Key highlights

Commercial real estate reflects the economy. Both a consumable and investable asset, commercial real estate is a significant contributor to and is inseparable from the economy and financial markets with which it is intertwined.

What's distinctive about late 2022 is that many risks are present at the same time. In more "ordinary" times, a few risks might be in play, but it is rare to have so many risks present at once.

For private market commercial real estate assets, there are at least two logical reasons why the risk-repricing transmission seen across other more liquid assets has been slower: leases and lags.

The economy and commercial real estate

Commercial real estate reflects the economy. Both a consumable and investable asset, commercial real estate is a significant contributor to and is inseparable from the economy and financial markets with which it is intertwined. Because of this interconnectedness, understanding the surrounding economy is important to understand commercial real estate.

Pockets of strength still persist for the US economy, such as high employment and resilient consumer spending, and compared to many other countries and regions of the world, the US is in a much stronger position.

Still, US consumer and business sentiment continues to sour and many leading indicators suggest weakness ahead -- very likely a recession. Continued monetary tightening and higher costs of capital threaten to slow or stall the future growth.

Forecasting a recession with any precision, such as how long it will last or how much economic output will contract, remains a guessing game. Nevertheless, the current environment, with all the many risks weighing on the economy, points to a macroeconomic slowdown.

The same dynamic is in play for commercial real estate sectors, with development, investment sales and leasing either slowing down slightly in real terms or seeing a slowdown in previously robust growth. Even the two hottest sectors since the onset of the pandemic, industrial and multifamily, are experiencing slower deal volumes and flattening forward expectations for rent growth.

Risks abound

Inflation and tech layoffs might be grabbing the headlines, but those are only part of the big picture. The US economy is currently exposed to many risks, some of which are typical and others are rare -- or at least less common risks that come along only a few times across the decades.

More “typical” risks include business, financial/market, and economic risks. While these are near impossible to forecast with great accuracy, their impact on business is more easily understood, and prepared for, at least among prudent investors.

Even less predictable are the ”abnormal” risks, including geopolitical, pandemic, and climate risk. These risks are arguably less studied (at least through a financial market perspective), and therefore are even more uncertain.

There are many risks, though different risks tend to come to the surface and be elevated at different times. What's distinctive about late 2022 is that many of these risks are present at the same time.

Spotting the risks is straightforward, however, interpreting the impact of the risks is much more difficult

Impact of high interest rates on risk assets

Financial markets price risk on a relative basis. The price of risk assets significantly shifted since the Federal Reserve started raising interest rates to cool high inflation.

Late November 2022, market yield on the 10-year US Treasury securities (considered a risk-free asset) was 3.76%, up more than 2.25x from the start of the year, when it was about 1.63%. The repricing of risk-free assets flowed through all risk asset markets driving costs of financing higher and valuations down. The more liquid markets showed the impact first. During the same period, US broad market equity indices fell more than 18%.

However, commercial real estate pricing seemed to be less affected.

If the economy and commercial real estate are so interconnected and the economic outlook has soured on so many present risks, why haven’t commercial real estate prices changed significantly like other assets?

For private market commercial real estate assets, there are at least two logical reasons why the risk-repricing transmission seen across other more liquid assets has been slower: leases and lags.

Leases and lags

Insulating leases

Leases are contractual agreements that protect cash flows from market volatility. With the exception of hospitality properties, whose leases run a matter of days, leases across commercial real estate tend to be measured in years.

Running a quick analysis of Altus data, we can show the typical lease terms across the main commercial real estate property types.

The longer-term remaining lease term across many property types helps to remove some cash flow uncertainty, ultimately helping to insulate property values from market risks and uncertainty in the economic environment.

Cumulative lags

The “lags” that affect commercial real estate are largely twofold:

Transaction lags

Data lags

First, transaction speeds differ across asset classes. For many asset classes in capital markets, units of time are measured in small intervals (i.e., seconds, minutes, hours). Examples of these faster-moving, often liquid, segments of the market include: stocks, bonds, and currency.

However, there are other asset classes, which are much slower moving. These segments of the market often measure time in larger units (i.e., days, weeks, months). Examples of these slower-moving, often less liquid, segments of the market include: venture capital, private equity, infrastructure, real estate.

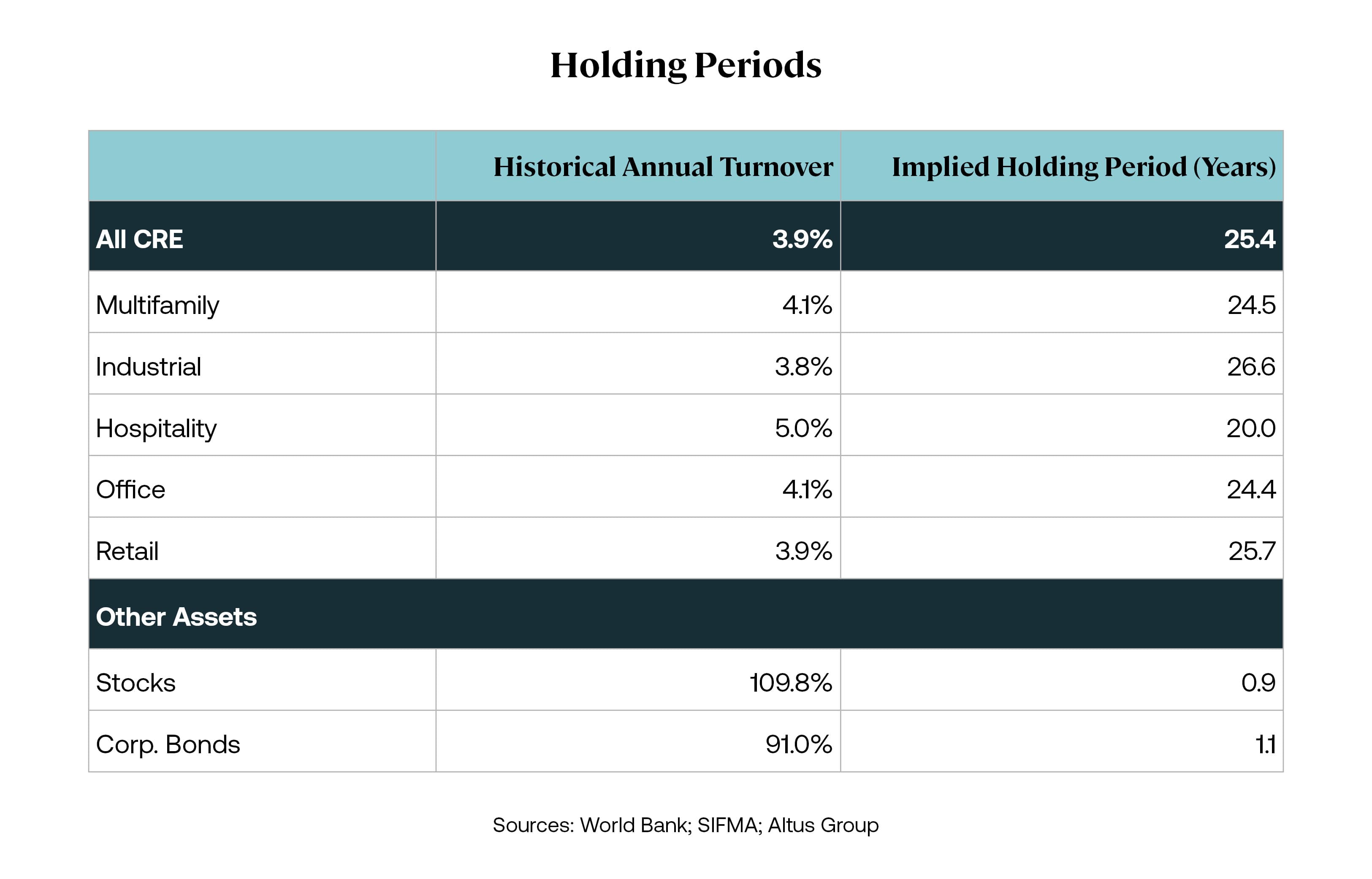

A major determinant of the “speed” of these markets is the time it takes to transact. It takes significantly less time to transact in the faster-moving segments of the markets than it does in slower-moving segments. As a result, the faster-moving segments tend to also have shorter holding periods than the slower-moving segments.

While an investor might be able to buy and sell stock or bonds in a single day, the same is not true for commercial real estate. From due diligence to negotiation, securing financing to closing – commercial real estate transactions often take months to complete.

These differences in transaction speeds are also reflected in the different holding periods for stocks/bonds and commercial real estate. For example, the average holding period for stocks/bonds is around 1 year, 11 months for stocks and 13 months for bonds. However, for commercial real estate, the average holding period is 25 years.

Second, aggregating data is slower in non-centralized markets.

No matter the segment of the market, it also takes time to collect, clean and interpret data. However, in the more centralized and standardized asset classes and segments of the capital markets, this process can be significantly faster. Public markets tend to have a greater degree of centralization (e.g., exchanges) and standardization (e.g., reporting, security agreement terms) than the private markets.

The vast majority of commercial real estate in the US is privately-owned, as opposed to being owned by a publicly traded REIT. This means that it is in the private markets, where there is no centralized exchange on which transactions take place and no standardized reporting. As a result, aggregated data is often published on a less frequent (often quarterly) and more delayed (often weeks after period end) schedule.

Taken together, these lags can accumulate and contribute to explaining some of the difference between what broad financial markets are experiencing and what is being reflected in the commercial real estate markets. These are two areas worth keeping in mind, as the macro economic situation evolves. Though they may slow the transmission of negative price changes, they are unlikely to fully offset the downward pressures.

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights