In the financial world, a “waterfall” is a method of determining the distribution of returns to different parties. While technically the waterfall distribution model includes the repayment of debt to any lender involved in the investment (because debt is senior to equity), it’s more common to refer to waterfalls for the purpose of equity distributions among the General Partners (GP’s) and Limited Partners (LP’s).

The rest of this article will go into more detail about what a waterfall is, provide a simplistic example of how a waterfall works, and describe some of the considerations of the parties involved.

What is a waterfall distribution in commercial real estate?

The goal of most real estate investments is to provide a return to the investors. And in most commercial real estate investments there are multiple capital providers that expect to receive a return on their investment. In a simple transaction, the capital providers would include a lender, a General Partner, and a Limited Partner.

General and Limited Partners will be discussed in more detail below. The lender receives a return on the capital provided by charging an interest rate on the funds borrowed. For the equity providers, however, things can get a bit more complicated.

In most real estate investments, rather than just providing a straight split of the returns (say 75%/25% or 80%/20%) to respective investors, distributions of returns are calculated based on the role the different investors play, the rate of return achieved on the investment, and other factors. To understand these nuances a little better, let’s discuss some of them.

The parties involved

Most real estate investments receive a certain amount of debt from a lender. Let’s say 70% of the total amount of money needed for the investment is provided by a bank in the form of a loan. That leaves 30% in equity that must be raised by the investors. This remaining amount is often split between two parties: the General Partner and the Limited Partner(s). Of this 30% equity, a majority comes from the Limited Partner(s) with a small piece of the equity contributed by the General Partner. The split can sometimes be as high as 90%/10% or 95%/5% with the larger amount of equity coming from the Limited Partner(s).

Roles of each party

The General Partner (GP), also sometimes called the “sponsor,” is a company or person that handles much of the day-to-day operations of the property, including the initial selection and acquisition of the property, operational management, and disposition decisions. The Limited Partner(s), also known as “LP’s,” are mostly passive investors that provide a majority of the equity needed for the initial acquisition/development of the property.

Concept of a waterfall structure

So now we know we have different types of investors who have different roles in the investment. One of the purposes of the waterfall structure is to ensure that the incentives are aligned for all investors in the deal.

For example, the acquisition and operation of a class A, stabilized property with long-term tenants probably won’t require a heavy hands-on presence from the GP, limiting the time spent and expenses incurred by the GP to operate the property.

On the other hand, the acquisition of a property that requires a major renovation with a difficult path to lease-up will likely require significant time, expertise, and cost on the part of the GP. LP’s will want to make sure the GP’s are properly incentivized to put in the time and effort needed for a successful outcome.

As we’ll describe below in more detail, the concept of a waterfall is that the higher the return the property achieves, the higher the portion of the return the GP receives in relation to the LP’s. This concept is described graphically and, in more detail, below.

How does a waterfall work?

Waterfalls can get very complicated. This article won’t go into a high level of complexity or discuss some of the nuances that are often found in waterfall models. Instead, we’ll focus on providing a simplistic example that conveys the ideas and intent of a waterfall model as it’s used in an investment structure. The reader should consult sources with more detailed information on waterfall structures if desired.

Think of a waterfall as a faucet with a series of cascading buckets beneath it. The water from the faucet flows into the first bucket and, when full, the first bucket tips and water spills over into the second bucket. The same process then repeats with the third, fourth, etc. buckets.

Figure 1 - Waterfall illustration

In this example, the buckets represent different rates of return that the property might achieve. For example, the first bucket might represent up to a 7% return. The second bucket a return between 7% and 10%. The third bucket a return between 10% and 14%.

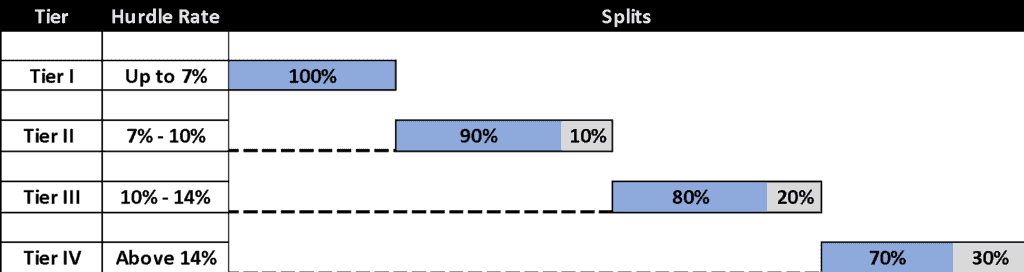

In waterfall models, each of the buckets are called “tiers” and each tier represents a level of return, called a “hurdle.” As each of the tiers (the lower buckets) are reached, the split between the GP and the LP’s changes. The table below shows an example waterfall structure:

Tier I, commonly known as the “preferred return,” distributes all funds to the LP (in blue) up to a 7% return to the LP.

Tier II, representing a return between 7% and 10%, distributes funds in a 90% split to the LP and 10% split to the GP.

Tier III, a return between 10% and 14%, distributes funds in an 80% split to the LP and a 20% split to the GP

The same trend continues with Tier IV and shows that the higher the return achieved on the property, the higher the proportion of return paid to the GP as a sort of performance incentive. The second column in the table, titled “Hurdle Rate,” is the rate of return that must be achieved before the cash flow distributions can move on to the next tier.

Figure 2 - Waterfall tier and hurdle rates

Considerations and motivations of each investor

Obviously, all parties involved in the transaction want the property to be as successful as possible.

What it takes to achieve that success can be different for each property, however, resulting in a different structure of the waterfall for each property. Perhaps this means providing a higher split rate or a lower hurdle rate to the GP for the successful operation of a more time-intensive property.

Another consideration includes the experience and expertise of the GP’s operating the property. The individual characteristics of each transaction and property should be considered when determining the hurdle rates and split rates for each party.

Conclusion

Hopefully by now we’ve made the concept of a waterfall model easy to understand. In reality, it can be extremely complicated and nuanced, with all sorts of different requirements and stipulations, requiring analysts with expertise in building waterfall models and attorneys well-versed in the legal aspect of waterfall agreements.

Despite these complications, waterfall return structures can benefit all equity partners and provide a documented way for money to be distributed to the parties involved.

Author

Altus Group

Author

Altus Group

Resources

Latest insights