There are many different ways to look at the value of a property in commercial real estate. Some of these methods, such as income capitalization (cap rate approach) or price per square foot, are designed to estimate the market value of the property at a specific point in time. Other methods, such as the discounted cash flow approach, are designed to give investors an idea of whether or not a property will offer a return over the entire hold period that fits the investors’ required rate of return on an investment.

The discounted cash flow (DCF) model allows investors to project the revenue, expenses, and cash flows for the entire estimated hold period of the property. The DCF model setup also allows two other types of analysis as a result of the estimated cash flows: Net Present Value (NPV) and Internal Rate of Return (IRR). Both the NPV and IRR are discussed in more depth in other articles, but in this article, we’ll look at one of the core components of the NPV method called the “discount rate” in order to better understand how the NPV works.

What is a discount rate

The discount rate is the measure that’s used to determine the current value of future cash flows from a property. The concept behind discounting and the time value of money is discussed in the article referenced above on the NPV, so it’s suggested that you first refer to that article if you’re unfamiliar with the time value of money and the NPV method.

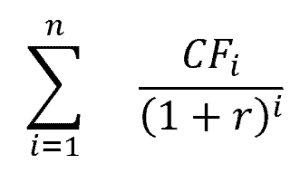

In order to understand the role and the importance of the discount rate, we have to first look at the NPV calculation. Mathematically, the NPV is calculated as below.

n = total number of periods (in the table above this would be 5)

i = period, where period starts at value 1

CF = CF at end of period

r = rate of return

In this formula, the “r” is the discount rate and represents the rate of return the investor demands to achieve on the investment.

Choosing a discount rate that accurately reflects the expectations of the investors and the reality of the property and market is more of an art than a science, but we’ll cover some of the main considerations that should be explored when choosing the rate at which to discount future expected cash flows in the next section.

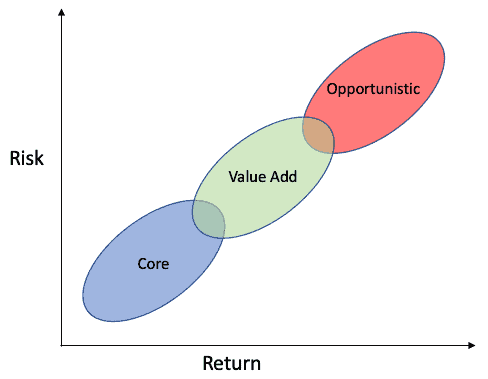

To give an idea of how the factors in the next section should be viewed, the figure below is a simplified representation of the relationship between risk and return for different types of real estate investment: core, value add, and opportunistic.

The higher the risk, the higher the return expectations should be. The factors in the next section should allow an investor or analyst to better quantify the characteristics of markets, properties, and investor expectations in order to determine which category of risk/return profile the property falls into. Then a discount rate can be estimated more accurately.

How to choose a discount rate

For those new to real estate, choosing an appropriate discount rate can be a confusing process. There are numerous factors that need to be considered when determining what discount rate should be applied to a specific property.

This usually starts with a general idea of what rates of return are being achieved on similar properties in the market and then making adjustments for the individual factors and situation of the property in question.

The sections below discuss what an analyst should be aware of when deciding how to discount projected cash flows for a property.

Market benchmark

Usually, the first place to start when choosing a discount rate is to analyze the macroeconomic situation. Just like any investment, real estate returns are predicated on some sort of risk premium above a benchmark, such as the rate on 10-year United States treasuries.

In times where the treasury rate has been high, discount rates have also been high, and vice versa. If rates on 10-year treasuries are 10%, for example, it doesn’t make sense to choose a discount rate of 4% for your investment.

The following factors are not necessarily in order, but should be reviewed collectively to determine the relationship between all of the factors.

Property characteristics

Once a premium above a benchmark is set, adjustments need to be made for the type of property you’re considering. Amongst the factors to be considered are the type of the property, the class of the property, market, submarket, and others.

Generally, properties in primary markets tend to have lower premiums than properties in secondary and tertiary markets, class A properties have lower premiums than class B or class C properties, and properties in central business districts tend to have lower premiums than those in the suburbs.

Market direction

Another thing that needs to be considered is the direction of the market. When it’s believed that the market will continue to grow (usually meaning rising lease rates and property values), it’s reasonable to assume a lower amount of risk and thus a lower discount rate.

However, if there is reason to believe the market will decline then the investor needs to account for a higher level of risk with a higher discount rate.

Property risks

After adjusting for the market and the characteristics of the property, a thorough review should be made to understand the stability of the future cash flows by identifying risks that the property faces. These risks include uncertainty around lease expirations, capital expenditures, or the viability of the property to be competitive in the future.

Investors required rate of return

All of the factors above need to be put in the context of the returns the individual investor needs to achieve to make the investment worthwhile. Large institutional investors usually have access to capital at much lower cost than smaller, less well-capitalized investors. For these smaller investors with higher cost of both debt and equity, the discount rate needed to cover those costs and achieve a profit is often higher than the hurdle faced by larger investors.

Conclusion

This list of factors that should be considered in adjusting the discount rate to better represent the characteristics of a specific property is not exhaustive, but should give an idea of the types of elements that need to be considered.

The takeaway here is that the discount rate is partially a reflection of the stability, or lack of stability, that the property presents. If an investor is purchasing a property that contains multiple areas of increased risk factors, then that investor should expect to be compensated for taking on the additional risk.

Likewise, if an investor is purchasing a fully-stabilized and high-quality property, then the return expectations should be lower than for that of more risky properties.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Altus Group

Author

Altus Group

Resources

Latest insights