Key highlights

The murky macroeconomic situation and capital market jitters have darkened outlooks and weighed down growth projections, across all asset classes, including CRE

CRE plays an integral part in the US economy. So, despite mostly sound fundamentals and a relatively attractive investment profile under inflationary conditions, history suggests higher rates will hurt the sector

Corporate earnings, home prices, lending practices, inflation, and interest rate decisions are all indicators worth watching in the coming weeks

How did we get here?

We were all there, so no need to dwell on it.

The economy was humming along in late 2019 in the longest expansion on record, with few major red flags.

Then COVID rocked the world economy, capital markets, and life.

Governments and public institutions (e.g., central banks) intervened on a large scale to stop a bad situation from getting any worse.

Gradually, things got better. And then got even better.

In the US alone, the Federal government and Federal Reserve (“Fed”) had added approximately $11 trillion to the US economy, not including the money-creating impact from the temporary removal of reserve requirements for US banks and cutting interest rates to near zero. These actions were intended to help drive demand and stimulate growth in the economy – and they did just that.

The amount of money in the system, measured by M2, jumped by 42.7% from the end of the year 2019 to April 2022. With so much new money in the system, inflation was inevitable.

Many market valuation metrics and measures of economic activity retraced lost ground from the pandemic’s initial market disruption to return to more “normal” levels, inflation took off and remained stubbornly high. In response, in March 2022, the Fed began hiking rates with the intent of raising financing costs to cool the economy and tame inflation.

Generally, when the Fed has raised interest rates in the past, a recession has followed. While the Fed is not trying to trigger a recession, the consensus is that a recession in the coming 12 months is likely, but the shape (depth and duration) of the anticipated slowdown is still being debated.

What’s the link between the macroeconomy, interest rates, and CRE?

These macroeconomic and broad capital market conditions will likely be the main thematic drivers for CRE over the coming quarters. The reason for this is the interconnectedness of the CRE industry and the US economy.

For context, real estate (residential and commercial) adds about $3.1 trillion, 12% of gross domestic product (“GDP”), to the US economy each year. And based on preliminary estimates using Altus data, institutional-quality commercial real estate accounts for approximately $17 trillion in investment and covers 171 billion square feet (roughly equivalent to 4 million acres or 6,200 square miles).

Taken all together, one should recognize the significance of CRE in the macro picture. It is both a major contributor to and a reflection of our collective social, commercial, and financial interactions. Because of that interconnectedness, CRE tends to move with the broad economy. And this time is likely not different.

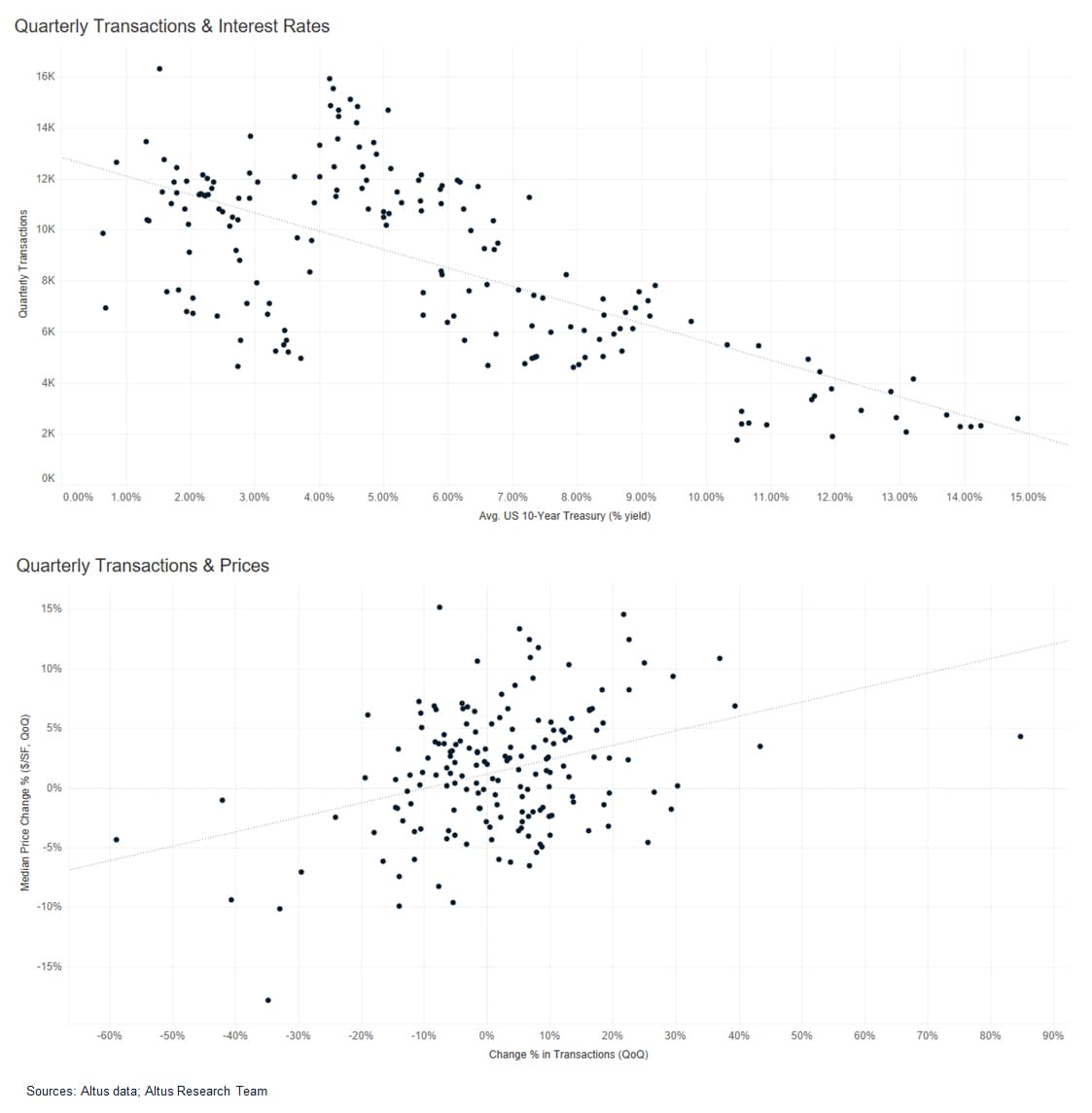

Figure 1 - Quarterly Transactions and interest rates, and prices

As an asset class, CRE largely benefitted from the pandemic response from the central authorities and capital market conditions. Cheap financing and surging (albeit recovering) demand helped drive more transactions, which helped to drive greater price discovery. Also, characteristics specific to CRE as an asset class, including features in many leases (e.g., step ups), and an impressive historical track record during times of inflation, helped the asset class look relatively attractive even when inflation runs hot. However, as the impact of higher rates began flowing through lenders, CRE was not immune. Deal and development activity have begun to slow.

Much of what is happening today is aligned with the historical record. Using Altus data to look at quarterly transaction data back to 1980, we can see in figure 2 that higher interest rates are negatively correlated with transaction activity. Additionally, the change in transaction activity is positively correlated with (albeit a weak correlation) price changes. Putting this together: as interest rates rise (or stay elevated), CRE transaction activity slows, and prices fall.

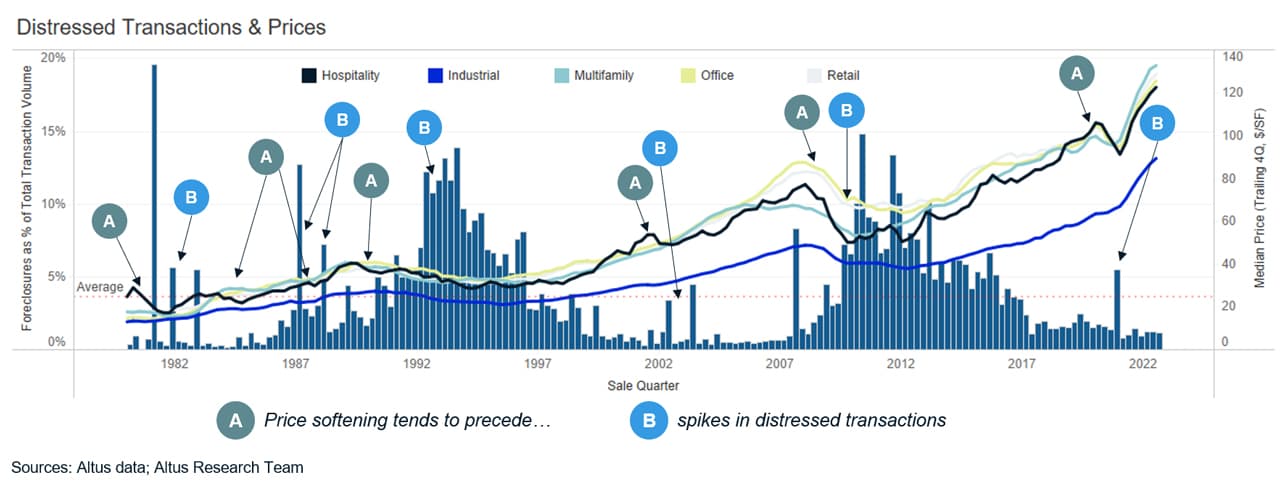

Figure 2 - Distressed transaction and prices

What to watch in the coming weeks?

Early CRE indicators show the pace of transaction activity slowing and prices softening, consistent with the historical record, these data points are still too early to be definitive. The situation continues evolving and driven largely by macroeconomic events with the market reacting to data releases. While there is a lot to watch, digest, and try to make sense of – the following are some of the key items worth watching in the coming weeks to help better understand the current sentiment:

Corporate earnings: At the time of writing this, publicly traded companies were kicking off the third-quarter earnings season. Pay close attention to comments from the management teams across CRE lenders (e.g., banks and mortgage REITs), investors (e.g., REITs and asset managers), and brokers about their recent performance and any forward guidance.

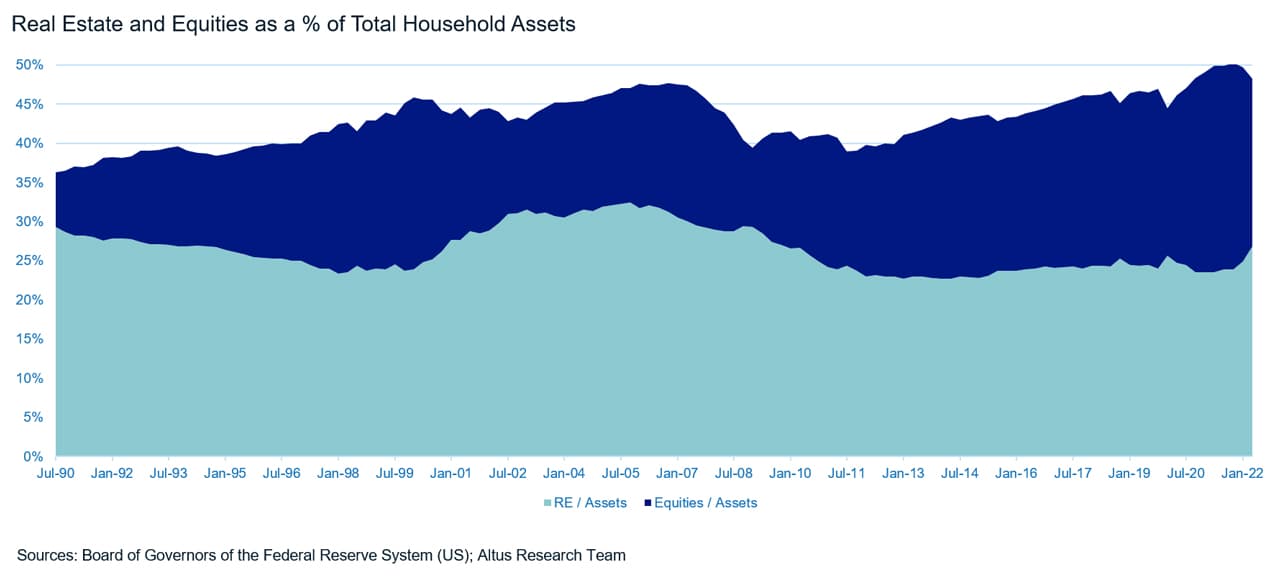

Home price indices: According to the Board of Governors of the Federal Reserve’s 2Q Z.1 report, which summarizes the current assets and liabilities across US households, equities and real estate accounted for nearly half of US household assets (Figure 3). While this was beneficial to many households in the recovery following the pandemic, this is now a potential vulnerability, as both equities and real estate are rate-sensitive. Before the next Z.1 report is released on December 9, pay attention to changes across other home price indices. A rapid decrease in home values may curb consumption which would go a long way to cool inflation.

Bank lending practices: Scheduled for a release in early November, the next iteration of the Senior Loan Officer Opinion Survey on Bank Lending Practices will help to highlight the sentiment and trending practices across bank lenders. While banks do not represent the full CRE lending universe, this survey is helpful to capture the lending landscape.

Inflation: The next release of the Consumer Price Index (“CPI”) inflation measure from the Bureau of Labor Statistics is scheduled for November 10. Both the headline number, which includes all item categories, and “core” CPI, which excludes energy and food items, are important to watch.

Fed’s FOMC November meeting: The Fed’s policy decision and minutes from its November 1-2 meeting will be released at the end of November and will clarify any additional policy rate decisions.

Figure 3 - Real estate and equities

Whether you are monitoring high-level market trends or following specific properties, Reonomy provides valuable through-the-cycle property intelligence. Learn more about how Reonomy can help with your CRE decisions

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights