ARGUS ValueInsight

An end-to-end asset valuation management software solution.

With ARGUS ValueInsight, you can leverage a modern, valuation management solution to seamlessly manage every stage of the asset valuation management process.

180+

customers

400+

valuation metrics from ARGUS Enterprise

20,000+

assets valued quarterly

20+

benchmark data points

Key features

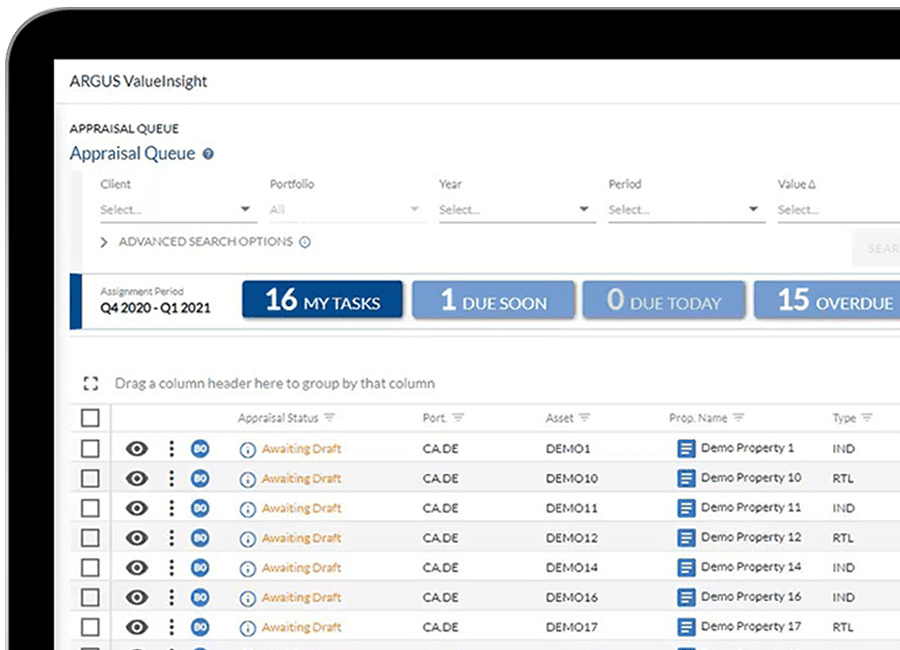

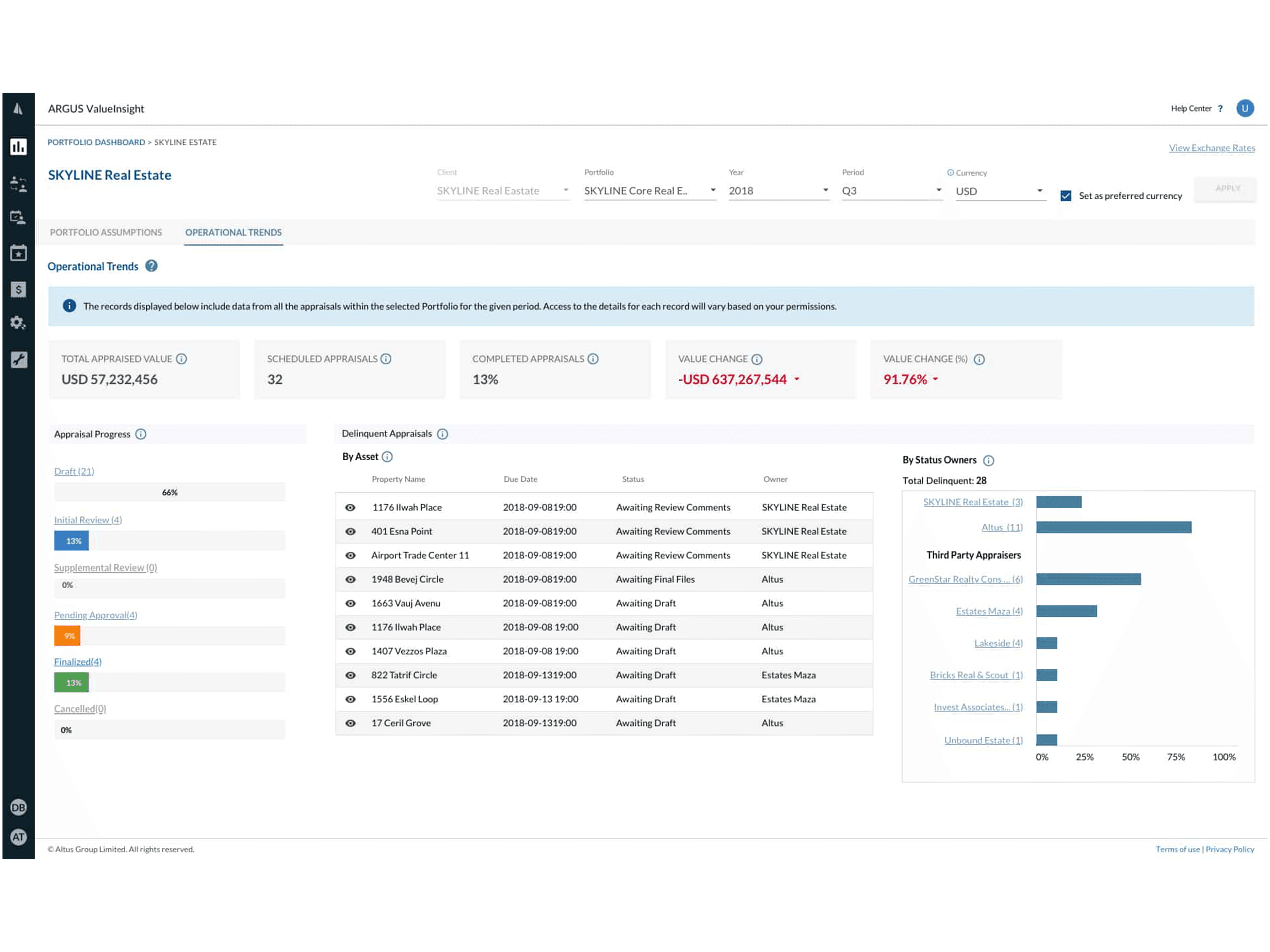

Confidently manage the asset valuation lifecycle

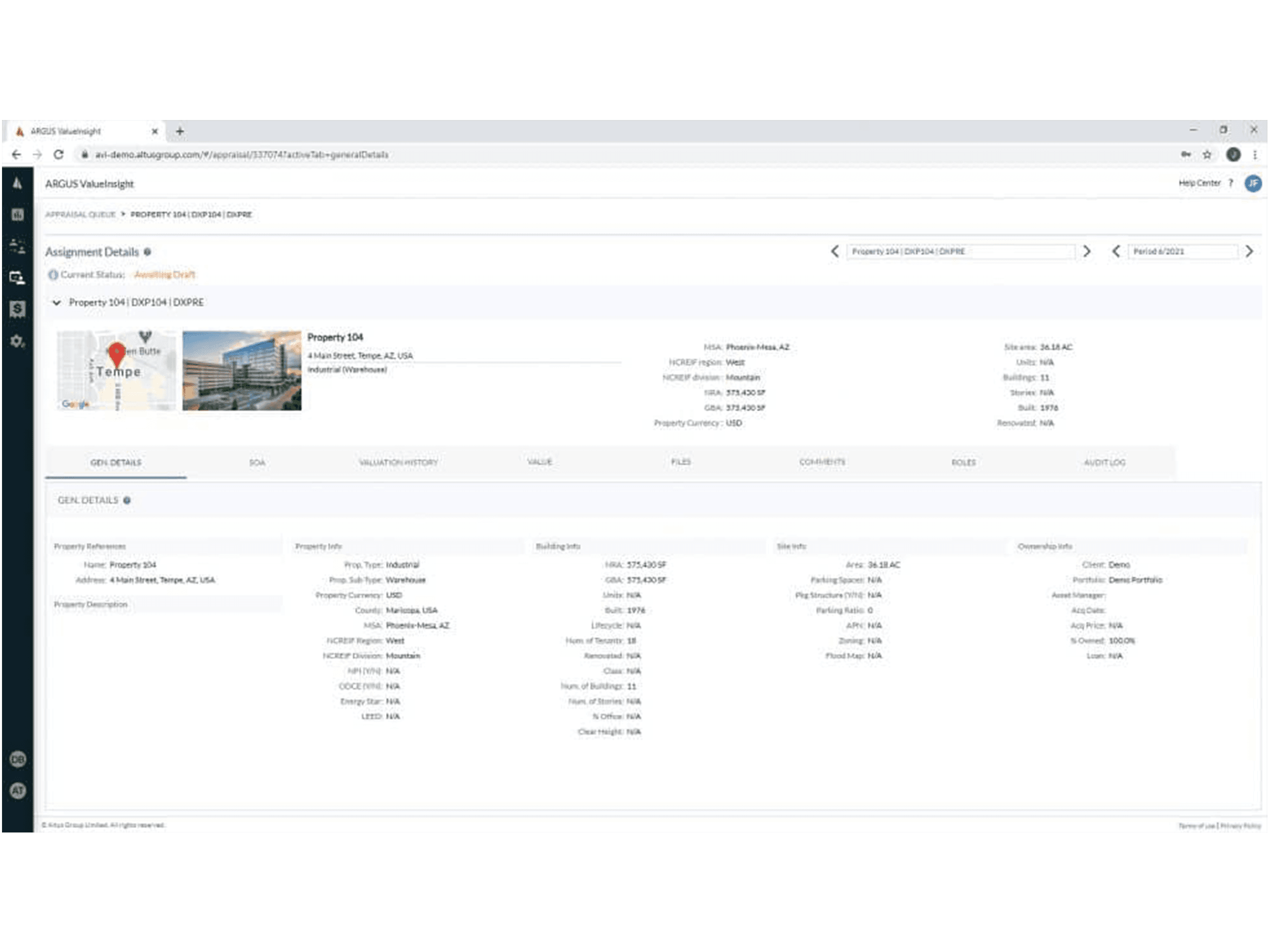

Centralize information and stakeholder access

Managing data and tracking communications takes time. Time that would be better spent making decisions based upon valuation results.

ARGUS ValueInsight acts as the nucleus of your valuations process. Centralize your key documents, valuation data, stakeholder access and communications. Start every asset valuation cycle with the information you need, so you can keep the process moving forward.

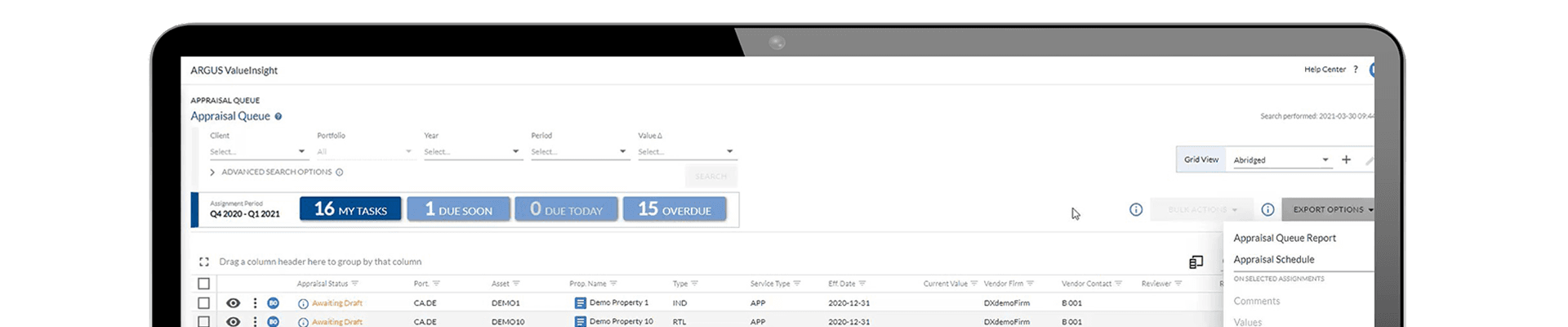

Collaboration and workflow automation

The asset valuation process requires active project management. ARGUS ValueInsight creates a standardized management process across all your funds. Whether managed through Altus Group or another firm or self-managed by your organization.

Implement granular oversight, from tracking and approving daily events, to fund-level review cycles. Looking to cut down on training time? ARGUS ValueInsight reduces the time to initiate and complete appraisals. This allows you to adopt multiple appraisal review processes easily

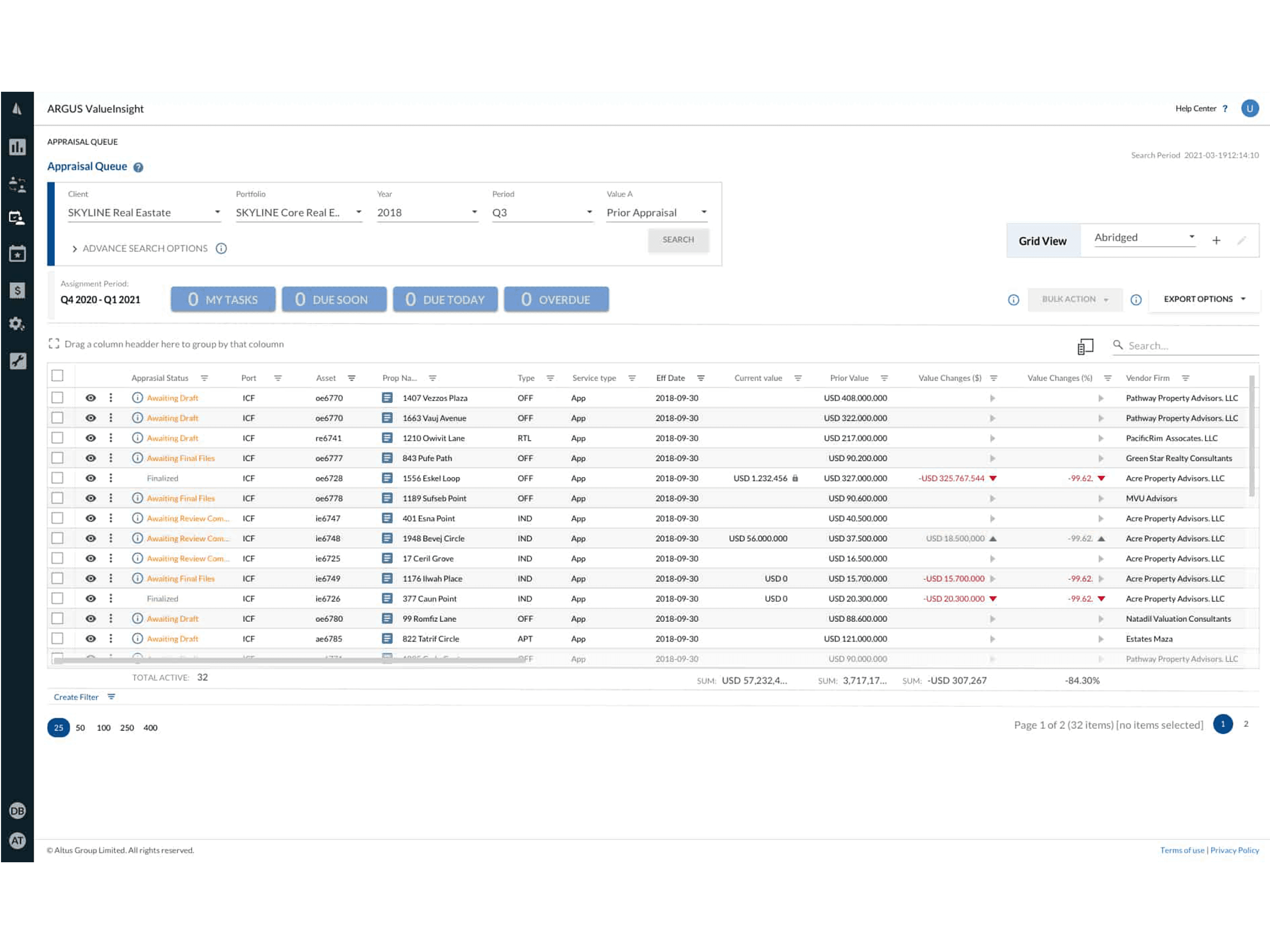

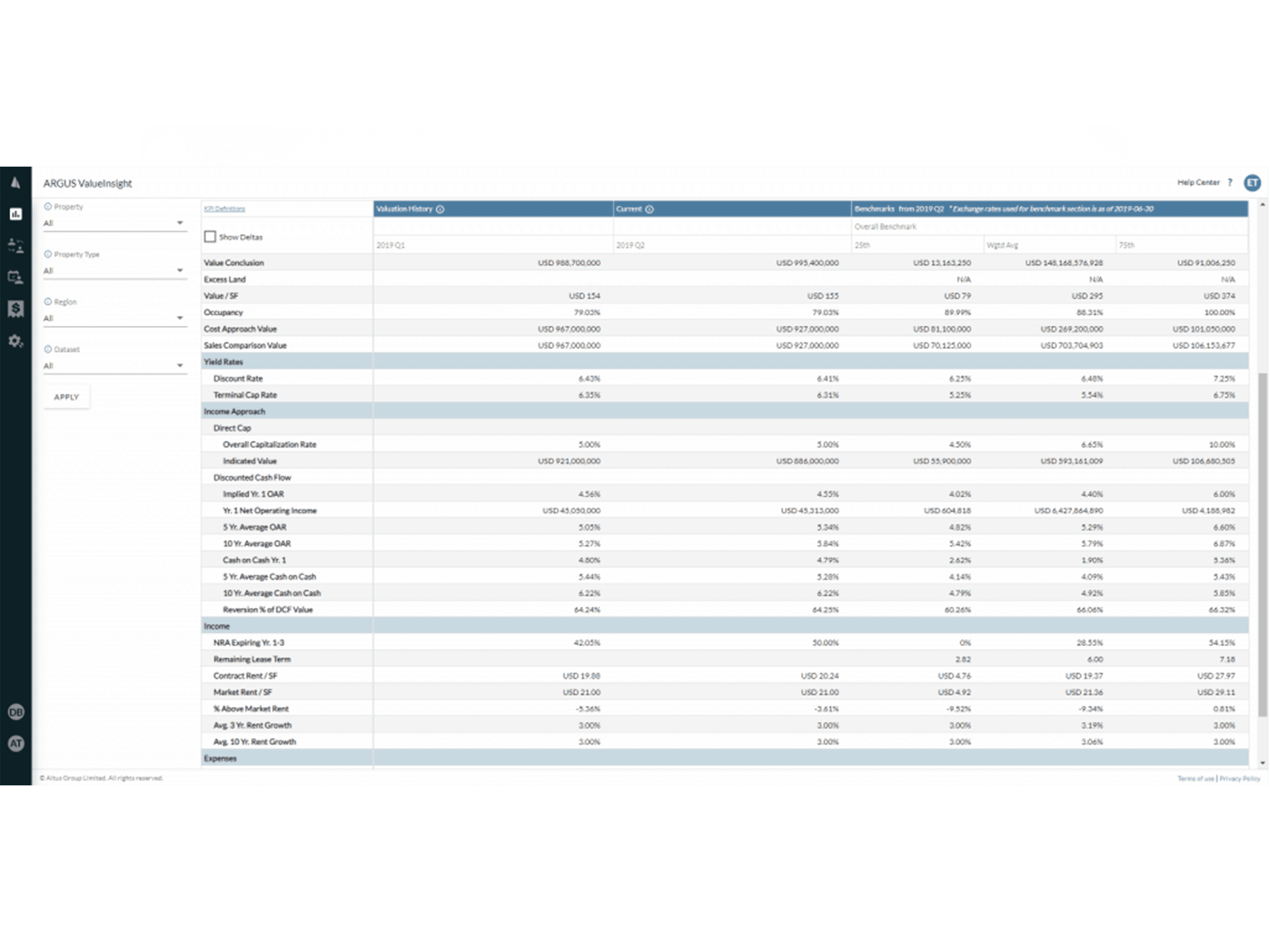

Rapidly access ARGUS Enterprise valuation metrics

ARGUS ValueInsight works seamlessly with the ARGUS Enterprise model, providing you with KPI's on a single dashboard. Get standard reports on valuation assumptions, historical trends and other metrics.

You can also refine fund data by property type, property sub-type and sector, compare against anonymized peer groups, view global portfolio assets in a standard currency, see trends in asset assumptions and compare current period values in real-time.

Valuation benchmarking

ARGUS ValueInsight provides a consolidated valuation benchmark overview every quarter. Analyze and generate custom portfolio reports across 20 data fields.

Take control of your performance and risk management and see your investment universe in the context of the whole market.

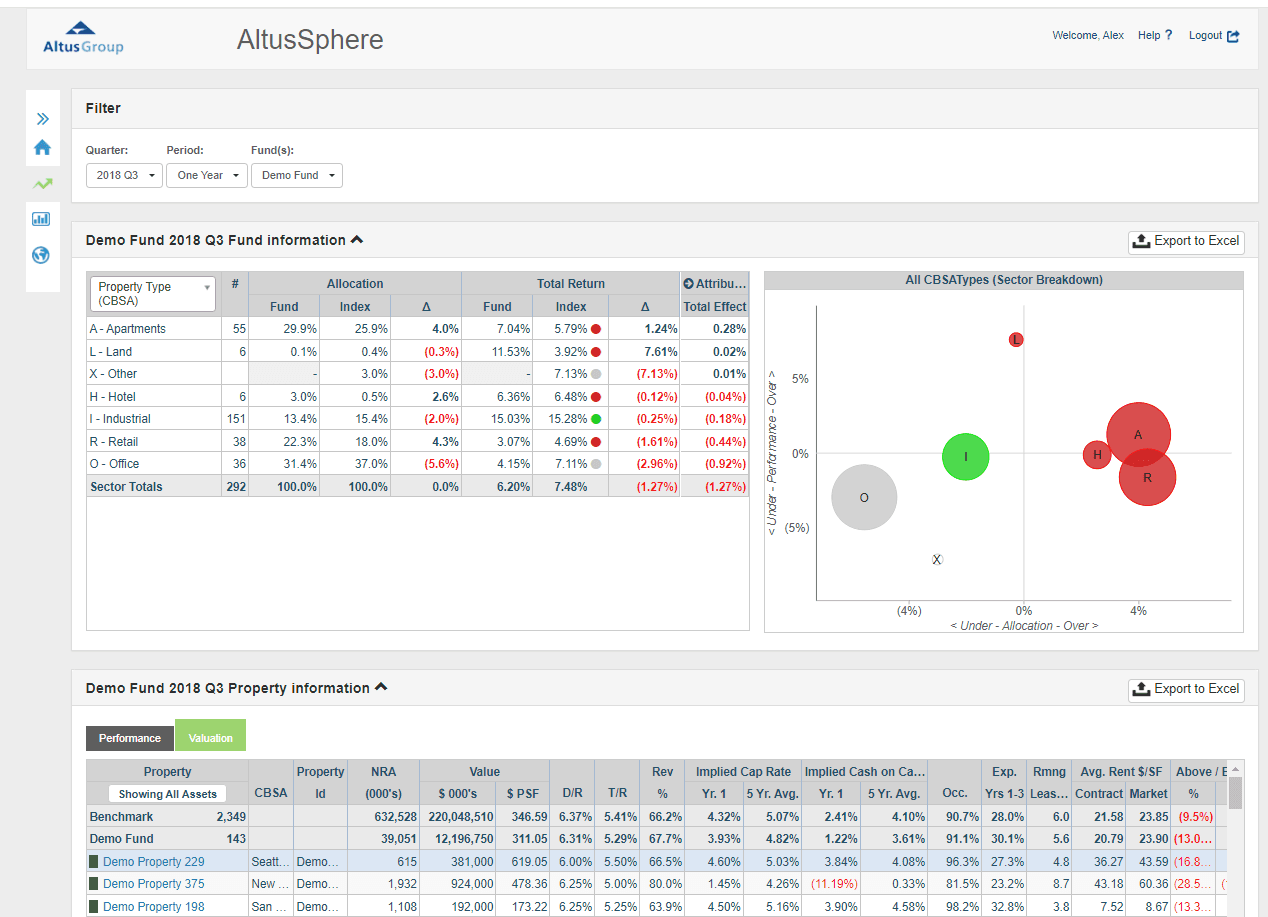

Performance attribution

Understand the ‘what’ and the ‘why’ in your asset and fund returns. Our comprehensive analysis and breakdown of the sources of returns for CRE assets and portfolios delivers insights into the factors driving your portfolio's performance, so you to make more informed investment decisions and optimize asset management.

It is complemented by our expert services designed for institutional investors, fund managers, seeking a deeper understanding of their CRE investments and returns.

Why ALTUS

30+ years of pioneering CRE software, trusted worldwide

With ARGUS ValueInsight, you can leverage a modern, web-based workflow, analytics and document management system to seamlessly handle information and output exchange throughout the commercial asset valuation management process.

Store all your asset valuation data in your property portfolios in one place, saving even more time on analysis and reporting.

Create a custom valuation management process for your organization and collaborate on one platform.

Our team of 350+ CRE professionals serve the global CRE community, ensuring compliance with local and national standards.

Advanced analytics to stress test how your commercial properties will perform in different market conditions.

Seamlessly integrate your ARGUS Enterprise valuation models and view your KPIs on a single dashboard.

CUSTOMERS

Hear what our customers say

"The adoption of ARGUS ValueInsight wasn't just a leap, it was a strategic move to streamline our appraisal process, allowing us to take a 10,000-foot view of our portfolio while also having the capability of drilling down into key insights and analytics.

Altus’ support made the transition smooth, offering invaluable assistance in managing varying levels of user comfort and enhancing our team's efficiency."

Andrel Wisdom, Senior Valuations Manager, Real Estate

Alberta Investment Management Corporation (AIMCo)

Resources

Latest insights