Using Monte Carlo to manage development project risks

Learn how the Monte Carlo simulation helps property developers reduce risk, predict outcomes, and boost profitability.

Overview

Like rolling the dice or betting on the roulette wheel, property development can sometimes seem like a game of chance.

All construction projects come with risks. But in a volatile market, understanding each project’s risk profile is paramount to success – and in some cases solvency. But how do you test a complex, unpredictable and ever-increasing array of assumptions? One way is by applying the Monte Carlo method.

Introduction

Also called the Monte Carlo simulation, this mathematical technique is used to estimate the possible outcomes of an uncertain event. Invented by John von Neumann and Stanislaw Ulam during World War II, it was named after Monaco’s famous casino as the element of chance is at its core.

By using repeated, random sampling, Monte Carlo simulations can assess the impact of risk on real-life scenarios, from stocks to sales forecasting, and project management to pricing.

The easiest way to understand the concept is to consider how we might calculate the probability of rolling two sixes on a pair of dice. There are 36 combinations of dice rolls, and from that we can manually compute the probability of rolling two sixes. Throwing the dice over and over – say, several million times – would give us a representative distribution of results and tell us how likely we are to roll two sixes.

By using the Monte Carlo method’s computational algorithm, we can achieve more accurate predictions by metaphorically rolling the dice millions of times in a matter of minutes.

Monte Carlo simulation in four steps

Define key project variables: Develop a risk register of all known and unknown risks. Cost, budget and contingency-related risks are allocated a dollar value and a likelihood of the risk occurring.

Generate probability distributions: Input risks into software so the most likely risk profile can be determined. Historical data sets and industry experience support this process.

Perform a simulation analysis: Let the software do its thing! The number of iterations can be in the thousands.

Aggregate the results: Review the results of the most likely outcome and convert chances into choices.

Digging deep into project risk profiles

Let’s take a look at an example.

Just say a developer of a proposed residential apartment requires a 20% profit margin. But with recent market volatility, construction cost escalation and interest rate rises, the developer needs to dig deeper into the project’s risk profile.

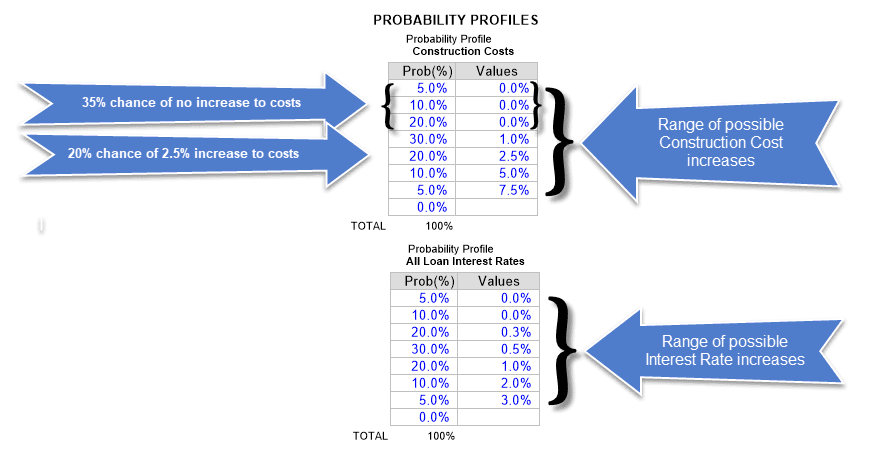

The developer uses historical data and expert cost advice to plug in construction cost probabilities, and the interest rates profile is determined from historical yield curves and economic forecasts.

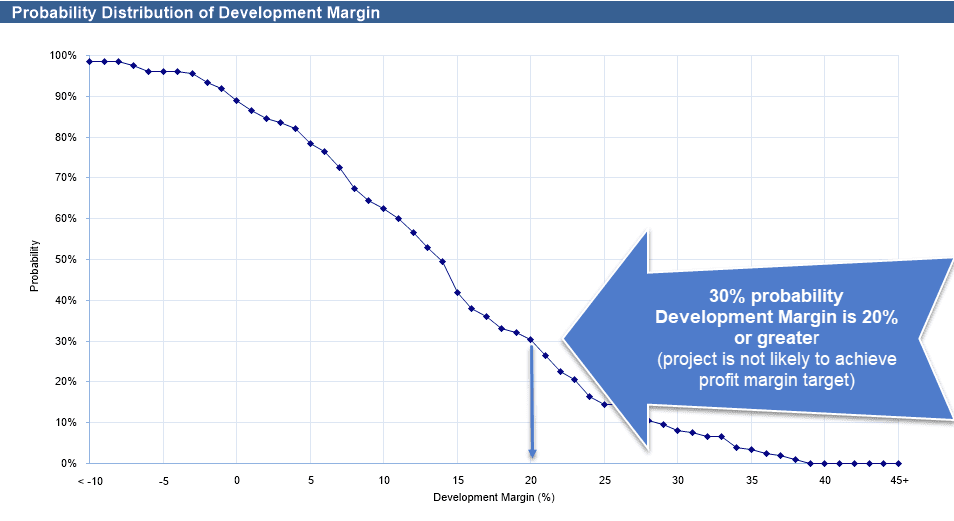

By applying this range of outcomes to the project model, the chance of each outcome occurring will show an equivalent probability range of the target margin.

The developer can see there is only a 25% probability that the project will meet the required profit margin of 20%. In other words, the project is unlikely to achieve the developer’s required profitability.

How do you place a safe bet?

Monte Carlo simulations and sensitivity analyses both vary one or more inputs and measure how that influences the profitability of a project. The difference is how they are done. Monte Carlo applies random variations while sensitivity analysis applies specifically chosen variables.

The greatest strength of the Monte Carlo method is that it can factor in a range of values for various inputs. But this is also its largest limitation. Outputs are only estimates based on the quality of the data inputs. This is why Monte Carlo analysis, undertaken in tandem with expert advice of experienced quantity surveyors, will achieve the best outcomes.

While there is no one ‘right’ way to quantify risks or estimate contingency, any method must be mathematically sound and consistent with best risk management practices. ARGUS EstateMaster, backed by the best market expertise, presents developers with a toolbox of powerful tools to understand risk exposure and forecast the future.

No risk can be eliminated. But a methodical risk management approach can help you place the safest bets in property development.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Lionel Newcombe

Real Estate Solution Expert

Author

Lionel Newcombe

Real Estate Solution Expert

Resources

Latest insights