The decision on office amenity costs - Unlocking the levers that impact valuations

Insight into how building amenities have become a key strategic lever to protect and grow CRE valuations.

Key highlights

There are numerous factors that can impact valuations of CRE properties, and while market forces are a key driver, there are also many “levers” that CRE owners can manage to protect and/or grow these assets

In a challenging CRE market, particularly within the office sector, amenities have risen in priority and moved from a rent-boosting feature to a tenancy-boosting one

Better amenities are one of the key reasons Class A+ properties maintain higher tenancy rates and market value over Class A, B, and C properties

Popular office building amenities among tenants and employees are those that add to workplace quality of life

Introducing valuation levers and why they matter

Understanding the value of commercial real estate (CRE) property is one of the most important metrics for any stakeholder. While uncontrollable market forces are a primary driver of value, there are many things CRE professionals can do to favorably impact their property valuations — “levers” they can “pull” to create positive effects.

One of the levers getting more and more attention in today’s more challenging market is the investment in building amenities – the various tenant-friendly perks and attractions buildings use to grow and retain building occupancy. In a post-pandemic world where properties continue to struggle with empty office space and the task of luring workers back to the office, there has been an increased focus on amenities as a way to build back tenancy and ultimately net operating income or NOI.

Prior to the pandemic this wasn’t necessarily the case. In New York City for example, office occupancy was around 90% in 2015, but has been instead decline ever since – particularly across older buildings that can’t compete with the features that newer buildings provide.

To add inside perspective for this article, we had the opportunity to interview a well-regarded property manager from a large North American metropolitan area, leveraging his firm’s perspective on amenities as a driver of both rental success and property valuations. While these perspectives are based on one specific market, they apply to most metro centres around the globe for the office sector.

The great divide between old and new properties

When examining amenities as an NOI building strategy it should be noted that there is a clear delineation between the haves and the have-nots. There is a clear “flight to quality”.

While vacancies are high for many B- and C-class buildings, A and A+ buildings are performing much better. A recent Altus Group study of New York City’s office sector magnified the economic difference as measured by NOI. Newer, higher-quality buildings have much better occupancy rates and are generating around 2.5x the NOI compared to older lower-quality buildings. Being amenity-rich is one of the key differentiators, and inaction for those with less attractive features may not be a viable strategy.

In a perfect world, property managers would add all the “bells and whistles” to a property, but that’s not how the market (or budgets) work. CRE managers must balance the initial investment and upkeep costs of each amenity with its potential contribution to tenant appeal and rental income.

Easy in theory but much harder in practice.

Managing NOI is a high priority. While amenity investment may drop NOI and even property values in the short term, the real question is if the long-term gains outweigh those short-term expenditures.

Where amenity improvement was once a rent-increasing strategy (and still is to some extent for A+ buildings), today its real value lies in doing what you can to improve leasing in a down market.

Leveraging amenities needs a well-informed strategy, ensuring budgets are spent efficiently and impactfully. This is particularly true for older buildings, where extensive renovations may not be as easy to retrofit.

Which amenities contribute positively to valuations?

Investing in the right amenities could be the difference between attracting a tenant at the rates wanted vs. seeing occupancy rates tumble. However, which amenities are worth it?

According to a recent report by JLL, these four office amenities have particular tenant appeal:

Buildings with a roof or sky terrace

Courtyards with outdoor seating

Fitness centres with shower facilities

LEED certification — i.e. “green” buildings

While the report gives some hard rent premium stats, we are discounting those since the correlation between amenities and rent premiums is a complex calculation. However, the overall trends identified are valuable. The other amenities that made the grade are listed below:

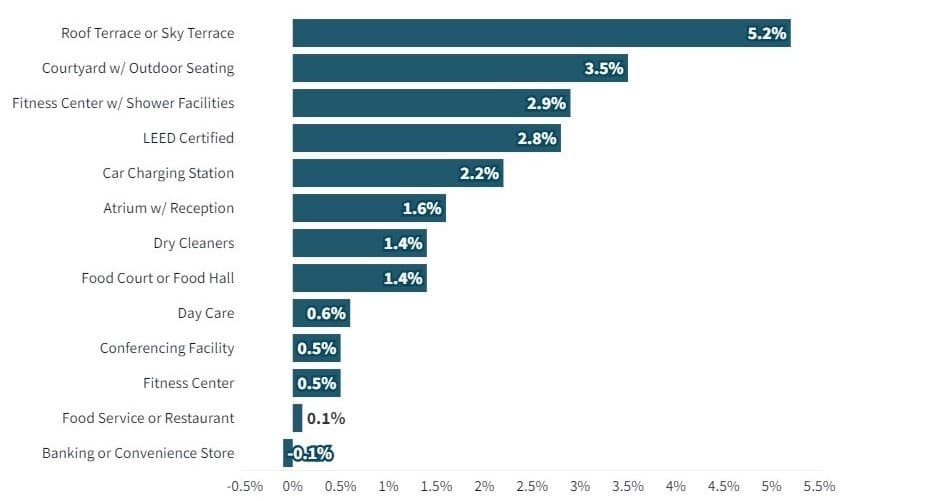

Figure 1 - Office amenities that have tenant appeal - Rent premium to Class A in same submarket (%)

Source: JLL Research

What can be extrapolated from an overview of these specific amenities? Notice that they primarily address “creature comforts” for employees. Look at the lower-scoring amenities. Many employees bank and shop online, and food vendors are not hard to come by in a well-chosen location.

However, a food hall on-site boosted value far higher, a factor of convenience. Meanwhile, amenities that improve workplace satisfaction, like the ability to take a break in the fresh air, see natural light (an ergonomic factor), shower before or after work, or charge an electronic vehicle (EV) ranked highly. The LEED certification point suggests that sustainability matters to employees as well.

The observations of our inside source aligned closely. Their top picks were as follows:

Tenant lounges, conference centers, and other semi-offsite “hang-out” areas for collaboration

Gym facilities

End-of-trip facilities like showers, bike racks, and EV charging stations

Patio areas, especially where weather allows for longer seasonal use

So, what does this really say?

In a world where employees no longer have to commute, they will only do so when the office environment is welcoming. Being the “cheap and cheerful” option is no longer viable. After all, a home office is also cheerful, and is cheaper. Whatever short-term financial gain the renting company sees by “cheaping out” will quickly be offset by poor tenancy rates.

How to improve amenity levers for valuation as cost-effectively as possible

For property managers looking to introduce appealing amenities to boost tenancy and property value, how can it be done as cost-effectively as possible? Here, the reduced occupancy trend brings a hidden blessing, as underutilized areas (such as formerly leasable areas that are now less desirable) can potentially be repurposed into a tenancy-boosting amenity.

While it is tempting to pass costs off indirectly to the employee or tenant as an operating expense, most successful properties are opting for free-use or nominal fees instead. At this point in the market it isn’t a profit-generating exercise, it’s a tenancy-boosting strategy.

Lastly, the core point is appeal. To incentivize a return to the office it’s not enough to declare an empty room as a “tenant lounge”. Property managers competing against other buildings as well as the comforts of home should remember that it is the appeal of these amenities and the recognition of what is truly of value to tenants that will contribute a positive impact on tenancy and valuation.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Richard Clift

Senior Director, Advisory

Author

Richard Clift

Senior Director, Advisory

Resources

Latest insights