US multifamily sector rallies for quick rebound as sentiment slips for other CRE sectors

Steady demand for rental housing and challenges in the single-family home market are contributing to positive expectations for near-term multifamily sector performance.

Key highlights

Steady demand for rental housing and challenges in the single-family home market are key factors contributing to positive expectations for near-term multifamily sector performance

Limited inventory and higher costs have resulted in near-record-low single-family home sales

Although apartment rents decelerated in many markets, the pace of year-over-year declines is slowing

The rebound in sentiment for multifamily is running counter to trends in other property sectors where sentiment has either slipped or has remained relatively flat

It will take more time for the rebound in sentiment for multifamily to translate into higher transaction volume

Expectations rise for improved multifamily performance over the next 12 months

Storm clouds gathering over the multifamily sector fueled by concerns surrounding oversupply, appear to be rapidly clearing. That resiliency speaks to the undersupply of housing generally, as well as challenges that exist in the single-family market. The dual factors of high mortgage rates and high home prices have helped buoy multifamily sentiment.

The latest results from Altus Group’s Q3 US CRE Industry Conditions and Sentiment Survey (ICSS) show a dramatic shift in sentiment with multifamily jumping back into the lead as the sector that most expected to be the “best performing” over the next 12 months. That rebound follows a pullback in sentiment for multifamily over the prior two quarterly surveys.

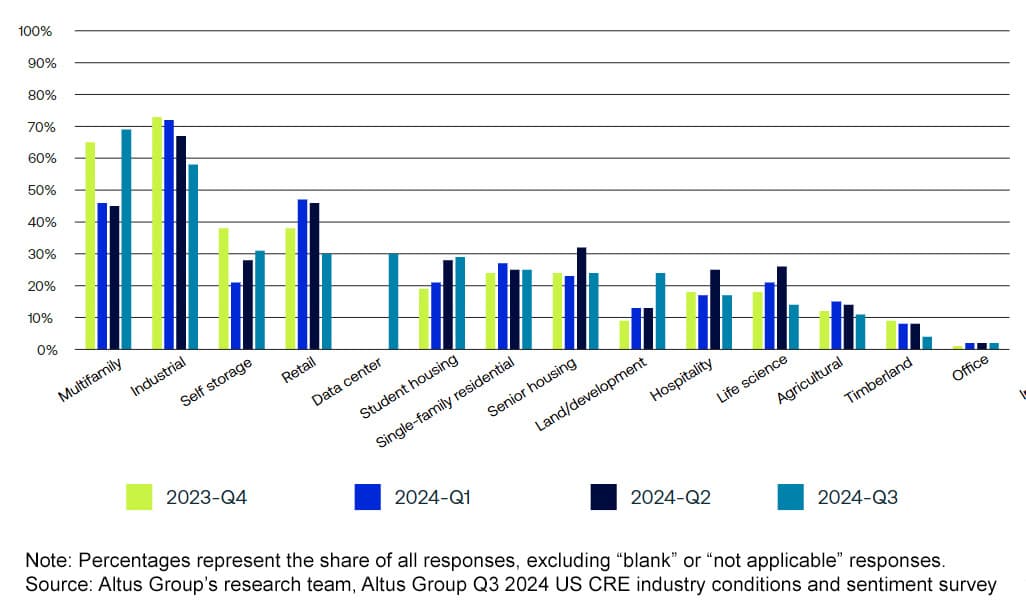

Figure 1 - Rank which property types you expect to be the best performing in the next 12 months

Specifically, 69% of survey respondents voted that multifamily is poised to outperform, which is a marked increase compared to the Q2 and Q1 surveys where less than half of respondents predicted that multifamily would be among the best-performing sectors. The increased optimism also stands out in stark contrast to a decline in the outlook for other sectors, including industrial, retail, hospitality, seniors housing and life sciences. Views of office as by far the “worst performer” have remained consistent for the past four surveys.

While some of the other sectors are seeing opinions and expectations slip, expectations around multifamily performance snapped back dramatically in Q3, exceeding even their Q4 2023 level (64%). Some of the key factors driving the rebound are the steady demand for rental housing, challenges in the single-family homebuying market, and the multifamily sector's relative resilience compared to other CRE property types.

Overcoming supply challenges

One of the biggest factors weighing on the outlook for multifamily performance in recent months has been the surge in new multifamily completions. Multifamily completions climbed above 500,000 units annually in 2023 and has far exceeded that annual rate through the majority of 2024, nearly double the pace of new supply being built a decade ago.

Figure 2 - Multifamily completions – Under construction vs. completed

The fear was that owners would face a tougher operating environment with slower rent growth, increased concessions, and softening occupancies that would take a bite out of net operating income (NOI). Although rent decelerated in many markets, the pace of year-over-year declines is slowing. In addition, national occupancies have held up relatively well with the national average continuing to hover at close to 94%, the highest since 2022 Q2, according to NCREIF.

Challenges have not been as widespread as some had anticipated the spike in supply to be confined to certain markets across the Sun Belt. Cities such as Phoenix, Atlanta, Dallas, Austin, and Nashville are among those that saw bigger increases in inventory, whereas far less new supply came online in the Northeast, Midwest, and West.

Strong tailwinds

Multifamily is benefiting from big obstacles to homeownership, such as limited inventory and higher costs, which have resulted in near-record-low single-family home sales. According to the National Association of REALTORS (NAR), pending home sales are at their lowest level since the Great Financial Crisis. Existing home sales for August dropped 4.2 percent from a year ago to a seasonally adjusted annual rate of 3.86 million.

Figure 3 – New and Existing Home Sales vs. 15 and 30-year fixed mortgage rate

Buyers are battling both high mortgage rates and high home prices. Despite the Fed’s September 50 bps rate cut, mortgage rates remain elevated with the average 30-year fixed mortgage rate still above 6%. Meanwhile, average home prices have continued to rise even in the higher rate environment. Challenges facing homebuyers, particularly first-time homebuyers, has resulted in people staying in the rental market longer.

Part of the gridlock in the single-family market also stems from the “lock-in effect” where existing homeowners don’t want to sell and trade their existing low rate, which in many cases is below 4%, for a higher rate. New home construction also is more constrained due to rising construction costs and supply chain disruptions. Higher interest rates have created a tough financing market for developers, which is slowing down the supply of new homes being built.

Dip in sentiment weighs on other CRE sectors

The rebound in sentiment for multifamily is running counter to trends in other property sectors where sentiment has either slipped or has remained relatively flat.

Office continues to face obvious challenges related to the seismic shift to remote and hybrid work models that is reducing demand for office space. Companies that are continuing to downsize office footprints are contributing to elevated vacancies and a bifurcated market where well-located, highly amenitized office space is outperforming the more commodity Class B space.

The retail sector continues to struggle with the shift to e-commerce and reduced foot traffic in traditional malls and shopping centers. Although space is tight in well-located necessity retail centers due to the lack of new construction, traditional malls and shopping centers continue to struggle to remain relevant and broaden their appeal with a mix of different uses.

Hospitality faces an uneven recovery and rising operating costs. Business travel, in particular, remains subdued, slowing the full recovery of hotels and convention spaces. In some cases, people are combining business and leisure travel into one trip, which is contributing to lower demand overall. The strong dollar also is encouraging more international travel with Americans choosing to travel abroad in lieu of domestic destinations.

Industrial that benefited from the surge in e-commerce demand is now seeing some of that oversized demand decline at the same time the market is dealing with the aftermath of a building boom. Expectations are adjusting as a result of a flood of speculative developments now coming online.

Moving forward: Key drivers for continued multifamily performance

The shift in sentiment reinforces a simple fact – demand for housing is inelastic. People need somewhere to live, and the number of American households continues to increase. Despite market fluctuations, there is consistent demand for rental housing, which makes the asset class resilient even during economic downturns. Multifamily also is continuing to benefit from the shift to a “renter by choice” mindset. The younger generations of Millennials and Gen Z renters in particular like the flexibility and affordability that renting offers compared to homeownership.

Yet it will take time for the rebound in sentiment for multifamily to translate into higher transaction volume. Apartment sales are still well below levels that occur in more “normal” sales markets. The rolling average of daily multifamily properties transacted during Q2 2024 was 28 as compared to 40+ prior to the pandemic in 2019 and 50+ in the robust sales market in 2021 (Source: Altus Group).

Figure 4 – US quarterly multifamily transaction activity: Average daily square feet transacted and average daily number of properties transacted

Although the expectation is that the Fed will continue to cut rates over the coming year, the financing environment is still difficult. Rates are still higher than what many borrowers became accustomed to in the era of very cheap capital. Liquidity is available through the GSEs, debt funds and other capital sources, but lenders are more cautious in their underwriting and LTVs. While multifamily sentiment is rebounding, it may take time for that sentiment to translate into increased investment activity.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Cole Perry

Associate Director of Research, Altus Group

Author

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights