A large part of the capital for real estate investments comes in the form of debt. Investors use debt as “leverage” to increase equity returns and/or limit the amount of equity needed to acquire a property. The main form of debt is the senior mortgage, but a less widely used form of debt is known as “mezzanine” debt.

In this article we’ll describe what mezzanine debt is, how it works, and run through some simplified examples that illustrate the core investment concepts of mezzanine financing.

What is mezzanine debt?

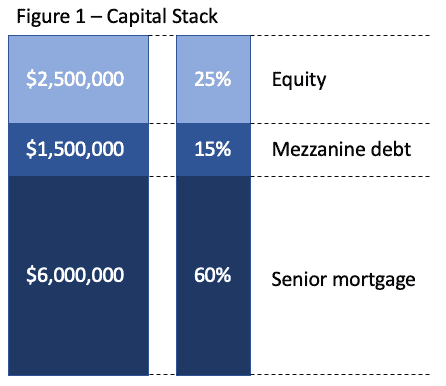

To get an idea of the role that mezzanine debt plays in commercial real estate, let’s first get an idea of what it looks like in the capital stack.

The image below shows a hypothetical capital stack for a property that’s being purchased for $10,000,000. For this acquisition, we’re assuming that the senior mortgage represents 60% of the total capital required ($6,000,000), while the mezzanine debt accounts for 15% ($1,500,000) of the capital required, and borrower/sponsor equity comprises the remaining 25% ($2,500,000).

The arrangement of the capital sources is not accidental. The senior mortgage has legal priority over all other forms of financing. Mezzanine debt is subordinate to a senior mortgage, but has a higher priority than the equity portion.

Equity has the lowest priority of the included capital sources. This subordination structure holds for both how cash flow from operations is distributed to the different parties and for legal rights in the property in the event of a default.

Reasons for using mezzanine debt

There are two main reasons why borrowers would look to include mezzanine debt as part of the capital required for the financing of a property.

The first is to boost equity returns. Theoretically, the less equity a borrower uses for a property, the higher their returns will be (there are many caveats and formulas that determine what amount of leverage is appropriate to maximize equity returns, but that’s beyond the scope of this article).

The second is to bridge the gap between the amount of equity that’s needed and the amount of equity that’s available. We’ll discuss each of these in more detail below.

Boosting equity returns

The figures below show highly simplified structures for the acquisition and operation of a property. In the real world there would be many more factors and inputs to these calculations, but for the sake of highlighting the role that mezzanine debt can play in increasing equity returns, we’ve kept it as simple as possible.

Figure 2 illustrates the return on equity achieved by the property when the capital stack includes only a senior mortgage (60%) and equity (40%) provided by the borrower. The return on equity for this structure is 8.75%.

Figure 3 shows the exact same property with the exact same purchase price and net operating income, but includes mezzanine debt as part of the capital stack.

With the $1,500,000 in mezzanine debt included, the amount of equity the borrower must contribute drops from $4,000,000 to just $2,500,000. The additional mezzanine debt also requires an additional debt service payment (in this case $100,000), which reduces the net cash flow from operations to $250,000. However, in this case, the addition of mezzanine debt increased the return on equity to 10.0%.

Figure 2: No mezzanine debt

Capital stack | |

|---|---|

Purchase price | $10,000,000 |

Senior mortgage | $6,000,000 |

Equity | $4,000,000 |

Cash flows | |

|---|---|

Net operating income | $800,000 |

Senior loan debt service | $450,000 |

Net cash flow | $350,000 |

Returns | |

|---|---|

Equity | $4,000,000 |

Net cash flow | $350,000 |

Return on equity | 8.75% |

Figure 3: With mezzanine debt

Capital stack | |

|---|---|

Purchase price | $10,000,000 |

Senior mortgage | $6,000,000 |

Mezzanine debt | $1,500,000 |

Equity | $2,500,000 |

Cash flows | |

|---|---|

Net operating income | $800,000 |

Senior loan debt service | $450,000 |

Mezzanine debt service | $100,000 |

Net cash flow | $250,000 |

Returns | |

|---|---|

Equity | $2,500,000 |

Net cash flow | $250,000 |

Return on equity | 10.00% |

As mentioned above, there are many additional factors not covered here that need to be considered to determine whether mezzanine debt is appropriate to include when financing a property. An analyst should always construct detailed financial models to ensure an understanding of all the advantages and disadvantages of the specific financial structure.

Reducing the amount of equity needed

In many cases, a borrower simply doesn’t have enough equity to purchase a property. Rather than miss an opportunity for an acquisition, the borrower often has to choose between two options.

The first is pursuing additional mezzanine debt to bridge the gap between the amount of equity the borrower has and the amount of equity needed to purchase the property. The second is to bring in additional investors to supply the remaining equity needed.

Additional equity investors will cause equity dilution and usually a lower amount of control of the property for the borrower. While mezzanine debt carries a higher cost than a senior mortgage and will require additional debt service payments, thus reducing net cash flow, that cost is usually below the cost of equity.

Legal aspects of mezzanine debt

One of the interesting legal quirks of mezzanine debt is what rights the mezzanine lender has to the property. Because there are two separate pieces of debt - senior mortgage and mezzanine debt there are also two separate debtors to make payments to.

As we saw in Figures 2 and 3 above, mezzanine debt requires additional payments above that of the senior loan. In the case of a drop in cash flow due to tenants vacating or some other loss of revenue, the cash available to service debt may not be sufficient to cover all debt service. In some situations, cash flow drops to a level where the borrower can still make payments on the senior mortgage, but there’s not enough cash flow left to make payments on the mezzanine debt.

As a result, there exists situations in which the borrower defaults on only the mezzanine debt and not the senior mortgage. In other situations, cash flow drops so much that the borrower is unable to make either the senior or the mezzanine payments and defaults on both.

The difference is that a senior mortgage is secured by a lien on the property, so that should a borrower default, the lender has a right to foreclose and take over the property to recover as much of their loan as possible. A mezzanine lender, however, has no such direct rights to the property in the event of a default. Instead, the mezzanine lender will be assigned the borrower’s interest in the legal entity that owns the property.

In the event of a default, the mezzanine lender will take over the borrower’s interest in the property and will usually begin to negotiate with the senior lender to cure any defaults that may exist.

Conclusion

As noted above, there are quite a few benefits to using mezzanine debt when financing a property. However, there could also be significant risks associated with adding a higher level of debt and debt service on a property.

While the increase in leverage can increase equity returns for the borrower, it also increases the risk of payment default and overleveraging (meaning more debt than the property is worth) in the case of a market downturn. This overleveraging scenario was common during the 2008 financial recession and led to tremendous losses on many real estate properties.

Investors should carefully analyze not only the current impact that additional debt will have on the property, but also the potential future risks should the property experience operating problems or market declines.

Author

Altus Group

Author

Altus Group

Resources

Latest insights