Key highlights

The “soft landing” narrative is brought back as recent economic and market indicators remain mixed, but expectations from survey data across consumers, business leaders, and economists are improving

While the AI-driven rally across broad equity market indices has captured the attention of many, red flags seen in the credit markets signal “caution ahead”

Regaining much of their 2022 losses, major equity market indices have been a key driver in improved investor and consumer confidence

Commercial real estate mirrored the mixed signals seen across the economy and broad capital markets, as decreased availability of capital continued to explain the low transaction activity and obscure price discovery

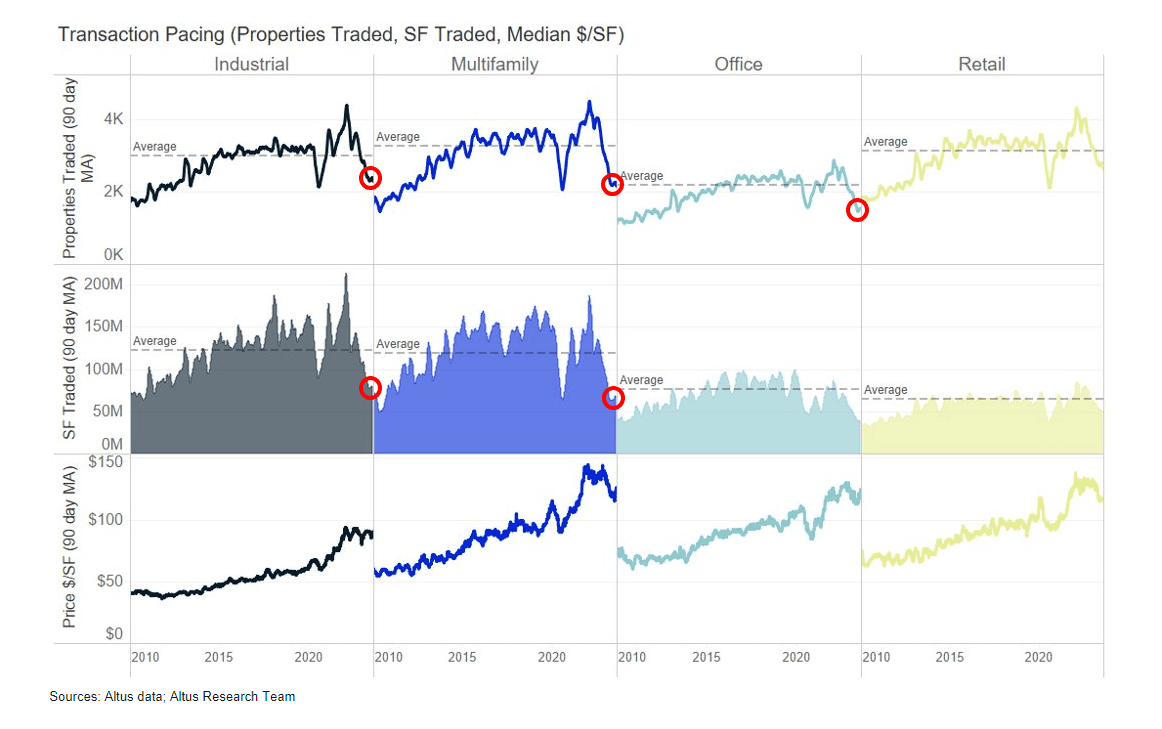

The most recent US CRE transaction data suggest that while pacing of transactions is still far below that of prior years and the historical average, the markets may have found the nadir

Where’s that recession everybody predicted?

Nearly two-thirds of the way through the year, many are stuck asking: where’s the recession everybody predicted?

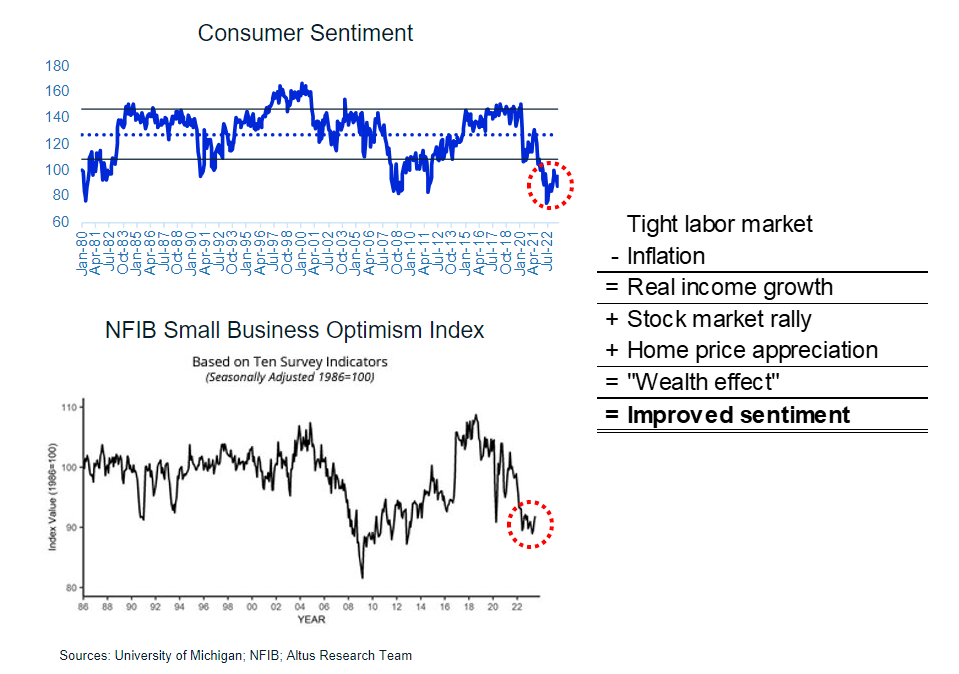

Recent economic and market indicators remain mixed, but expectations based on survey data across consumers, business leaders, and economists are improving. This improvement in overall sentiment seems to be driven, in large part, by the improved situation of consumers. First, a tight labor market (combined with moderating inflation) is helping to drive real earnings growth for employees. Second, resilient home prices – having shaken off recent declines seen earlier this year – have combined with year-to-date gains in the stock market drive to create a “wealth effect”. In simple terms, consumers feel wealthier and are willing to continue spending. Third, the consumer demand is flowing through to help lift business leader confidence.

While many forecasters and investors were anticipating a deteriorating economy, the highly anticipated recession has yet to appear, and the economy remains resilient.

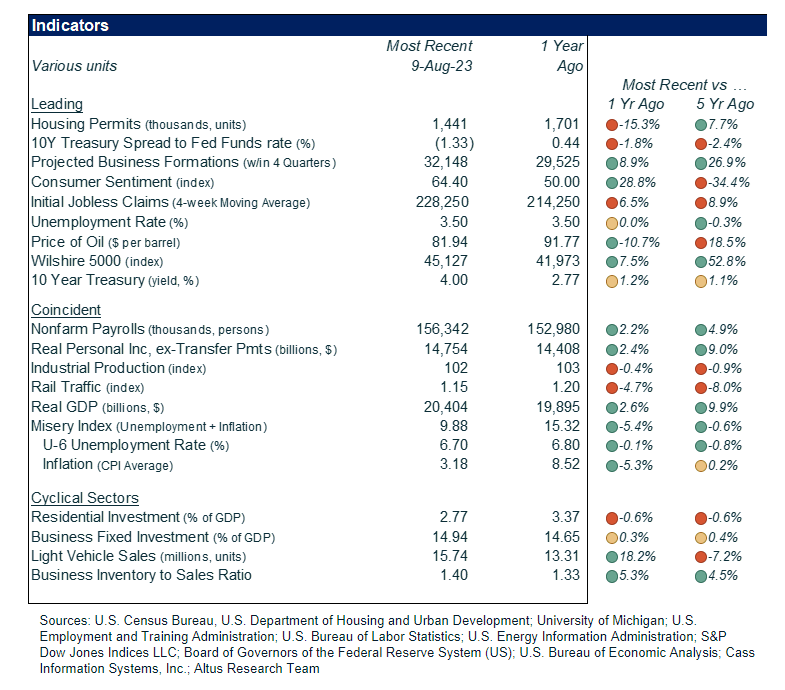

Figure 1 - Macroeconomic indicators still show mixed picture

This improved sentiment emerges despite the significant rise in cost of capital, and while the recent uptick in expectations is welcome, the possibility of slow-down or downturn remains on the table.

Figure 2 - Consumer and business sentiment indices experienced a slight rebound on improved expectations for a possible soft-landing.

Improved, but too soon to call

Even with the return of the “soft-landing” narrative, market signals leave many investors and economists wary of eliminating their calls for trouble ahead. While the AI-driven rally across broad equity market indices has captured the attention of many, red flags seen in the credit markets signal “caution ahead”.

Regaining much of their 2022 losses, major equity market indices have been a key driver in improved investor and consumer confidence. However, commentary from second quarter earnings calls suggested that most management teams remain cautiously optimistic, amidst the challenging environment for margin expansion given moderating sales growth and higher expenses. Current earnings multiples (~25x for price-to-trailing 12-month earnings and ~20x for price-to-forward earnings for 2023) suggest that margin expansion is necessary to justify continued market values. The current rally is particularly fragile, given that nearly 70% of the major index year-to-date returns have been driven by the top 7 companies. And any cynical or pessimistic view of market conditions would be incomplete without pointing out that this year’s equity market rally falls in line with pre-recession market rallies seen in the past.

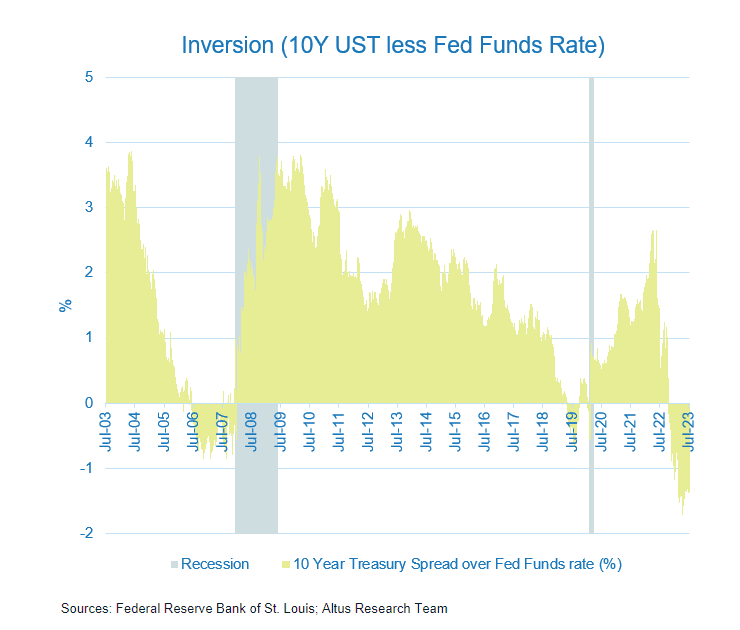

In the credit markets, the yield curve, arguably one of the strongest predictors of recession, remains inverted and has been since November 2022 (across all pairs: 10Y/2Y, 10Y/3M, 10Y/FF). Additionally, the high cost of capital combined with a pullback in lending has already helped drive the tally of corporate defaults in 2023 above the total defaults in 2022. Through the first half of the year, there were 55 defaults, well above the 36 seen in all of 2022, according to Moody’s and reported by Wall Street Journal.

Figure 3 - The yield curve remains inverted, as yields on longer-term US Treasury securities are below those of short-term securities.

Spotting silver-lining in CRE

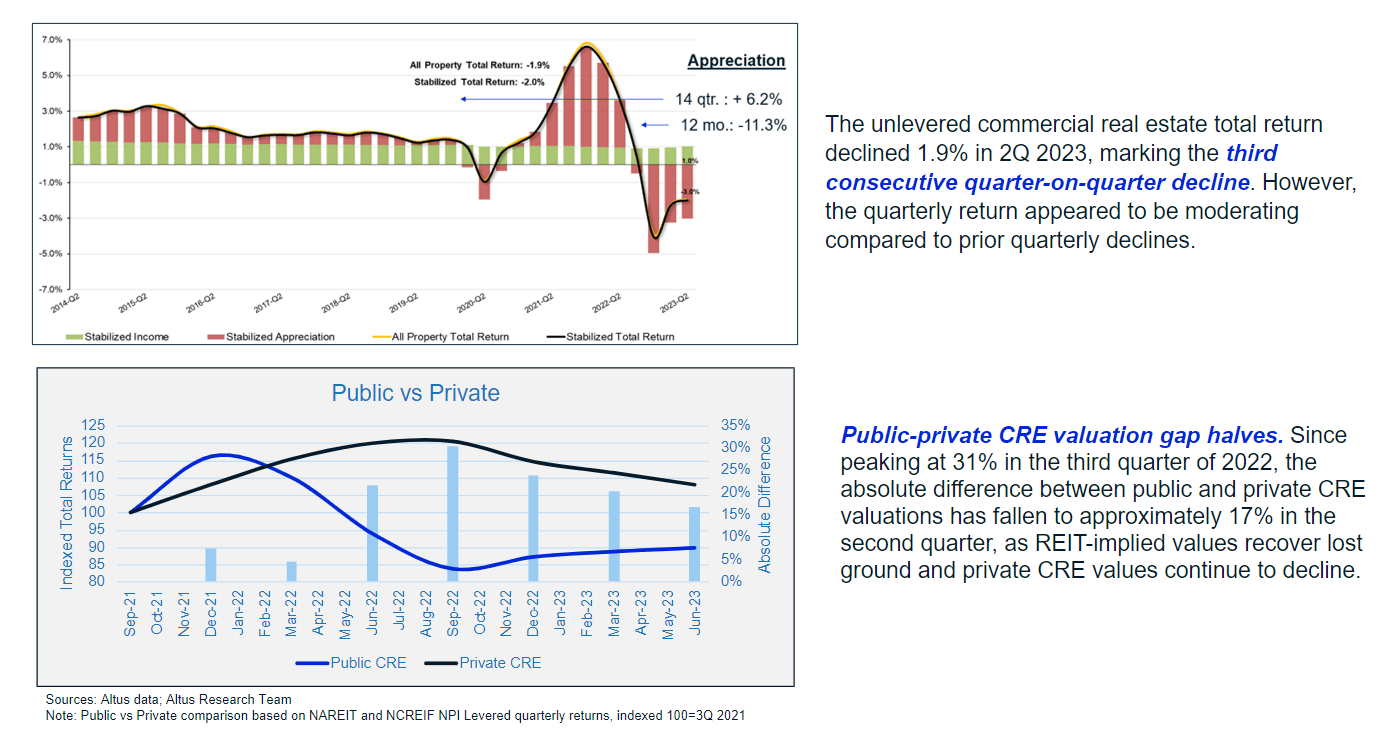

Commercial real estate mirrored the mixed signals seen across the economy and broad capital markets. Decreased availability of capital continued to explain the low transaction activity and obscure price discovery. In public markets, REITs have rallied nearly 7% on the year, but trail the broad market price performance. Private CRE returns for the second quarter were negative, marking the third consecutive quarterly write down of property values, but the most recent write-down was less than prior quarters. Since peaking at 31% in the third quarter of 2022, the absolute difference between public and private CRE valuations has fallen to approximately 17% in the second quarter, as REIT-implied values recover lost ground and private CRE values continue to decline.

Figure 4 - While pacing of transactions is still far below that of prior years and the historical average, the markets may have found the nadir.

Silver-linings for the CRE asset class have begun to emerge. Notably, cumulative transaction data coupled with commentary from brokerages and REITs during second quarter earnings calls suggests that we may be nearing the nadir in transaction activity. Additionally, performance across different geographies and property types varies significantly – with many constituent market-property type combinations showing positive returns that are masked by the higher-level and aggregated numbers. The central and mid-west markets generally outperformed the national averages across most property types, as the west-coast markets generally lagged.

Figure 5 - Private market CRE returns were negative for the second quarter. These losses appear to be moderating for most property types and markets.

Here are the key developments that caught my attention over the past weeks:

Economy

Fitch downgraded the US credit rating to AA+ from AAA due to expected fiscal deterioration, a high debt burden, and erosion of governance. The downgrade came as the Treasury announced plans to borrow $1.85 trillion in the second half of 2023, with inflation and economic growth keeping rates high.

Per the latest release from the Conference Board, CEO confidence rose to 48 in the third quarter, marking an increase of +6 points from the prior quarter. The level remains below the neutral rate of 50, reflecting lingering concern of recession. “In Q3, 84% reported that they are preparing for a US recession over the next 12-18 months, compared to 93% in Q2. That said, the vast majority continued to expect a short and shallow US recession, with just 4% now expecting a deep US with major global spillovers — down from a high of 13% in Q4 2022. Meanwhile, the proportion of CEOs expecting no recession at all climbed steadily from 2% in Q4 2022 to 17% in the latest survey.”

The latest Consumer Price Index release from Bureau of Labor Statistics showed signs of moderating inflation. CPI rose 0.2% in July from June on a seasonally adjusted basis and was up 3.2% on year-on-year basis before seasonal adjustment.

The University of Michigan’s August survey of consumer confidence survey came in at 71.2, little changed from prior month. This level is up 22.3% from a year earlier and about 42% above the all-time historic low reached in June of 2022, though remains below the historical average reading of 86.

Capital markets

Public company second quarter earnings season is wrapping up. According to FactSet, earnings for the S&P 500 Index declined 5.2% in the second quarter of 2023, this marks the third consecutive quarter of earnings declines, with energy and health care sectors leading the second quarter decline. Consumer discretionary was the only sector to report earnings growth, while sales growth was minimal.

The Wall Street Journal reported that the yield on money market funds broke the 5% threshold, the first time since 2007. The total amount of money in retail money market funds stood at more than $1.5 trillion at the end of July.

Futures markets data from CME Group’s FedWatch Tool showed that markets are expecting the Federal Reserve to hold interest rates steady at their September meeting. The markets indicate that there is a 90% chance of no rate increase and a 10% chance of a 25 bps increase to a range of 5.50-5.75%.

Commercial real estate

Banks reported tighter standards and weaker demand for all commercial real estate loan categories in the Federal Reserve’s July Senior Loan Officer Opinion Survey. “For CRE loans, major net shares of banks reported that lending standards were on the tighter ends of their historical ranges for all loan categories.”

Altus Group’s analysis of 2Q 2023 NCREIF ODCE Index performance showed the unlevered CRE total return declined 1.9% in 2Q 2023, marking the third consecutive quarter-on-quarter decline. The return variance in between the top-performing property sector (industrial, 0.2%) and the bottom-performing sector (office, -7.3%) widened to 750 basis points (bps). The return variance is up from 550 bps in 2Q 2022, and demonstrates the increasing disparity in returns across property types and markets.

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights