Key takeaways

Participants in the Q3 2024 survey anticipate interest rates and the cost of capital to continue to decline for commercial real estate, leading to improved financing conditions

Capital availability is expected to increase over the next year across both equity and debt capital sources, but bank lenders and mortgage REITs are expected to remain somewhat constrained

While some property sector perceptions remain as “overpriced”, many respondents are seeing more fairly priced properties across the major sectors

Respondents are increasingly planning to transact in the near-term, driven by the larger institutions, though the smallest institutions intend to be net buyers

Property-level (operating) and community-related topics (housing issues) moved up in the ranking of priority issues, though capital considerations remain a top priority

Survey results show an improved outlook on easing capital conditions and sound fundamentals

In the latest installment of Altus Group’s Q3 US Commercial Real Estate Industry Conditions and Sentiment Survey (ICSS), responses indicated that the commercial real estate (CRE) industry is expecting an improved financing environment, steady operating cashflows, moderate cap rate compression, and increased transaction activity. This article shares additional details from Altus Group’s Research Team on key takeaways from the survey.

Financing environment is anticipated to improve over the next year

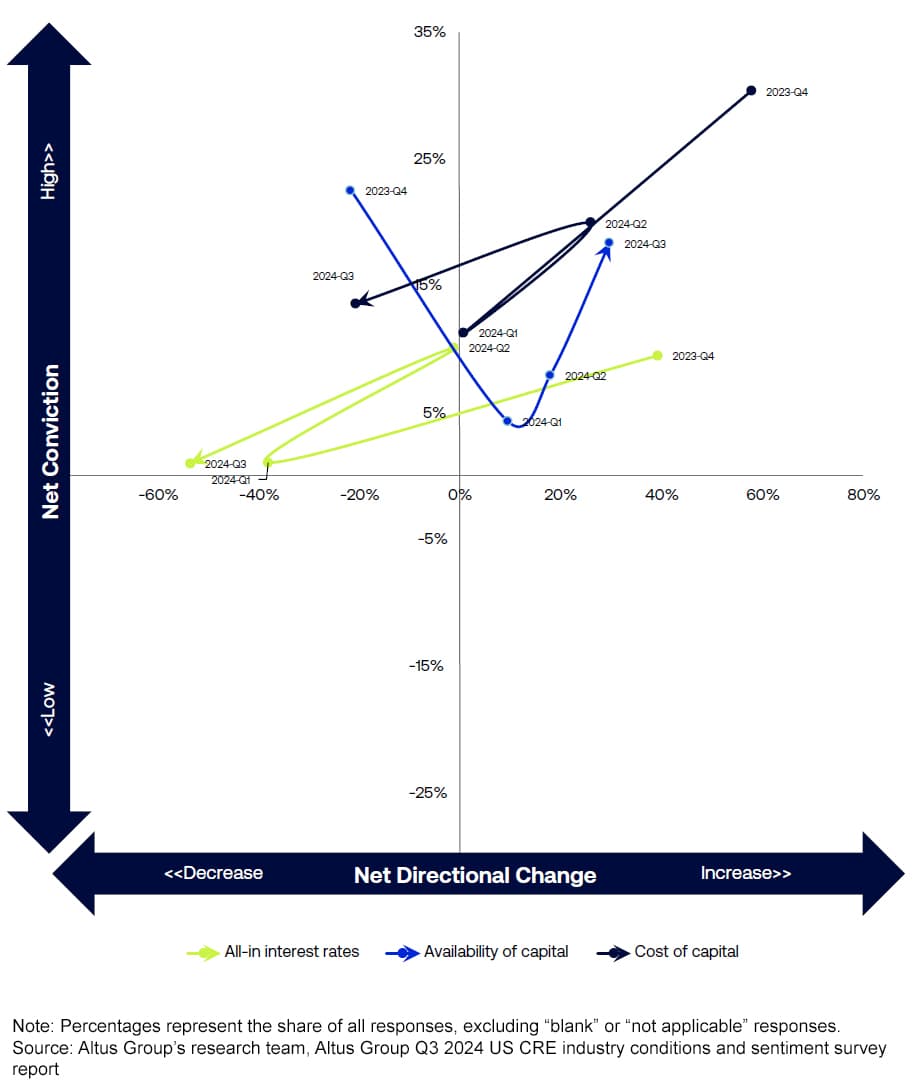

Anticipating the recent shift by the Federal Reserve to start easing monetary policy through interest rate cuts, participants in the Q3 2024 survey indicated that they expect all-in interest rates and the cost of capital for CRE to meaningfully continue to decline over the next 12 months.

Figure 1 - Capital: Interest rates, availability, cost of capital

Property-level revenue and NOI growth are generally expected to remain stable over the next year, suggesting that the improved financing conditions coupled with some modest cap rate compression could be supportive of property valuations.

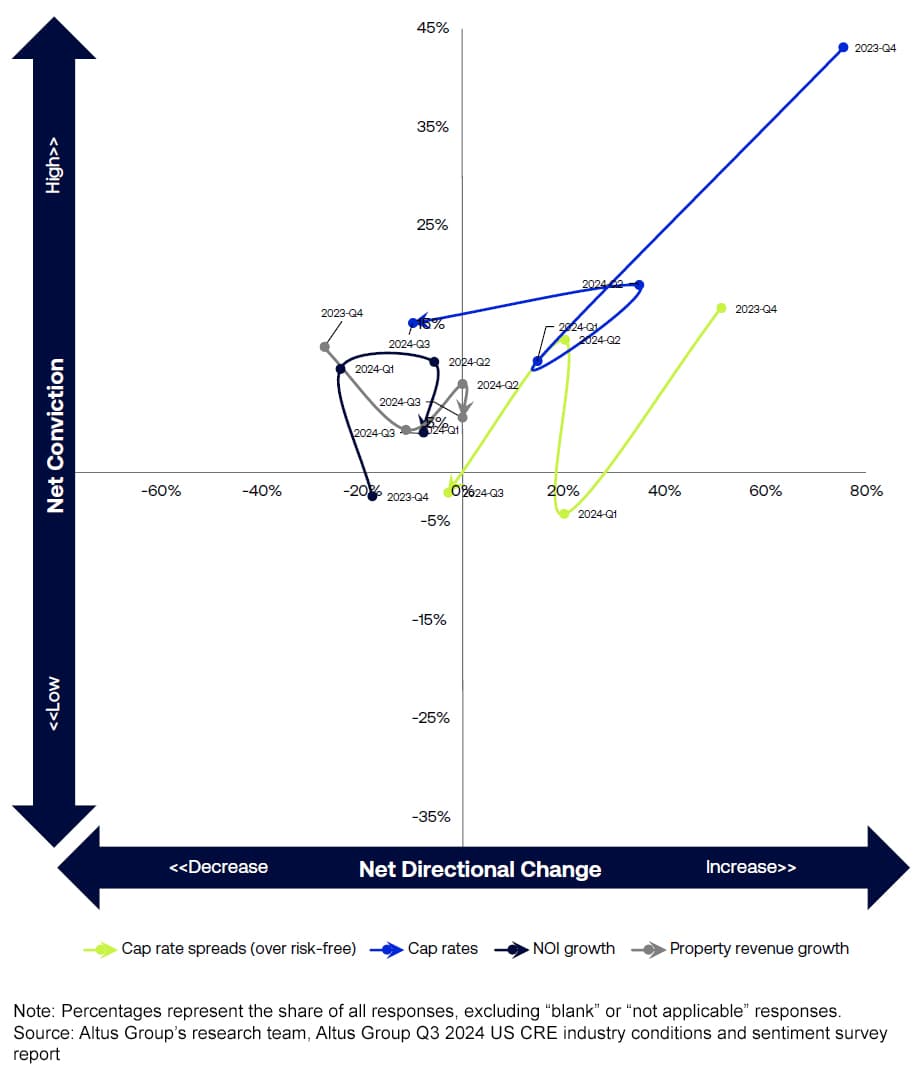

Figure 2 - Fundamentals: Revenues, NOI, cap rates

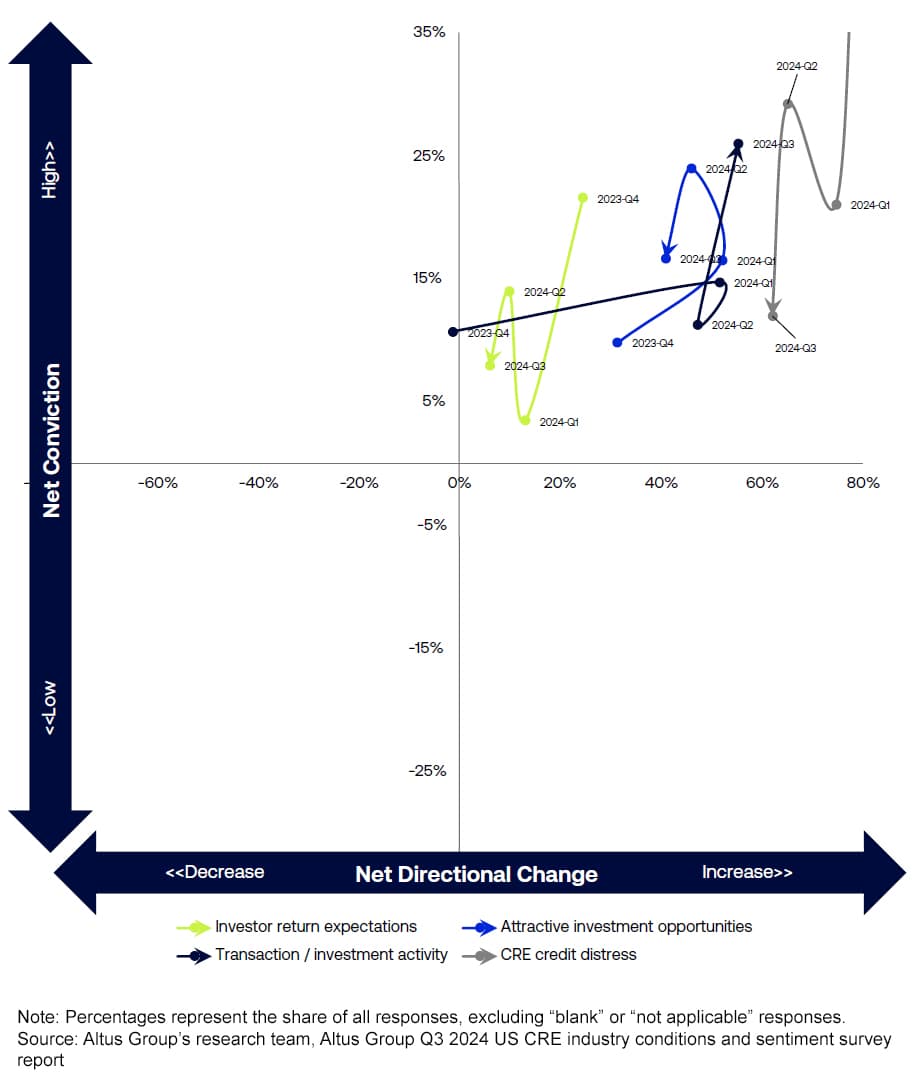

While survey participants still expect distress to pick up, they hold this view with less conviction than in prior quarters. An uptick in distressed transactions may provide attractive investment opportunities and contribute to the overall increased investment activity that participants anticipate.

Figure 3 - Investments, returns, distress, activity

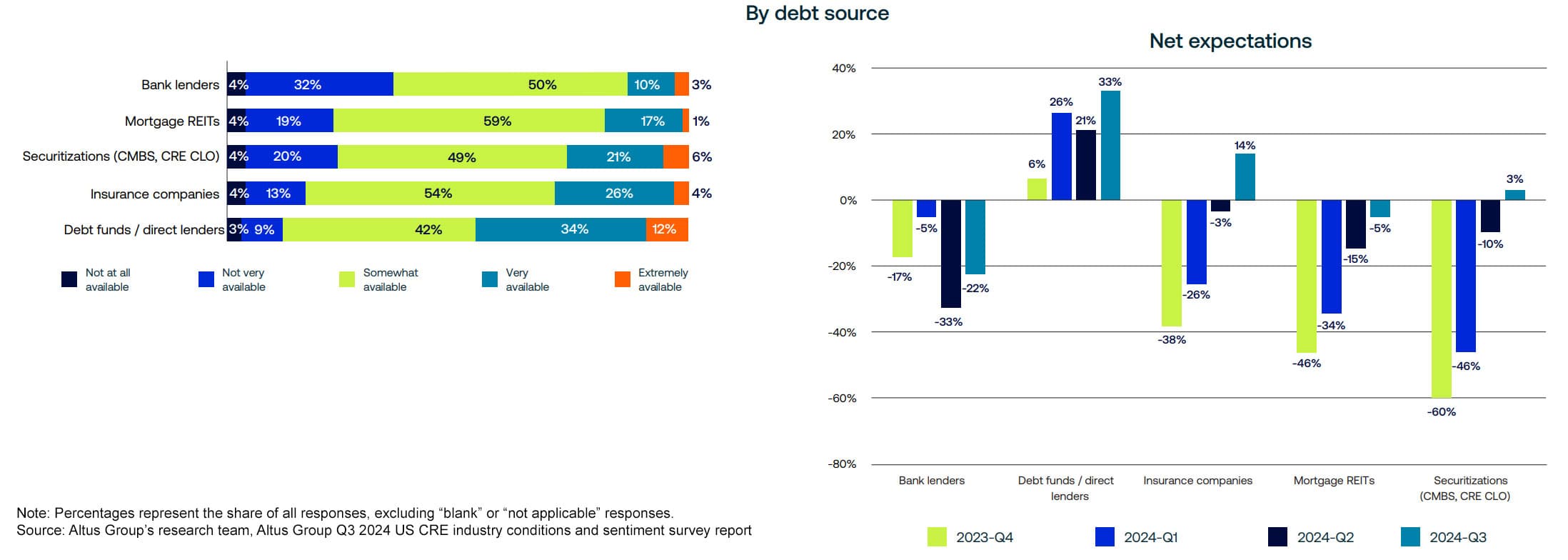

Capital availability is also expected to improve across sources

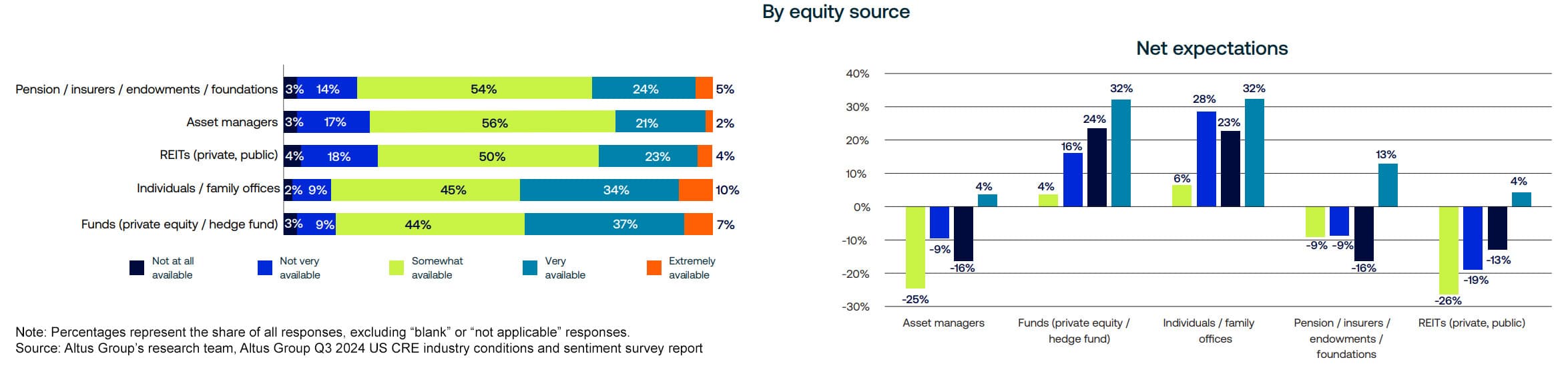

Capital availability from both equity and debt sources is expected to improve over the next year, as the recent Fed rate cuts are digested and work their way through to capital providers. Net expectations for capital availability by source surged in the latest survey results.

While survey results indicated improved availability expectations across nearly all capital sources, bank lenders and mortgage REITs remain outliers, as the net expectations indicate that these debt providers will remain constrained. Responses over the past four quarters have shown vast improvements in net expectations for debt capital from life insurers and securitizations, which have improved 52 percentage points and 63 percentage points, respectively, since Q4 2023.

Figure 4 - Expectations for capital availability by equity source

Figure 5 - Net expectations for debt sources

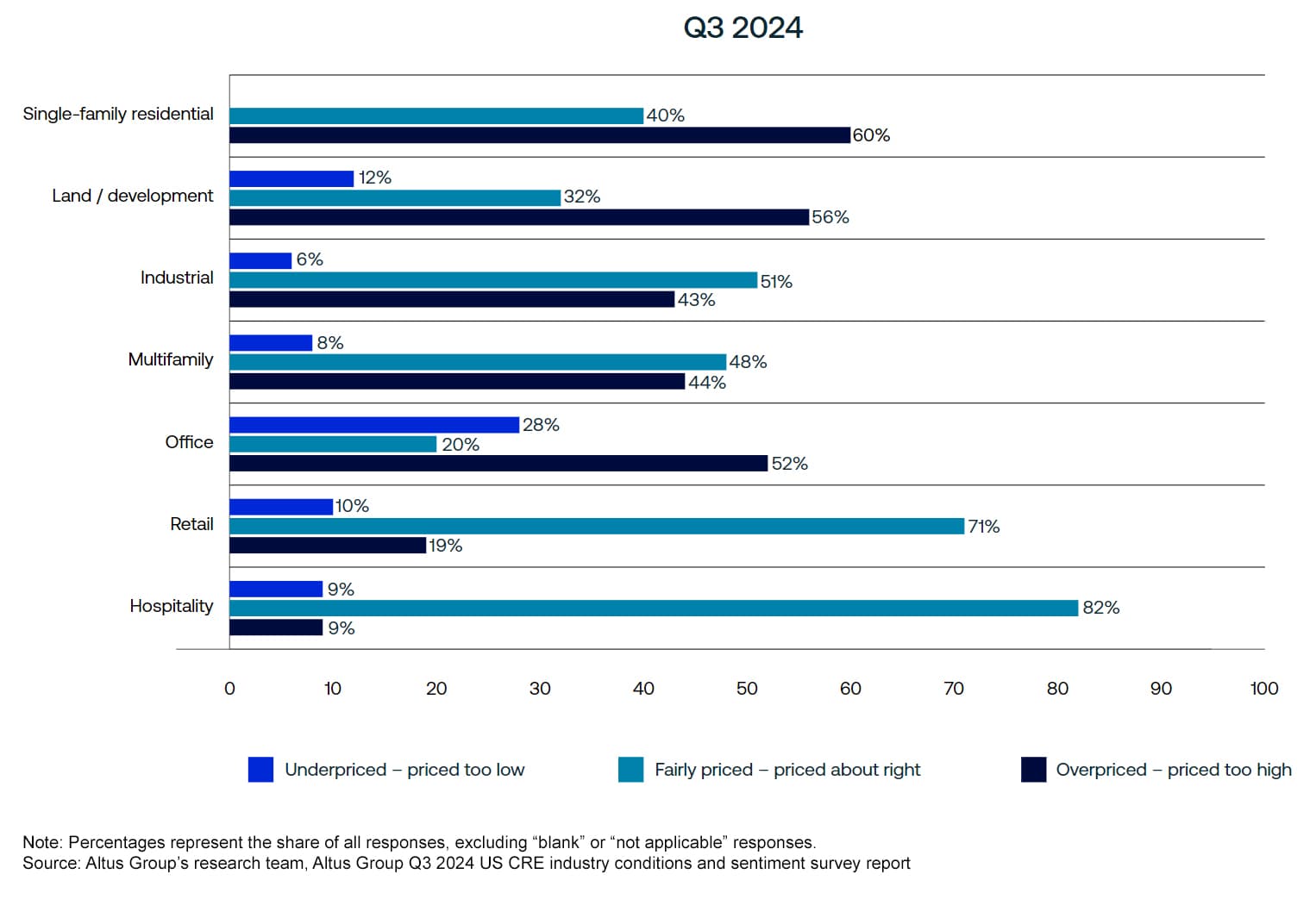

Perception of current pricing continues to shift towards “fairly priced”

Across the largest property sectors, participants increasingly describe current pricing as being “priced about right”. The majority of respondents across seven of the 11 sectors chose the “fairly priced” characterization. While single-family residential and land/development were still described as being “overpriced” in Q3, hospitality and multifamily saw significant swings from “overpriced” to “fairly priced” from Q2.

Figure 6 - How would you characterize current pricing for the following property types

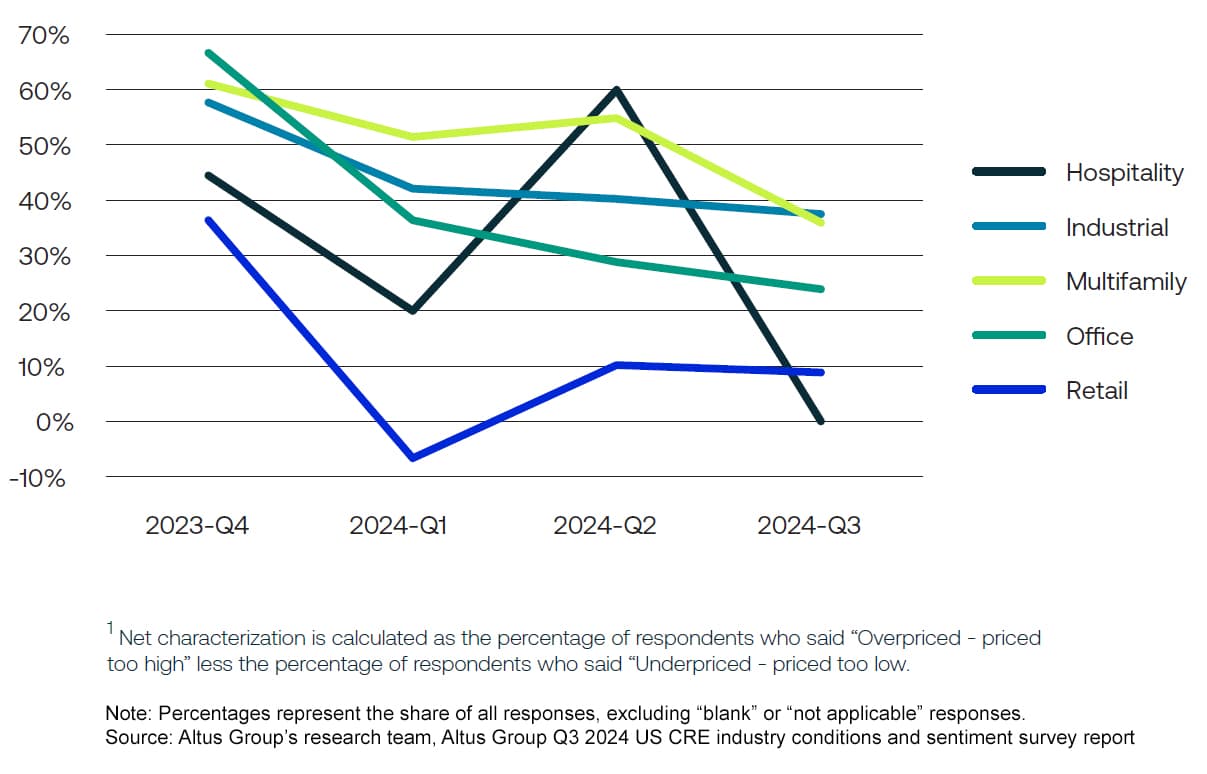

Looking back over the last four quarters, the overall net characterization of pricing (the percentage of respondents who selected “overpriced” less the percentage of respondents who selected “underpriced”) has been trending down across the major property sectors.

Figure 7 - Net characterization of current pricing

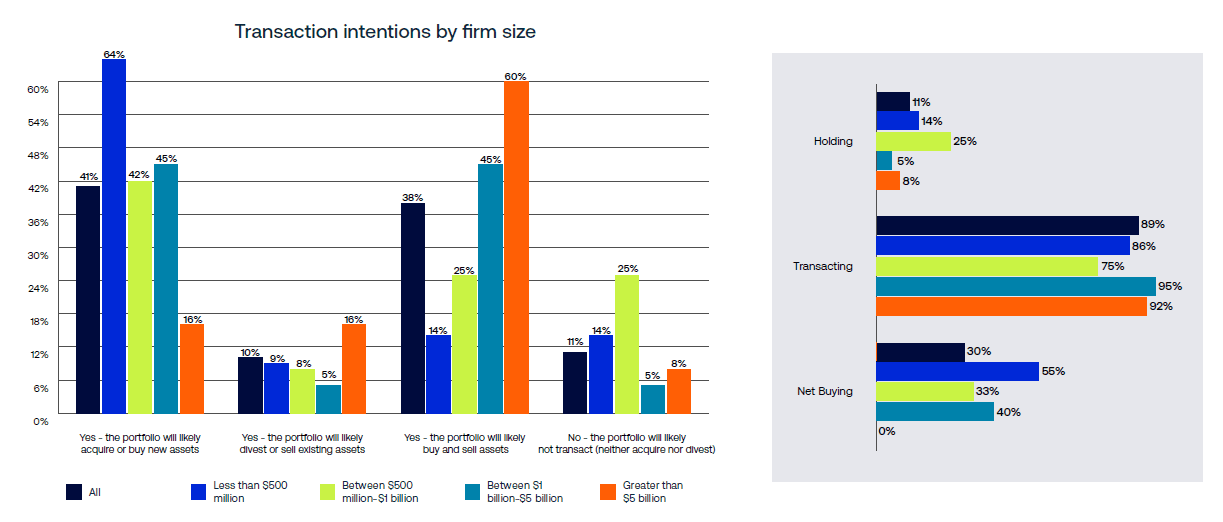

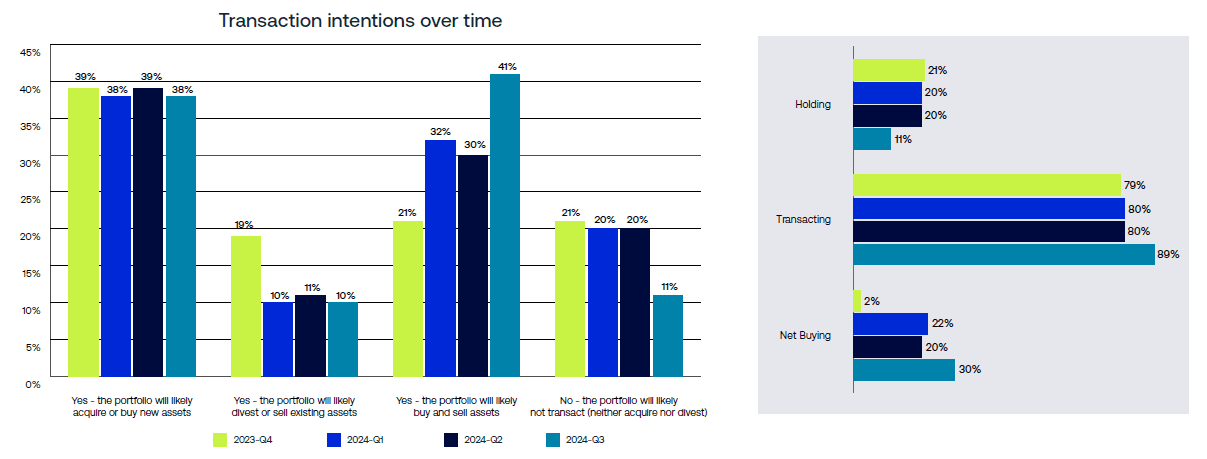

Near-term transaction intentions lifted across all firm sizes

Respondents’ near-term transaction intentions continued to increase through Q3. A significant majority (89%) of respondents noted that they plan to transact (buy and/or sell) in the next 6 months, representing the highest level recorded. The smallest institutions (less than $500 million) reported that they intend to be net buyers, while 60% of the largest institutions (greater than $5 billion) reported that they plan to buy and/or sell.

Figure 8 - Transaction intentions over the next six months by firm size

Figure 9 - Transaction intentions over the next 6 months

Localized issues climb on list of anticipated priorities

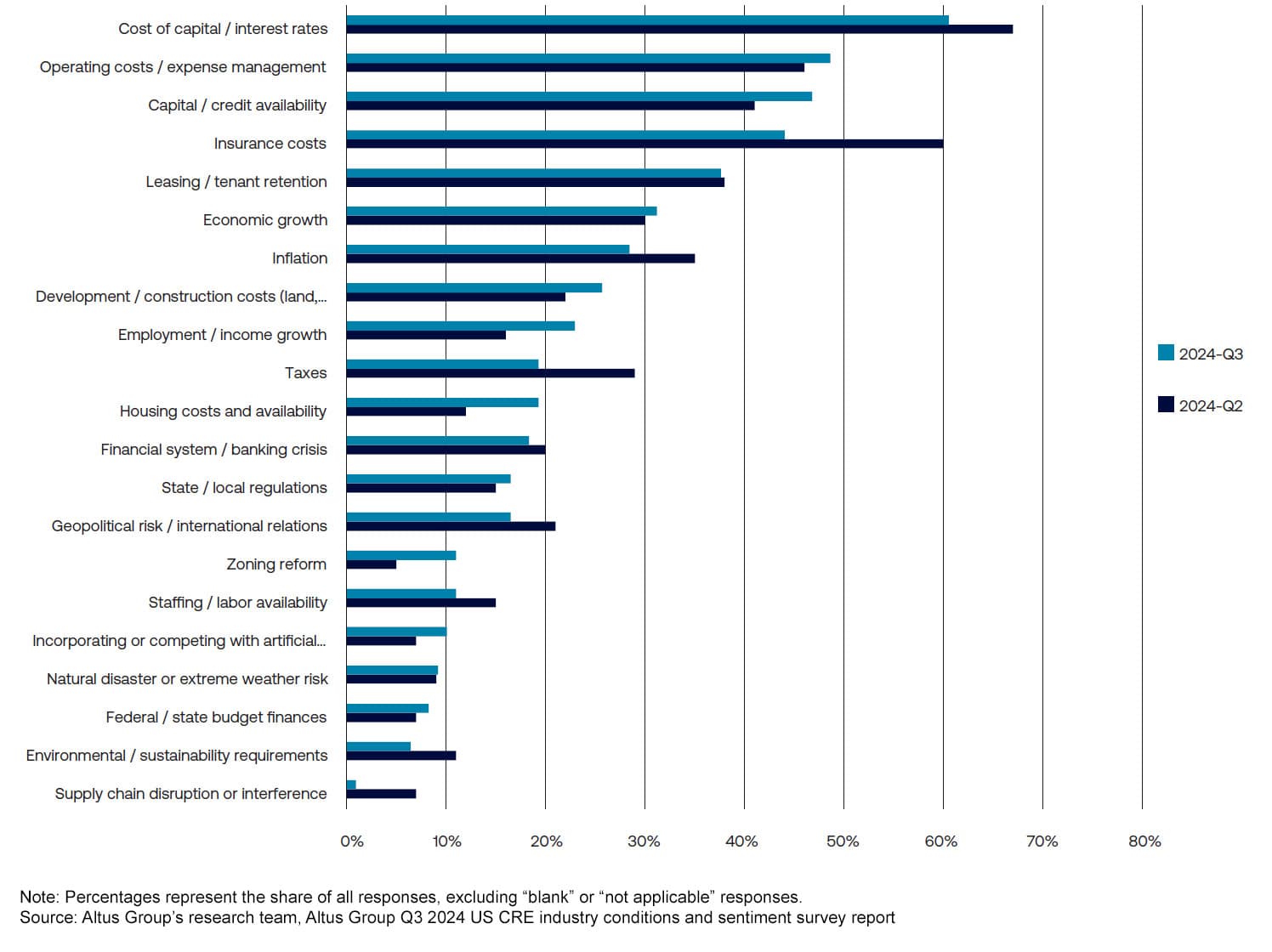

Participants’ responses indicated that capital considerations (cost of capital, capital availability) remained top priority issues in the Q3 survey – though this may have been, at least in part, due to the fact that the survey collection period preceded the Fed’s first rate cut announcement.

Cost of capital remained the top concern of respondents for the fourth consecutive quarter, with 60% of respondents citing it as a priority—the only issue identified by a majority during Q3. Capital availability was also a significant concern, ranking third at 47%, and showing a notable increase (+6%) quarter-over-quarter.

Figure 10 - Priority issues over the next 12 months

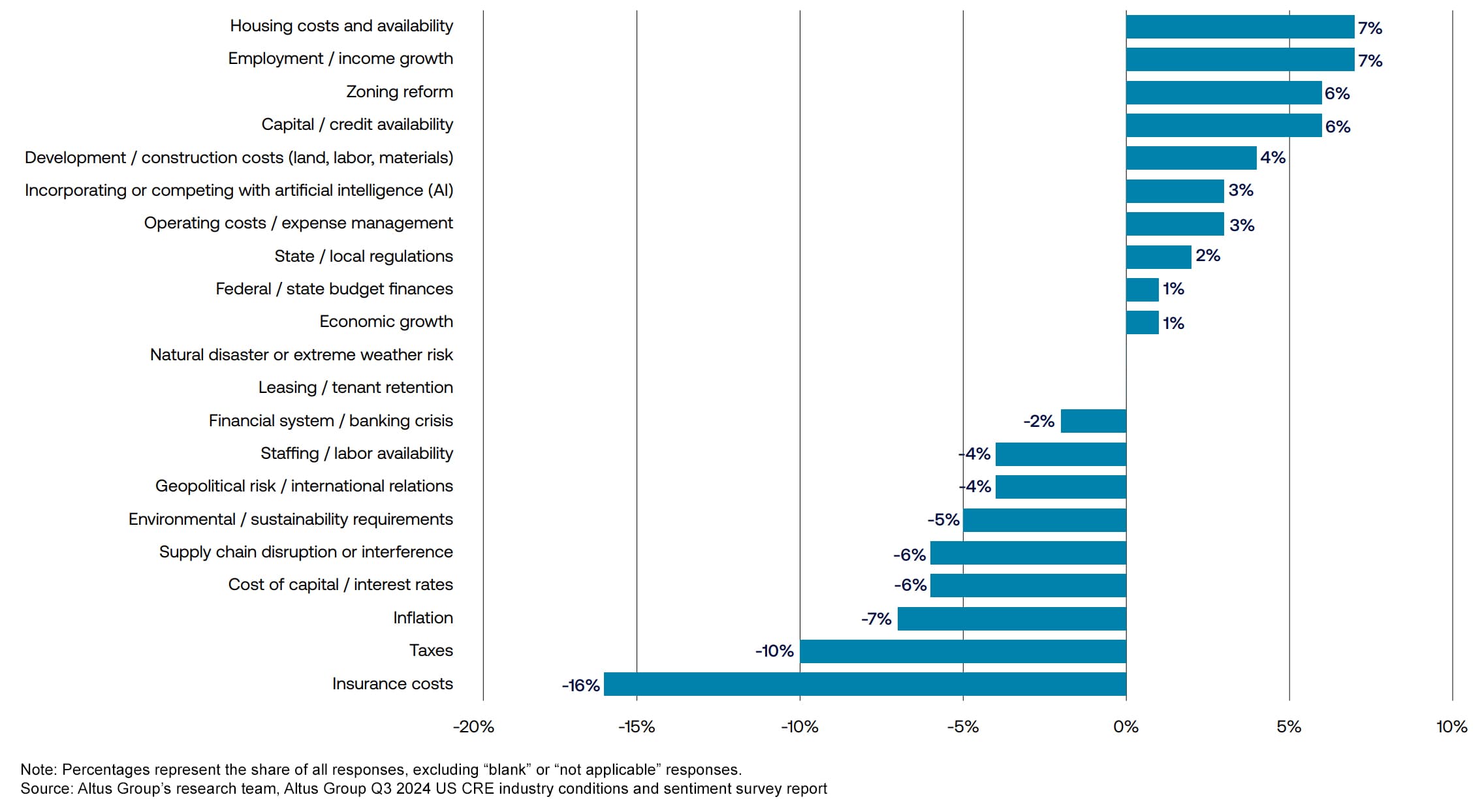

Property-level issues were also widely acknowledged. Operating costs were a priority for 49% of respondents, reflecting a 3% increase from Q2. Tenant retention remained a steady concern, with 38% of respondents identifying it as a priority, unchanged from the prior quarter. Among property-level concerns, the percentage of respondents citing “insurance costs” declined 16 percentage points in Q3, the most out of any issue, while the share concerned about taxes declined nearly 10 percentage points.

Community-related concerns rose to the forefront, while some property-level concerns such as taxes and insurance costs faded. Community and region-level concerns saw a notable uptick in Q3, with housing issues coming to the forefront. Housing cost and availability rose by 7% as a priority, employment and income growth also increased by 7%, and zoning reform was up 6%.

Figure 11 - Changes in priority issues since Q2 2024

A request for your participation

Our ability to share valuable market insights depends on the active participation of industry professionals like you. As we gather a diverse range of voices, the richness of the data deepens, allowing us to segment responses and paint a more detailed portrait of the industry’s collective outlook each quarter.

Your participation is instrumental in shaping the narrative of the commercial real estate landscape, please support this survey program by sharing your perspective on our next installment of the ICSS.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Omar Eltorai

Senior Director of Research, Altus Group

Cole Perry

Associate Director of Research, Altus Group

Authors

Omar Eltorai

Senior Director of Research, Altus Group

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights