Key highlights

Altus recently hosted a webinar panel discussion on the state of the European CRE debt market with experts in both lending and borrowing

It is widely believed we are close to reaching the peak with interest rates, with the possibility of rates lowering slightly by 2025. Nevertheless, it is expected that this higher rate environment, relative to years past, is here for the foreseeable future.

While lender/borrower relations remain quite good in Europe, higher interest rates mean adjustments for everyone. Core banks are beginning to tighten lending requirements, alternative lenders are emerging to help fill in lending gaps and borrowers are now often required to make an equity injection to make the loans work.

ESG requirements add further complexity and cost to the situation. Borrowers faced with higher interest rates and equity injection requirements are now also having to finance ESG investments to satisfy “the new normal”.

In a market with volatility and ever-changing loan requirements there is a greater need for data and technology solutions to help manage all the moving parts, predict future outcomes and reduce overall market and interest rate risk.

A changing environment

Recently, Altus Group hosted a webinar on the state of the European CRE debt market, breaking down current trends in the debt industry and identifying key points investors and other parties should be aware of. Joining the panel were industry experts Katja Gramatte, Head of Real Estate Financing at BNP Paribas Real Estate Investment Management, Karolina Wójtowicz, Director of Real Estate Debt Strategies at Nuveen and Altus Group’s own Nicolas Obolensky, VP Offer Management and Julien Sporgitas, Strategic Client Partner.

With rising interest rates, the landscape for debt transactions has changed for lenders and borrowers alike. In an uncertain market, borrowers rely on critical debt management tools to monitor and forecast interest expenses and help manage exposures to interest rate risk. Investors are left observing this fluctuating market, hoping to determine if the underlying valuations of assets will continue to adjust to the cost of capital at a time when transaction volume is at a historical low.

Brief outlook on the European investment and the debt market

While we are currently in a high-interest environment for the European Central Bank (ECB) rate, the panelists believed that they should peak in the near term before levelling by the 2025 fiscal year. This results in a market where lenders are stretching themselves to meet existing loan agreements, getting extensions where they can or refinancing where possible. However, borrowers and lenders alike will need to adjust to this higher interest rate environment for the foreseeable future.

Offering the lender’s perspective, Karolina Wójtowicz highlighted that there is still a lending appetite despite interest rate impacts. She went on to add that, from a real estate investor’s perspective, “debt is more attractive at the moment than equity… offering the best risk-adjusted return in the current environment.” She also added that some private equity investors have moved into the debt space, creating competition in the lending market. However, some senior lenders are backtracking on the loan-to-value (LTV) and leverage on offer, engaging more in refinancing transactions versus new acquisitions.

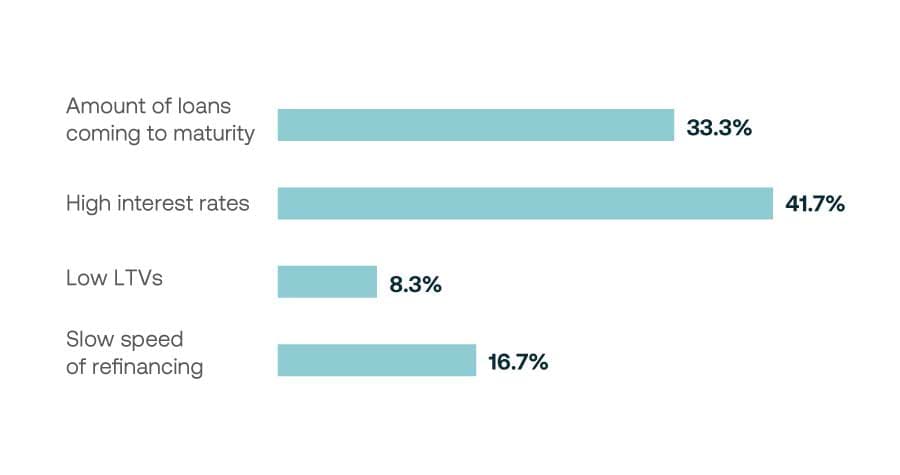

Figure 1 - What do you foresee being the most challenging aspects of the debt market in 2024?

As can be seen from the audience poll results (Figure 1), this aligns with the attendee’s general feelings, although our panelists seemed more confident about the ‘debt wall’ being less of an issue for the European market, which they explored later.

The situation in Europe versus the US lending climate

Perspective on the current state of things in Europe can be gained by examining what is happening in the US debt market. Nicolas Obolensky touched on some of these differences. “In the US, we see the volatility in asset prices priced into credit spreads already.” He continued, “While the Fed has promised a leveller interest environment, the regional banks, which have had some setbacks in recent years, hold about a third of all lending power, and there is an approaching ‘debt wall’. This creates a vastly different perspective, and more uncertainty around all-in rates, compared to Europe.”

European banks have greater reserves and risks already provisioned into models, creating a relatively more positive risk perception and offering a more stable lending environment.

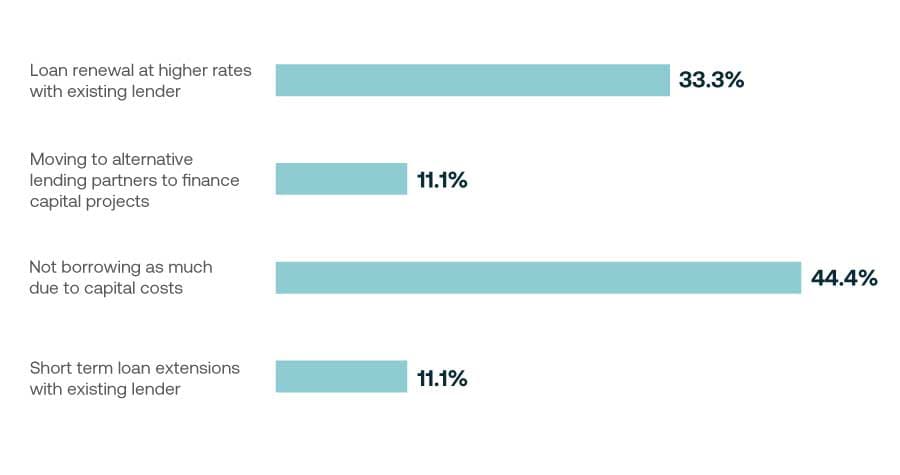

Figure 2 - What has been the most common result as it relates to loan maturities?

Our audience poll (Figure 2) shows 1/3 of attendees have absorbed loan renewal rate rises with existing lenders, while 44.4% have taken a conservative borrowing stance. However, our panelists had some key points on the rising growth of the other two categories as alternate strategies.

The senior lending perspective

In the European market, in past years we have seen banks focus on LTV, which is now under pressure. This necessitates digging deeper into the debt-to-yield equation of assets: can the income generated cover the higher interest rates of lending? Currently, debt yields of 8% are the most attractive, according to Katja Gramatte.

Alternative lenders are emerging as a solution to debt gaps

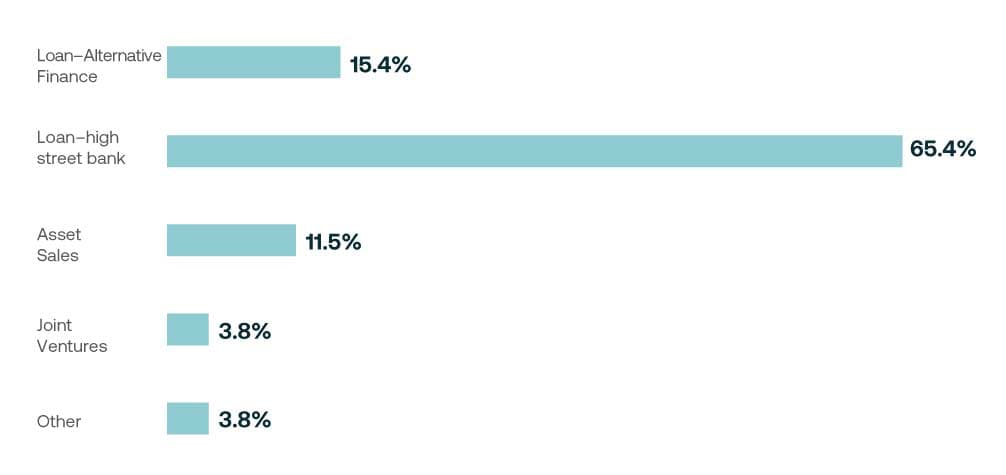

This shift in the lending climate has created a window of opportunity for lenders outside the traditional bank system, particularly for the refinancing that is the focus of most current market movements. More flexible mezzanine loans can be applied to funding gaps where asset potential is strong, potentially offering better terms. Wójtowicz further added that we have also seen fixed-rate loans, which save on hedging costs, becoming more attractive and competitive. As you can see from the audience poll (Figure 3), a few attendees have established alternative lenders as a primary source of capital.

Figure 3 - What is your preferred choice of capital?

However, where the whole debt stack cannot be financed, Wójtowicz underscored that lenders want to see either equity injections from sponsors or a healthy interest reserve to address facets like ESG-related capex requirements or the reduction of existing loan obligations. She went on to reiterate that lenders can still offer short-term loan extensions on the 1 to 2-year horizon, situation-dependent. This creates a climate with less distress than the US is facing around maturities, in which lenders and other parties are still amicably able to work together to find solutions.

Obolensky expanded on this idea, noting that the climate has moved from loan-by-loan hedging to macro-hedging strategies as a way to lower average interest rates on overall portfolios. He added that the increased and consistent demand for Altus’ tools and expertise to support more complex hedging strategies as well as loan extensions reflects the current market challenges. Wójtowicz observed that retail real estate is becoming attractive to alternative lenders, allowing for lower leverage, an attractive debt/yield in double digits, and a solid risk-adjusted return. However, senior banks have yet to show much interest in the sector.

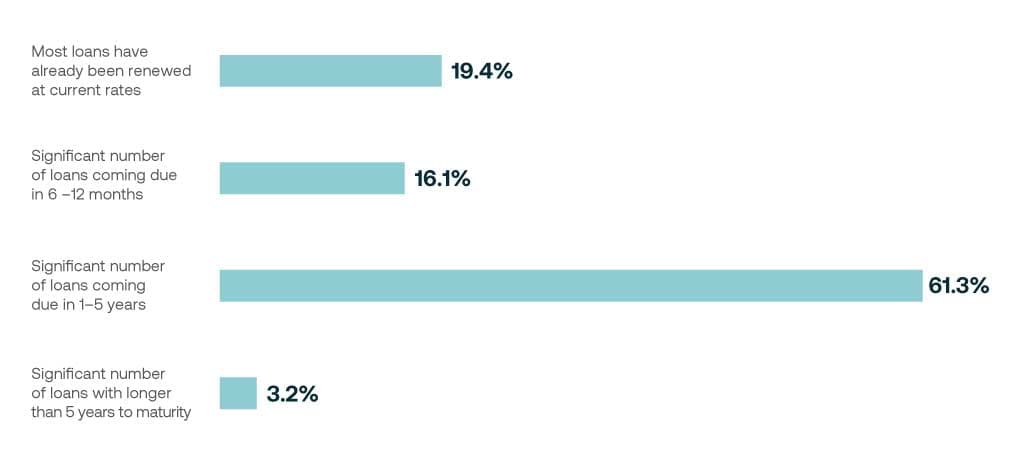

Figure 4 - What would best describe your company’s loan maturity schedule?

In our fourth audience poll question, an overwhelming number of attendees are facing significant loan maturation in the next 5 years or less, and alternate capital sources could become a more supported and embraced financial model with time.

ESG requirements and pressures

ESG issues are a flashpoint in the European market. Many banks now offer ‘Green’ labelled and transformation loans to address compliance. Katja Gramatte pointed out that, “we are still in a time where (these requirements) need to be streamlined a bit, “with most of the related requirements yet to be standardised despite a pressing need for reform toward a single ESG score.

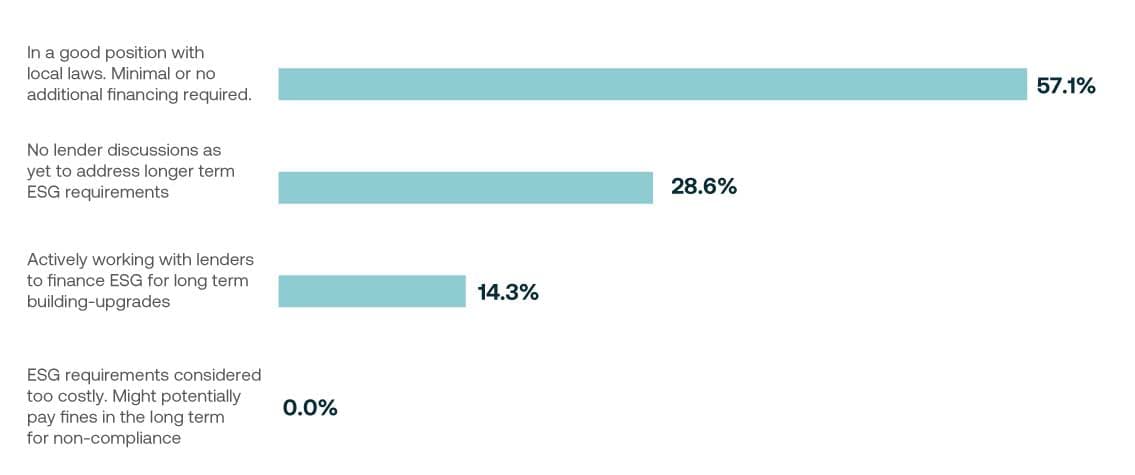

She went on to explain that the need to meet ESG requirements, especially in a refinancing environment, means that banks often want to see the additional capital for ESG compliance as an equity injection. This creates a drag on yield, but is, inevitably, the ‘new normal’. However, it causes an issue where a lot of capital is in demand, both for refinancing and ESG compliance, leaving yields out of balance. Our polled attendees’ experiences equally reflect this idea of ESG being the new normal, too (Figure 5).

Figure 5 - Where does your company stand as it relates to ESG requirements?

Wójtowicz expanded with the point that lenders want to know how future-proof and competitive property portfolios are, and that ESG-certified assets can offer the opportunity for more competitive loan pricing, but Gramatte observed that, as ESG develops into this ‘new normal’, it becomes hard to detect so-called ‘ESG loans’ and capital valuations over others within available data, leaving it more of a consideration on the bond side.

The importance of debt management capabilities in times of uncertainty

Overall, we’re entering a period where there is a general tightening in lending compared to low-interest environments. Uncertainty in the markets demands transparency and data. Monitoring and easily forecasting covenant levels based on expected capital market conditions help borrowers negotiate covenant waivers or reset forward-looking measures with their lenders.

Obolensky reiterated that transparency is especially required with credit spreads, not only to understand what financing or refinancing conditions are but also to report the loan’s fair values to investors. Worst- and best-case scenarios can be built. Finally, understanding the drivers behind credit spread movements can help borrowers predict what future financing conditions could be.

Authors

Nicolas Obolensky

Vice President, Offer Management

Katja Gramatte

Head of Real Estate Financing, BNP Paribas Real Estate Investment Management

Karolina Wójtowicz

Director of Real Estate Debt Strategies, Nuveen

Authors

Nicolas Obolensky

Vice President, Offer Management

Katja Gramatte

Head of Real Estate Financing, BNP Paribas Real Estate Investment Management

Karolina Wójtowicz

Director of Real Estate Debt Strategies, Nuveen