US commercial real estate transaction analysis – Q3 2025

A quarterly review of US commercial real estate transaction activity across all property types. This article is based on our commercial real estate investment trends and transaction quarterly report.

Key highlights

This review of US commercial real estate transaction activity across all property types is based on our Q3 2025 US commercial real estate investment and transaction quarterly report

Aggregate transaction volume totaled $150.6 billion in Q3 2025, up 23.7% from Q2 2025 and 25.1% year-over-year, signaling a robust recovery in CRE transaction markets

Median price per square foot rose 2.9% quarter-over-quarter and 14.2% year-over-year across all property sectors, reaching post-pandemic highs

Large deals ($10M+) returned in force, reaching the highest quarterly count since 2022, though median deal size remained approximately $2 million below peak levels

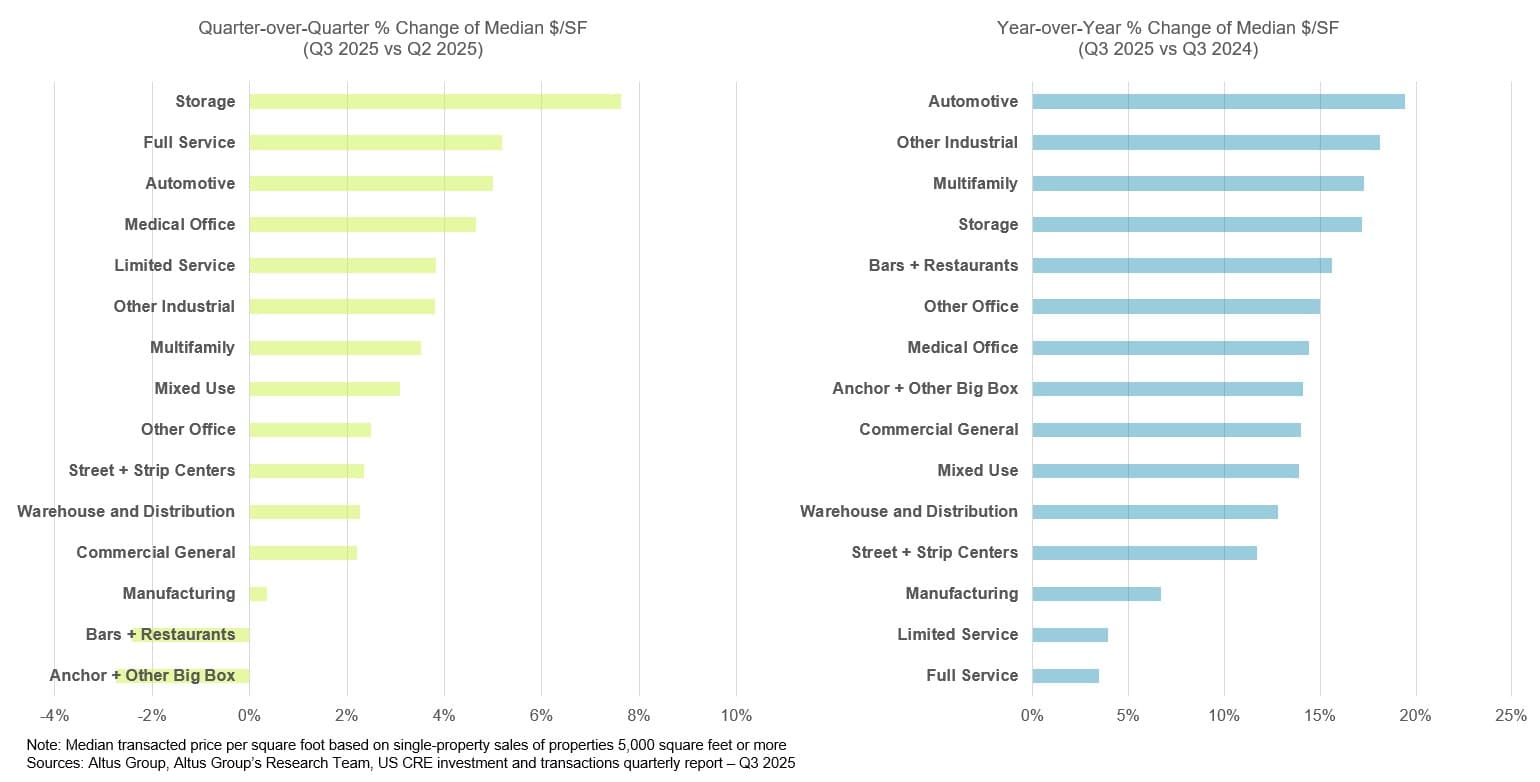

Nearly all major property subsectors saw quarterly price gains, with 13 of 15 subsectors recording increases led by storage (+7.6%), full-service hotels (+5.2%), and automotive (+5.0%)

Geographic dispersion widened with Texas, Florida, and Carolina MSAs surging while Northeast and Southern California markets lagged national trends

Q3 2025: Monetary policy easing meets risk-on sentiment

Macroeconomic and capital market backdrop

The third quarter of 2025 unfolded against a backdrop of decisive monetary policy easing and accelerating risk appetite. The Federal Reserve's rate cut in September was the first of 2025, catalyzing a powerful "melt-up" across risk assets, as investors aggressively priced in a soft landing scenario and economic growth prospects driven by artificial intelligence (AI). This optimism arose despite clear evidence of a cooling but resilient labor market and continued, albeit noisy, progress in disinflation.

Monetary policy shifts

The Federal Open Market Committee (FOMC) delivered its anticipated 25-basis point rate cut at the September meeting, a continuation of the easing cycle it started a year before in September 2024. Chair Powell cited cumulative progress on inflation and softening labor market conditions as justification for policy normalization. The official unemployment rate was 4.3% through August, before the federal government shutdown interrupted data releases. However, this gradual labor softening provided the Fed necessary cover for its dovish pivot while economic growth remained robust; the Atlanta Fed’s GDPNow model indicated Q3 growth near 4.0% SAAR despite lingering concerns over trade and tariff uncertainties.

Public capital markets response

Credit markets operated in a distinctly risk-on environment throughout the third quarter. The benchmark 10-year US Treasury yield declined approximately 8 basis points over the quarter, ending at 4.16%, driven by the Fed's accommodative stance and moderating growth expectations. Corporate bond spreads compressed across both investment-grade and high-yield categories. These favorable conditions unleashed a wave of bond issuance, with the high-yield market raising nearly $124 billion as issuers rushed to lock in lower financing costs.

Equity markets posted exceptionally strong returns. The S&P 500 gained nearly 8% while the NASDAQ rose nearly 11%, both reaching new all-time highs. Most notably, the rally broadened significantly; the Russell 2000 surged 12%, as rate-sensitive smaller companies benefited directly from the easing monetary policy. Market concentration remained extreme, with the top 10 S&P 500 constituents accounting for nearly 40% of total market capitalization. However, traditional IPO activity outpaced 2024 levels, and M&A showed renewed signs of life.

Q3 2025 transaction activity

National CRE transactions post strong recovery

National CRE transaction activity demonstrated clear momentum in Q3 2025, with 45,893 properties transacting - a 12.6% increase from Q2 2025 and a 6.8% gain year-over-year. Aggregate dollar volume reached $150.6 billion, surging 23.7% quarter-over-quarter and 25.1% annually, marking a decisive shift toward recovery.

Total number of properties transacted

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

The rebound was primarily driven by multifamily transactions, which surged 51.1% year-over-year, accounting for 30% of all activity and 34% of single-asset sale dollars. Industrial (+26.5%), office (+28.0%), and general commercial (+48.9%) each posted annual gains that exceeded the overall 25.1% increase. Hospitality remained the notable laggard, declining 11.9% annually as investor caution persisted around more cyclical assets.

Total dollar volume of properties transacted

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Transaction counts through the first three quarters of 2025 totaled just over 93,000 properties, tracking between year-to-date tallies observed in 2013 (~86,000) and 2015 (~97,000). While cumulative dollar volume of $265 billion remained below historical peaks, it outpaced the same period in both 2023 and 2024, confirming sustained recovery momentum.

Cumulative dollar volume of properties transacted

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Transaction pacing and pricing trends

Median CRE prices reach post-pandemic highs

Pricing momentum accelerated throughout Q3 2025. The median price per square foot for single-property transactions rose 2.9% quarter-over-quarter and 14.2% year-over-year, pushing sector-level medians to post-pandemic highs across traditional property types.

Pricing since Q1 2015

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Hospitality led quarterly growth with pricing up 4.3%, followed by multifamily at 3.5%. On an annual basis, multifamily remained the standout performer with a 17.3% increase, while office (+14.8%) and general commercial (+13.8%) also posted strong gains. The sustained pricing recovery reflects growing investor confidence and narrowing bid-ask spreads as market participants aligned on valuation expectations.

Median transaction price per square foot

Property type | Q3 2025 | Q2 2025 | vs. Q2 2025 | Q3 2024 | vs. Q3 2024 |

|---|---|---|---|---|---|

Multifamily | $144 | $139 | 4% | $123 | 17% |

Industrial | $105 | $102 | 3% | $92 | 14% |

Manufacturing | $82 | $82 | 0% | $77 | 7% |

Other industrial | $101 | $97 | 4% | $85 | 18% |

Storage | $79 | $73 | 8% | $67 | 17% |

Warehouse and distribution | $111 | $109 | 2% | $99 | 13% |

Office | $135 | $133 | 2% | $117 | 15% |

Medical office | $194 | $185 | 5% | $169 | 14% |

Other office | $128 | $125 | 2% | $111 | 15% |

Retail | $134 | $132 | 2% | $119 | 13% |

Anchor + other big box | $99 | $102 | -3% | $87 | 14% |

Automotive | $143 | $136 | 5% | $119 | 19% |

Bars and restaurants | $212 | $217 | -2% | $183 | 16% |

Street and strip centers | $130 | $127 | 2% | $117 | 12% |

Hospitality | $134 | $128 | 4% | $129 | 4% |

Full service | $139 | $132 | 5% | $134 | 3% |

Limited service | $118 | $114 | 4% | $114 | 4% |

Commercial general and mixed use | $102 | $99 | 3% | $90 | 14% |

Commercial general / misc | $88 | $86 | 2% | $77 | 14% |

Mixed use | $111 | $108 | 3% | $97 | 14% |

Subsector performance highlights

Thirteen of fifteen subsectors recorded quarterly increases in median price per square foot. Storage led all categories with a 7.6% gain, followed by full-service hotels (+5.2%) and automotive (+5.0%). Only bars and restaurants (-2.4%) and big-box retail (-2.8%) posted declines.

Subsector median price changes

Annual subsector performance showed universal gains, led by automotive (+19.4%) and other industrial (+18.1%). Hospitality subsectors posted the most modest growth, with limited-service hotels up 3.9% and full-service hotels gaining 3.4% year-over-year, reflecting continued investor caution around travel-dependent assets.

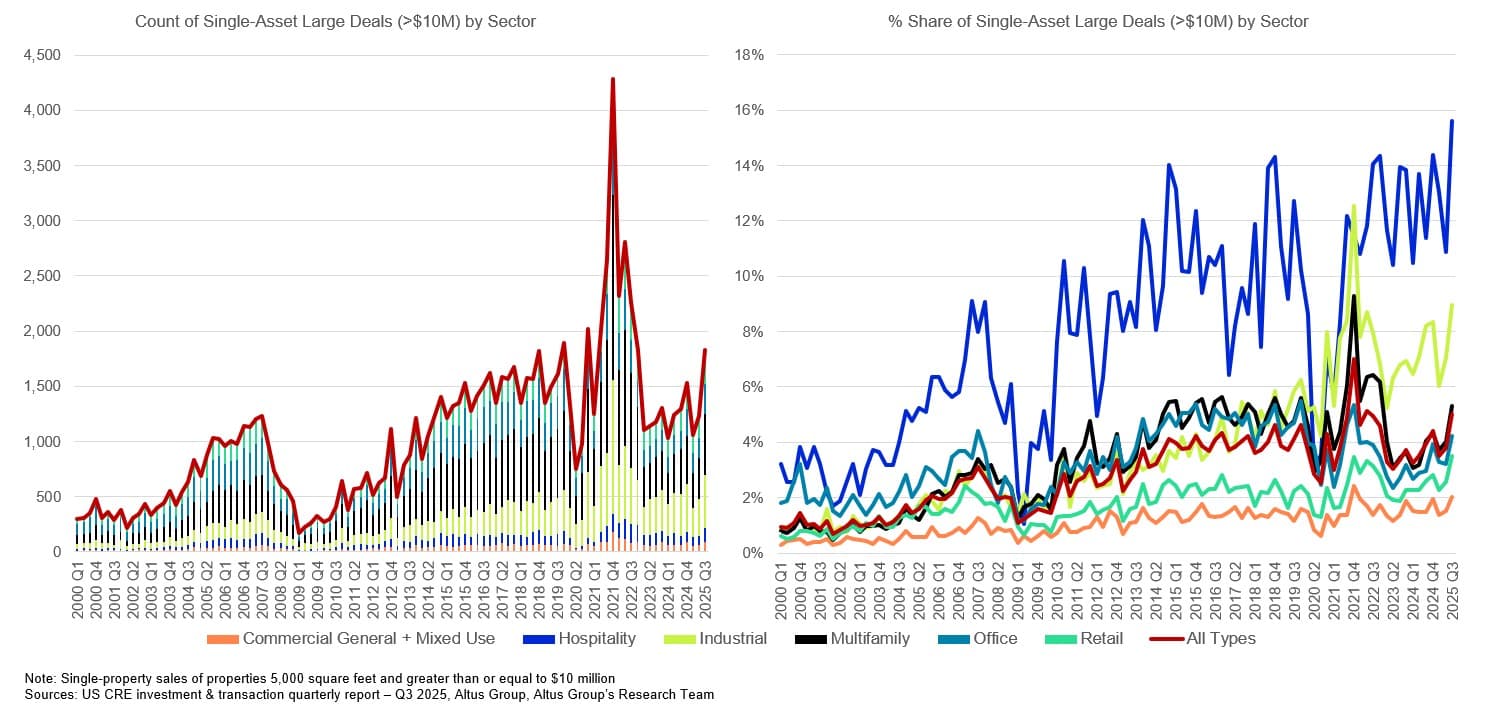

Transaction size and pacing metrics

The return of large deals emerged as a defining characteristic of Q3. Transactions exceeding $10 million reached their highest quarterly count since 2022, though median deal size among this cohort remained approximately $2 million below peak levels. This dynamic partially explains why total dollar volume, while showing signs of recovering, has not yet reached 2021-2022 peaks.

Single-asset large deals (>$10M) - Count and percent share

Median transacted building sizes showed clear expansion across sectors annually, led by hospitality (+9.9%), multifamily (+4.1%), and office (+3.6%). This metric, which bottomed out in early 2024 for most sectors, has climbed consistently since, signaling renewed appetite for larger, institutional-quality assets.

Regional and metropolitan performance

Geographic dispersion widens

Q3 2025 revealed significant geographic divergence in transaction activity. In terms of property counts (+12.6% quarter-over-quarter nationally), every MSA in the Northeast corridor from Washington to Boston (except Providence) underperformed the broader market. California metros similarly lagged, while Southern markets excelled. Texas MSAs particularly stood out, with most exceeding the national change by 20 percentage points or more.

Annual performance showed clearer regional patterns. Texas, Florida, and Carolina MSAs experienced transaction volume surges that significantly outpaced the 25.1% national increase. Conversely, large Midwest, Northeast, and Southern California metros lagged, reflecting divergent economic fundamentals and investor preferences.

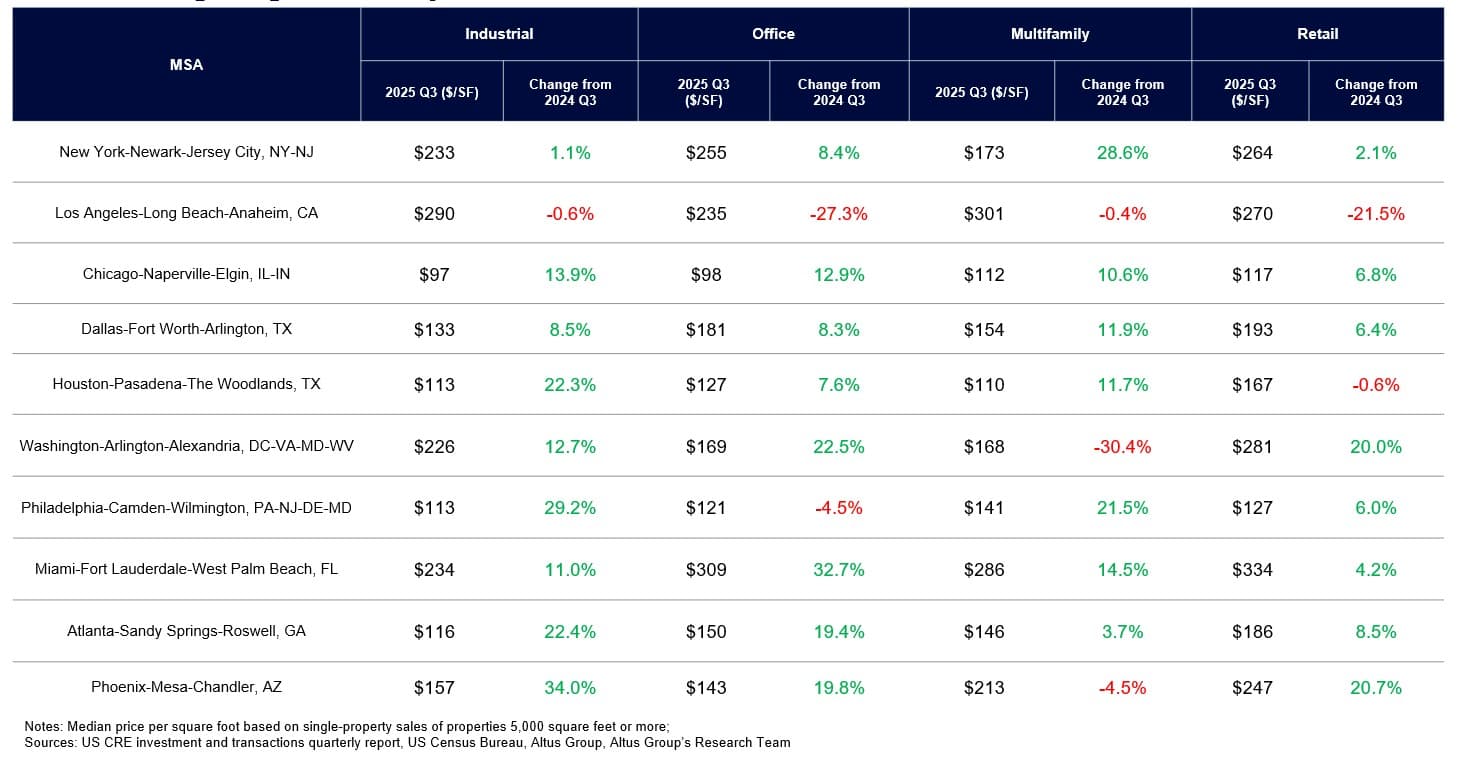

Top 10 MSA pricing dynamics

Across the ten largest MSAs, median prices per square foot rose across nearly all major property sectors, with notable exceptions and outliers:

Los Angeles emerged as the clear outlier, posting declines across sectors: office (-27.3%), retail (-21.5%), industrial (-0.6%), and multifamily (-0.4%)

Miami office led all gains with a 32.7% annual increase, while Washington D.C. multifamily recorded the largest decline at -30.4%

New York, Chicago, Dallas, Miami, and Atlanta saw annual increases across all major property types, with Chicago approaching double-digit gains in all sectors

Washington D.C. showed the widest dispersion: office up 22.5% but multifamily down 30.4%, highlighting sector-specific dynamics within individual markets

Multifamily was the only sector with at least three of the top 10 MSAs showing price declines (Los Angeles, Washington D.C., and Phoenix), suggesting potential oversupply concerns in select markets despite a strong national performance.

Median price per square foot by MSA

Property sector deep dives

Multifamily: Clear market leader

Multifamily dominated Q3 2025 performance metrics. Transaction volume surged 51.1% year-over-year, with the sector accounting for 34% of single-asset sale dollars. Median pricing rose 3.5% quarter-over-quarter and 17.3% annually, reaching $144/SF.

Median pricing by subtype ($/SF)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

The sector's median transaction size jumped 27.3% annually, the largest increase across all property types. This growth reflects institutional investor preference for larger, newer properties in growth markets. Daily trading averaged approximately 138 properties, though this remained 12.9% below pre-pandemic averages, suggesting continued room for activity expansion.

Median transaction size ($)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Industrial: Steady momentum continues

Industrial transaction activity maintained steady momentum despite moderating from pandemic-era peaks. Total volume increased 26.5% year-over-year, with median pricing up 13.7% annually to $105/SF. The storage subsector particularly excelled, posting 7.6% quarterly and 17.2% annual price gains.

Median pricing by subtype ($/SF)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

The industrial sector's operating fundamentals softened over recent quarters, though they are showing signs of moderation and a supportive reversal to that trend. Median building sizes increased 3.3% annually, while daily trading averaged about 80 properties – just five trades below pre-pandemic norms. Institutional demand continues to focus on modern logistics facilities and last-mile distribution centers.

Median transaction size ($)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Office: Selective recovery emerges

Office transactions demonstrated selective recovery, with volume increasing 28.0% year-over-year. The 14.6% annual increase in transaction counts marked the strongest growth since 2021, though absolute levels remain well below historical norms. Median pricing rose 1.6% quarter-over-quarter and 14.8% annually to $135/SF.

Median pricing by subtype ($/SF)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Quality and location increasingly drive performance divergence. Medical office properties command significant premiums, while older CBD assets continue to face headwinds. Median transaction sizes increased 23.8% annually, and are up a whopping 38.5% compared to the Q4 2019 median deal size, reflecting institutional focus on trophy and specialized properties.

Median transaction size ($)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Retail: Mixed signals persist

Retail performance remained mixed, with certain subsectors showing strength while others struggled. Automotive properties led with 5.0% quarterly and 19.4% annual price gains. Conversely, bars and restaurants (-2.4% quarterly) and big-box stores (-2.8% quarterly) faced pressure.

Median pricing by subtype ($/SF)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Overall sector median pricing rose modestly, increasing 1.8% quarter-over-quarter and 12.5% annually. Daily trading averaged approximately 122 properties across the retail sector, approaching but not reaching pre-pandemic levels (126 daily trades). Investor preference continues to favor necessity-based and experiential formats over traditional mall-based retail.

Median transaction size ($)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Hospitality: Gradual stabilization

Hospitality showed signs of stabilization despite remaining the weakest-performing major sector. While transaction counts were down 11.9% year-over-year in Q3, the quarter was up 13.3% versus the prior quarter, and median pricing showed modest improvement compared to both the prior quarter and Q3 2024. Full-service hotels gained 5.2% quarter-over-quarter, while limited-service properties’ prices increased 3.8%.

Median pricing by subtype ($/SF)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

The sector's median building size increased 9.9% annually, the largest gain across property types, as investors focused on larger, higher-quality assets. Recovery remains uneven geographically, with leisure-oriented markets outperforming urban business hotels.

Median transaction size ($)

Source: Altus Group, Q3 2025 US Commercial Real Estate Investment and Transactions Quarterly report

Market outlook and key takeaways

The CRE turnaround takes shape

Q3 2025 data appears to send some confirmatory signals that the commercial real estate recovery has gained meaningful traction. Several metrics point to an inflection point having been reached:

Pricing recovery acceleration: Median price per square foot has posted consistent gains across most sectors since early 2024, with Q3 marking post-pandemic highs. The breadth of recovery - 13 of 15 subsectors showing quarterly gains - suggests fundamental factors are driving appreciation.

Large deal renaissance: The return of transactions exceeding $10 million represents a critical confidence signal. In the first two months of Q3 alone, large deal counts surpassed all of Q2, reaching levels unseen since 2022. While median deal sizes remain below peaks, volume momentum continues building.

Median building size expansion: This often-overlooked metric provides crucial market insights. After bottoming out in early 2024 across most sectors, median transacted building sizes have climbed consistently, indicating institutional capital's return and growing appetite for larger, higher-quality assets.

Supporting factors align and signal building momentum

Q3 2025's outperformance carries particular significance when viewed through historical context. Over the past 25 years, third-quarter transaction counts have exceeded second-quarter counts only 28% of the time - primarily during recovery periods following recessions (2003, 2009, 2013-2015, 2020-2021). The unseasonably strong Q3 2025, representing the largest Q2-to-Q3 jump outside the immediate post-pandemic period in the last quarter-century, provides confirmatory support for a genuine market recovery.

Historical patterns also suggest strong year-end performance ahead. Q4 transaction activity has exceeded Q3 levels 72% of the time over the past 25 years. Given Q3's robust showing and improving financing conditions, CRE investment activity appears positioned to close 2025 on a decidedly positive note.

Looking outside of the historical data, there are also multiple market indicators that support continued momentum building. Three that are top of mind are:

Increased lending activity: The financing environment for CRE is improving. This improvement is evident in both the US securitized markets, which saw 2025 new issuance in the first three quarters nearly match all of 2024, or the H.8 US bank data, which shows bank CRE lending activity picking up. Additionally, the Federal Reserve's October Senior Loan Officer Opinion Survey showed lenders are making CRE credit more available to meet increasing financing demand.

REIT performance: Public market valuations and recent earnings calls reflect growing optimism about property fundamentals, transaction and development pipelines, across most major property sectors.

Brokerage activity: On their third-quarter earnings calls, major public CRE brokerages reported increasing deal flow and narrowing bid-ask spreads across markets.

Taking all of this information together, the combination of easing financing conditions, improving demand, and narrowing valuation gaps has created conditions for sustained recovery. While challenges remain, particularly around specific (sub) sectors and local markets, the broader CRE market appears to have turned the corner from the 2022-2023 correction. As large institutional capital returns and transaction velocity accelerates, the foundation for continued momentum into 2026 appears increasingly solid.

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights