Key highlights

Altus Group releases the results of its fourth installment of the Commercial Real Estate Industry Conditions and Sentiment Survey for the US (ICSS), a quarterly survey of CRE professionals to gauge perspectives on current and future conditions for the industry.

While 49% of respondents do not expect a near-term recession, those predicting a recession in the next 6 months increased by 7 percentage points from Q1 2024

A broad majority of respondents (68%) indicated moderate to significant increases in their expectations for going-in/current cap rates (68%) and reversion/exit cap rates (60%)

Expectations for capital expenditures have somewhat stabilized, with 49% indicating that their expectations have remained “about the same” compared to 12 months ago

Targeted gross IRRs advertised for new funds and deals averaged 12.4% across all property types in Q2 2024, an increase of 60 basis points from the previous quarter

Eighty percent of respondents expect to make transactions in the next 6 months, with 91% of the largest firms indicating an intention to transact in the near term, up from 83% in Q1 2024

Debt capital availability expectations have significantly improved across various sources compared to the previous quarter

Perspectives amongst US commercial real estate participants highlight a mixed bag of quarter-over-quarter shifts and continuing stabilization

Altus Group conducted its fourth consecutive quarterly survey across the US to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry.

The Q2 2024 installment of the US survey, focused on current conditions and future expectations, was conducted between March 25 to April 29, 2024. There were 227 respondents, representing at least 49 different firms (firm count based on participants who chose to identify themselves).

Altus Group’s Research Team shares their top takeaways from the Q2 2024 results.

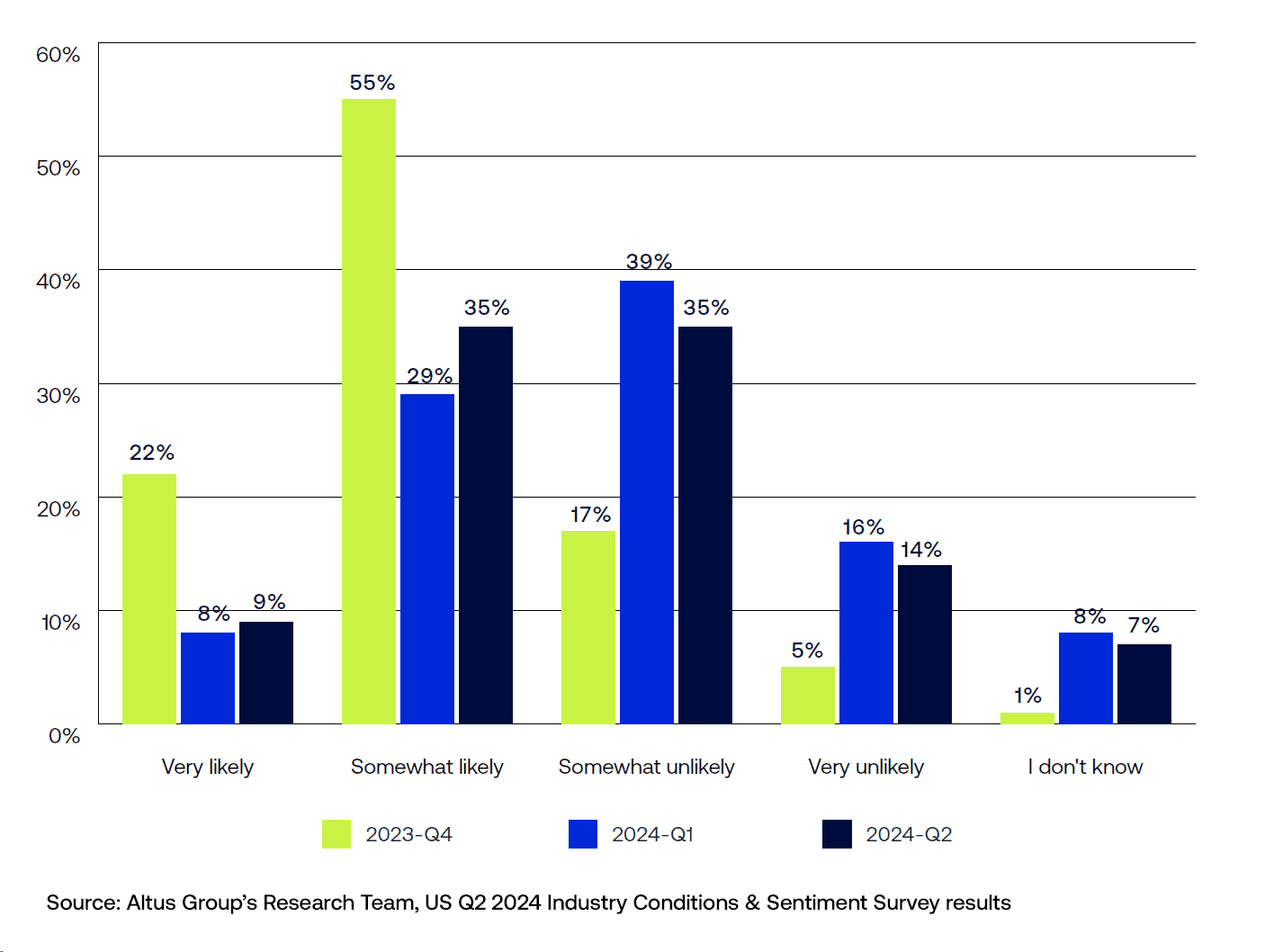

Recession concerns tick up slightly and anticipated magnitude worsens

The majority (49%) of respondents do not expect a recession in the near term. However, the number of people who believe a recession is likely in the next 6 months (either "very likely" or "somewhat likely") has increased by 7 percentage points (pp) from the previous quarter. This change means that 70% of the industry currently falls into the "somewhat" category, indicating that they believe a recession is either "somewhat likely" or "somewhat unlikely."

Figure 1: How likely is an economic recession in the next 6 months? (Quarter-over-quarter comparison)

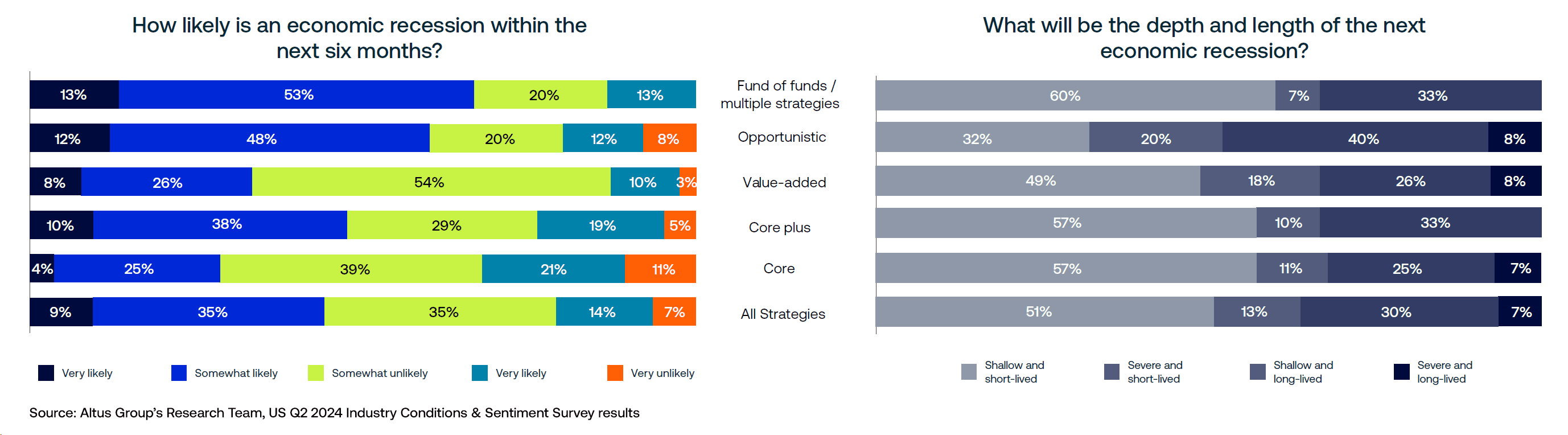

Across the different fund strategies, respondents who identified as having a core strategy are the least expectant of a near-term recession, while those with fund of funds and opportunistic strategies are the most expectant. However, fund of funds, opportunistic, and core strategies all saw quarterly increases in respondents who anticipate a near-term recession.

Figure 2: Expectations for a future economic recession in the US

And while the overall percentage of respondents who said “I don’t know” remained small (7%, down 1 percentage point from Q1 2024), both core and core plus strategies saw increases from the previous quarter. The majority (80%) of respondents expect the next recession to be shallow, either “shallow and short-lived” or “shallow and long-lived,” a decrease from the prior quarter (89%). However, those who expect the next recession to be “severe,” either “severe and short-lived” or “severe and long-lived,” increased by 9 pp across all strategies and by 11 pp in core and 10 pp in opportunistic strategies.

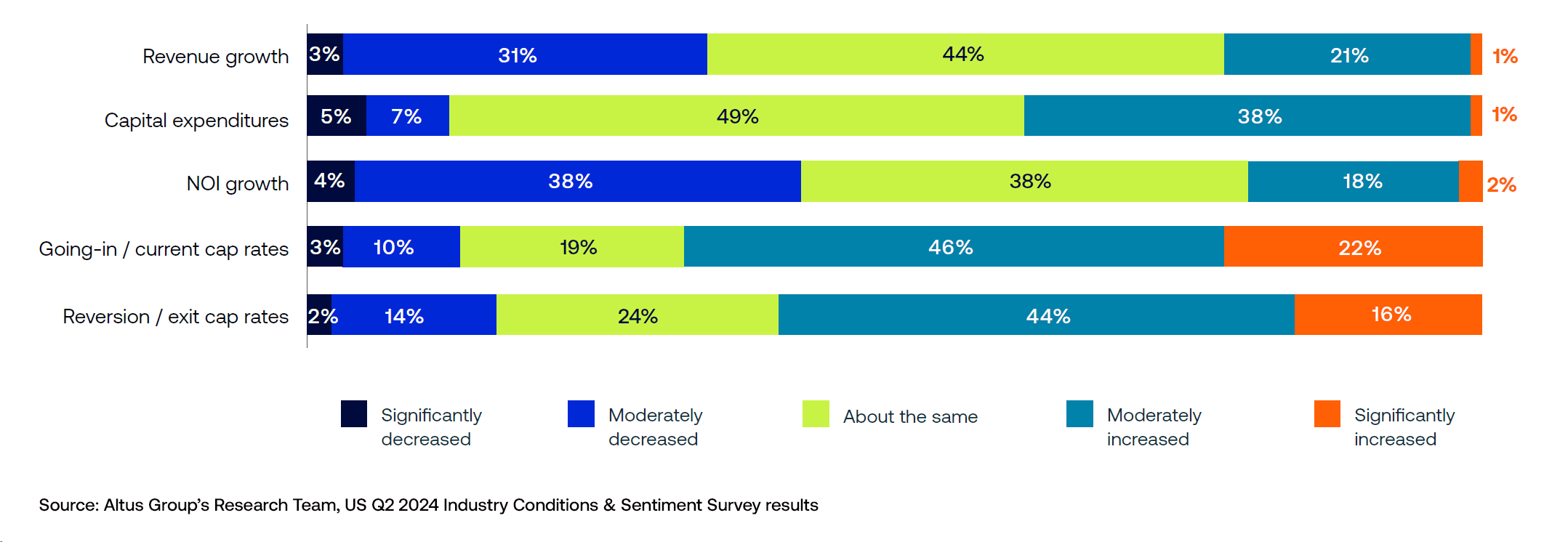

Broad majorities note increased expectations for cap rates while capital expenditure assumptions show signs of stabilizing

Over one-third of the respondents reported higher expectations for revenue growth, while 42% indicated increased expectations for NOI growth. Over 20% mentioned moderate to significant increases in their revenue and NOI growth expectations. The proportion of respondents stating that their expectations for both revenue and NOI growth were "about the same" remained consistent over consecutive quarters, indicating a continuing stabilization in cash-flow expectations.

Figure 3: How have your expectations for your portfolio changed compared to 12 months ago?

The expectations for capital expenditures have somewhat stabilized. Nearly half of the respondents indicated that their expectations for capital expenditures have remained "about the same" compared to 12 months ago, while almost four in ten stated that their expectations have increased. A broad majority of respondents noted moderate to significant increases in their expectations for both going-in and current cap rates, with 16% and 22% stating that expectations for going-in / current cap rates and reversion / exit cap rates have significantly increased.

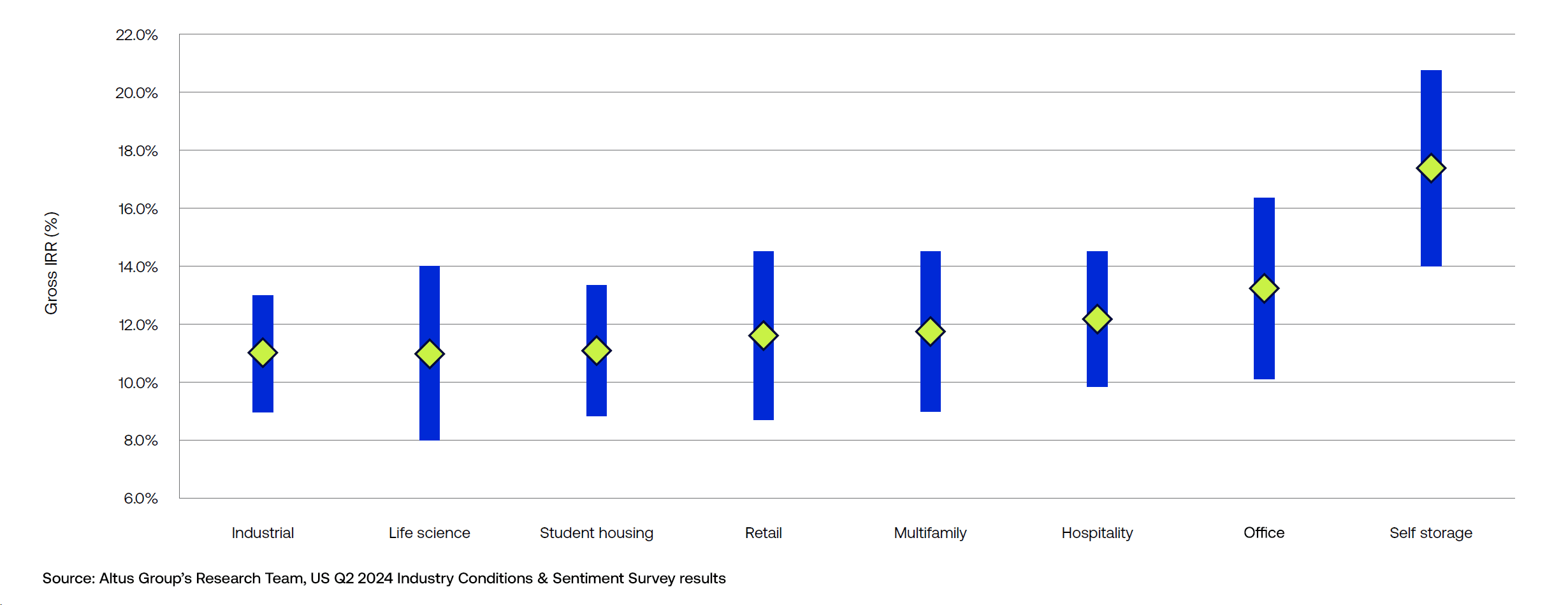

New fund-targeted gross IRRs increase modestly across property sectors over the prior quarter

Targeted gross internal rate of returns (IRRs) marketed for new funds and deals averaged 12.4% across all property types in the second quarter of 2024, an increase of 60 basis points (bps) from the previous quarter. For the four main types of properties (retail, multifamily, office, industrial), the reported average gross IRR was 12.2%, up 130 bps from the first quarter of 2024.

Figure 4: What are typical ranges for the returns you are seeing across the current market for new funds?

In the second quarter of 2024, the reported average return rates (IRR midpoints) saw the biggest increases in the self-storage and office sectors, going up by 571 bps to 17.4% and 121 bps to 13.2% respectively. The largest decreases in midpoint IRR were in the life science and hospitality sectors, with declines of 410 bps and 83 bps, bringing the rates down to 11.0% and 12.2% respectively compared to the previous quarter.

Smaller firms signal intent to sell, while larger firms show more transaction appetite

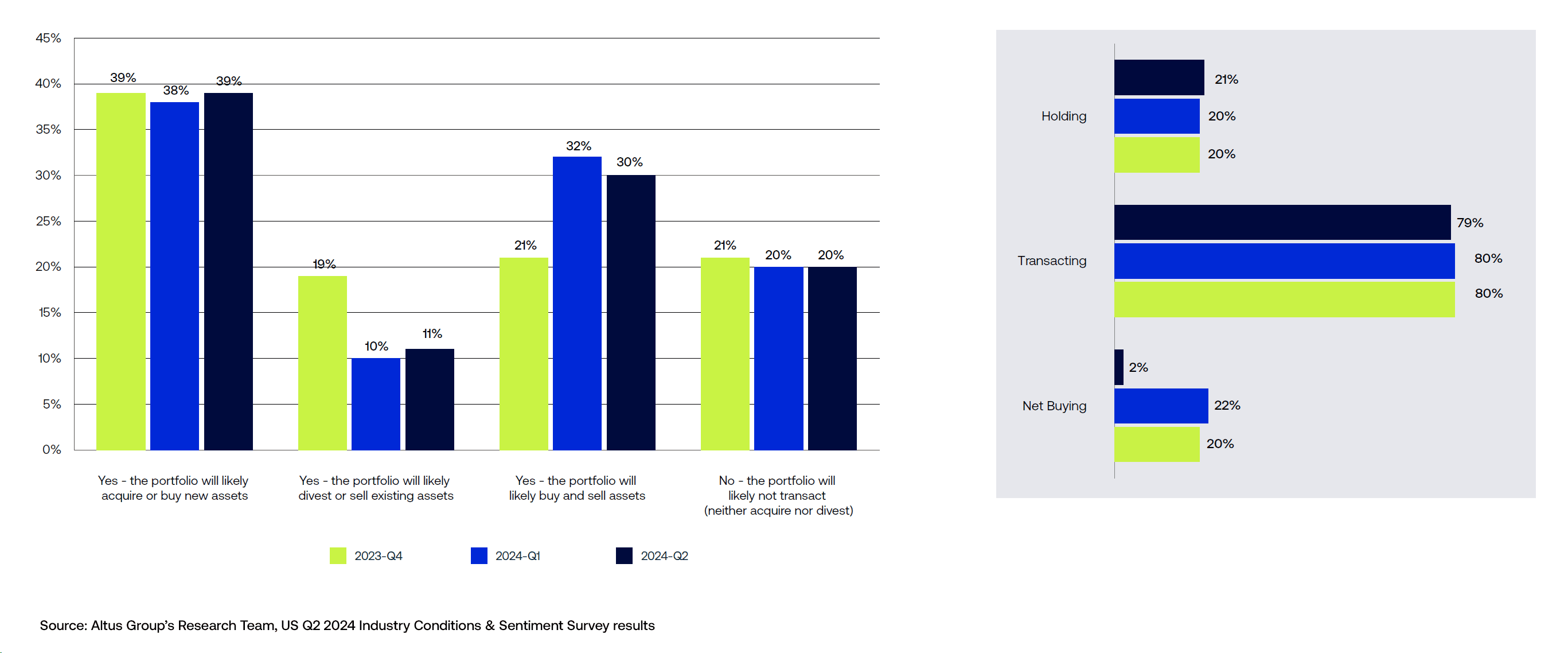

Respondents anticipate increased market activity in the next 6 months, with 80% expecting transacting (buying, selling, or both) to remain the same as the previous quarter.

Figure 5: Over the next 6 months, do you anticipate any transactions in your portfolio? (Quarter-over-quarter comparison)

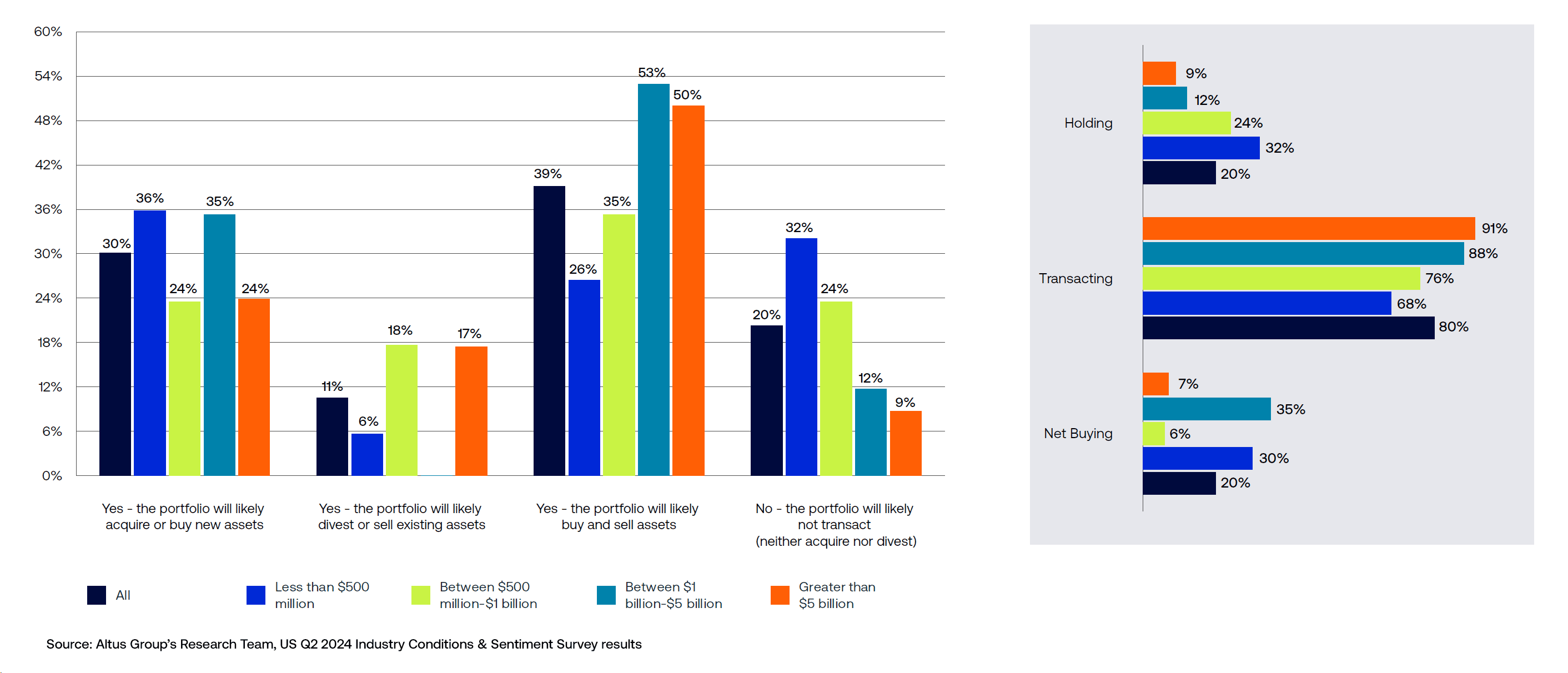

While 91% of the largest firms (greater than $5 billion) indicated their intention to engage in transactions (buy, sell, or both) in the near term, a rise from 83% in Q1 2024, smaller firms (with commercial real estate exposure between $500 million and $1 billion) experienced a 33 pp decrease in buying intention, an 18 pp increase in selling intention, and a 17 pp increase in intention to hold.

Figure 6: Over the next 6 months do you anticipate any transactions in your portfolio? (Comparison by size of CRE portfolio)

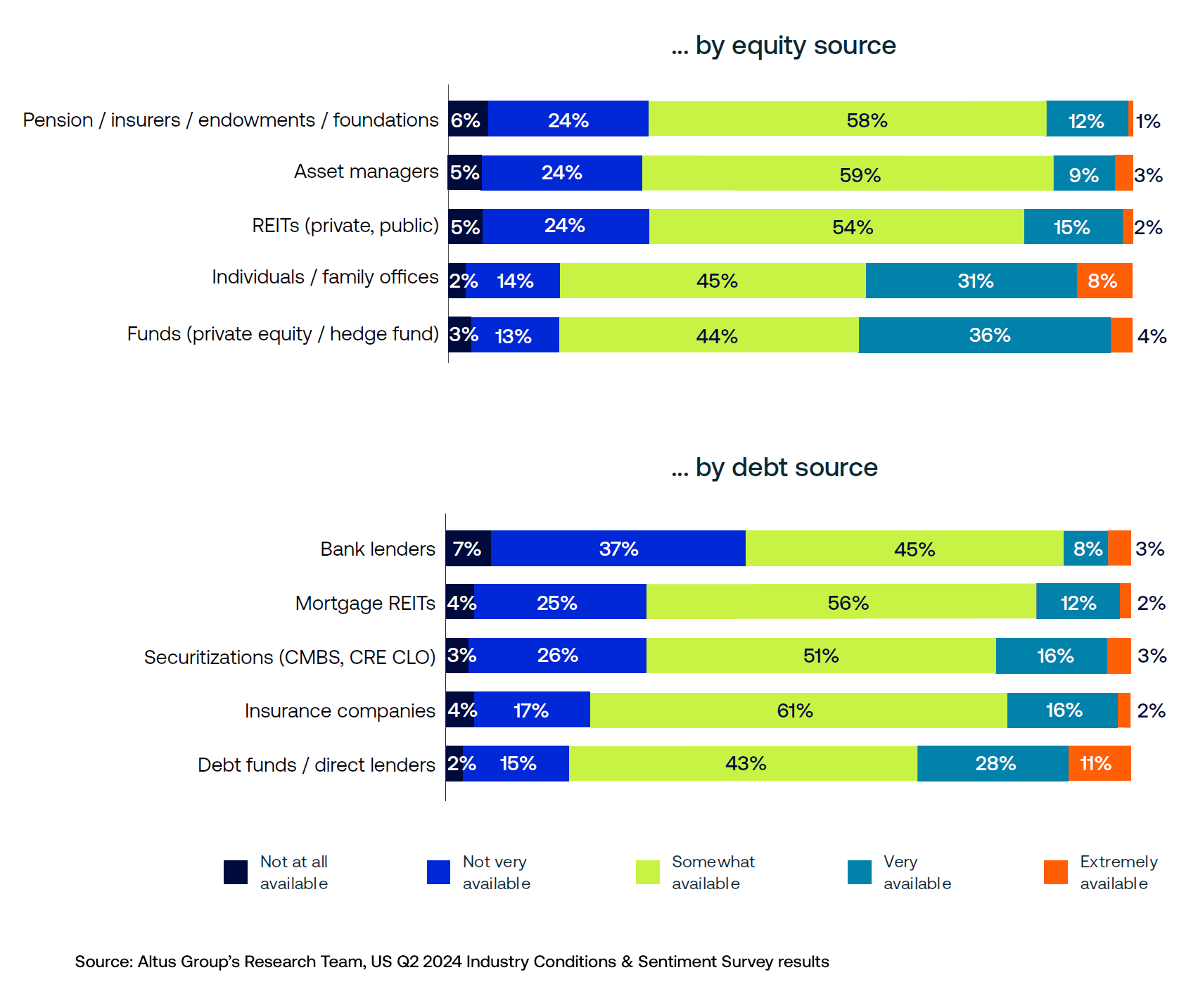

Capital availability expectations continue to improve across most sources except banks

The expectations for debt capital availability have improved dramatically across numerous sources versus the prior quarter. The net capital availability expectations, which is the sum of responses for “extremely available” and “very available” minus the sum of responses for “not very available” and “not at all available”, have increased by 20 pp for mortgage REITs, 22 pp for insurers, and 36 pp for securitizations. However, there has been a rapid deterioration in net expectations for bank lenders, dropping from -5% to -33% over the same period. Few respondents anticipate banks to engage in CRE lending within the next 12 months, with 44% stating that they expect banks to be “not at all available” or “not very available”.

Figure 7: What are your expectations for the availability of capital over the next 12 months?

Majorities say that they expect six of ten individual sources of capital to be “somewhat available” over the next 12 months. At the same time, more than 40% of respondents expect all ten sources to be somewhat available. This suggests that availability of funding remains highly dependent on specific circumstances, use cases, and relationships.

A request for your participation

Our ability to share valuable market insights depends on the active participation of industry professionals like you. As we gather a diverse range of voices, the richness of the data deepens, allowing us to segment responses and paint a more detailed portrait of the industry’s collective outlook each quarter.

Your participation is instrumental in shaping the narrative of the commercial real estate landscape, please support this survey program by sharing your perspective on our next installment of the ICSS.

Until our next survey opens, we encourage you to download the latest results of the Q2 2024 US Industry Conditions and Sentiment Survey.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Omar Eltorai

Senior Director of Research, Altus Group

Cole Perry

Associate Director of Research, Altus Group

Authors

Omar Eltorai

Senior Director of Research, Altus Group

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights