ARGUS Taliance

CRE fund and REIT modeling software.

ARGUS Taliance is a robust real estate fund management software solution enabling you to model and manage the performance of real estate funds and real estate investment trusts (REITs).

30+

years developing our ARGUS software

100+

countries across the globe using ARGUS

200+

universities and colleges teaching ARGUS

Key features

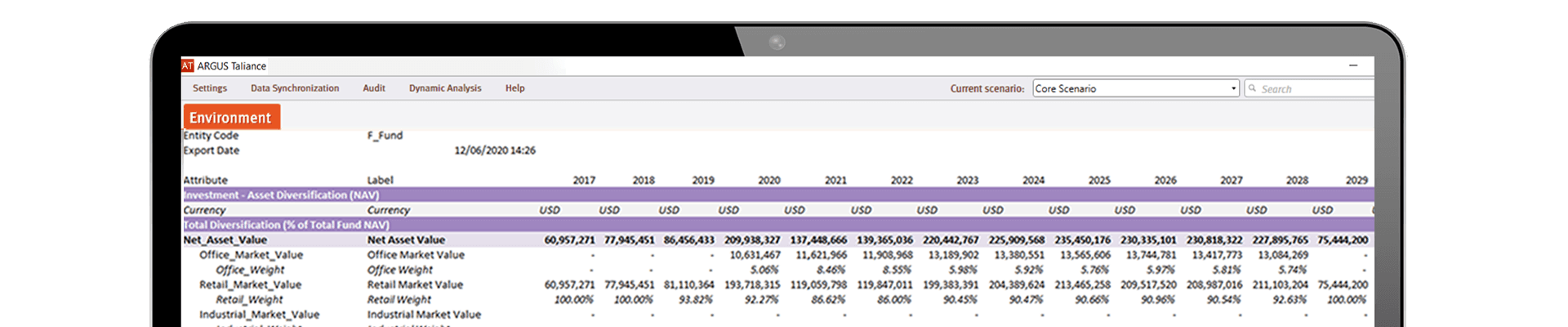

A clear view of your real estate fund and investment performance

Fund modeling and investment structures

ARGUS Taliance allows you to model an entire portfolio of real estate funds through an interactive interface, to quickly view your investment structure over time.

You can also drill down into each individual investment entity or even adjust models to configure waterfall distributions and distribution-per-unit calculations. Allowing you to forecast stakeholder returns confidently.

Forecasting and scenario analysis

ARGUS Taliance gives you powerful sensitivity tools, to see the impact of your investment structure changes and predict changes to market inflation or rent.

You can even test a change in ownership resulting in property acquisition or disposition and quickly generate income reports to see the effect on the internal rate of return (IRR) and net cash flow.

Data consolidation and auditability

With ARGUS Taliance, you can consolidate data from property management, accounting systems, and multiple spreadsheets, into one, easy-to-use solution.

Define the data hierarchy structure, quickly identify where your data is coming, view changes to any calculation formulas, and drill down to audit the changes made over time.

Why ALTUS

30+ years of pioneering CRE software, trusted worldwide

Easily model complex investment structures and run scenario testing to assess the impact of market or ownership changes. Calculate distribution waterfalls and create clear and detailed reports for stakeholders and investors.

Consolidate all your investment data in a secure repository, saving even more time on analysis and reporting.

Connect to property management and accounting systems for real-time data and see its direct impact on your fund.

Advanced analytics to stress test how your fund and commercial properties will perform in different market conditions.

Robust calculation engine to run detailed forecasts, apply changes over time and see direct impact on your fund structure.

Safeguard your fund investment data and guarantee the integrity of your calculations with our powerful calculation engine.

Build more than 20 industry-standard reports to meet all your regulatory and local market compliance needs.

TRAINING

ARGUS Taliance training and certification

Build on your commercial real estate knowledge and expertise with our ARGUS Taliance and ARGUS FinAsset training and certification courses.

We offer private training options allow you to tailor your training experience to meet your company’s requirements. Choose from our standard training agendas, or build a custom agenda over topics pertinent to your day-to-day operations.

Explore our training catalogue:

ARGUS software certification

Public training

Resources

Latest insights