Key highlights

Q2 US survey results show a clear trendline of improving sentiment around the availability of debt capital from non-bank lenders

The jump in sentiment from respondents who cited raising or deploying capital as their primary focus over the next 6 months in the Q1 survey held steady in Q2

80% of respondents expect to be actively buying, selling or both over the next six months

Obstacles to transacting persist with high capital costs and views that many property types remain overpriced

Respondents predict improvement ahead in access to non-bank commercial real estate debt financing

Even as high interest rates remain a significant obstacle to deal-making, the latest results from Altus Group’s Q2 Commercial Real Estate Industry Conditions and Sentiment Survey show notable positive shifts in expectations for the coming year.

On the surface, the subdued pace of transaction activity during the second quarter suggests that little has changed over the past six months. The Fed has held firm on its 2% inflation target, liquidity is still constrained, and capital is more expensive. Yet results from the Q2 survey indicate that borrowers are adjusting to the current environment. Notably, expectations for debt capital availability have improved dramatically across numerous non-bank sources versus the prior quarter.

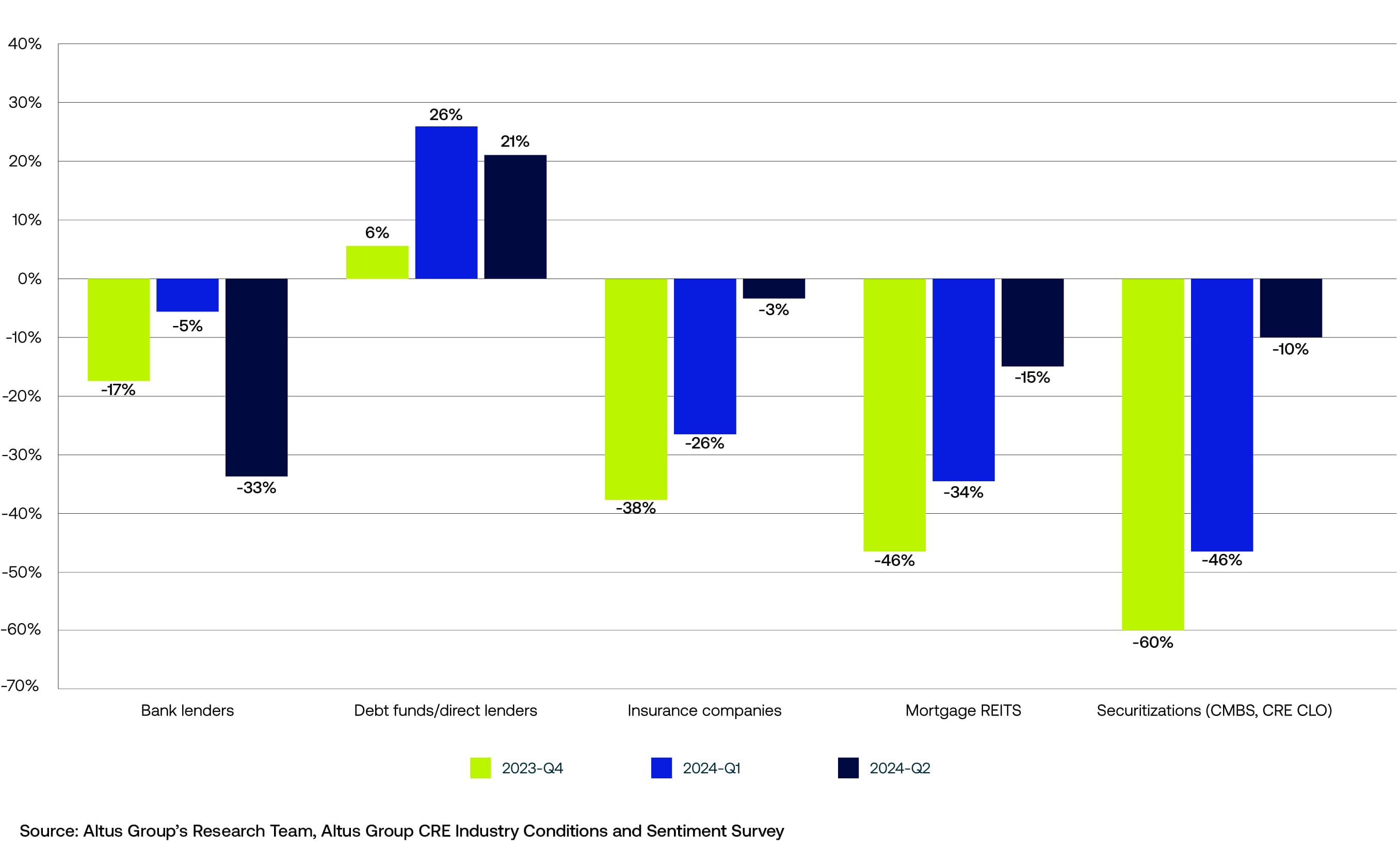

Specifically, the net capital availability expectations (sum of responses for “extremely available” and “very available” less the sum of responses for “not very available” and “not at all available”) improved 20% for mortgage REITs, 22% for insurers, and 36% points for securitizations compared to the Q1 survey results.

Improving access to commercial real estate debt sources

Non-bank lenders are recognizing the opportunity to provide needed capital to the CRE market, as well as write deals with higher quality sponsors and assets. Mortgage REITs, debt funds, insurers, and securitizations, are all stepping in to fill the void in CRE lending left by regional banks. As such, net expectations for capital availability over the past three quarters are showing a steady trend line of improvement across these lenders. Over just three quarters, from Q4 2023 to Q2 2024, net availability expectations increased 15% for debt funds, 35% for insurance companies, 31% for mortgage REITs, and 50% for securitizations (CMBS/ CRE CLOs).

Figure 1 – Net expectations for debt capital availability

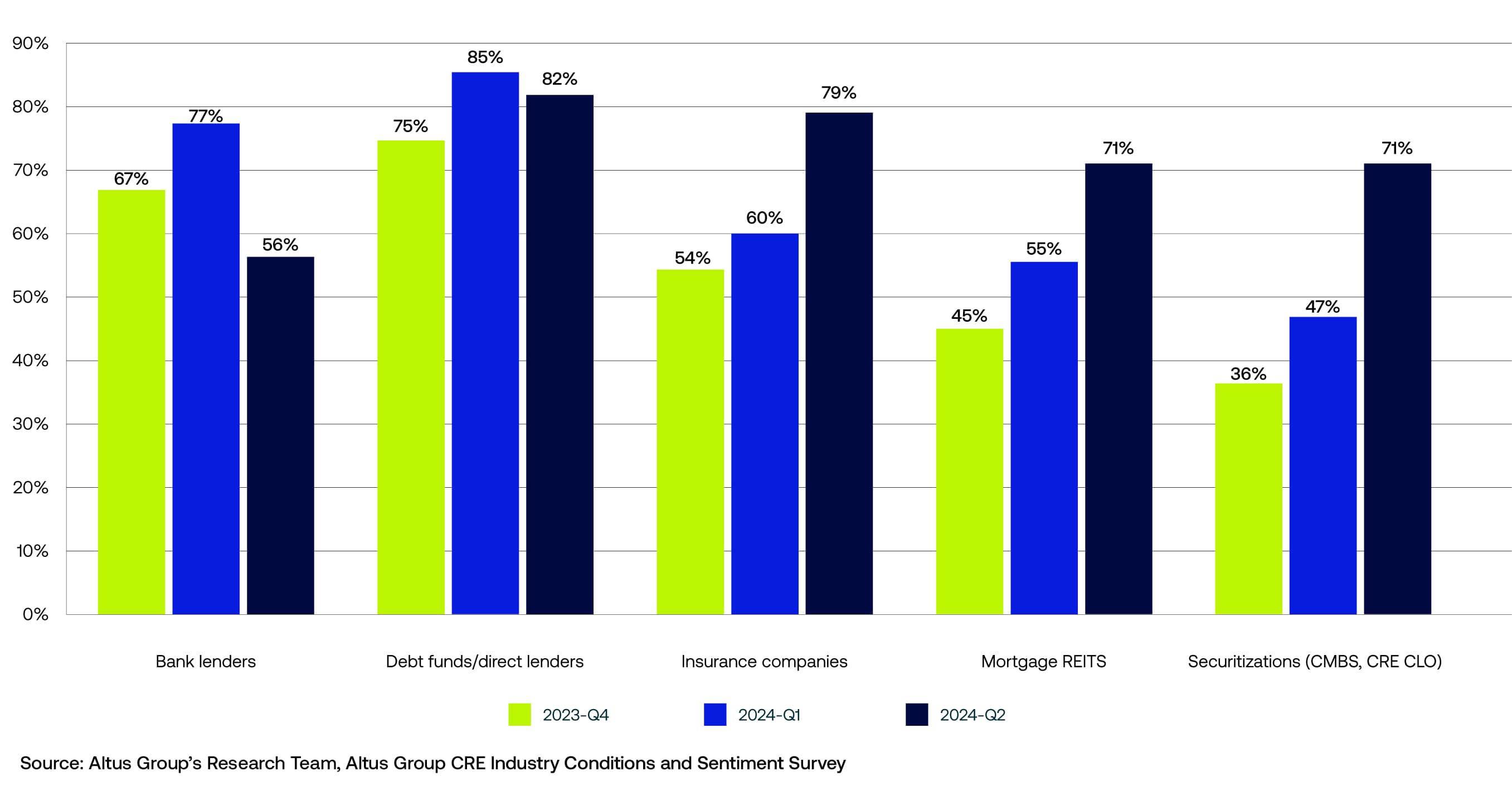

From another perspective, a majority of respondents believe that debt capital will be at least somewhat available from all sources. Debt funds rated the highest with 82% who said that capital would be at least somewhat available for that source in the coming year, followed by insurance companies at 79%, mortgage REITs and securitizations each at 71% and banks at 56%. Again, we observe that the overall perception of capital availability from alternative lenders is either remaining steady at or increasing to the "broad majority" level. In contrast, banks have seen a significant decline in expectations for capital availability over the prior quarter, taking them from “broad majority” into “simple majority” territory.

Figure 2 – Expectation that debt source will be at least “somewhat available”

Roughly 44% of respondents think that bank financing is not going to be available to them over the next six months. Part of the negative sentiment around the availability of capital from banks could be colored by perception given news stories concerning CRE exposure and regulatory scrutiny of banks, particularly among regional banks. Banks are worried about CRE loan books, while at the same time feeling pressure from deposit flight and loans that are extending and not rolling off the books.

The flip side is that a majority of respondents, 56%, think that bank financing will be at least somewhat available. Although banks are moving more cautiously and trying to trim their exposure to CRE, they may still lend to relationship customers across numerous property sectors.

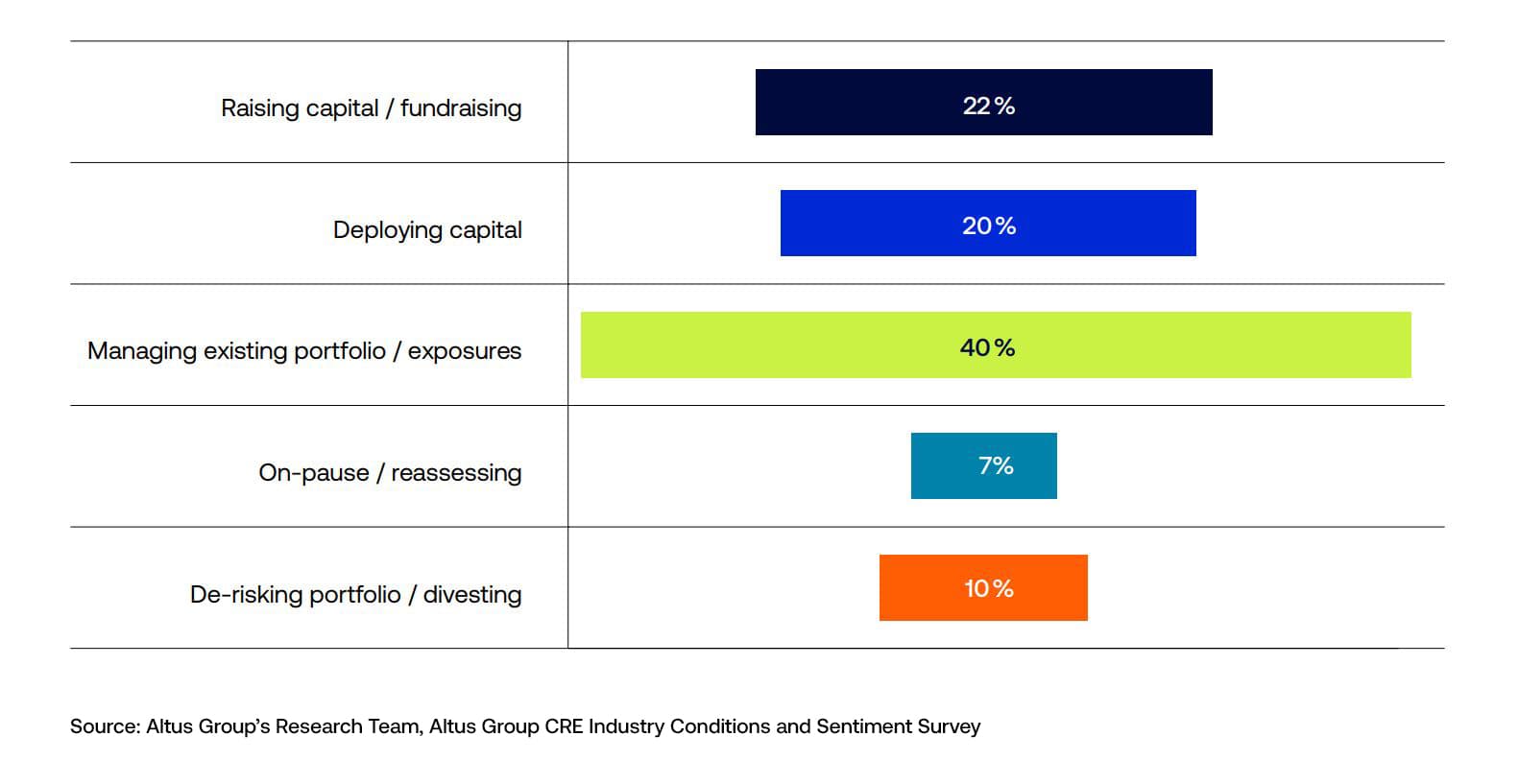

Strong intent to raise / deploy capital

One of the key findings in the Q1 Survey was a huge jump in the percentage of respondents that said they would either be raising capital or deploying it. Specifically, the share of respondents who selected deploying capital as their primary focus over the next six months surged from 7% in Q4 2023 to 25% in Q1 2024. Raising capital also climbed 5% to 22% over the same period.

Although managing existing portfolio and exposures remains a primary focus of 40% of respondents in Q2, those focused on raising capital /fundraising held firm at 22%, while those who are primarily focused on deploying edged slightly lower to 20%. The Q2 survey results reinforce an underlying appetite to do deals. Sentiment has held steady despite more pessimism around the timing and magnitude of Fed rate cuts. The CRE industry was anticipating potentially six rate cuts in 2024 at the beginning of the year, while the current debate is whether there will be perhaps one, two or even no rate cuts until 2025.

Figure 3 – What do you think your team’s primary focus will be over the next 6 months?

It also is important to qualify some of the findings. The survey responses do not capture “how much” capital respondents are looking to raise or deploy. So, while survey responses on a percentage basis haven’t shifted much, firms could be indicating that they plan to be raising or deploying capital, albeit less of it due to the elevated interest rate environment.

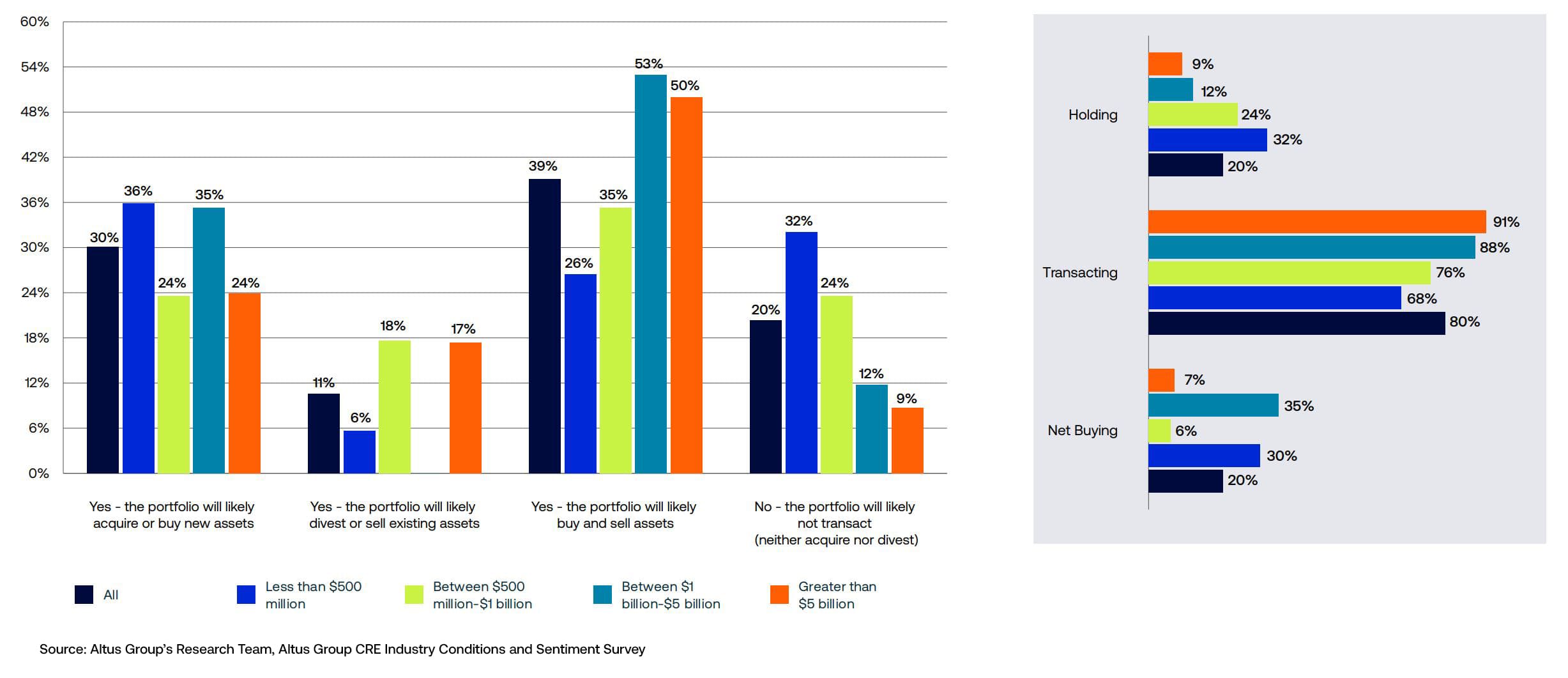

Larger commercial real estate firms expect to be more active

Another glimmer of positivity in the Q2 Sentiment Survey is that a large majority of all respondents, 80%, expect to be actively buying, selling or both over the next six months. Larger firms in particular are likely to be more active. 91% percent of firms with $5B or more in assets expect to be actively transacting in the second half of the year, followed by 88% of firms between $1B-$5B.

Figure 4 – Over the next 6 months, do you anticipate any transactions in your portfolio?

Larger players may have an easier path to capital. Some have relationships with not one, but multiple banks. Additionally, they may have an easier time tapping life insurers or the securitization market, which can be competitive on rates.

However, Q2 results may also suggest that despite the desire, and perhaps the capital, to transact, the specific opportunities that firms are looking for may be slim or absent. Survey respondents believe most property types, including office, multifamily, hospitality, life sciences and land, are currently overpriced. Capital may not be put to use until participants perceive pricing across major property types to be fair again.

Adapting to a higher-rate environment

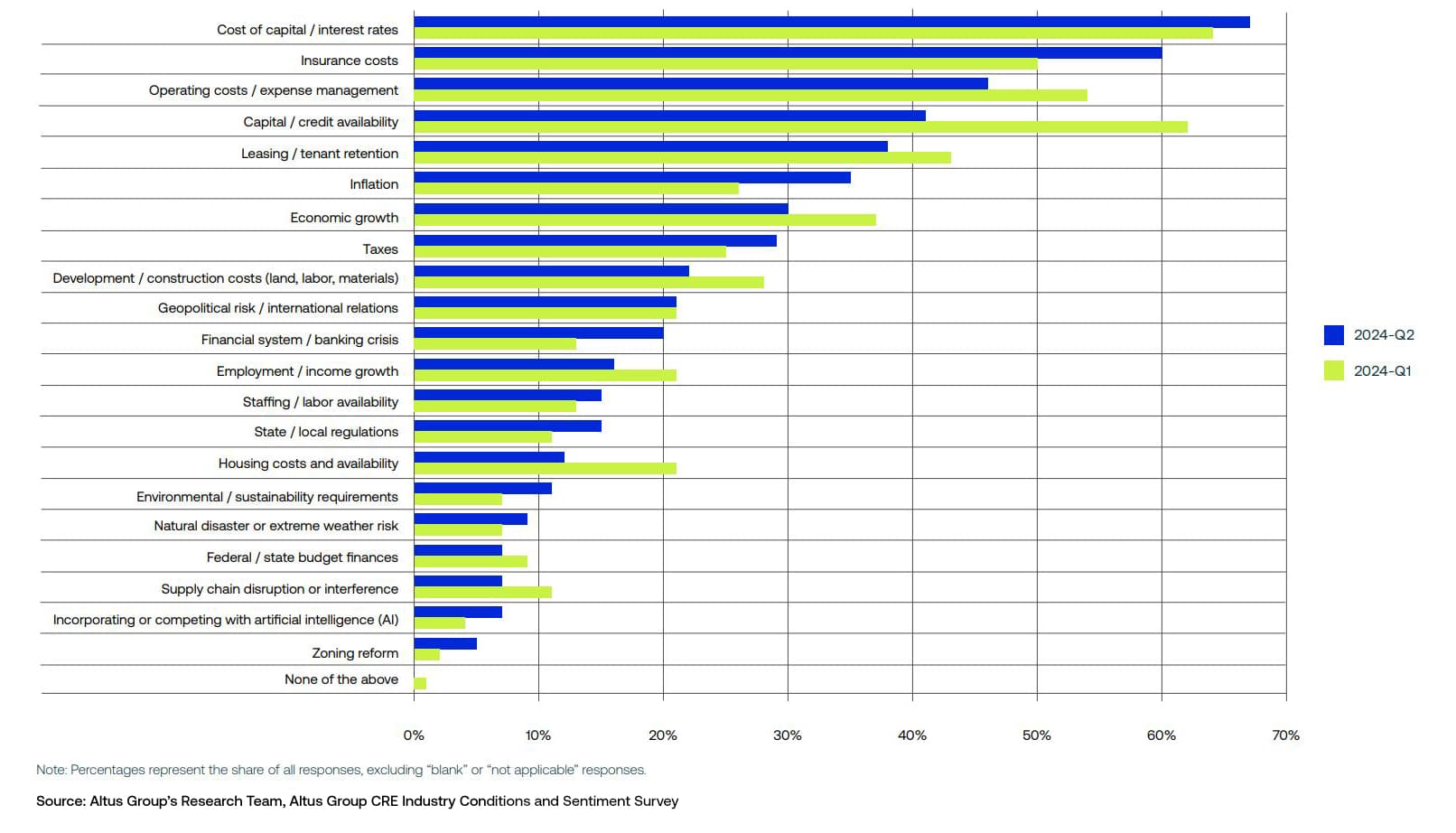

A key takeaway from the Q2 survey is that the commercial real estate market has not fully seized up. Although capital cost is a priority issue of more than two thirds of respondents, capital availability has plummeted as a concern. The issue was a top priority of just over 40% of respondents in Q2, down nearly 20% from Q1.

Figure 5 – Priority issues over the next 12 months

The latest Consumer Price Index (CPI) data suggests that inflation data is slowing to levels that are closer to Fed targets, and the Fed funds rate is broadly expected to level off between 3.0 and 3.5% in 2025. While it may take time to achieve the target 2% inflation rate, Fed estimates put it on a downward trend.

The CRE market may well be in a very different position in six months. Looking ahead to Q3, Altus Group’s Research Team anticipates focusing on any additional shifts in capital availability sentiment for alternative lenders as well as any movement of capital availability as a “priority issue”. Will concerns around capital availability continue to decline, or will sentiment swing back the other way?

Author

Cole Perry

Associate Director of Research, Altus Group

Author

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights