Key highlights

Over the last two decades, traditional mall anchors have struggled with competition from online retailers and discount department stores

Although institutional investors (including private funds and public mall REITs) have reduced their mall holdings, those retaining and investing in top-performing assets show better operating and performance metrics despite declining occupancy

Institutional managers have reassessed and rebalanced their mall portfolios, keeping the winners and shedding the losers

Were the calls for the “retail apocalypse” a false alarm?

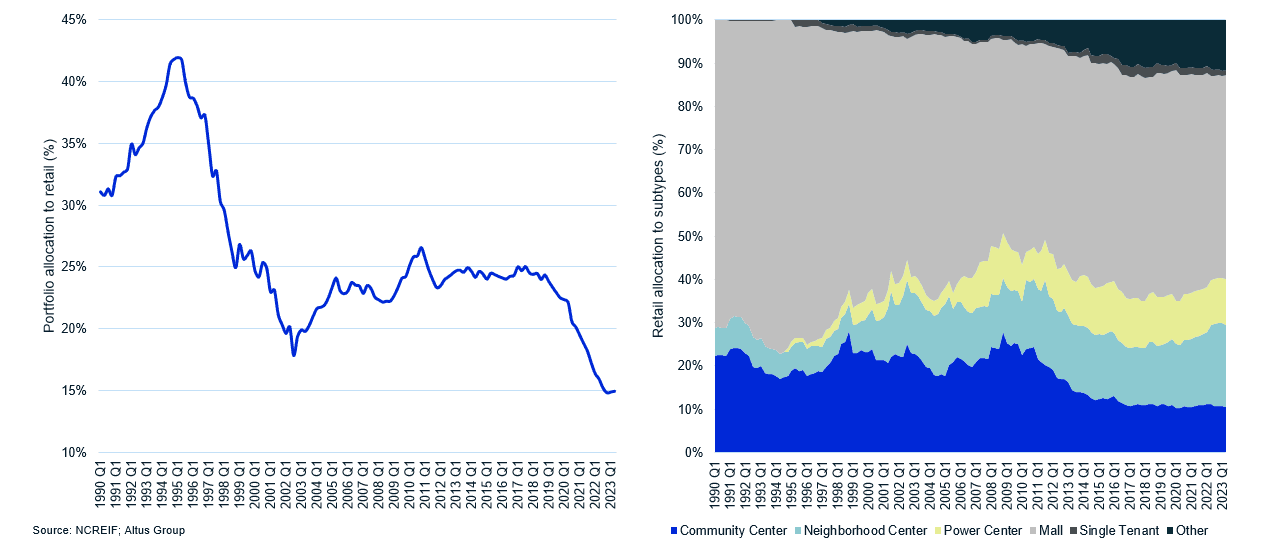

The US enclosed mall sector has long grappled with perception challenges, as it was once a darling of the commercial real estate (CRE) investable universe, attracting institutional capital and investment. To this effect, in the mid-1990s, malls accounted for approximately 25-30% of private CRE fund investment, and 70-75% of their total retail investment. Over the next 25 years, however, the investment in malls declined to less than half of total retail investment and only 7% of total CRE investment. A wave of retailer bankruptcies coupled with the rapid rise of e-commerce forced many retailers to reassess and downsize their physical footprint, weighing heavily on the mall performance and returns, while leaving many markets over-supplied. While this multi-decade long slide from investment manager graces received ample analyst and media coverage, and introduced a new catchy name (”retail apocalypse”), the data suggest the reality for malls was challenging but not dire.

Figure 1 - Private CRE fund allocation to malls

Despite a two-decade decline in occupancy, signs of resilience are evident in private and public institutional mall portfolios. Market rents now exceed in-place rents and cap rates are at historical lows. Numerous recent stories shed positive light on the sector:

Trepp’s report on CMBS Remittance noted improving occupancy, robust sales figures, and promising loan performance. In addition, they noted that mall fundamentals are holding strong and leasing volumes are solid.

CRED iQ’s ‘Regional Mall Update’ noted that only 5.19% of malls are in economic distress, and that renovated/modernized malls that have shed the anchor store model have seen improved foot traffic and tenancy.

During Placer’s ‘The State of Malls’ webinar, participants noted that private owner/operators have swung to investment in experiential retail across their portfolio. Recent increases in foot traffic have been driven primarily by the resurgence in theatrical experiences.

The evolving mall landscape

Malls traditionally relied upon large anchor stores surrounded by smaller retailers, built on the premise that large stores (typically department stores) would boost foot traffic to the smaller in-line retailers at the mall. But the anchor store concept has since fallen out of favor, as the primary advantage of department stores – the amassing of a wide range of goods in one place – can be achieved more efficiently either in large discount stores or online. So, while the mall is not dead, its former lifeblood, the department store, is struggling.

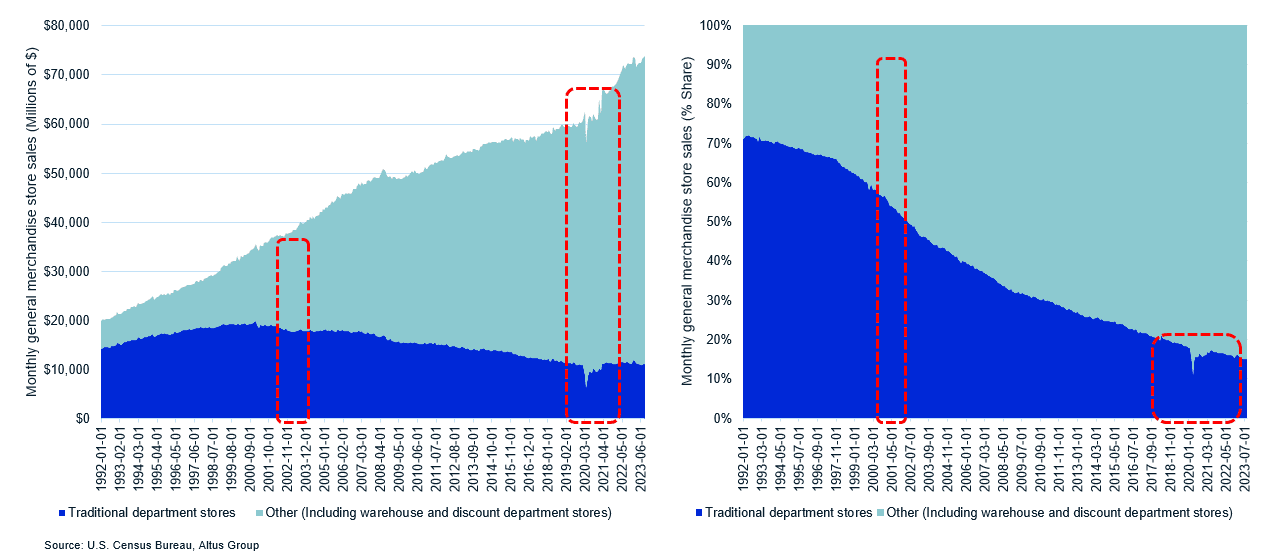

Altus Group recently highlighted the challenges “big box” brick-and-mortar retailers face in the wake of online competition. This was demonstrated during the pandemic, during which e-commerce briefly surged past 16% of total sales before returning to pre-pandemic levels of growth in 2023, to just below 14%. However, there’s one facet of the shifting retail landscape that is often neglected: the impact of discount department stores. In 2002, the in-person retail environment was split almost evenly between traditional department stores and these then-new competitors.

Figure 2 - Department store vs. Discount department store market share

Today’s retail landscape has undergone a notable shift. These ‘other’ retail sources accounted for more than 90% of total sales during the pandemic, as malls temporarily shuttered. While traditional department stores have since reclaimed ground, they hold just 15% of the market share, compared to the more than 35% they accounted for entering the Great Financial Crisis (GFC).

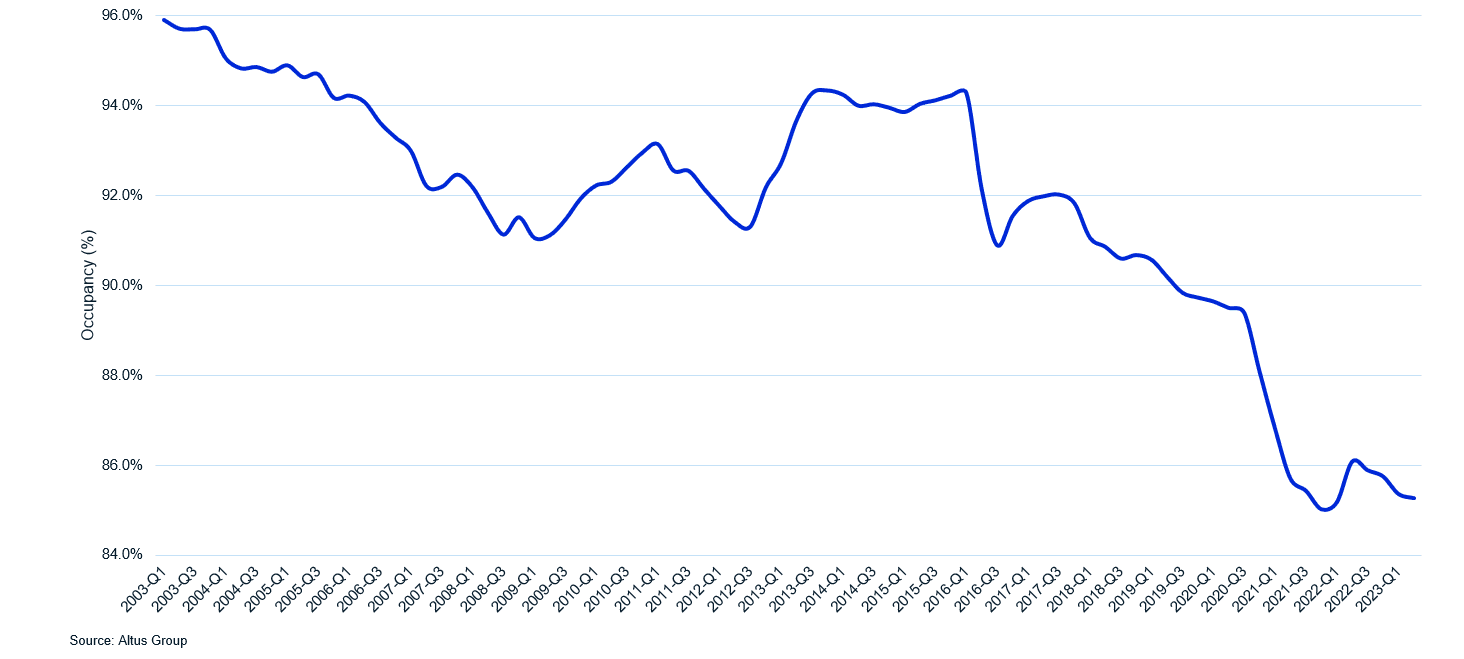

Mall occupancy has steadily declined since 2000, driven by the shifting competition previously discussed and some large legacy retailers’ bankruptcies in 2017/18. Lease structures which included co-tenancy clauses amplified the negative occupancy impact as many of the traditional anchor tenants, such as Sears, restructured or dissolved. Co-tenancy clauses connected many of the in-line retailers to anchor tenants; if an anchor departed, nearby tenants had the option to terminate lease agreements early with minimal penalty. This dynamic suddenly left many malls with large amounts of unoccupied space and a quickly over-supplied market. Many markets experienced the same effects, occupancy rates slid from 96% to 86%, and market rents began to slide on the influx of available space.

Figure 3 - Regional mall occupancy since 2000

With falling demand and increasing availability, the development pipeline began to dry up. Despite these challenges, and similar to other retail sectors, the stagnant mall development pipeline has allowed mall owners to recalibrate and adapt to changing consumer demand, diverging from the rapid growth of enclosed malls and department stores in the 1980s and ‘90s. Over the years, many markets have started to see a healthier and more balanced supply of retail space. And as the health of the American consumer improved coming out of the pandemic, many of the retail properties are bucking the long-term challenges they have faced and faring better than expected. Current owners/operators are innovating, transitioning from the traditional anchor model to experiential retail or even repurposing for multifunctional uses.

Trimming the fat; Battling negative perception

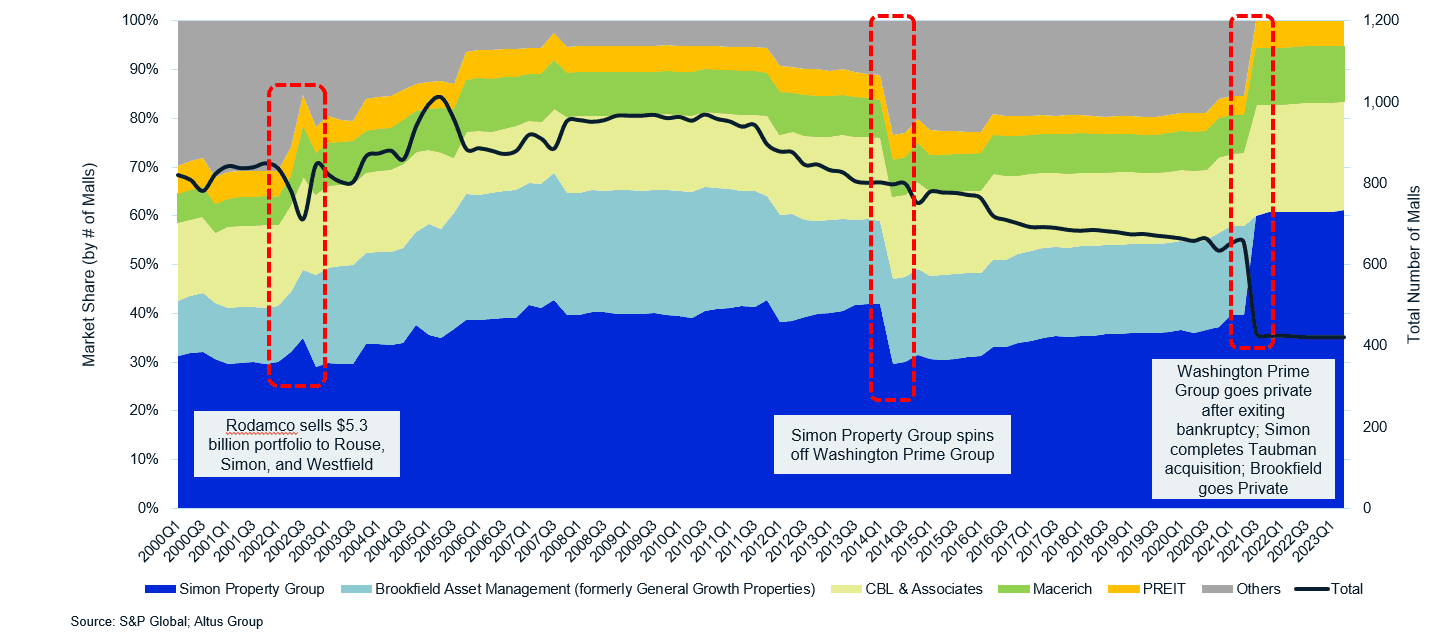

Public mall REITs and other institutional owners have long been out of the development game. In fact, fewer than 10 enclosed mall properties have been built in the 21st century. The modern mall narrative has therefore shifted toward optimization – in addition to creatively reinvesting in existing properties, institutional owners are divesting from underperformers and consolidating stronger ones. Of the roughly 1,400 malls currently operating in the US, only 400 fall under the ownership of public REITs, down from a peak of 1,012 in 2005. At the turn of the millennium, 10 public mall REITs were in operation. Today, that number has dwindled to 4, with a strong possibility of further reduction to 3, as PREIT eyes a potential exit of the sector by the end of 2023. If so, the best of their 40 mall properties will likely find themselves in other institutional portfolios. Another case in point of the trend is Simon Property Group’s (SPG) spinoff of nearly 100 of their weaker small-footprint mall properties into Washington Prime Group (WPG) in 2014, which eventually entered bankruptcy and went private in late 2021. That same year, Simon acquired upscale operator Taubman’s portfolio.

Figure 4 - Public REIT enclosed mall ownership since 2000

Examples of public REITs’ exit from the mall sector might still easily create a picture of decline and lack of opportunity for investors, especially when paired with flashy bankruptcy news. But not all of these ownership shifts can be attributed to failure. The fundamentals of many properties have steadied and are quite strong.

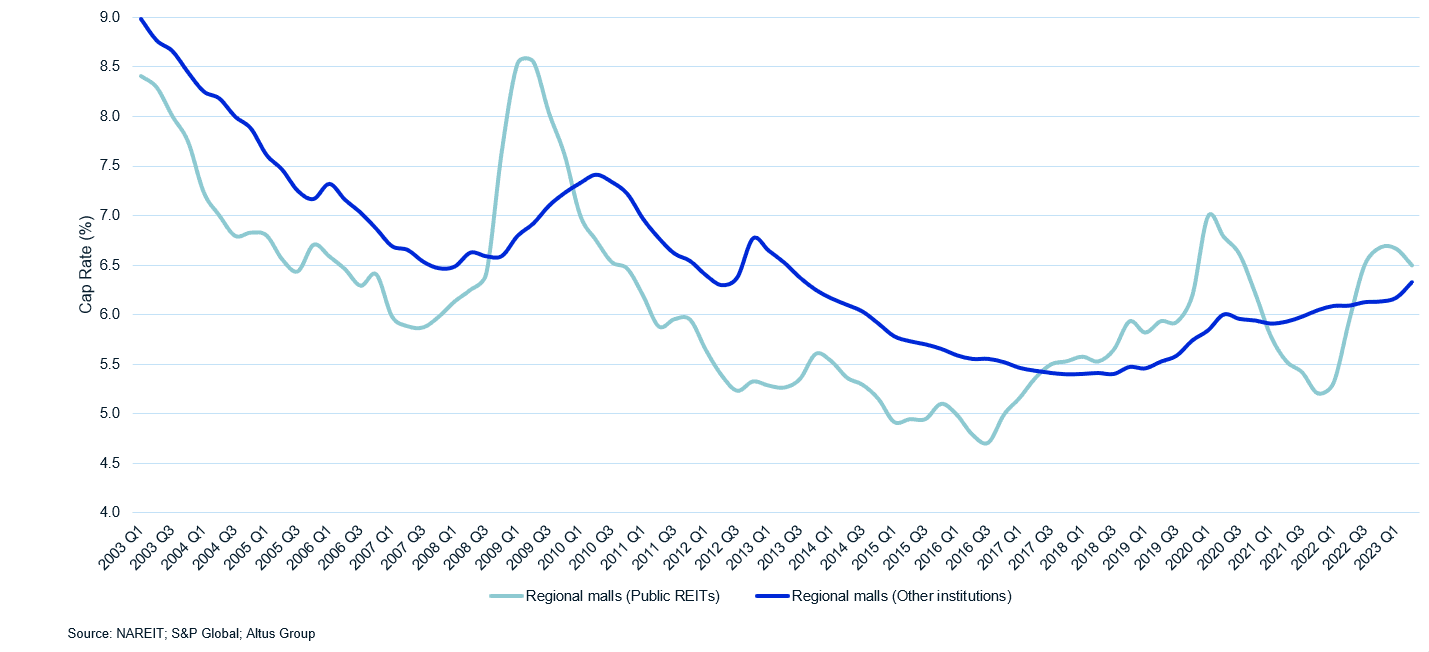

Figure 5 - Public vs. Private mall cap rate comparison

Implied cap rates for both privately and publicly owned malls have declined over the preceding decade. Public cap rates exceeded private for much of the past 6 years, which had not been seen since the GFC – a sign that those malls continue to be seen as less risky investments than they were in the early 2010s.

The takeaway

The US mall sector, while still grappling with the challenges of e-commerce and shifting consumer preferences, has showcased remarkable resilience, particularly among its top-tier assets. A steep and necessary correction from the mall oversaturation of the ‘90s has long been underway. Today’s institutional mall portfolios are a testament to strategic optimization and rebalancing characterized by more favorable tenant mixes. Over the years, owners have steadily axed their worst-performing properties in line with economic changes and have invested intelligently in response to the growth of two key competitors — online retailers and discount department stores.

As the ‘anchor’ department store model enters retirement, innovative reinvestment approaches are redefining the enclosed mall shopping experience. It is crucial to mark the difference between narratives of “apocalyptic” decline and the nuanced reality: enclosed shopping malls remain a sector that has and continues to evolve.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Cole Perry

Associate Director of Research, Altus Group

Author

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights