides further commentary on the broader European property market.

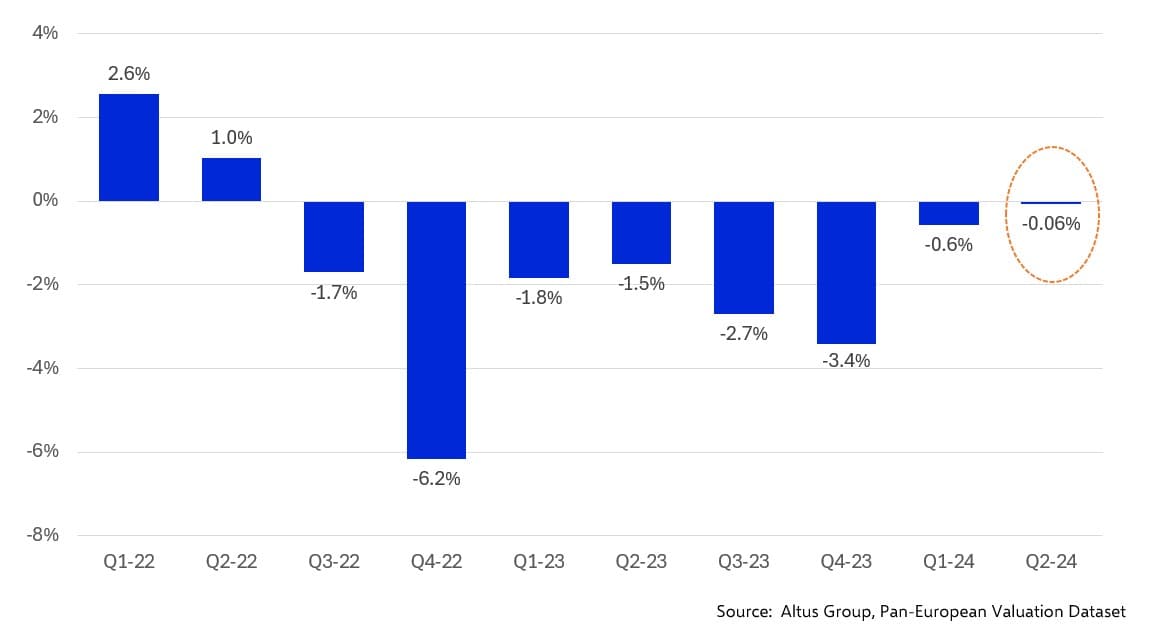

Valuations for the aggregate all property category in Q2 2024 were essentially unchanged compared to Q1, registering a miniscule decline of just -0.06% against the results in Q1. Following on from the smaller write-downs in Q1 all property values, we interpret this as early evidence of stabilisation in commercial property, as an investment sector.

Figure 1 - Quarterly value appreciation – All Property

At the sector level, the dataset showed that industrial was the largest gainer this quarter compared to Q1 2024, with more modest increases posted by residential and retail. Office sector valuations decreased again in Q2, but at -0.8%, this was the smallest write-down for offices since the initial declines began in Q3 2022.

Although the downturn in property values over the last eight quarters has impacted all the sectors, office has been the worst affected given the now well-observed trend in companies contracting for less space than pre-pandemic.

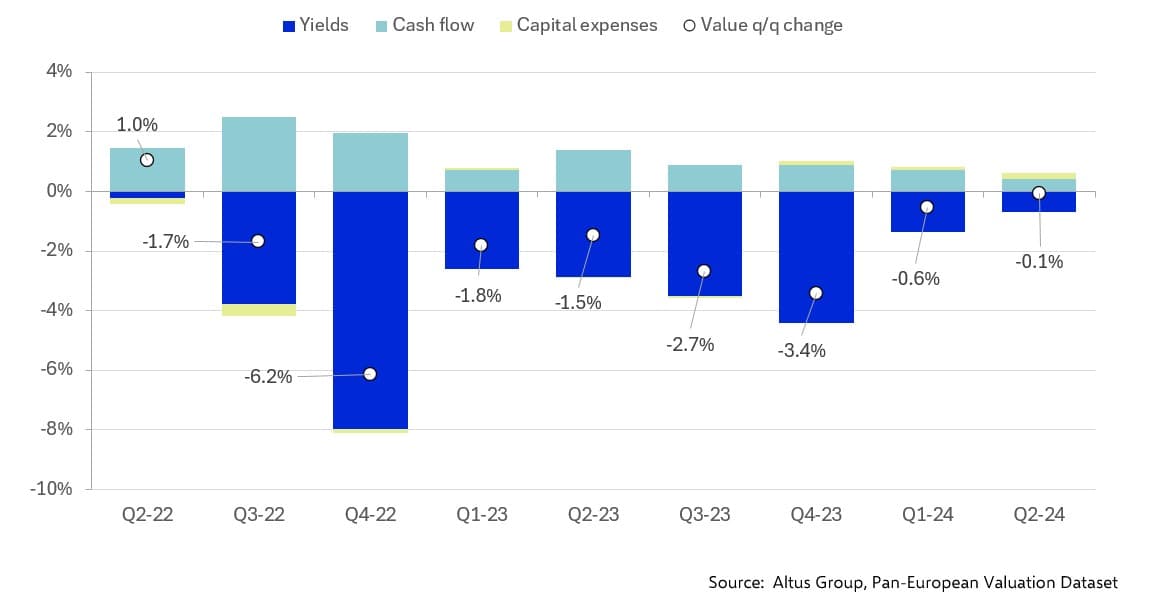

As has been the case since property valuations started posting negative quarter-on-quarter (q/q) results in Q3 2022, yields, once again provided a significant negative impact on the change in valuations across all property, which was not quite offset by positive contributions from cash flow and capital expenses.

Figure 2 - Contribution to the q/q change in value of European commercial property (all property)

The dataset indicates that yields across all property have slowed, which is likely a reflection of investor expectations of the first rate cut by the European Central Bank (ECB) which occurred in June. Capital Economics expects two more rate cuts from the ECB in 2024. While that does fit with the expectations of property investors that rates are more likely to fall than rise going forward, it also means that the pressure from yields will be only gradually reduced.

The dataset indicates that pressure from yields is not affecting all sectors equally. We note that the levelling out of yields evident in the residential sector in Q1 appears to have continued. Although both office and industrial experienced negative pressure from higher yields in Q2, there is some flattening beginning to appear in those sectors as well.

Industrial: Cash flow generally outweighs yield, allowing valuations to increase

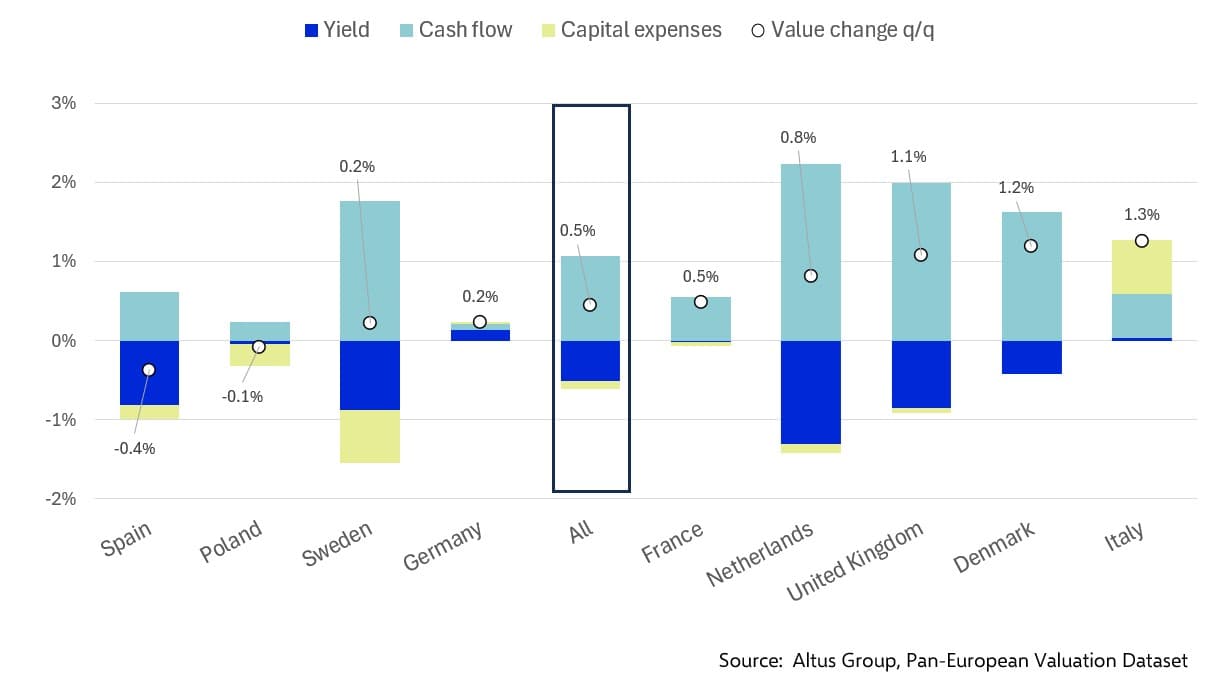

Industrial valuations turned positive in Q2, rising 0.5% q/q versus the first three months of the year. Figure 3 illustrates the impact of yield, cash flow and capital expenses on valuations in Q2.

Figure 3 - Contributions to country industrial sector valuations in Q2 2024

Cash flow has been the largest influence across all countries in the dataset and it has shown to be universally positive as well. Yields are primarily a negative impact while that of capital expenses is very mixed depending on the country.

The industrial sector is strongly tied to the level of online shopping as it promotes demand for warehouses and logistics related to “last mile” delivery. JLL have reported that e-retailer take up is still running about 20% below pre-pandemic averages. However, Capital Economics expect that the underlying trend towards increased online shopping will be supported as wage growth, and by extension, incomes, in Europe continue to rise due to ongoing tightness in labour markets. With inflation also subsiding, and interest rates more likely to fall than rise, consumers will be expected to have more disposable income - another pillar supporting further growth in online sales.

For further in-depth observations read: Pan European Valuation Dataset – Expert Analysis Q2 2024

Office: Stronger jobs growth has not fed through to the demand for space

The office sector was the only major sector to experience a write-down in Q2 2024. Yet, the 0.8% q/q decline is the smallest one registered since office values began falling in Q3 2022. On average, valuations in the sector are still down 20.5% compared to 2021 Q4, which marks an improvement from the eight-quarter peak-to-trough 22.6% decline.

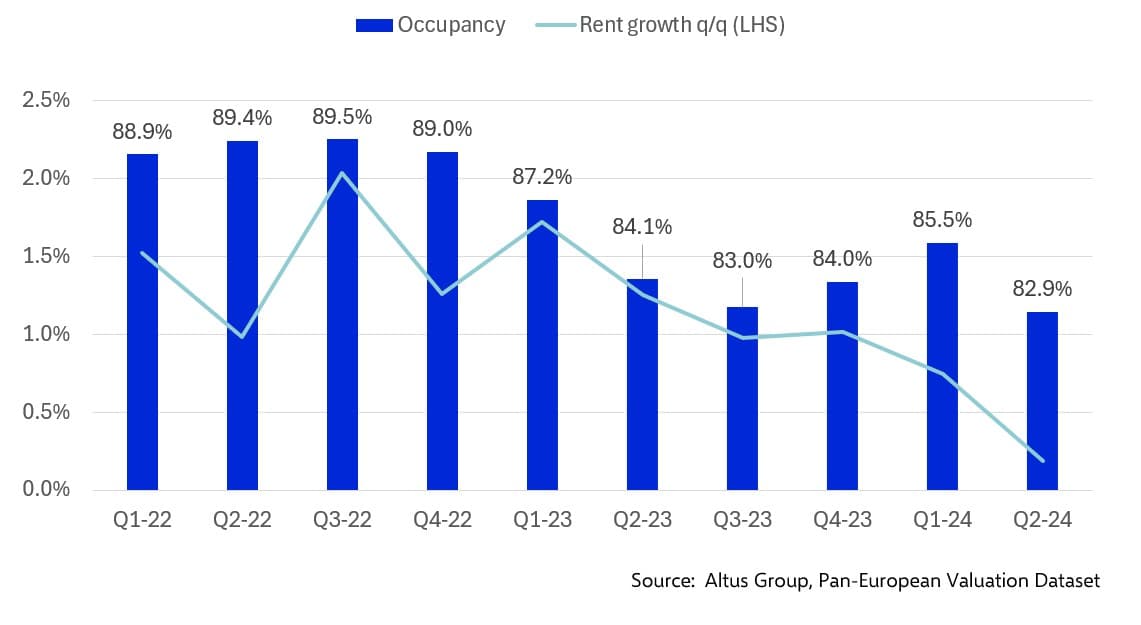

As Figure 4 indicates, the performance of the office sector continues to be weighed down by high vacancy rates – which weakened to a series low in Q2. It therefore comes as no surprise that rent growth has overall been quite modest and increased by just 0.2% in Q2.

Figure 4 - Office occupancy and rent growth, sector average

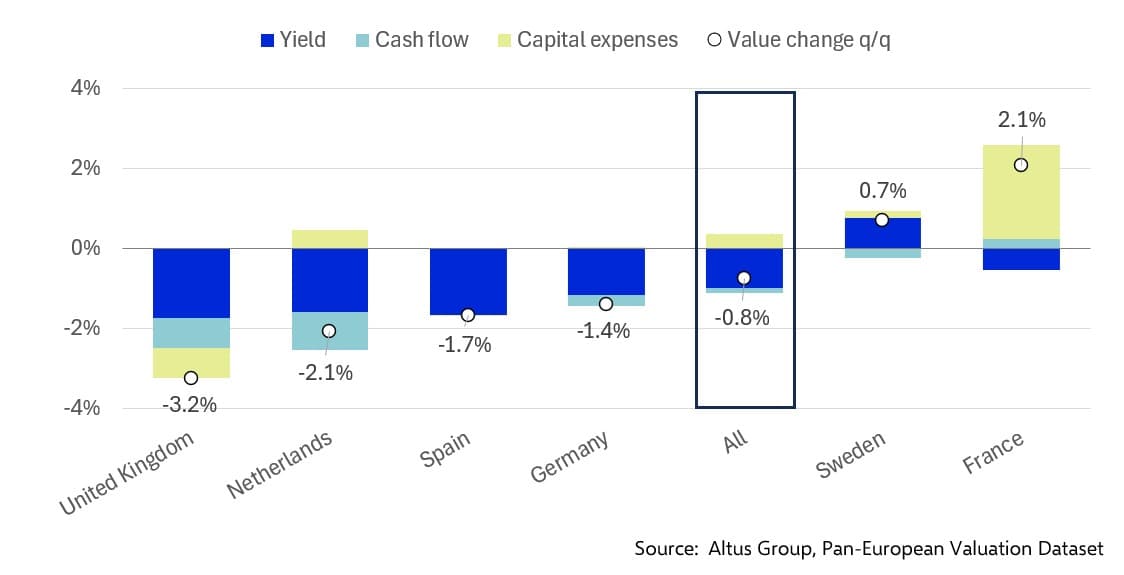

There is some variation in performance across the markets included in the dataset. Figure 5 shows the impact of each of the components of valuation for the countries represented in the Altus dataset.

Figure 5 - Contributions to country office sector valuations in Q2 2024

The Altus valuation data for Q2 indicates that French offices were the best performer, driven by an outsized influence from capital expenses. In Sweden, yields were a positive impact on value, whereas the rest of the countries in the dataset experienced negative pressure from yields and further write-downs this quarter.

Capital Economics notes that France has been one of the economies with the strongest jobs growth in the euro-zone this year. Since remote working in France is less widespread, the demand for office space has held up better than in some other economies.

In Sweden, the Riksbank cut rates by 25 basis points back in May, earlier than the ECB in June, which could be a reason for the more positive response in valuations. However, this positive performance may not last as we expect the supply of office space in Stockholm, in particular, to be well above the 10-year average in 2024, after being somewhat undersupplied in 2023.

The lower valuations in German offices reflects what Capital Economics see as much weaker occupier demand prospects than in most of the euro-zone. Office-based jobs growth in Germany has ground to a halt. For major cities, the issue comes down to the supply pipeline. Hamburg and Munich have fewer completions coming to market so rents there should do better than in Berlin, where there is a lot of new space becoming available at the same time that the tech sector is still shedding space.

In Spain, employment growth overall has been among the strongest in the euro-zone. Although this does not appear to have yet taken hold in the data through to Q2 2024, we believe that robust jobs growth, combined with a smaller rise in remote working should help support demand for office space for the rest of the year.

UK offices posted the strongest write-down in Q2. Remote working continues to depress the demand for space and Capital Economics sees a good deal of disparity in demand around the country. Central London continues to have extremely high vacancy rates, with prime locations much more in demand than older buildings. This is similar to the experience of other major European cities as well. Though companies are beginning to upgrade space, in Q2 this does not appear to have been enough to keep valuations in the UK from falling further.

Retail: A small gain in values belies strong disparities in subsectors

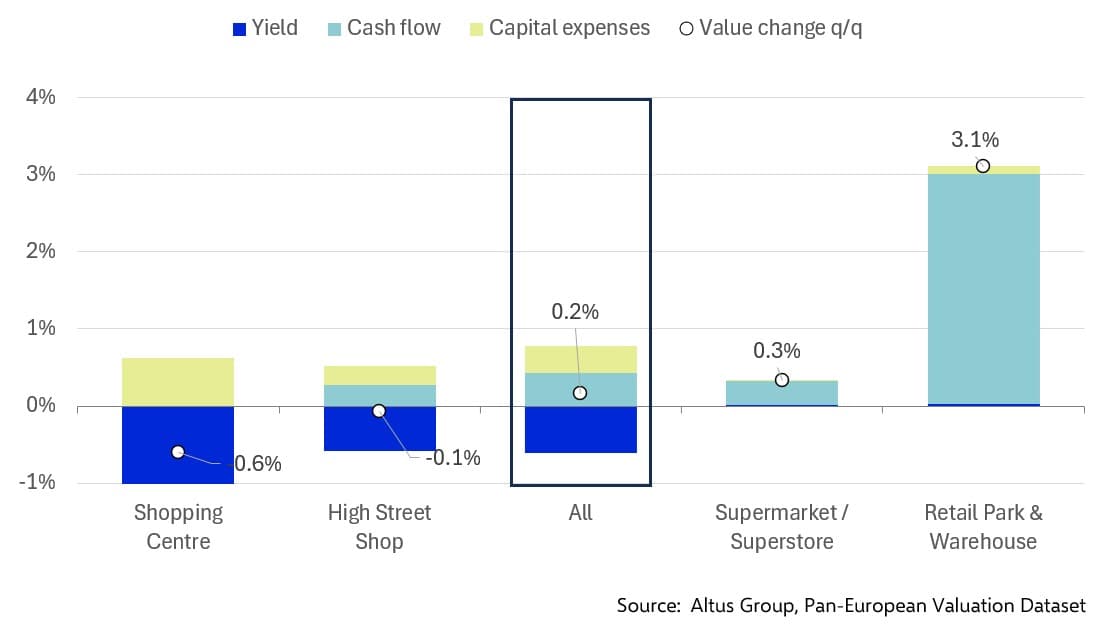

Valuations in the retail sector posted a 0.2% q/q increase, after registering a decline of 0.8% in the prior three months. As can be seen in Figure 6, the average outturn of the sector as a whole masks rather significant differences across the subsectors.

Figure 6 - Contributions to retail subsector valuations in Q2 2024

Shopping centres and high street shops continued to see yields drag on their valuations. There was little negative pressure on either supermarket/superstore or retail park and warehouse as cash flow was the primary influence for those latter two categories. Generally, capital expenses helped preserve value across the subsectors but had the most positive influence on shopping centres and high street shops.

The valuations in the subsectors have also evolved differently since tracking began in Q4 2021. The retail park and warehouse sector has held its value best, followed by the supermarket/superstore subsector. We see this as consistent with the nature of these types of properties. Supermarkets sell the necessities of daily life so should remain valuable unless an area is suffering from a high level of outmigration. Retail parks and warehouse space are chosen for their favourable location for logistics purposes so should, in theory, hold their value well.

The retail subsectors exposed to more cyclical economic factors, namely high street shops and shopping centres, have seen valuations continue to deteriorate. High street shops have the added problem of having to compete with online retailers for customer patronage, so it is not surprising that their valuations have declined the most since the end of 2021.

Retail park and warehouse, where value has held up the best, has seen rents increase steadily. High street shops, which also registered solid rent increases throughout 2023 and early 2024, experienced a slight decrease in rents in Q2. There appears, however, to be a modest recovery in occupancy at high street shops and shopping centres. Thus, going forward, an increase in rent growth could be possible in these subsectors, since, according to Capital Economics, consumer spending is set to be a stronger driver of economic growth in Europe later this year and in 2025.

Residential: Valuations appear to have stabilised

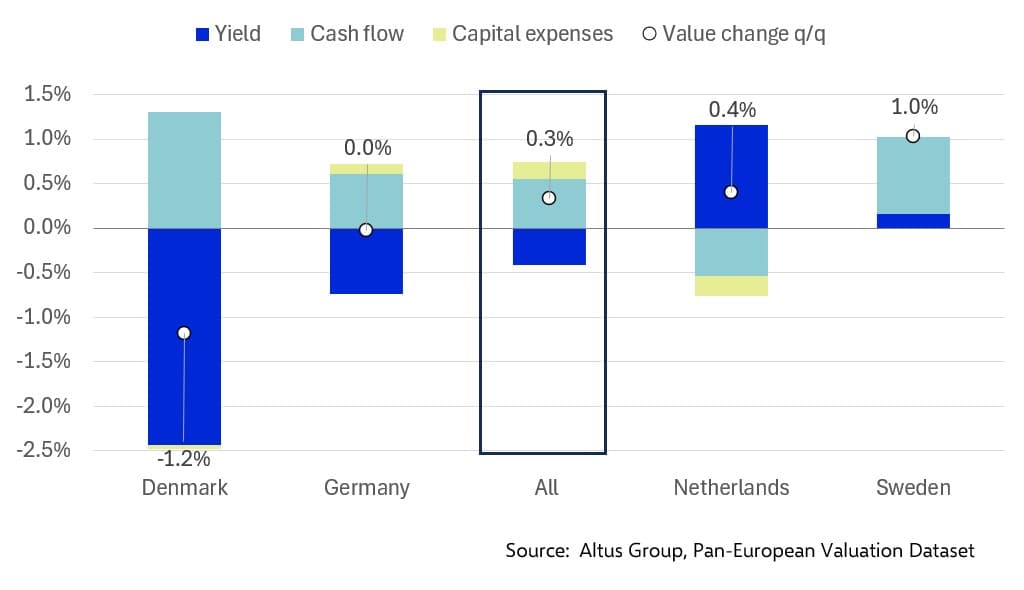

After posting a small decline of 0.3% q/q in Q1, residential valuations within the dataset have reversed and posted a small increase of 0.3% in Q2. There are relatively large differences across the markets included in the Altus dataset as shown in Figure 7.

Figure 7 - Contributions to country residential valuations in Q2 2024

Yields had a negative influence in both Denmark and Germany but were positive in the case of both Netherlands and Sweden. Cash flow had a positive impact in Denmark, Germany and Sweden but was a drag on values in Netherlands. Capital expenses helped offset yield declines in Germany but were modestly negative factors in Denmark and Netherlands.

Looking at valuations for the countries over the ten quarters, Capital Economics sees some evidence that the sector has reached a bottom. Valuations in Germany were unchanged in Q2 compared to Q1 whereas in the Netherlands, values rose once again. This could potentially signal a reversal is in progress in these two countries. In Denmark, however, it is difficult to call the bottom since values dropped in Q2 after increasing in Q1. In Sweden, residential property valuations rose in both quarters thus far in 2024.

The Altus data also shows that rent growth decelerated between Q2 2023 and Q1 2024, while, at the same time, occupancy was improving. Then, in Q2, rent growth rebounded to post an increase compared to the first quarter of the year. Capital Economics views this as further evidence of the potential bottoming out of valuations in the residential sector overall.

Conclusions

Altus Group’s Pan-European Valuation Dataset for Q2 2024 has indicated broadly positive news for investors in commercial property, with the office sector still lagging in terms of performance. Economic conditions in Europe appear to be improving, with inflation subsiding and allowing for the prospect of further interest rate cuts this year and into 2025. In addition, jobs growth remains robust in much of the region, which is supporting the outlook for industrial and retail property. That said, the tech sector is still shedding jobs and remote working remains a significant factor in many markets which is limiting the potential improvement in the office sector.

About Capital Economics:

Capital Economics is a world-leading provider of independent economic insight enabling to make better investment decisions that deliver sustainable value. Our team of 70+ experienced economists provides award-winning macroeconomic, financial market and sectoral analysis, forecasts and consultancy to serve our diverse global client base.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Altus Group

Capital Economics

Authors

Altus Group

Capital Economics

Resources

Latest insights