Almost everyone has bought a home or is familiar with the process. One of the first questions people often ask is, “What is it worth?” In the residential world, this question can be answered by looking at sales or listings of similar homes in the same geographic area to determine comparability.

Once a few comparable homes have been found, appraisers or brokers make a few adjustments to account for the subtle differences between the homes, and then settle on an estimated home value.

This process is somewhat similar in the world of commercial real estate, although the value in commercial is driven largely by the income the property is or is expected to generate in the future. This paper will focus on the analysis of revenue from leases and other income.

While not exhaustive, it will provide a foundational overview of the components of leases and the effect that each of these components have on the value of the revenue stream from each lease.

The importance of revenue

There are several components involved in the estimation of income, or more specifically Net Operating Income (NOI) and Net Cash Flow (NCF), including the following:

Revenue from leases and other income

Expenses such as taxes, insurance, and utilities

Capital expenditures such as major repairs or upgrades to a property

As a refresher, recall that the NOI is the result of revenue minus expenses and NCF is the result of NOI minus debt service and capital expenditures, as seen below.

Description | $ amount |

|---|---|

Revenue | $1,000,000 |

- Expenses | $400,000 |

= Net operating income (NOI) | $600,000 |

- Capital expenditures | $100,000 |

- Debt service | $250,000 |

= Net cash flow | $250,000 |

And to illustrate the role that NOI plays in the valuation of a property; we can look at the difference in value when there’s a drop in revenue for a property. Let’s take a hypothetical scenario where a building loses a tenant that’s currently paying $200,000 in annual rent.

Example 1 below shows the property with $1,000,000 in revenue and $400,000 in expenses, resulting in an NOI of $600,000. At a market cap rate of 5.0%, this property has an estimated value of $12,000,000.

However, example 2 shows the same property after losing the tenant with revenue of only $800,000, expenses of $400,000, and an NOI of $400,000. At the same market cap rate of 5.0%, this property is now worth only $8,000,000. This represents a drop in estimated market value of 33.33% from a 20% reduction in revenue.

Example 1 | $ amount | Example 2 | $ amount |

|---|---|---|---|

Revenue | $1,000,000 | Revenue | $800,000 |

- Expenses | $400,000 | - Expenses | $400,000 |

= NOI | $600,000 | = NOI | $400,000 |

Market cap rate | 5.00% | Market cap rate | 5.00% |

Property value | $12,000,000 | Property value | $8,000,000 |

How does commercial real estate leasing work?

Now that we have a better understanding of the relationship between revenue and value, we can dive deeper into where that revenue comes from with an emphasis on leases. Revenue consists mainly of base lease payments, expense reimbursements, and other income.

The large majority of income typically comes from the base lease payments. For office, retail, and industrial properties, leases can be anywhere from five to ten years or longer. For multifamily properties, leases are usually six months to one year, with some exceptions. Because multifamily leases are usually less complex than leases for office, retail, and industrial properties, we’ll discuss multifamily leases briefly and focus mostly on leases for the other property types.

Multi-family leases

A typical multifamily lease runs for a period of six months to one year, occasionally spanning multiple years. These leases include the monthly rent for a property along with stipulations for what expenses the tenant is responsible for paying vs. the expenses the landlord is responsible for. Some of the more common additional expenses an analyst should look for are water, electric, and cable/internet.

Another aspect of a multifamily lease an analyst should be aware of is any free rent periods, whether those periods come at the beginning of the lease, the end of the lease, or are spread amongst the entire period of the lease.

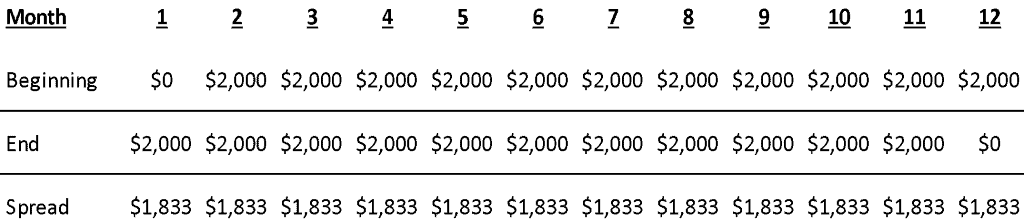

For example, let’s say an apartment has a market rent of $2,000 per month. The table below shows the application of one free month of rent under different scenarios.

The first is at the beginning of the lease period, the second is at the end of the lease period, and the third spreads the free month across all 12 months of the lease ($2,000 per month X 12 months = $24,000; with one free month the total annual rent would drop to $22,000; $22,000 divided by 12 months ≈ $1,833 per month).

Office, retail and industrial leases

As mentioned above, office, retail, and industrial leases are generally more complicated than multi-family residential leases. In this section, we’ll explore some of the major components of these leases that an analyst needs to consider, though you should be aware that there is an almost infinite combination of factors that could be included in leases for these property types.

Lease term

When analyzing the revenue of a property, an analyst needs to look at not only what the current revenue is, but what it is likely to be in the future.

One of the most important factors in predicting future revenue is knowing how many tenants will occupy the building at any point in time. When analyzing the financials and rent rolls of a property, an analyst should be aware of the expiration date of tenants that currently occupy the property.

Special attention should be paid to any tenant who occupies a large portion of the property or a period where multiple tenants expire within a short period of time. A large number of smaller tenants that all expire in the same year could lead to a significant drop in revenue all at the same time.

Base rent

The base rent that a tenant pay is pretty straightforward. Much like the rent a tenant pays on an apartment per month, the base rent is a set amount a tenant will pay each month/year to the landlord. There are several different types of leases that the analyst should be aware of, ranging from a “gross lease” to a “NNN lease” (known as a “triple-net lease”).

Gross lease: the tenant pays a base rent plus a pro-rata share of the property tax on the property, along with utilities and janitorial services associated with their specific purpose

Single net lease: the tenant pays a base rent plus a pro-rata share of the property tax on the property, along with utilities and janitorial services associated with their specific space

Double net lease: the tenant pays a base rent plus a pro-rata share of the property tax and insurance on the property, along with utilities and janitorial services associated with their specific space

Triple net lease: the tenant pays a base rent plus a pro-rata share of the property tax, insurance, and other common operating expenses on the property

Expense reimbursements

A property incurs expenses during normal operations, such as taxes, utilities, insurance, maintenance, etc. As mentioned above, there are multiple different types of leases (gross, single net, double net, triple net) that could apply to all tenants in a property or each tenant in a property could have different reimbursement terms in their lease.

The analyst should know exactly what reimbursement type is associated with each tenant, along with an understanding of what each tenant is paying in expense reimbursements.

Rent escalations

Leases will often include guidance on how the base rent, expenses, etc. will increase over time and can take many different forms. Sometimes the escalation is a flat rate, such as 3% per year, while others the escalation is tied to the national inflation rate or some other metric. An analyst should be aware of how the base rent and other income is likely to change in the future.

Tenant improvements

Often a tenant who is about to take occupancy in a property on a new lease (though sometimes existing tenants also ask for tenant improvements) will require the space be constructed to certain specifications.

For example, a space that was previously a law office will likely require a significant expense to convert the layout into something that’s appropriate for a doctor’s office. This expense is sometimes paid by the landlord in the form of something called a “tenant improvement” and can range from a small amount to large amounts.

Early termination clauses

Sometimes companies will enter into a lease for a specified period of time, but also ask that they have the ability to terminate the lease prior to the expiration of the lease. This is known as an early termination clause. Sometimes an early termination clause will include guarantees of a specific period of time, allow cancellations only between or after a specified period of time, or require payments or fees in order to terminate the lease early.

An analyst should review leases for early termination clauses and be aware of the specifics of any such clauses.

Credit quality of the tenant

When an individual goes to buy a car or a home or anything else, the seller usually requires a credit check to make sure the buyer/borrower is likely to pay the debt. The higher the credit score, the lower the interest rate and vice versa.

Similarly, companies that are tenants in buildings also have a level of credit-worthiness. If a company is publicly traded, Apple or GE, for example, the company will have a credit rating that’s known and available. If a tenant is not publicly traded, however, it’s more difficult to understand the credit-worthiness of the tenant. The analyst should be cognizant of the financial situation of the company holding the lease to ensure the risk is tolerable.

Base rent compared to market rent

Given the long-term nature of office, retail, and industrial leases, there could come situations where the rent a tenant is paying is well below or above current market rates. For example, many leases signed in 2007/2008 when market rents were at their then highest levels ever required that tenants continue to pay these high rates even when market rates had fallen during the financial crisis and beyond.

On the other hand, a lease that requires 3% increases in base rent could be well below market if market rents have increased at 5% over the term of the lease. An analyst should be aware of risks associated with a tenant who is currently paying above market (that tenant is more likely to leave when their lease expires or demand a drop in base rent to current market rates in order to renew their lease – in both cases the landlord will experience a drop in revenue).

Alternatively, a tenant paying below market rents represents an opportunity to increase revenue through either an increase in the base rent of the current tenant or a re-leasing of the property to a new tenant at current market rates.

Bringing it all together

The sections above provide an introduction to cap rates and to the major considerations of applying cap rates to commercial real estate. Property-specific factors, real estate market factors, and broader economic factors must all be considered holistically when finding and adjusting cap rates.

Although we can often track data on economic and real estate markets, there are others such as pandemics, terrorist attacks, etc. that we can’t predict. The current COVID-19 crisis illustrates the ripple effects from economic shocks to shocks in the real estate market.

It’s uncertain as to how the COVID-19 crisis will play out and the medium- to long-term impact on the real estate market, but we’re already experiencing significant impacts in the performance of the real estate industry, which will no doubt be reflected in changes to cap rates.

Valuation of real estate using cap rates is an essential method to understand the current market value of a property. While there are multiple methods of valuation, each with their own merits, the cap rate method is not only a great place to start getting an idea of the value of a property, but also provides an important foundation for understanding the future performance of a property.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Josh Panknin

Director, Real Estate AI Research & Innovation at Columbia University Engineering

Author

Josh Panknin

Director, Real Estate AI Research & Innovation at Columbia University Engineering

Resources

Latest insights