Top four takeaways from the Q2 2024 Canada CRE industry conditions and sentiment survey

Key highlights

Altus Group releases the results of its fourth installment of the Commercial Real Estate Industry Conditions and Sentiment Survey for Canada (ICSS), a quarterly survey of CRE professionals to gauge perspectives on current and future conditions for the industry.

Across investment strategies, 45% of respondents expect a recession to be either “very likely” or “somewhat likely” in the next 6 months, however, this is down from 63% in Q1 2024

Concerns regarding capital/credit availability overtook concerns about inflation with 45% citing the former as a top priority issue in the next 12 months

The percentage citing development/construction costs (land, labour, materials) as a top priority issue in the next 12 months increased 10 percentage points from 1Q 2024 to 56%

Intentions to buy (56%) in the next 6 months still outweigh intentions to sell (38%), though those intending to hold (35%) were up 6 percentage points from Q1 2024

Respondents’ 12-month forward view of all-in, fixed-rate financing increased to 6.0-7.3%, up from 5.6-7.0% in Q1 2024, across the main portfolio strategies

Q2 2024 perspectives amongst Canada commercial real estate participants showcase some significant quarter-over-quarter slides in market expectations

Altus Group conducted its fourth consecutive quarterly survey across Canada to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry.

The survey, focused on current conditions and future expectations, was conducted between March 25 and April 29, 2024, and involved 333 respondents representing at least 48 different firms.

In this article, Altus Group’s Research Team shares a handful of the key insights from the Q2 2024 results.

Near-term recession concerns fade, though uncertainty increases across core and value-added strategies

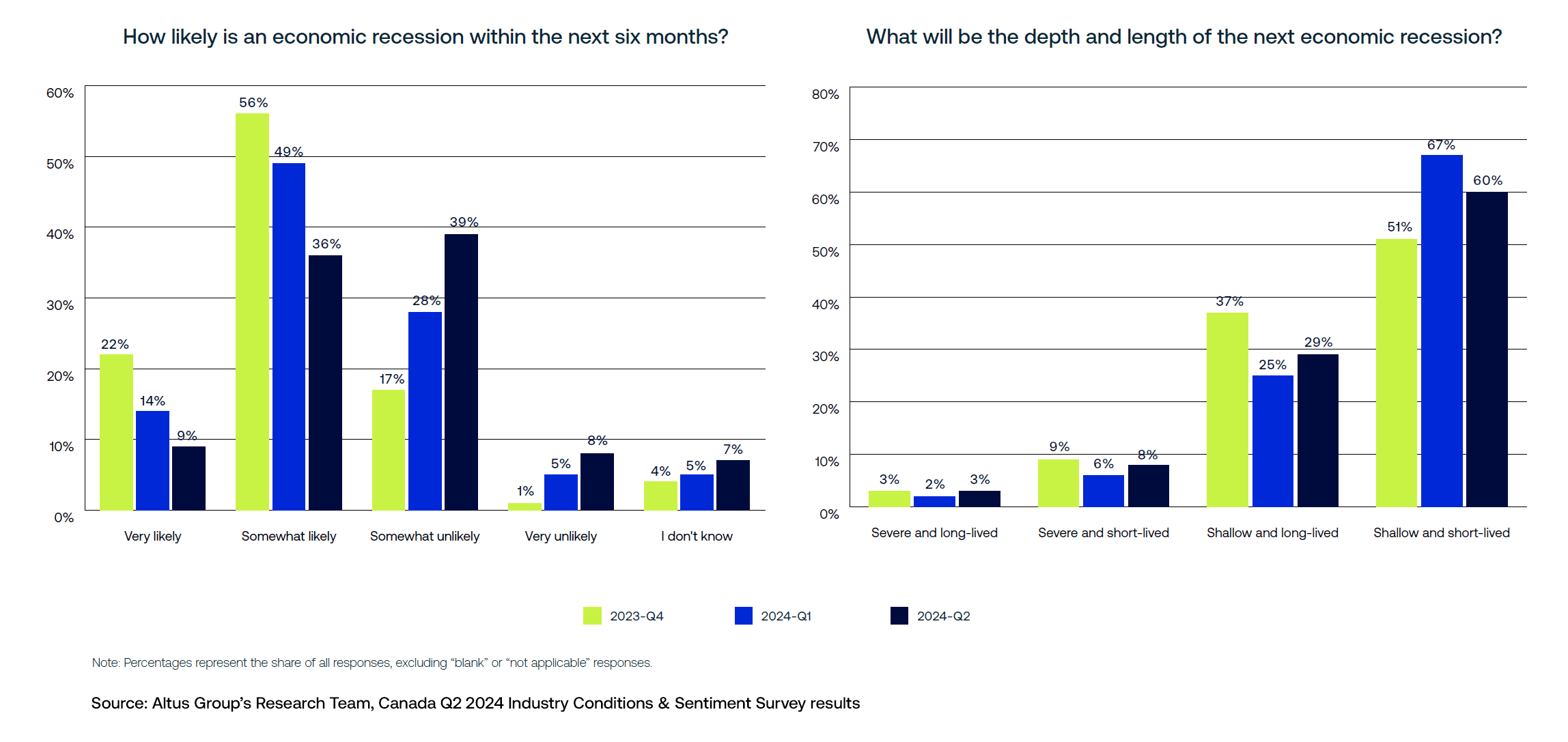

Across the main investment strategies, 45% of respondents anticipate a recession in the next 6 months to be likely (either “very likely” or “somewhat likely”), however, this expectation is down 17 percentage points (pp) from the 63% who stated the same in Q1 2024.

Figure 1: Sentiment around the likelihood of economic recession in the next six months and depth and length of the recession (quarter-over-quarter comparison)

Respondents who identified as having either core or value-added fund strategies saw similar downward shifts in near-term recession expectations (25 pp and 22 pp, respectively). Respondents from these two strategies also saw notable increases in uncertainty, with 10% and 7% responding with "I don't know", respectively.

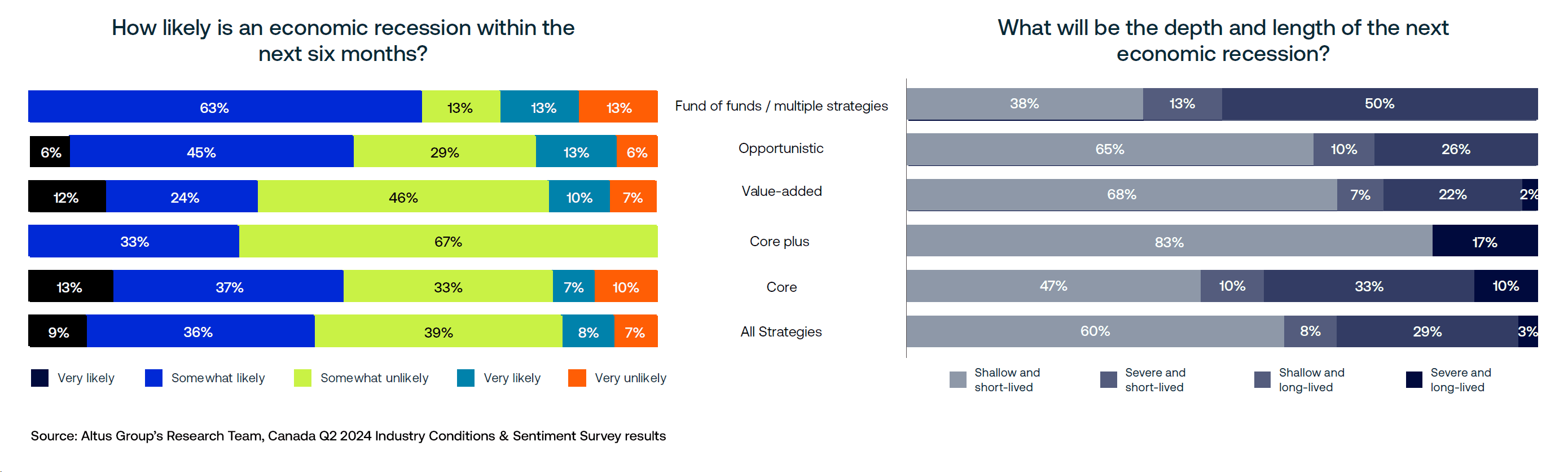

Figure 2: Expectations for an economic recession in Canada

Most responses also indicated expectations for the next recession to be “shallow”, with more than 89% of respondents indicating the next recession to be “shallow” as opposed to “severe”, down slightly from 92% in Q1 2024.

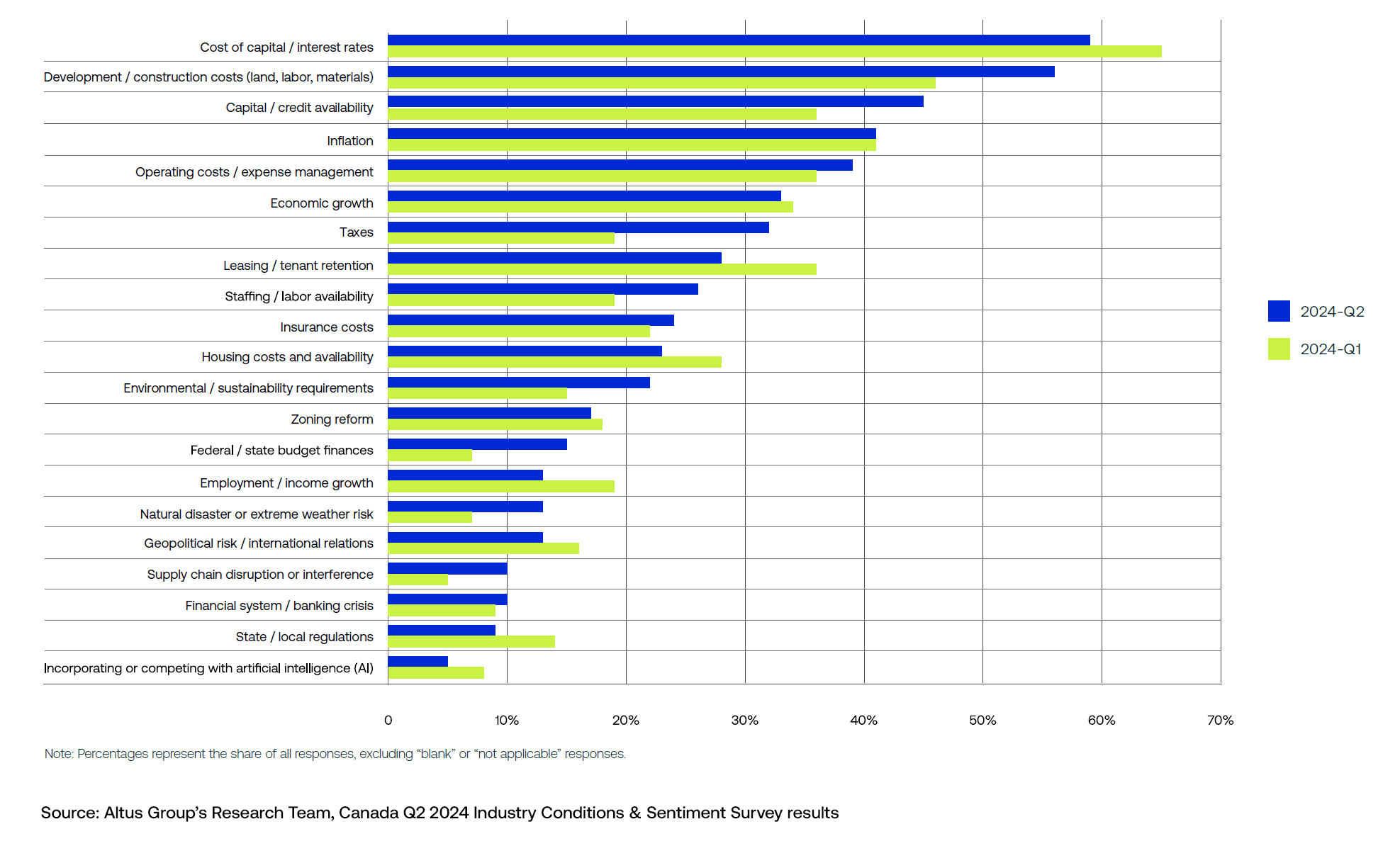

Capital availability concerns rebound and construction cost concerns spike while property-specific concerns diverge

Cost of capital and development costs were the top priority issues expected over the next 12 months for the fourth consecutive quarter. However, the percentage of those concerned about the cost of capital declined by 6 pp from Q1 2024, while the percentage of those concerned about development costs increased by 10 pp. Concerns regarding capital/credit availability surpassed concerns about inflation, with 45% citing the former as a top priority issue in the next 12 months, an increase of 9 pp. The percentage naming inflation remained constant quarter-over-quarter at 41%

Figure 3: Which of the following do you expect will be high-priority issues for you professionally in the next 12 months?

Property-specific concerns showed significant changes from the previous quarter. While more than one in three respondents continued to prioritize operating costs and expense management in the near term, 32% of respondents expressed concerns about taxes, which is a 13 pp increase from Q1 2024 and an 18 pp increase from Q4 2023. Additionally, 28% of respondents cited leasing and tenant retention as a top priority, down from 36% in Q1 2024 and even lower than the 30% figure from Q4 2023.

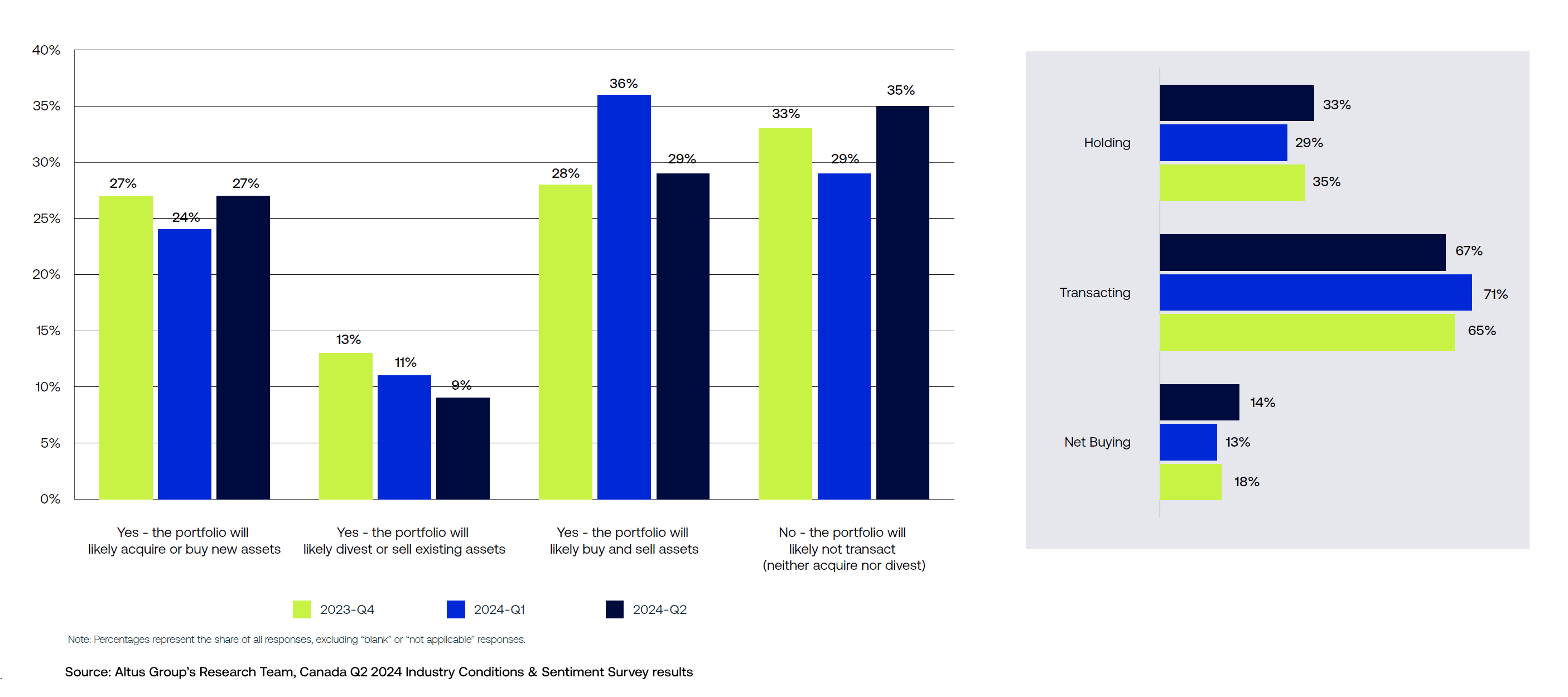

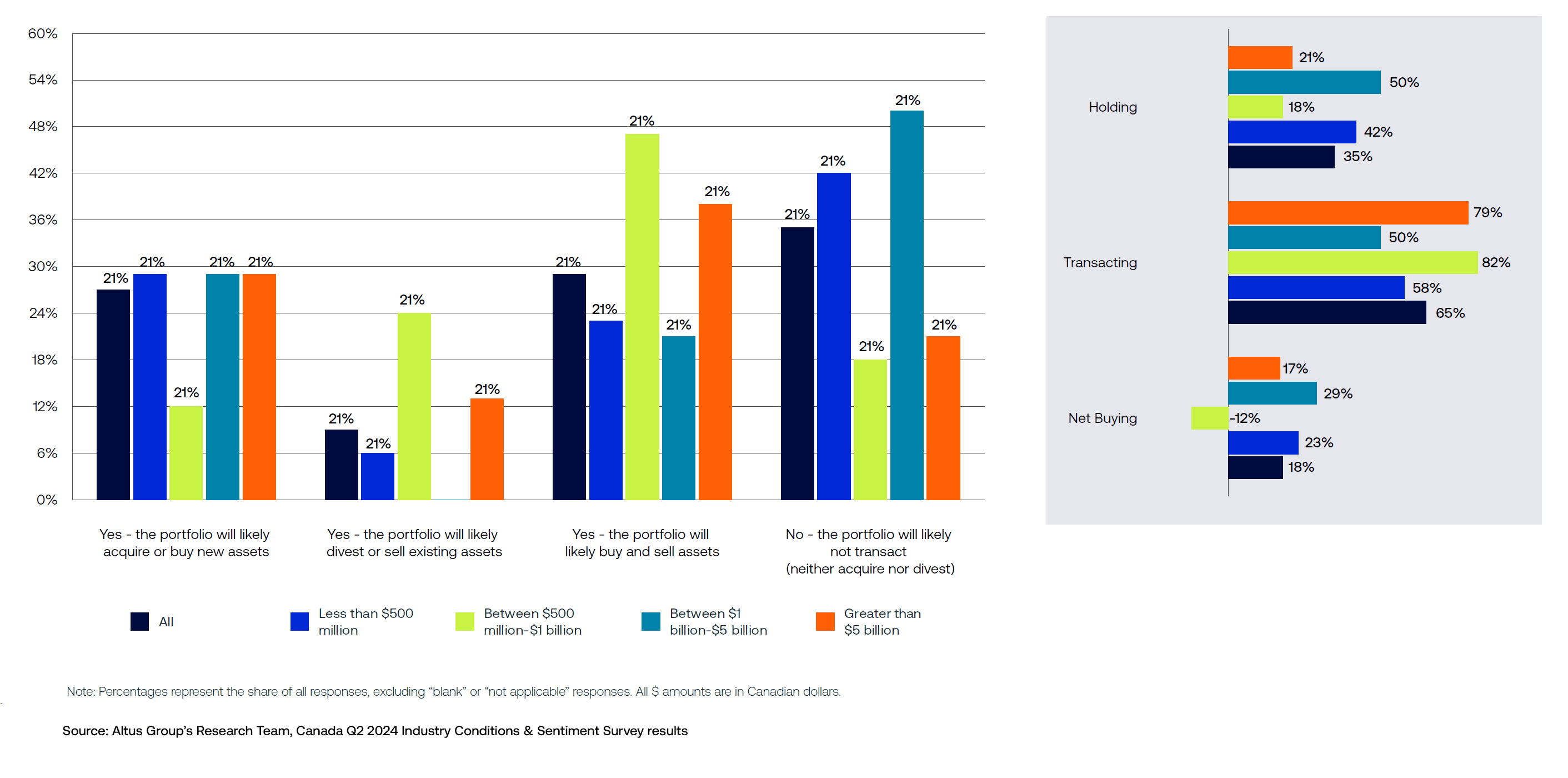

Intentions to buy in the next 6 months still outweigh intentions to sell, though those intending to hold also increase

Responses show 65% plan to transact (buy, sell, or both) in the next 6 months, down from 71% in the previous quarter.

Figure 4: Over the next 6 months, do you anticipate any transactions in your portfolio? (Quarter-over-quarter comparison)

Contributing to the downward shift in companies planning to transact, mid-sized companies with commercial real estate (CRE) exposure between $1 billion and $5 billion CAD showed a 28 pp decrease in transactions and a shift towards holding onto their properties. On the other hand, the largest firms with CRE exposure greater than $5 billion indicated their intention to buy properties in the next 6 months. The proportion of these firms planning to buy increased by 15 pp over the quarter, bringing the total close to a third of these firms intending to make a purchase in the near term.

Figure 5: Over the next 6 months, do you anticipate any transactions in your portfolio? (Compared by size($) of CRE portfolio)

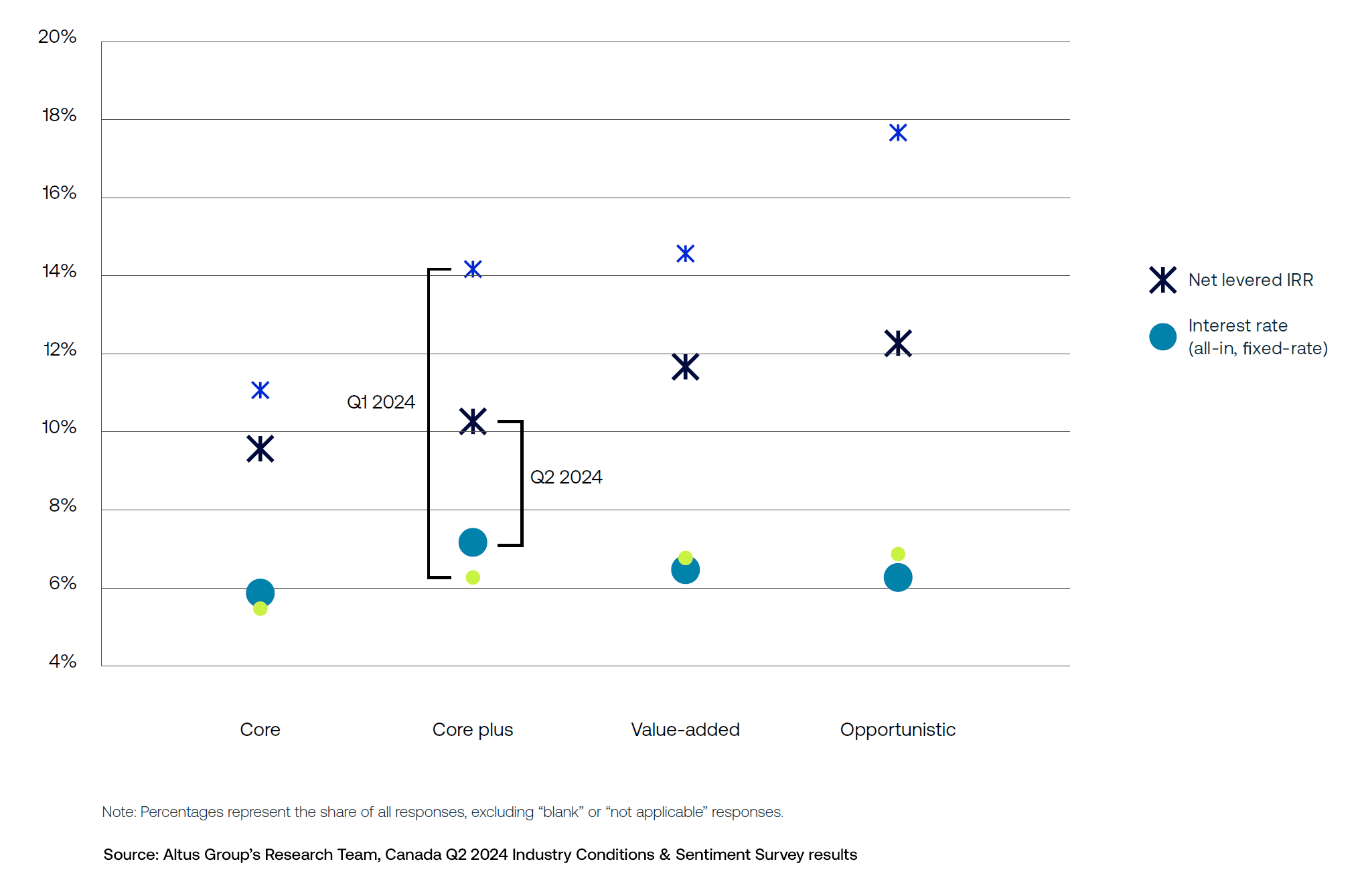

Net levered returns to equity decline and expected cost of debt increases for core and core plus

The expected 12-month fixed-rate financing for respondents has increased to 6.0-7.3%, up from 5.6-7.0% in Q1 2024, across the main portfolio strategies. Debt costs for core and core plus strategies are expected to increase by 36 basis points (bps) and 96 bps, respectively. Meanwhile, value-added and opportunistic strategies are expected to see declines by 26 bps and 61 bps, respectively, over the quarter.

Figure 6: Where do you anticipate the cost of capital to be over the next 12 months (on annualized basis)?

The expected net returns to equity (net levered IRRs) for all strategies decreased by an average of 343 bps. The opportunistic strategy saw the largest decline at 548 bps, while the core strategy experienced the smallest decline at 153 bps compared to the previous quarter.

A request for your participation

Our ability to share valuable market insights depends on the active participation of industry professionals like you. As we gather a diverse range of voices, the richness of the data deepens, allowing us to segment responses and paint a more detailed portrait of the industry’s collective outlook each quarter.

Your participation is instrumental in shaping the narrative of the commercial real estate landscape, please support this survey program by sharing your perspective on our next installment of the ICSS.

Until our next survey opens, we encourage you to download the latest results of the Q2 2024 Canada Industry Conditions and Sentiment Survey.

Authors

Omar Eltorai

Senior Director of Research, Altus Group

Cole Perry

Associate Director of Research, Altus Group

Authors

Omar Eltorai

Senior Director of Research, Altus Group

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights