Part 5 - Property development finance - How to secure funding for your project

In part 5 of the property development feasibility series, learn how to navigate the complexities of securing financing for your next development project.

Overview

Access to development funding is an integral part of the property development process. But capital is not always easy to secure. The world of development project finance is changing rapidly. Evolving financial markets, shifting public policy priorities, are all influencing the products and strategies needed to bring development dreams to life.

Depending on the environment you are operating in, development loans can be harder to secure, and they are getting more expensive and restrictive. At the same time, pre-sales could also be harder to secure in some places, and certain developers are adapting to a build-to-hold investment model.

When developers are looking to longer-term investors, like debt funds and equity partners, these lenders require greater transparency and accountability during development and operational management.

To compete for cash with lenders, developers must learn the language of investment management. But demonstrating financial discipline is increasingly difficult to do with simple spreadsheets.

Financial structuring of a real estate development

Initiating a real estate development is similar to starting a new business from scratch. It’s unlike purchasing a stock on the stock market that pays immediate dividends or even a property that’s fully built with a tenant and revenue already in place.

Developing a commercial real estate property means putting up a lot of money for purchasing land, building the property, and then maintaining the property until stabilization.

Depending on the size of the property, the complexity of the development, how speculative the development is, and numerous other factors, this can be an extremely long and risky endeavor. Developers need sources of both debt and equity financing that are tolerant of this risk in order to fund the project.

The capital stack

The two main types of private financing a developer can obtain are debt and equity. Debt is usually provided by a lender, such as a bank or other institutional investor. Equity can be provided by any number of parties, from large institutions to private family offices or even individuals. And within each of the debt and equity categories are subcategories of each, such as senior or mezzanine capital for debt. Equity can be a mix of preferred or common equity.

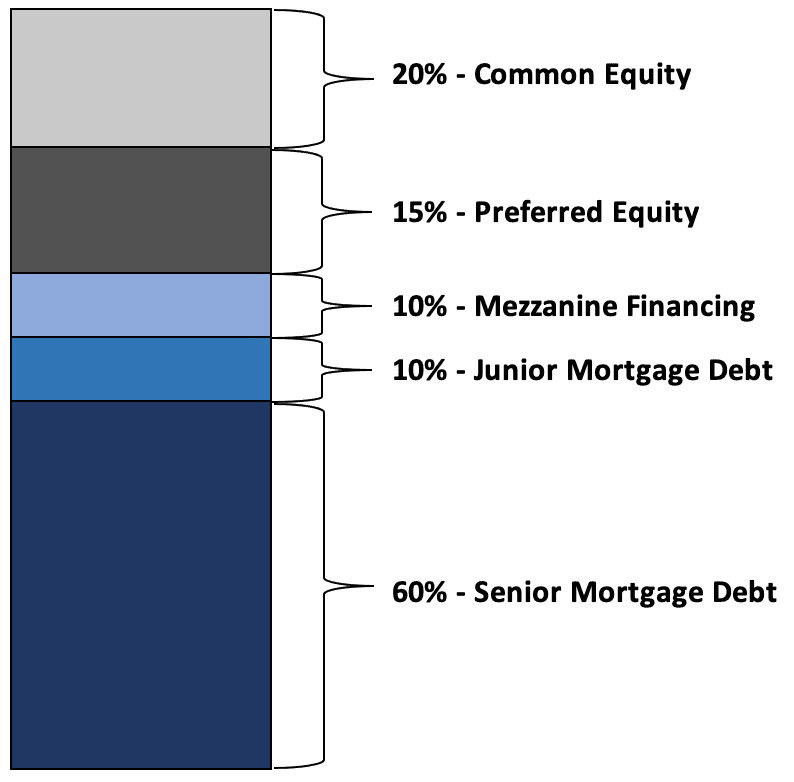

The combination of all of the different types of financing for a commercial real estate development is commonly known as the “capital stack” and provides a representation of not only how much of each type of financing is provided, but also the order of precedence each type takes in the project. The image below is a visual representation of the capital stack.

Figure 1 - Visual representation of the capital stack

The percentage split between the different types of capital is often very flexible and not every project will have every type of capital involved. Some projects may even have other types of financing, such as government grants, as part of the capital stack.

The order of precedence in the capital stack goes from bottom to top, as does the level of risk for each type of capital. Senior debt has the highest priority of cash flows of all the types of capital and common equity has the lowest priority of cash flow. The flipside to the priority in cash flow is the potential return.

Senior debt charges an interest rate, either fixed or floating, but the return to the lender is limited to the rate of the interest charged. Common equity, on the other hand, has almost unlimited potential in the level of return it can earn. As you move up the capital stack from senior mortgage debt to junior mortgage debt, etc., each type of capital bears more risk and more potential return. The capital providers who are exposed to the lowest levels of risk are also limited in their return.

The types of financing

Senior mortgage debt

Senior mortgage debt is often provided by institutional lenders (large banks or pension funds, for example) and typically makes up the bulk of the capital for commercial real estate developments.

The lender charges some form of interest rate on the funds provided, either in the form of a fixed interest rate or a floating interest rate. In the capital stack shown above, the senior lender is providing 60% of the capital needed for the development of the project.

Again, keep in mind that these percentages are used as an example only and most projects will have different percentage splits between the capital types.

Senior debt is secured by a deed of trust on the property, meaning the lender can foreclose and take ownership of the property in the event that the owner/sponsor fails to keep the debt in good standing. This means that the lender has the ability to take back ownership of the property and then either sell the property or the loan to recoup as much of their capital as possible, ultimately lowering the risk exposure of the senior lender.

Junior mortgage debt

Junior mortgage debt is simply a smaller loan that sits above the senior loan in the capital stack. Some projects will have junior mortgage debt and some will not. The big difference between senior and junior mortgage debt is that the junior debt has a lower priority on cash flows than senior debt (though still higher in precedence than equity) and charges a slightly higher interest rate on the capital provided.

Many times, the capital above the senior loan will come in the form of mezzanine debt or preferred equity instead of a junior mortgage loan (discussed below), but often serve the same purpose of bridging the gap between the amount of common equity needed and the amount of debt provided by the senior lender.

Mezzanine financing

Mezzanine financing sits in the middle of the capital stack between debt and equity capital and can take on the form of either type of capital. If the mezzanine financing for a property is structured more as a type of debt, it charges a higher rate of interest than the senior mortgage loan. If structured as equity, it can take the form of a preferred equity stake. Mezzanine capital has lower priority to cash flows and has more limited rights of foreclosure than does the senior lender.

If structured as equity, it can take the form of a preferred equity stake (discussed below). Mezzanine capital has lower priority to cash flows and has more limited rights of foreclosure than does the senior lender. Mezzanine providers enter into agreements with the senior mortgage lender, called “Intercreditor Agreements,” that lay out the options provided to the mezzanine lender in the event of a default by the borrower.

Preferred equity

Preferred equity is a unique type of capital, offering some characteristics of debt and some of equity. Preferred equity has a required rate of return and also typically shares in the upside of the returns of the property.

For example, the preferred equity agreement could call for the preferred equity provider to receive a 7% return before any cash flow is provided to the common equity holders. The preferred equity holder then can receive a portion of any upside the property achieves beyond the 7% required rate of return.

Common equity

Common equity is the last in line in the capital stack. The common equity is usually provided by two parties: a General Partner and Limited Partner(s).

The General Partner (GP) in a project is an active partner, handling the day-to-day operations of the development, such as identification and acquisition of the property, development and construction, lease-up (or sale), and operational aspects of the property once the development is completed. The Limited Partner(s), also known as “LP’s,” are usually passive investors in the project.

Comparison of debt and equity

There are many factors that need to be considered when determining how to structure the capital stack for a commercial real estate development. In reality, most projects do not include all of the types of financing described above. It’s not uncommon for a project to have only senior debt and common equity, or perhaps a piece of mezzanine capital as well.

Each project will be structured differently and should be based on the specific characteristics of the project and the parties involved. Also, the terms and conditions of each type of financing will play a major role in determining which type of financing is right for each project.

Often the owners/sponsors of the project will choose to pursue capital in the middle of the stack, such as mezzanine or preferred equity, as a result of a lack of sufficient equity capital on the part of the General Partner or simply a result of trying to receive a higher return by placing more leverage on the project.

However, higher leverage could increase the risk of default and completely wipe out any equity component along the way. Structuring the capital stack should be based on a holistic analysis of the project, the parties, the market, and the risk tolerances of all players. Also, a deep understanding of the strategic role each type of financing can play in the success of the project is essential.

The nuts and bolts of development finance

If you’re not familiar with the complexities of finance, sometimes sourcing the right funding can be a confusing process.

Development finance differs from ordinary investment finance, as you can usually borrow the ongoing interest as part of your finance package. This means you don’t pay interest during the construction phase, but the interest is added to the amount you owe at the end of each month.

At no stage will the bank allow you to exceed the total loan amount, and the interest is capitalised, so you pay interest on the interest . It is only when you begin marketing and selling your project that you commence repayments. This makes development finance a riskier proposition for lenders.

There are several types of loans that are designed to suit various project stages. These include:

Acquisition: This covers the purchase, development application and pre-construction costs

Construction: This loan typically gives you access to staged payments at each stage of a construction project, from slab to completion

Investment: This loan is used if you are retaining your development as a long-term investment.

Looking at your loan-to-value ratio

How much it costs to develop a property can vary dramatically depending on your goals. But how much you can borrow is underpinned by a fixed formula. The amount you can borrow is known as the loan-to-value ratio or LVR.

LVR = Loan amount / Purchase price (or valuation of the property)

LVRs employed by lenders can fluctuate depending on market conditions and risk appetite. Generally, a lower LVR means you'll need to contribute more equity to secure a loan for your development project.

That means, depending on the project and the lender, you may be required to provide a significant portion of the equity yourself. Every lender will have its own criteria, terms, and conditions, but when calculating how much finance you will need, consider:

Total build costs

Solicitors and legal fees

Agency and marketing fees

Contingency costs

Completion fees

Brokerage and loan fees

Two questions to secure your development loan

Risk-shy lenders will expect you to answer two important questions:

Can I repay my loan?

Is my development viable?

Providing documentation to prove yourself to your potential lender is not always easy. The application process for large projects can take weeks and even months. Lenders will be looking at everything from your reputation and your track record to your feasibility study and financials. Here are just some of the key pieces of information to consider:

Project information: Include a comprehensive site description, zoning and concept design

Cash flow feasibility: Provide a full breakdown of your costs, from acquisition to sales, taxation to professional services. Lenders will check and challenge all your assumptions. Do the revenue, time and cost numbers stack up?

Equity: Show evidence of sufficient cash or equity; the less equity you have, the higher the interest rate is likely to be.

Presales: Most large projects are dependent on pre-sales to minimise the lender’s risk. This means a percentage of the development is pre-sold – sometimes as much as 60% – before the project can break ground. The funds from pre-sales can’t be used to fund your development and must remain in the trust.

Credentials: Provide proof that your project team, builder and professional services are up to the task.

Contingency: Demonstrate your capacity to meet cost overruns, regardless of water-tight contracts. Typically, 5-10% of your budget should be allocated to cover additional or unexpected costs during the construction project. Most lenders will expect proof of budget and cash controls and reassurance that you can cope with any budget blowouts.

Operating income: Forecast realistic operational revenues and costs to generate a total return if your model is a build-to-rent opportunity.

Security: Provide evidence that your projected returns meet market expectations. Lenders will want assurance they can get a return on their investment even if they must hold a fire sale.

Progress reports: Show progress reports from your builder or project manager and updates to cash flow forecasts, financial projections or feasibility studies based on delays, budget blowouts or movements in the market.

Continue reading the next instalment: Property development feasibility series part 6 – Our guide to highest and best use in real estate

Set your development feasibility up for success with ARGUS EstateMaster

Risk-averse lenders expect more than a back-of-the-envelope calculation or a few spreadsheets. They expect trustworthy and transparent financial models so they can do their due diligence.

ARGUS EstateMaster is an industry-standard for financial modelling, which can be applied throughout the development lifecycle. Feasibility studies can be shared with potential lenders, and underlying assumptions can be tested, offering full transparency behind every report.

Once you input your costs and revenues, you can calculate key performance indicators, including residual land value, development margin and profit, net present value and internal rate of return to help you evaluate development opportunities.

Author

Lionel Newcombe

Real Estate Solution Expert

Author

Lionel Newcombe

Real Estate Solution Expert

Resources

More on development feasibility

Jan 8, 2025

Part 4 - The trade-off between development feasibility software and spreadsheets